Statement of Changes in Beneficial Ownership (4)

June 18 2019 - 6:23PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

MURREN JAMES

|

2. Issuer Name

and

Ticker or Trading Symbol

MGM Resorts International

[

MGM

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__

X

__ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

CHAIRMAN & CEO

|

|

(Last)

(First)

(Middle)

3600 LAS VEGAS BLVD. SOUTH

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/27/2017

|

|

(Street)

LAS VEGAS, NV 89109

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock $.01 Par Value ND

|

2/27/2017

|

|

G

|

|

3991

|

D

|

$0.00

|

3990

|

I

|

By Grantor Retained

Annuity Trust

|

|

Common Stock $.01 Par Value ND

|

2/27/2017

|

|

G

|

|

3991

|

A

|

$0.00

|

3991

|

I

|

By Jack Murren

Irrevocable Trust

|

|

Common Stock $.01 Par Value ND

|

2/27/2017

|

|

G

|

|

3990

|

D

|

$0.00

|

0

|

I

|

By Grantor Retained

Annuity Trust

|

|

Common Stock $.01 Par Value ND

|

2/27/2017

|

|

G

|

|

3990

|

A

|

$0.00

|

3990

|

I

|

By Theordore Murren

Irrevocable Trust

|

|

Common Stock $.01 Par Value ND

|

1/22/2018

|

|

G

|

|

127382

|

D

|

$0.00

|

346149

|

I

|

By Grantor Retained

Annuity Trust

|

|

Common Stock $.01 Par Value ND

|

1/22/2018

|

|

G

|

|

127382

|

A

|

$0.00

|

131373

|

I

|

By Jack Murren

Irrevocable Trust

|

|

Common Stock $.01 Par Value ND

|

1/22/2018

|

|

G

|

|

127382

|

D

|

$0.00

|

218767

|

I

|

By Grantor Retained

Annuity Trust

|

|

Common Stock $.01 Par Value ND

|

1/22/2018

|

|

G

|

|

127382

|

A

|

$0.00

|

131372

|

I

|

By Theordore Murren

Irrevocable Trust

|

|

Common Stock $.01 Par Value ND

|

5/16/2019

|

|

G

|

V

|

318669

|

D

|

$0.00

|

0

|

D

|

|

|

Common Stock $.01 Par Value ND

|

5/16/2019

|

|

G

|

V

|

318669

|

A

|

$0.00

|

318669

|

I

|

J&H Investments LLC

|

|

Common Stock $.01 Par Value ND

|

|

|

|

|

|

|

|

793788

|

I

|

By spousal limited access

trusts

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Restricted Stock Units

|

(1)

|

6/14/2019

|

|

A

|

|

78.693

|

|

10/5/2016

|

10/5/2019

|

Common Stock $.01 Par Value ND

|

78.693

|

(2)

|

16822.7875

|

D

|

|

|

Restricted Stock Units

|

(3)

|

6/14/2019

|

|

A

|

|

371.795

|

|

(3)

|

(3)

|

Common Stock $.01 Par Value ND

|

371.795

|

(2)

|

79478.324

|

D

|

|

|

Restricted Stock Units

|

(1)

|

6/14/2019

|

|

A

|

|

126.3454

|

|

10/3/2017

|

10/3/2020

|

Common Stock $.01 Par Value ND

|

126.3454

|

(2)

|

27008.7979

|

D

|

|

|

Restricted Stock Units

|

(1)

|

6/14/2019

|

|

A

|

|

263.879

|

|

11/14/2018

|

11/14/2021

|

Common Stock $.01 Par Value ND

|

263.879

|

(2)

|

56409.2131

|

D

|

|

|

Restricted Stock Units

|

(4)

|

6/14/2019

|

|

A

|

|

168.305

|

|

(5)

|

2/23/2021

|

Common Stock $.01 Par Value ND

|

168.305

|

(2)

|

35978.4297

|

D

|

|

|

Restricted Stock Units

|

(6)

|

6/14/2019

|

|

A

|

|

498.5204

|

|

10/19/2019

|

10/19/2022

|

Common Stock $.01 Par Value ND

|

498.5204

|

(2)

|

106568.317

|

D

|

|

|

Restricted Stock Units

|

(4)

|

6/14/2019

|

|

A

|

|

128.2406

|

|

(7)

|

2/21/2023

|

Common Stock $.01 Par Value ND

|

128.2406

|

(2)

|

27413.8863

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

Restricted Stock Units ("RSUs") granted under the MGM Resorts International Amended and Restated 2005 Omnibus Incentive Plan (the "Plan"). Each RSU represents the right to receive, following vesting, one share of common stock. Any fractional shares will be paid in cash upon settlement.

|

|

(2)

|

Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on MGM Resorts International's common stock and vest on the same dates and in the same relative proportions as the RSUs on which they accrue.

|

|

(3)

|

RSUs granted under the Plan. Each RSU represents the right to receive one share of MGM Resorts common stock. The RSUs cliff vest on December 31, 2021, with delivery automatically deferred until Mr. Murren's separation from the Company (unless such separation is determined to have been for Employer's Good Cause, as defined in his employment agreement), and are subject to automatic forfeiture in the event of Mr. Murren's termination for any reason prior to December 31, 2021.

|

|

(4)

|

RSUs granted under the Plan. Each RSU represents the right to receive one share of MGM Resorts International common stock. Any fractional shares will be paid in cash upon settlement.

|

|

(5)

|

The RSUs are fully vested. Delivery of shares will be made on the third anniversary of the grant date.

|

|

(6)

|

RSUs granted under the Plan. Each RSU represents the right to receive, following vesting, one share of MGM Resorts common stock. The RSUs are subject to meeting minimum performance criteria set by the Compensation Committee of the Board of Directors of MGM Resorts, during the six-month period ending on June 30, 2019 (the "Measurement Date"). Provided such criteria are met, the RSUs will vest in four equal annual installments commencing on the first anniversary of the grant date. If such criteria are not met, then the RSUs will automatically expire on the Measurement Date without any shares being issued.

|

|

(7)

|

The RSUs are fully vested. Delivery of shares will be made in four equal annual installments commencing on the first anniversary of the grant date.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

MURREN JAMES

3600 LAS VEGAS BLVD. SOUTH

LAS VEGAS, NV 89109

|

X

|

|

CHAIRMAN & CEO

|

|

Signatures

|

|

/s/ Andrew Hagopian III, Attorney-In-Fact

|

|

6/18/2019

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

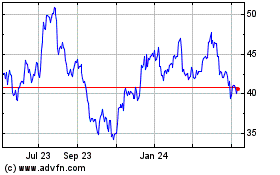

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

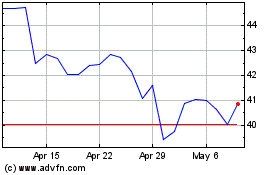

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024