Methode Electronics, Inc. (NYSE: MEI), a global

developer of custom-engineered and application-specific products

and solutions, announced financial results for the third quarter of

Fiscal 2019 ended January 26, 2019.

Third Quarter Fiscal 2019Methode's

third-quarter Fiscal 2019 net sales increased $18.9 million, or 8.3

percent, to $246.9 million from $228.0 million in the same quarter

of Fiscal 2018. Year over year, currency rate fluctuations

decreased net sales $2.2 million.

GAAP net income increased $55.0 million to $30.7 million, or

$0.82 per share, in the third quarter of Fiscal 2019 from a loss of

$24.3 million, or a loss of $0.65 per share, in the same period of

Fiscal 2018.

Adjusted net income, a non-GAAP financial measure, increased to

$31.3 million, or $0.83 per share, in the third quarter of Fiscal

2019 from $27.5 million, or $0.74 per share, in the same period of

Fiscal 2018. Adjusted net income excludes expenses for initiatives

to reduce overall costs and improve operational profitability,

acquisition-related costs (including purchase accounting

adjustments), long-term incentive plan accrual adjustments and the

transition tax and the impact of revaluing deferred taxes due to

the change in the federal tax rate from U.S. Tax Reform in the

applicable periods.

Year over year, Fiscal 2019 third-quarter GAAP net income

benefitted from:

- lower income tax expense of $66.4 million;

- higher sales in the Industrial segment (inclusive of

Grakon);

- increased international government grants of $2.1 million;

- lower legal expense of $0.8 million; and

- the favorable impact of the weakening Mexican peso compared to

the U.S. dollar.

Year over year, Fiscal 2019 third-quarter GAAP net income was

negatively affected by:

- reduced passenger car demand and production in Europe and

Asia;

- higher stock award amortization expense of $4.7 million, due

primarily to the change from target to threshold performance

estimates in the third quarter of fiscal 2018;

- increased acquisition-related costs ($0.8 million) and

increased purchase accounting adjustments related to inventory

($3.0 million) totaling $3.8 million;

- increased intangible asset amortization expense related to the

Grakon acquisition of $3.5 million;

- higher net interest expense of $2.9 million;

- initiatives to reduce overall costs and improve operational

profitability of $2.6 million;

- tariff expense on imported Chinese goods of $2.1 million;

- the absence of the gain in the Fiscal 2018 period related to

the sale of exclusive rights for a licensing agreement of $1.6

million; and

- customer pricing reductions.

Consolidated gross margins as a percentage of net sales

decreased to 26.0 percent for the Fiscal 2019 third quarter

compared to 26.4 percent in the same period last year. Year over

year, gross margins were negatively impacted by the effect of

reduced passenger car demand in Europe and Asia and pricing

reductions on certain products in the Automotive segment, as well

as lower sales in the Interface segment, acquisition-related

purchase accounting adjustments, initiatives to reduce overall

costs and improve operational profitability and tariff expense.

These decreases were partially offset by increased sales and a

favorable sales mix in the Industrial segment and a favorable

currency impact. Adjusted gross margins as a percentage of sales, a

non-GAAP financial measure, increased to 27.7 percent in the Fiscal

2019 third quarter from 26.4 percent in the same period of Fiscal

2018 and exclude expense for initiatives to reduce overall costs

and improve operational profitability and acquisition-related

purchase accounting adjustments in the applicable periods.

Selling and administrative expenses as a percentage of sales

increased to 13.3 percent for the Fiscal 2019 third quarter

compared to 9.9 percent in the same period last year due to higher

stock award amortization expense, selling and administrative

expenses attributable to the Grakon acquisition, increased

acquisition-related costs and initiatives to reduce overall costs

and improve operational profitability, partially offset by lower

legal expense. Adjusted selling and administrative expenses as a

percentage of sales, a non-GAAP financial measure, were unchanged

at 12.5 percent in the Fiscal 2019 and Fiscal 2018 third quarters

and exclude acquisition-related costs, initiatives to reduce

overall costs and improve operational profitability and long-term

incentive plan accrual adjustments in the applicable periods.

Year over year, intangible asset amortization expense in the

third quarter of Fiscal 2019 increased $3.5 million, or 175.0

percent, to $5.5 million, due to amortization expense related to

the Grakon acquisition.

In the Fiscal 2019 third quarter, income tax expense decreased

$66.4 million to a benefit of $3.0 million compared to an expense

of $63.4 million in the Fiscal 2018 third quarter primarily due to

the transition tax and the impact of revaluing deferred taxes due

to the change in the federal tax rate from U.S. Tax Reform in

the applicable periods. In addition, the Company recognized a tax

benefit from foreign tax credits and a release of a tax reserve.

The Company’s effective tax rate decreased to a benefit of 10.4

percent in the Fiscal 2019 period from an expense of 162.1 percent

in the previous third quarter.

EBITDA (Earnings Before Interest, Taxes, Depreciation and

Amortization of Intangibles), a non-GAAP financial measure, in the

Fiscal 2019 third quarter was $43.1 million compared to $46.5

million in the Fiscal 2018 period. Adjusted EBITDA, a non-GAAP

financial measure, excludes expenses for initiatives to reduce

overall costs and improve operational profitability,

acquisition-related costs (including purchase accounting

adjustments) and long-term incentive plan accrual adjustments from

EBITDA, improved to $49.5 million in the Fiscal 2019 third quarter

from $40.5 million in the Fiscal 2018 period.

Segment Comparisons (GAAP Reported)Comparing

the Automotive segment's Fiscal 2019 third quarter to the same

period of Fiscal 2018,

- Net sales decreased 6.5 percent, or $12.0 million, attributable

to:

- a 25.5 percent sales decline in Asia due to a combination of

pricing reductions and reduced volume of transmission lead-frame

assembly product as a result of lower passenger car demand and

production, as well as decreased steering angle sensor volume as

the product approaches end of production; and

- a 19.9 percent sales decrease in Europe mainly the result of

lower passenger car production due to European emission testing

standards and an overall reduction in passenger car demand, as well

as the exclusion of pre-production tooling sales as the result of

newly adopted accounting guidelines regarding revenue recognition

under ASC 606, partially offset by higher sensor product volumes;

partially offset by

- a 5.8 percent sales increase in North America attributable to

automotive sales from Grakon of $13.2 million and new launches,

partially offset by pricing reductions and sales mix of center

console products, and a combination of pricing reductions and

reduced volume of transmission lead-frame assembly product due to

reduced passenger car demand and production.

