NetworkNewsWire

Editorial Coverage: With a worldwide pandemic raging,

industries that were already moving toward digital applications

have accelerated the process. People now grab their mobile device

for everything from ordering groceries to buying cars — and

the trend isn’t likely to end any time soon. The founders

of Lottery.com (Profile) recognized

the shifting trends years ago and were first movers to address the

untapped global lottery market. The company uniquely combines

blockchain with other cutting-edge technology to offer at-home

lottery participation and aims to capture a lion’s share of huge

lottery and sports betting markets. Now the company is timing its

entry into the public markets with another hot trend: investor

appetite for special purpose acquisition companies, or SPACs. The

entire gambling and gaming industry is likely to explode as the

pandemic subsides and the economy gets its legs back. DraftKings Inc. (NASDAQ:

DKNG) used the SPAC path to go public last April,

and traditional casinos are expecting revenue resurgence

post-pandemic, with companies such as Bally’s Corporation (NYSE:

BALY), MGM

Resorts International (NYSE:

MGM) and Penn

National Gaming Inc. (NASDAQ: PENN) all eager for

a return to normalcy.

- The global lottery market is valued at $398 billion, more than

the worldwide SaaS, video games and film industries combined.

- com, one of the foremost brands in global lottery data, is

planning to go public via a SPAC reverse merger transaction.

- The company offers a suite of high-margin lottery products,

with operations in 12 U.S. states and quickly expanding

internationally.

- Management forecasts gross revenue of $71 million in 2021, $279

million in 2022 and $571 million in 2023.

Click here to view the custom infographic of

the Lottery.com editorial.

Mind-Boggling Market

Words such as huge or massive are often tossed around to

describe a market’s size, and rightfully so — it would be a

disservice to call the $138

billion global video games or $158

billion Software-as-a-Service (SaaS) sectors anything

less. Still, it begs the question of what adjective accurately

describes the $398 billion

global lottery market, which is larger than the worldwide video

games and SaaS markets combined? Mind boggling comes to mind

especially when considering the global lottery market is forecast

to reach $625 billion in 2025. Despite the size, it’s a market that

investors have little exposure to presently.

Even with its scale, the lottery market is particularly unique.

Competition is relatively scant due to the difficulty of breaking

the long-held paradigm of buying tickets at a retail point of sale.

Currently less than 3% of global lottery sales are online. That’s

only about $12 billion market penetration into a nearly $400

billion industry. A digital transformation seems inevitable, one

that aligns with the online sports betting market where 82% of all

activity is online.

High-Margin Product Suite

An innovator in blockchain, Lottery.com is leading the digital transformation

by building a premier global marketplace for games of chance.

Already one of the most recognized and trusted brands in the space,

Lottery.com is a premier provider of global lottery data with a

diverse product offering, underscoring current revenues and

projections for strong upcoming cash flow. The company’s online

platform and mobile application allow users to play

state-sanctioned lottery games from their homes or on the go in the

United States and internationally. In 2020, Lottery.com sold more

than one million Powerball and Mega Millions tickets across 148

countries worldwide, a milestone in the company’s rapid

expansion.

Lottery.com is working in conjunction with states to steadily

bring the lottery into the digital age, a necessity realized by

lottery officials amid covid

lockdowns. So far, Lottery.com operates in 12 states, with

expectations to add at least six more in 2021 and to be operational

in 34 states by the end of 2023. The company’s technology is

turnkey, utilizing blockchain as a digital ledger, while allowing

people to quickly play from a selection of sanctioned games, check

winning numbers and jackpot totals, and even be notified of

winnings which can be collected directly within the app (in

accordance with state laws). Consumers keep 100% of the winnings,

just like in a retail setting.

Lottery.com derives revenue primarily from revenue service fees

paid by app users and subscription fees for lottery data access

from digital publishers and other data consumers. The company has

established itself as a top lottery data service provider, with

more than 400 customers that include the likes of Google and

Amazon. Lottery.com charges a subscription fee to its data clients

plus a per record fee for certain data sets that translates to an

eye-popping 75%–95% margin.

The company has a spectrum of other business-to-consumer (B2C)

and business-to-business (B2B) products that range in margin from

17% to 54%. These include a robust API platform for selling lottery

tickets, domestic and international lotteries, international games,

charitable sweepstakes and an innovative user subscription program

that provides premium market data and exclusive, members-only

lottery pools.

The Upcoming SPAC

Lottery.com (planned NASDAQ ticker LTRY) is planning to go

public through an imminent merger with the SPAC Trident

Acquisitions Corp. A SPAC company raises money through an IPO

exclusively for the purpose of acquiring or merging with a

privately held company and bringing it public. These blank-check

companies are the hottest trend on Wall Street, with celebrities to

billionaire investors all joining the mix as a quick route to enter

the public domain. According to Business

Insider, $166 billion in SPAC deals took place in Q1 2021, more

than all of 2020.