- Gross margins as a percentage of sales decreased to 24.2

percent from 27.9 percent mainly due to lower sales volume as the

result of an overall reduction in passenger car demand and

production in Europe and Asia, as well as pricing reductions,

initiatives to reduce overall costs and improve operational

profitability and tariff expense, partially offset by a favorable

currency impact.

- Income from operations decreased $12.4 million, or 31.5

percent, resulting from lower sales volume due to an overall

reduction in passenger car demand and production in Europe and

Asia, pricing reductions and sales mix in North America,

initiatives to reduce overall costs and improve operational

profitability and higher stock award amortization expense,

partially offset by income from Grakon and a favorable currency

impact.

Comparing the Industrial segment's Fiscal 2019 third quarter to

the same period of Fiscal 2018,

- Net sales increased 136.1 percent, or $34.7 million,

attributable to:

- a 324.7 percent sales improvement in North America as the

result of sales from Grakon of $31.4 million, partially offset by

lower busbar product volume;

- a 33.7 percent sales improvement in Europe due to sales from

Grakon of $1.9 million, as well as improved busbar and radio remote

control product volumes, partially offset by decreased bypass

switch volume; and

- a 21.5 percent sales increase in Asia attributable to sales

from Grakon of $0.4 million and higher busbar product volume.

- Gross margins as a percentage of sales increased to 33.1

percent from 24.7 percent due to higher sales and a favorable sales

mix partially offset by purchase accounting adjustments and tariff

expense.

- Income from operations improved to $8.9 million compared to

$3.2 million resulting from income from Grakon, increased radio

remote control volume and lower legal expense, partially offset by

purchase accounting adjustments and tariff expense.

Comparing the Interface segment's Fiscal 2019 third quarter to

the same period of Fiscal 2018,

- Net sales decreased 22.2 percent, or $3.9 million, attributable

to:

- a 20.8 percent sales decline in North America as the result of

the delayed launch of a major appliance program and reduced legacy

data solution product volume; and

- a 50.0 percent sales decrease in Asia due to lower sales

volumes of legacy products.

- Gross margins as a percentage of sales decreased to 16.1

percent from 19.3 percent due to lower sales volumes, partially

offset by a favorable currency impact.

- Income from operations declined $1.6 million to break even

resulting from lower sales, partially offset by a favorable

currency impact.

Comparing the Medical segment's Fiscal 2019 third quarter to the

same period of Fiscal 2018,

- Net sales were constant at $0.1 million year over year.

First Nine Months Fiscal 2019Methode's first

nine months of Fiscal 2019 net sales increased $75.0 million, or

11.4%, to $734.3 million from $659.3 million in the same period of

Fiscal 2018. Year over year, currency rate fluctuations decreased

net sales by $1.1 million.

GAAP net income increased $48.6 million to $69.0 million, or

$1.83 per share, in the first nine months of Fiscal 2019 from $20.4

million, or $0.54 per share, in the same period of Fiscal 2018.

Adjusted net income, a non-GAAP financial measure, increased to

$87.9 million, or $2.34 per share, in the nine months of Fiscal

2019 compared to $77.9 million, or $2.07 per share, in the same

period of Fiscal 2018. Adjusted net income excludes expenses for

initiatives to reduce overall costs and improve operational

profitability, acquisition-related costs (including purchase

accounting adjustments), long-term incentive plan accrual

adjustments and the transition tax and the impact of revaluing

deferred taxes due to the change in the federal tax rate from U.S.

Tax Reform in the applicable periods.

Year over year, first nine months of Fiscal 2019 GAAP net income

benefitted from:

- lower income tax expense of $68.1 million;

- higher sales in the Automotive and Industrial segments

(inclusive of Pacific Insight, Procoplast and Grakon);

- lower legal expense of $3.6 million;

- increased international government grants of $2.1 million;

and

- the favorable impact of the weakening Mexican peso compared to

the U.S. dollar.

Year over year, first nine months of Fiscal 2019 GAAP net income

was negatively affected by:

- reduced passenger car demand and production in Europe and

Asia;

- increased acquisition-related costs ($3.7 million) and

increased purchase accounting adjustments related to inventory

($4.8 million) totaling $8.5 million;

- higher stock award amortization expense of $8.4 million;

- increased intangible asset amortization expense related to the

Pacific Insight, Procoplast and Grakon acquisitions of $7.4

million;

- initiatives to reduce overall costs and improve operational

profitability of $5.8 million;

- higher net interest expense of $4.7 million;

- tariff expense on imported Chinese goods of $2.1 million;

- the absence of the gain in the Fiscal 2018 period related to

the sale of exclusive rights for a licensing agreement of $1.6

million; and

- customer pricing reductions.

Consolidated gross margins as a percentage of sales decreased

slightly to 26.6 percent in the first nine months of Fiscal 2019

from 27.0 percent in the first nine months of Fiscal 2018. Year

over year, gross margins were negatively impacted by the effect of

reduced passenger car demand and production in Europe and Asia,

sales mix and pricing reductions on certain products in the

Automotive segment, as well as lower sales in the Interface

segment, purchase accounting adjustments, initiatives to reduce

overall costs and improve operational profitability and tariff

expense. These decreases were partially offset by a favorable sales

mix in the Industrial segment and favorable currency impact.

Adjusted gross margins as a percentage of sales, a non-GAAP

financial measure, increased to 27.8 percent in the Fiscal 2019

first nine months from 27.1 percent in the same period of Fiscal

2018 and exclude expense for initiatives to reduce overall costs

and improve operational profitability and acquisition-related

purchase accounting adjustments in the applicable periods.

Selling and administrative expenses as a percentage of sales

increased to 15.0 percent for the first nine months of Fiscal 2019

compared to 12.6 percent in the first nine months of Fiscal 2018

due to selling and administrative expenses attributable to the

Procoplast and Grakon acquisitions, higher stock award amortization

expense, increased acquisition-related costs, initiatives to reduce

overall costs and improve operational profitability and higher

personnel-related costs, partially offset by lower legal expense.

Adjusted selling and administrative expenses as a percentage of

sales, a non-GAAP financial measure, decreased to 12.3 percent in

the Fiscal 2019 first nine months compared to 12.6 percent in the

first nine months of Fiscal 2018 and exclude acquisition-related

costs, expense for initiatives to reduce overall costs and improve

operational profitability and long-term incentive plan accrual

adjustments in the applicable periods.

Year over year, intangible asset amortization expense in the

first nine months of Fiscal 2019 increased $7.4 million, or 200.0

percent, to $11.1 million, due to the Pacific Insight, Procoplast

and Grakon acquisitions.

In the first nine months of Fiscal 2019, income tax expense

decreased $68.1 million to $4.5 million compared to $72.6 million

in the first nine months of Fiscal 2018 primarily due to the

transition tax and the impact of revaluing deferred taxes due to

the change in the federal tax rate from U.S. Tax Reform in the

applicable periods. In addition, the Company recognized a tax

benefit from foreign tax credits and a release of a tax reserve.

The Company’s effective tax rate decreased to 6.1 percent in the

first nine months of Fiscal 2019 from 78.1 percent in the first

nine months of Fiscal 2018.

EBITDA (Earnings Before Interest, Taxes, Depreciation and

Amortization of Intangibles), a non-GAAP financial measure, in the

first nine months of Fiscal 2019 was $109.1 million compared to

$113.3 million in the first nine months of Fiscal 2018. Adjusted

EBITDA, a non-GAAP financial measure, excludes expenses for

initiatives to reduce overall costs and improve operational

profitability, acquisition-related costs (including purchase

accounting adjustments) and long-term incentive plan accrual

adjustments from EBITDA, improved to $137.6 million in the first

nine months of Fiscal 2019 from $114.1 million in the first nine

months of Fiscal 2018.

Segment Comparisons (GAAP Reported)Comparing

the Automotive segment's Fiscal 2019 first nine months to the same

period of Fiscal 2018,

- Net sales increased 4.1 percent, or $21.7 million, attributable

to:

- a 13.7 percent sales improvement in North America due to higher

sales from Pacific Insight of $37.2 million, sales from Grakon of

$19.3 million and new launches, partially offset by pricing

reductions and sales mix of center console products, and a

combination of pricing reductions and reduced volume of

transmission lead-frame assembly product as the result of reduced

passenger car demand and production; partially offset by

- a 16.0 percent sales decrease in Asia mainly attributable to a

combination of pricing reductions and reduced volume of

transmission lead-frame assembly product due to reduced passenger

car demand and production, and lower steering angle sensor product

volume as the product approaches end of production; and

- a 4.7 percent sales decrease in Europe mainly as a result of

lower passenger car production attributable to European emission

testing standards and an overall reduction in passenger car demand

and production, as well as the exclusion of pre-production tooling

sales due to newly adopted accounting guidelines regarding revenue

recognition under ASC 606, partially offset by higher sales from

Procoplast of $6.6 million and improved sensor products

volume.

- Gross margins as a percentage of sales declined to 26.1 percent

from 28.4 percent due to unfavorable sales mix in Asia and at

Pacific Insight, pricing reductions, initiatives to reduce overall

costs and improve operational profitability and tariff expense,

partially offset by a favorable currency impact.

- Income from operations decreased $21.4 million, or 18.1

percent, resulting from an unfavorable sales mix, higher stock

award amortization expense, initiatives to reduce overall costs and

improve operational profitability, pricing reductions, tariff

expense and increased intangible asset amortization expense,

partially offset by Grakon and Pacific Insight sales and a

favorable currency impact.

Comparing the Industrial segment's Fiscal 2019 first nine months

to the same period of Fiscal 2018,

- Net sales increased 83.9 percent, or $63.8 million,

attributable to:

- a 182.1 percent sales improvement in North America as the

result of sales from Grakon of $48.3 million and increased radio

remote control and busbar products volume;

- a 40.3 percent sales increase in Asia due to sales from Grakon

of $0.7 million and higher busbar product volume; and

- a 17.3 percent sales improvement in Europe attributable to

sales from Grakon of $2.8 million and higher radio remote control

and busbar products volume, partially offset by lower bypass switch

product volume.

- Gross margins as a percentage of sales improved to 31.8 percent

from 25.5 percent due to a favorable sales mix partially offset by

purchase accounting adjustments and tariff expense.

- Income from operations increased to $21.1 million from $8.3

million as result of income from Grakon, improved radio remote

control and busbar sales volume and lower legal expense, partially

offset by higher stock award amortization expense, purchase

accounting adjustments and tariff expense.

Comparing the Interface segment's Fiscal 2019 first nine months

to the same period of Fiscal 2018,

- Net sales decreased 20.1 percent, or $11.1 million,

attributable to:

- a 19.7 percent sales decrease in North America as the result of

the delayed launch of a major appliance program and reduced legacy

data solution products volume; and

- a 35.3 percent sales decline in Asia due to lower legacy

product volume.

- Gross margins as a percentage of sales declined to 15.0 percent

from 20.1 percent due to lower sales volumes and an unfavorable

sales mix, partially offset by a favorable currency impact.

- Income from operations decreased $4.8 million, or 96.0 percent,

as the result of lower sales volumes and an unfavorable sales mix,

partially offset by a favorable currency impact.

Comparing the Medical segment's Fiscal 2019 first nine months to

the same period of Fiscal 2018,

- Net sales increased $0.5 million due primarily to an expanded

customer base.

Fiscal 2019 GuidanceMethode anticipates Fiscal

2019 sales to be at the lower end of the previous guidance range of

$1.0 billion to $1.04 billion. The Company has updated guidance for

pre-tax income to a range of $104.5 million to $111.5 million and

earnings per share to a range of $2.50 to $2.67 from pre-tax income

in the range of $91.5 million to $105.5 million and earnings per

share in the range of $2.02 to $2.33.