With a management team featuring successful serial entrepreneurs

uniquely positioned in the lottery market, Lottery.com has

attracted an impressive list of investors and advisors. The list

includes, among others, Senator Mark Lipparelli (former chairman of

Nevada Gaming Control Board and current chairman of Galaxy Gaming)

and Paraag Marathe, president of the San Francisco 49ers

Enterprises. These heavy hitters are betting big on the digital

gaming market.

A Technology Play with a Do-Good Benefit

In the way that Apple is a tech company rather than a computer

maker, so goes it for Lottery.com. The company is growing revenue

through its suite of services (effectively an e-commerce platform)

and data library rooted in next-generation blockchain technology

securing it all. The numbers speak to the success being achieved,

with gross revenue rising at a compound annual growth rate of 363%

from 2016 to 2020 as foundation was put in place. Looking ahead,

management forecasts gross revenue of approximately $71 million

this year, $279 million in 2022 and $571 million in 2023.

Lottery.com built and recently launched WinTogether, a program that allows players to

donate to qualified causes and get entered into sweepstakes to win

luxury prizes or once-in-a-lifetime experiences. For instance, the

inaugural campaign supported the Time for Trees(R) initiative where

a participant could win a Tesla Cybertruck.

Expectations are that the trend toward digital applications will

continue accelerating well past the pandemic. Already on an upswing

with enormous growth projections, the digital gaming markets appear

to be a winning ticket. It just might be time to bet on it.

Polishing the Edges

Last year — 2020 — was a year that will be talked about for

decades. If nothing else, it identified potentially every pain

point a company could experience, from operational efficiencies to

overlooked business segments that aren’t keeping pace with changing

demographics and consumer demand. Most consumer-facing companies

languished but adjusted to weather the storm and hopefully see a

rebound in 2021.

DraftKings Inc. (NASDAQ:

DKNG) is well positioned not only because

sporting events are returning to full schedules and re-opening

economies giving people a little extra cash to play with, but wider

legalization of online sports betting is also anticipated. The

company has recently launched in Virginia and Michigan and is

certainly watching as 19 state legislatures have introduced

legislation to legalize online sports betting. There is a

reason DraftKings recently raised its

2021 revenue guidance.

Bally Corporation (NYSE:

BALY) president and CEO George Papanier recently

called 2020 a “truly remarkable” year for his company, which only

suffered a small net

loss despite the coronavirus pandemic shutdowns and storm

damage from Hurricane Zeta at its Hard Rock Biloxi. Several moves

were made to strengthen the company for 2021 and going forward,

including the pending acquisition of Bet.Works and closing the

acquisitions of the Bally’s Atlantic City Hotel & Casino and

the Eldorado Resort Casino Shreveport, as well as opening its first

FanDuel Sportsbook.

MGM

Resorts International (NYSE: MGM) is coming out

of the pandemic stronger than before, focusing on the future while

overcoming the obstacles. The international hotel and casino

juggernaut was hit hard during Q4, with consolidated net revenues

slumping 53% year-over-year to $1.5 billion. CEO Bill Hornbuckle is

confident in the recovery of Las Vegas and Macau markets, as well

as the future of

BetMGM, the company’s sports betting and iGaming app that is

expanding across the United States

Penn

National Gaming Inc. (NASDAQ: PENN), owner of the

wildly popular Barstool Sports franchise, was another prime example

of a company trending the right way before getting derailed by

COVID-19-related shutdowns in strong markets. In addition to its

hotel and casino operations, its Barstool Sports media business

should not be overlooked. This is a dominant brand among younger

generations with more than 52 million followers on Instagram and

another 53 million between TikTok and Twitter. The loyal followers

are showing up at retail sportsbooks being rebranded under the

Barstool moniker.

While analysts pay plenty of attention to the online gambling

markets, it seems only a matter of time before a growing choir of

voices starts to muse about the opportunity in the lottery space, a

little-recognized market with global scale and reach. As digital

lottery operations gain global traction, it may well be time to

place a bet on the future of gaming.

For more information

about Lottery.com, please

visit Lottery.com.

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

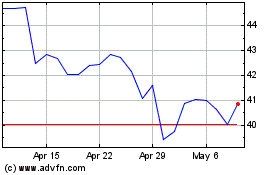

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

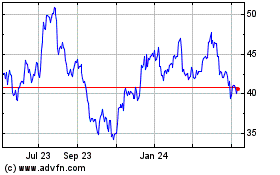

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024