Fiscal 2019 guidance considers:

- Tax-related benefits of $7.2 million of which $4.8 million is

due to finalization of U.S. Tax Reform;

- Improved anticipated operational results at Grakon from

guidance issued in Fiscal 2019 second quarter;

- Lower anticipated impact of tariffs on imported Chinese goods

at 10 percent to approximately $4.3 million from $5.5 million

issued in Fiscal 2019 second quarter guidance;

- Pre-tax expense for initiatives to reduce overall costs and

improve operational profitability in Fiscal 2019 of $7.3

million;

- Stock award amortization expense due to change in Fiscal 2020

EBITDA estimate from Threshold to Target of $5.7 million;

- Acquisition-related costs of $7.9 million;

- Purchase accounting adjustments for inventory and severance

related to the acquisition of Grakon of $7.0 million; and

- International government grant of $5.9 million.

The guidance ranges for Fiscal 2019 are based upon management's

expectations regarding a variety of factors and involve a number of

risks and uncertainties, including, but not limited to, the

following:

- sales volumes and timing thereof for certain makes and models

of pickup trucks, sports utility vehicles and passenger cars;

- the potential impact of the current and proposed Chinese

tariffs and the costs associated with mitigating those

tariffs;

- the successful integration of acquisitions;

- the price of commodities, particularly copper and resins;

- sales mix within the markets served;

- currency exchange effect of the operations of foreign

businesses;

- supplier issues or manufacturing quality events;

- any unusual or one-time items; and

- an effective tax rate in the 9 to 11 percent range and no

significant changes in tax credit movement, valuation allowances or

enacted tax laws.

Management CommentsPresident and Chief

Executive Officer Donald W. Duda said, “Although we are facing

challenging automotive market conditions, including an overall

reduction in passenger car demand and production and European

emission testing standards, Fiscal 2019 third-quarter and

nine-month sales grew year over year due mainly to our Grakon

acquisition. Additionally, we generated $63 million in free cash

flow through the nine months of Fiscal 2019. This allowed us to

repay $55 million of our debt during the quarter, making

significant progress toward our goal to reduce debt. With a solid

balance sheet and sound financial performance, we remain well

positioned to execute on our plan to deleverage our balance sheet

while also investing for growth."

Non-GAAP Financial MeasuresTo supplement the

Company's financial statements presented in accordance with

generally accepted accounting principles in the United States

(“GAAP”), Methode uses Adjusted Net Income, Adjusted Earnings Per

Share, Adjusted Income from Operations, Adjusted Gross Profit,

Adjusted Gross Margins as a Percentage of Sales, Adjusted Selling

and Administrative Expenses, Adjusted Selling and Administrative

Expenses as a Percentage of Sales, EBITDA, Adjusted EBITDA, and

Free Cash Flow as non-GAAP measures. Reconciliation to the nearest

GAAP measures of all non-GAAP measures included in this press

release can be found at the end of this release. Methode's

definitions of these non-GAAP measures may differ from similarly

titled measures used by others. These non-GAAP measures should be

considered supplemental to, and not a substitute for, financial

information prepared in accordance with GAAP. The Company believes

that these non-GAAP measures are useful because they (i) provide

both management and investors meaningful supplemental information

regarding financial performance by excluding certain expenses that

may not be indicative of recurring core business operating results,

(ii) permit investors to view Methode's performance using the same

tools that management uses to evaluate its past performance,

reportable business segments and prospects for future performance

and (iii) otherwise provide supplemental information that may be

useful to investors in evaluating Methode.

Conference CallThe Company will conduct a

conference call and Webcast to review financial and operational

highlights led by its President and Chief Executive Officer, Donald

W. Duda, and Chief Financial Officer, Ron Tsoumas, today at 10:00

a.m. Central time.

To participate in the conference call, please dial (877)

407-9210 (domestic) or (201) 689-8049 (international) at least five

minutes prior to the start of the event. A simultaneous Webcast can

be accessed through the Company’s Web site, www.methode.com, by

selecting the Investor Relations page, and then clicking on the

“Webcast” icon.

A replay of the conference call will be available shortly after

the call through April 7, 2019, by dialing (877) 481-4010 and

providing Conference ID number 44548. On the Internet, a replay

will be available for 30 days through the Company’s Web site,

www.methode.com, by selecting the Investor Relations page and then

clicking on the “Webcast” icon.

About Methode Electronics, Inc.Methode

Electronics, Inc. (NYSE: MEI) is a global developer of custom

engineered and application specific products and solutions with

manufacturing, design and testing facilities in Belgium, Canada,

China, Egypt, Germany, India, Italy, Lebanon, Malta, Mexico, the

Netherlands, Singapore, Switzerland, the United Kingdom and the

United States. We design, manufacture and market devices employing

electrical, electronic, wireless, safety radio remote control,

sensing and optical technologies to control and convey signals

through sensors, interconnections and controls. Our business is

managed on a segment basis, with those segments being Automotive,

Industrial, Interface and Medical. Our components are in the

primary end markets of the automobile, commercial vehicle,

computer, information processing and networking equipment, voice

and data communication systems, consumer electronics, appliances,

aerospace vehicles and industrial equipment industries. Further

information can be found on Methode's Web site www.methode.com.

Forward-Looking StatementsThis press release

contains certain forward-looking statements, which reflect

management's expectations regarding future events and operating

performance and speak only as of the date hereof. These

forward-looking statements are subject to the safe harbor

protection provided under the securities laws. Methode undertakes

no duty to update any forward-looking statement to conform the

statement to actual results or changes in Methode's expectations on

a quarterly basis or otherwise. The forward-looking statements in

this press release involve a number of risks and uncertainties. The

factors that could cause actual results to differ materially from

our expectations are detailed in Methode's filings with the

Securities and Exchange Commission, such as our annual and

quarterly reports. Such factors may include, without limitation,

the following: (1) dependence on a small number of large customers,

including two large automotive customers; (2) dependence on the

automotive, appliance, commercial vehicle, computer and

communications industries; (3) international trade disputes

resulting in tariffs: (4) investment in programs prior to the

recognition of revenue; (5) timing, quality and cost of new program

launches; (6) changes in U.S. trade policy; (7) ability to

withstand price pressure, including pricing reductions; (8) ability

to successfully market and sell Dabir Surfaces products; (9)

currency fluctuations; (10) customary risks related to

conducting global operations; (11) recognition of goodwill

impairment charges; (12) dependence on the availability and price

of raw materials; (13) fluctuations in our gross margins; (14)

ability to withstand business interruptions; (15) ability to

successfully benefit from acquisitions and divestitures; (16)

dependence on our supply chain; (17) income tax rate fluctuations;

(18) ability to keep pace with rapid technological changes; (19)

breach of our information technology systems; (20) ability to avoid

design or manufacturing defects; (21) ability to compete

effectively; (22) ability to protect our intellectual property;

(23) success of Pacific Insight, Procoplast and Grakon and/or our

ability to implement and profit from new applications of the

acquired technology; (24) significant adjustments to expense based

on the probability of meeting certain performance levels in our

long-term incentive plan; and (25) costs and expenses due to

regulations regarding conflict minerals.

For Methode Electronics, Inc.Kristine

WalczakVice President - Corporate

Communications708-457-4030kwalczak@methode.com

Steve CarrDresner Corporate

Services312-780-7211scarr@dresnerco.com

METHODE ELECTRONICS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited)($ in millions, except per

share data)

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

January 26, 2019 |

|

January 27, 2018 |

|

January 26, 2019 |

|

January 27, 2018 |

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

246.9 |

|

|

$ |

228.0 |

|

|

$ |

734.3 |

|

|

$ |

659.3 |

|

|

|

|

|

|

|

|

|

|

|

| Cost of Products

Sold |

|

182.6 |

|

|

167.9 |

|

|

539.1 |

|

|

481.6 |

|

| |

|

|

|

|

|

|

|

|

| Gross Profit |

|

64.3 |

|

|

60.1 |

|

|

195.2 |

|

|

177.7 |

|

| |

|

|

|

|

|

|

|

|

| Selling and

Administrative Expenses |

|

32.8 |

|

|

22.5 |

|

|

110.3 |

|

|

83.3 |

|

| Amortization of

Intangibles |

|

5.5 |

|

|

2.0 |

|

|

11.1 |

|

|

3.7 |

|

| |

|

|

|

|

|

|

|

|

| Income from

Operations |

|

26.0 |

|

|

35.6 |

|

|

73.8 |

|

|

90.7 |

|

| |

|

|

|

|

|

|

|

|

| Interest Expense,

Net |

|

3.2 |

|

|

0.3 |

|

|

5.0 |

|

|

0.3 |

|

| Other Income, Net |

|

(4.9 |

) |

|

(3.8 |

) |

|

(4.7 |

) |

|

(2.6 |

) |

| |

|

|

|

|

|

|

|

|

| Income before Income

Taxes |

|

27.7 |

|

|

39.1 |

|

|

73.5 |

|

|

93.0 |

|

| |

|

|

|

|

|

|

|

|

| Income Tax Expense

(Benefit) |

|

(3.0 |

) |

|

63.4 |

|

|

4.5 |

|

|

72.6 |

|

| |

|

|

|

|

|

|

|

|

| Net Income (Loss) |

|

$ |

30.7 |

|

|

$ |

(24.3 |

) |

|

$ |

69.0 |

|

|

$ |

20.4 |

|

| |

|

|

|

|

|

|

|

|

| Basic and Diluted

Income (Loss) per Share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.82 |

|

|

$ |

(0.65 |

) |

|

$ |

1.84 |

|

|

$ |

0.54 |

|

|

Diluted |

|

$ |

0.82 |

|

|

$ |

(0.65 |

) |

|

$ |

1.83 |

|

|

$ |

0.54 |

|

| |

|

|

|

|

|

|

|

|

| Cash Dividends per

Common Share |

|

$ |

0.11 |

|

|

$ |

0.11 |

|

|

$ |

0.33 |

|

|

$ |

0.29 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average Number

of Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

37,405,550 |

|

|

37,292,934 |

|

|

37,387,181 |

|

|

37,275,041 |

|

|

Diluted |

|

37,654,250 |

|

|

37,292,934 |

|

|

37,637,470 |

|

|

37,661,020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

METHODE ELECTRONICS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(in millions, except per share

data)

| |

|

January 26, 2019 |

|

April 28, 2018 |

| |

|

(Unaudited) |

|

|

| Assets: |

|

|

|

|

| Current Assets: |

|

|

|

|

| Cash and Cash

Equivalents |

|

$ |

73.7 |

|

|

$ |

246.1 |

|

| Accounts

Receivable, Net |

|

211.5 |

|

|

202.6 |

|

|

Inventories: |

|

|

|

|

| Finished

Products |

|

33.9 |

|

|

15.4 |

|

| Work in

Process |

|

9.3 |

|

|

14.6 |

|

|

Materials |

|

80.8 |

|

|

54.1 |

|

| Total

Inventories |

|

124.0 |

|

|

84.1 |

|

| Prepaid

and Refundable Income Taxes |

|

14.7 |

|

|

2.4 |

|

| Prepaid

Expenses and Other Current Assets |

|

22.5 |

|

|

14.8 |

|

| Total Current

Assets |

|

446.4 |

|

|

550.0 |

|

| Property Plan and

Equipment: |

|

|

|

|

| Land |

|

3.6 |

|

|

0.8 |

|

| Buildings

and Building Improvements |

|

74.7 |

|

|

69.2 |

|

| Machinery

and Equipment |

|

390.3 |

|

|

364.7 |

|

| Property,

Plant and Equipment, Gross |

|

468.6 |

|

|

434.7 |

|

| Less:

Allowances for Depreciation |

|

279.5 |

|

|

272.5 |

|

| Property, Plant and

Equipment, Net |

|

189.1 |

|

|

162.2 |

|

| Other Assets: |

|

|

|

|

|

Goodwill |

|

236.8 |

|

|

59.2 |

|

| Other

Intangible Assets, Net |

|

267.6 |

|

|

61.0 |

|

| Cash

Surrender Value of Life Insurance |

|

8.6 |

|

|

8.2 |

|

| Deferred

Income Taxes |

|

32.8 |

|

|

42.3 |

|

|

Pre-production Costs |

|

32.5 |

|

|

20.5 |

|

|

Other |

|

12.4 |

|

|

12.5 |

|

| Total Other Assets |

|

590.7 |

|

|

203.7 |

|

| Total Assets |

|

$ |

1,226.2 |

|

|

$ |

915.9 |

|

| Liabilities and

Shareholders' Equity: |

|

|

|

|

| Current

Liabilities: |

|

|

|

|

| Accounts

Payable |

|

$ |

88.6 |

|

|

$ |

89.5 |

|

| Salaries,

Wages and Payroll Taxes |

|

21.4 |

|

|

22.8 |

|

| Other

Accrued Expenses |

|

34.4 |

|

|

21.6 |

|

|

Short-term Debt |

|

15.2 |

|

|

4.4 |

|

| Income

Tax Payable |

|

16.8 |

|

|

18.7 |

|

| Total Current

Liabilities |

|

176.4 |

|

|

157.0 |

|

| Long-term Debt |

|

287.7 |

|

|

53.4 |

|

| Long-term Income Taxes

Payable |

|

33.0 |

|

|

42.6 |

|

| Other Liabilities |

|

6.7 |

|

|

4.6 |

|

| Deferred Income

Taxes |

|

38.9 |

|

|

18.3 |

|

| Deferred

Compensation |

|

9.4 |

|

|

10.0 |

|

| Total Liabilities |

|

552.1 |

|

|

285.9 |

|

| Shareholders'

Equity: |

|

|

|

|

| Common

Stock, $0.50 par value, 100,000,000 shares authorized, 38,333,576

and 38,198,353 shares issued as of January 26, 2019 and

April 28, 2018, respectively |

|

19.2 |

|

|

19.1 |

|

|

Additional Paid-in Capital |

|

148.2 |

|

|

136.5 |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

(8.5 |

) |

|

13.9 |

|

| Treasury

Stock, 1,346,624 shares as of January 26, 2019 and April 28,

2018 |

|

(11.5 |

) |

|

(11.5 |

) |

| Retained

Earnings |

|

526.7 |

|

|

472.0 |

|

| Total Shareholders'

Equity |

|

674.1 |

|

|

630.0 |

|

| Total Liabilities and

Shareholders' Equity |

|

$ |

1,226.2 |

|

|

$ |

915.9 |

|

|

|

|

|

|

|

METHODE ELECTRONICS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (Unaudited)($ in millions)

| |

|

Nine Months Ended |

| |

|

January 26, 2019 |

|

January 27, 2018 |

|

|

|

|

|

|

|

|

|

|

| Operating Activities: |

|

|

|

|

|

|

|

|

| Net

Income |

|

$ |

69.0 |

|

|

$ |

20.4 |

|

|

Adjustments to Reconcile Net Income to Net Cash Provided by

Operating Activities: |

|

|

|

|

| Gain on

Sale of Fixed Assets |

|

(0.6 |

) |

|

— |

|

| Gain on

Sale of Licensing Agreement |

|

— |

|

|

(1.6 |

) |

|

Depreciation of Property, Plant and Equipment |

|

19.5 |

|

|

16.3 |

|

|

Amortization of Intangible Assets |

|

11.1 |

|

|

3.7 |

|

|

Stock-based Compensation |

|

11.7 |

|

|

3.3 |

|

| Provision

for Bad Debt |

|

0.1 |

|

|

0.1 |

|

| Change in

Deferred Income Taxes |

|

(0.5 |

) |

|

(12.2 |

) |

| Changes

in Operating Assets and Liabilities, Net of Acquistions: |

|

|

|

|

|

Accounts Receivable |

|

12.2 |

|

|

5.9 |

|

|

Inventories |

|

(10.9 |

) |

|

(5.8 |

) |

|

Prepaid Expenses and Other Assets |

|

(16.4 |

) |

|

14.6 |

|

|

Accounts Payable and Other Expenses |

|

(30.9 |

) |

|

42.4 |

|

| Net Cash Provided by

Operating Activities |

|

64.3 |

|

|

87.1 |

|

| Investing

Activities: |

|

|

|

|

| Purchases

of Property, Plant and Equipment |

|

(37.0 |

) |

|

(34.7 |

) |

|

Acquisition of Business, Net of Cash Received |

|

(421.6 |

) |

|

(129.9 |

) |

| Purchases

of Technology Licenses, Net |

|

— |

|

|

(0.7 |

) |

| Sale of

Business/Investment/Property |

|

0.3 |

|

|

0.3 |

|

| Net Cash Used in

Investing Activities |

|

(458.3 |

) |

|

(165.0 |

) |

| Financing

Activities: |

|

|

|

|

| Taxes

Paid Related to Net Share Settlement of Equity Awards |

|

(1.7 |

) |

|

(0.3 |

) |

| Proceeds

from Exercise of Stock Options |

|

— |

|

|

0.2 |

|

| Cash

Dividends |

|

(12.7 |

) |

|

(10.6 |

) |

| Proceeds

from Borrowings |

|

350.0 |

|

|

71.3 |

|

| Repayment

of Borrowings |

|

(103.3 |

) |

|

(3.0 |

) |

| Net Cash Provided in

Financing Activities |

|

232.3 |

|

|

57.6 |

|

| Effect of Foreign

Currency Exchange Rate Changes on Cash and Cash Equivalents |

|

(10.7 |

) |

|

30.3 |

|

| Increase (Decrease) in

Cash and Cash Equivalents |

|

(172.4 |

) |

|

10.0 |

|

| Cash and Cash

Equivalents at Beginning of Year |

|

246.1 |

|

|

294.0 |

|

| Cash and Cash

Equivalents at End of Period |

|

$ |

73.7 |

|

|

$ |

304.0 |

|

|

|

|

|

|

|

METHODE ELECTRONICS, INC. AND

SUBSIDIARIES(Unaudited)($ in

millions, except per share data)

Reconciliation of Non-GAAP Financial

Measures for the Three Months Ended January 26, 2019

| |

|

|

|

|

|

Acquisition-Related Costs |

|

|

|

|

|

|

| |

|

U.S. GAAP(As

Reported) |

|

Expense for Initiatives to Reduce Overall Costs

and Improve Operational Profitability |

|

Purchase Accounting Adjustments Related to

Inventory |

|

Severance |

|

Other |

|

Long-term Incentive Plan Accrual Adjustment due

to change in Fiscal 2020 EBITDA estimate |

|

Transition tax and the impact of revaluing

deferred taxes due to the change in the federal tax rate from U.S.

Tax Reform |

|

Non-U.S. GAAP Financial Measures |

|

Gross Profit |

|

$ |

64.3 |

|

|

$ |

1.3 |

|

|

$ |

3.0 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

68.6 |

|

| Gross

Margin (% of sales) |

|

26.0 |

% |

|

0.5 |

% |

|

1.2 |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

27.7 |

% |

| Selling and Administrative

Expenses |

|

$ |

32.8 |

|

|

$ |

(1.3 |

) |

|

$ |

— |

|

|

$ |

(0.1 |

) |

|

$ |

(0.7 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

30.7 |

|

| Selling

and Administrative Expenses (% of sales) |

|

13.3 |

% |

|

(0.5 |

)% |

|

— |

% |

|

— |

% |

|

(0.3 |

)% |

|

— |

% |

|

— |

% |

|

12.5 |

% |

| Income from

Operations |

|

$ |

26.0 |

|

|

$ |

2.6 |

|

|

$ |

3.0 |

|

|

$ |

0.1 |

|

|

$ |

0.7 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

32.4 |

|

| Net Income |

|

$ |

30.7 |

|

|

$ |

2.2 |

|

|

$ |

2.5 |

|

|

$ |

0.1 |

|

|

$ |

0.6 |

|

|

$ |

— |

|

|

$ |

(4.8 |

) |

|

$ |

31.3 |

|

| Diluted Earnings per

Share |

|

$ |

0.82 |

|

|

$ |

0.06 |

|

|

$ |

0.07 |

|

|

$ |

— |

|

|

$ |

0.01 |

|

|

$ |

— |

|

|

$ |

(0.13 |

) |

|

$ |

0.83 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial

Measures for the Three Months Ended January 27, 2018

| |

|

|

|

|

|

Acquisition-Related Costs |

|

|

|

|

|

|

| |

|

U.S. GAAP(As

Reported) |

|

Expense for Initiatives to Reduce Overall Costs

and Improve Operational Profitability |

|

Purchase Accounting Adjustments Related to

Inventory |

|

Severance |

|

Other |

|

Long-term Incentive Plan Accrual Adjustment due

to change in Fiscal 2020 EBITDA estimate |

|

Transition tax and the impact of revaluing

deferred taxes due to the change in the federal tax rate from U.S.

Tax Reform |

|

Non-U.S. GAAP Financial Measures |

|

Gross Profit |

|

$ |

60.1 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

60.1 |

|

| Gross

Margin (% of sales) |

|

26.4 |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

26.4 |

% |

| Selling and Administrative

Expenses |

|

$ |

22.5 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6.0 |

|

|

$ |

— |

|

|

$ |

28.5 |

|

| Selling

and Administrative Expenses (% of sales) |

|

9.9 |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

2.6 |

% |

|

— |

% |

|

12.5 |

% |

| Income from

Operations |

|

$ |

35.6 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(6.0 |

) |

|

$ |

— |

|

|

$ |

29.6 |

|

| Net Income (Loss) |

|

$ |

(24.3 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(5.0 |

) |

|

$ |

56.8 |

|

|

$ |

27.5 |

|

| Diluted Earnings (Loss)

per Share |

|

$ |

(0.65 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(0.13 |

) |

|

$ |

1.52 |

|

|

$ |

0.74 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial

Measures for the Nine Months Ended January 26, 2019

| |

|

|

|

|

|

Acquisition-Related Costs |

|

|

|

|

|

|

| |

|

U.S. GAAP(As

Reported) |

|

Expense for Initiatives to Reduce Overall Costs

and Improve Operational Profitability |

|

Purchase Accounting Adjustments Related to

Inventory |

|

Severance |

|

Other |

|

Long-term Incentive Plan Accrual Adjustment due

to change in Fiscal 2020 EBITDA estimate |

|

Transition tax and the impact of revaluing

deferred taxes due to the change in the federal tax rate from U.S.

Tax Reform |

|

Non-U.S. GAAP Financial Measures |

|

Gross Profit |

|

$ |

195.2 |

|

|

$ |

2.7 |

|

|

$ |

5.6 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

203.5 |

|

| Gross

Margin (% of sales) |

|

26.6 |

% |

|

0.4 |

% |

|

0.8 |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

27.8 |

% |

| Selling and Administrative

Expenses |

|

$ |

110.3 |

|

|

$ |

(3.1 |

) |

|

$ |

— |

|

|

$ |

(1.5 |

) |

|

$ |

(8.2 |

) |

|

$ |

(7.4 |

) |

|

$ |

— |

|

|

$ |

90.1 |

|

| Selling

and Administrative Expenses (% of sales) |

|

15.0 |

% |

|

(0.4 |

)% |

|

— |

% |

|

(0.2 |

)% |

|

(1.1 |

)% |

|

(1.0 |

)% |

|

— |

% |

|

12.3 |

% |

| Income from

Operations |

|

$ |

73.8 |

|

|

$ |

5.8 |

|

|

$ |

5.6 |

|

|

$ |

1.5 |

|

|

$ |

8.2 |

|

|

$ |

7.4 |

|

|

$ |

— |

|

|

$ |

102.3 |

|

| Net Income |

|

$ |

69.0 |

|

|

$ |

4.8 |

|

|

$ |

4.7 |

|

|

$ |

1.2 |

|

|

$ |

6.8 |

|

|

$ |

6.2 |

|

|

$ |

(4.8 |

) |

|

$ |

87.9 |

|

| Diluted Earnings per

Share |

|

$ |

1.83 |

|

|

$ |

0.13 |

|

|

$ |

0.13 |

|

|

$ |

0.03 |

|

|

$ |

0.18 |

|

|

$ |

0.17 |

|

|

$ |

(0.13 |

) |

|

$ |

2.34 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial

Measures for the Nine Months Ended January 27, 2018

| |

|

|

|

|

|

Acquisition-Related Costs |

|

|

|

|

|

|

| |

|

U.S. GAAP(As

Reported) |

|

Expense for Initiatives to Reduce Overall Costs

and Improve Operational Profitability |

|

Purchase Accounting Adjustments Related

to Inventory |

|

Severance |

|

Other |

|

Long-term Incentive Plan Accrual Adjustment due

to change in Fiscal 2020 EBITDA estimate |

|

Transition tax and the impact of revaluing

deferred taxes due to the change in the federal tax rate from U.S.

Tax Reform |

|

Non-U.S. GAAP Financial Measures |

|

Gross Profit |

|

$ |

177.7 |

|

|

$ |

— |

|

|

$ |

0.8 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

178.5 |

|

| Gross

Margin (% of sales) |

|

27.0 |

% |

|

— |

% |

|

0.1 |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

27.1 |

% |

| Selling and

Administrative Expenses |

|

$ |

83.3 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(6.0 |

) |

|

$ |

6.0 |

|

|

$ |

— |

|

|

$ |

83.3 |

|

| Selling

and Administrative Expenses (% of sales) |

|

12.6 |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

(9.1 |

)% |

|

9.1 |

% |

|

— |

% |

|

12.6 |

% |

| Income from

Operations |

|

$ |

90.7 |

|

|

$ |

— |

|

|

$ |

0.8 |

|

|

$ |

— |

|

|

$ |

6.0 |

|

|

$ |

(6.0 |

) |

|

$ |

— |

|

|

$ |

91.5 |

|

| Net Income |

|

$ |

20.4 |

|

|

$ |

— |

|

|

$ |

0.7 |

|

|

$ |

— |

|

|

$ |

5.0 |

|

|

$ |

(5.0 |

) |

|

$ |

56.8 |

|

|

$ |

77.9 |

|

| Diluted Earnings per

Share |

|

$ |

0.54 |

|

|

$ |

— |

|

|

$ |

0.02 |

|

|

$ |

— |

|

|

$ |

0.13 |

|

|

$ |

(0.13 |

) |

|

$ |

1.51 |

|

|

$ |

2.07 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of EBITDA and Adjusted

EBITDA to Net Income

| |

Three Months Ended |

|

Nine Months Ended |

| |

January 26,

2019 |

|

January 27,

2018 |

|

January 26,

2019 |

|

January 27,

2018 |

|

Net Income |

$ |

30.7 |

|

|

$ |

(24.3 |

) |

|

$ |

69.0 |

|

|

$ |

20.4 |

|

| Income

Tax Expense (Benefit) |

(3.0 |

) |

|

63.4 |

|

|

4.5 |

|

|

72.6 |

|

| Interest

Expense, Net |

3.2 |

|

|

0.3 |

|

|

5.0 |

|

|

0.3 |

|

|

Amortization of Intangibles |

5.5 |

|

|

2.0 |

|

|

11.1 |

|

|

3.7 |

|

|

Depreciation |

6.7 |

|

|

5.1 |

|

|

19.5 |

|

|

16.3 |

|

| EBITDA |

43.1 |

|

|

46.5 |

|

|

109.1 |

|

|

113.3 |

|

| Expense

for Initiatives to Reduce Overall Costs and Improve Operational

Profitability |

2.6 |

|

|

— |

|

|

5.8 |

|

|

— |

|

|

Acquisition-related Costs - Purchase Accounting Adjustments Related

to Inventory |

3.0 |

|

|

— |

|

|

5.6 |

|

|

0.8 |

|

|

Acquisition-related Costs - Severance |

0.1 |

|

|

— |

|

|

1.5 |

|

|

— |

|

|

Acquisition-related Costs - Other |

0.7 |

|

|

— |

|

|

8.2 |

|

|

6.0 |

|

| Long-term

Incentive Plan Accrual Adjustment due to change in Fiscal 2020

EBITDA estimate |

— |

|

|

(6.0 |

) |

|

7.4 |

|

|

(6.0 |

) |

| Adjusted EBITDA |

$ |

49.5 |

|

|

$ |

40.5 |

|

|

$ |

137.6 |

|

|

$ |

114.1 |

|

|

|

|

|

|

|

Reconciliation of Free Cash Flow to Net

Income

| |

Three Months Ended |

|

Nine Months Ended |

| |

January 26,2019 |

|

January 27,2018 |

|

January 26,2019 |

|

January 27,2018 |

|

Net Income |

$ |

30.7 |

|

|

$ |

(24.3 |

) |

|

$ |

69.0 |

|

|

$ |

20.4 |

|

|

Amortization of Intangibles |

5.5 |

|

|

2.0 |

|

|

11.1 |

|

|

3.7 |

|

|

Depreciation |

6.7 |

|

|

5.1 |

|

|

19.5 |

|

|

16.3 |

|

| Purchases

of Property, Plant and Equipment |

(8.4 |

) |

|

(18.3 |

) |

|

(37.0 |

) |

|

(34.7 |

) |

| Free Cash Flow |

$ |

34.5 |

|

|

$ |

(35.5 |

) |

|

$ |

62.6 |

|

|

$ |

5.7 |

|

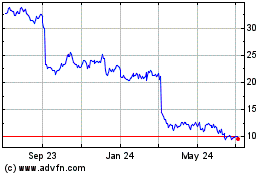

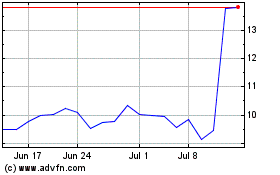

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Apr 2023 to Apr 2024