MEDNAX, Inc. (NYSE: MD), the national health solutions partner

specializing in prenatal, neonatal, and pediatric services, today

reported a net loss of $41.0 million, or $0.49 per share for the

three months ended September 30, 2020, primarily reflecting a

non-cash loss on the classification of the MEDNAX Radiology

Solutions medical group to assets held for sale. On a non-GAAP

basis, MEDNAX reported Adjusted EPS from continuing operations of

$0.37.

On September 9, MEDNAX entered into a definitive agreement to

sell MEDNAX Radiology Solutions. The results for MEDNAX Radiology

Solutions have been classified as discontinued operations beginning

with the third quarter of 2020, and prior period results have been

conformed to the current period presentation for comparison

purposes. For the third quarter of 2020, MEDNAX Radiology Solutions

generated net revenue and Adjusted EBITDA of $125.8 million and

$21.1 million, respectively.

For the 2020 third quarter, MEDNAX reported the following

results from continuing operations:

- Net revenue of $461 million;

- Loss of $3 million; and

- Adjusted EBITDA of $73 million.

“We believe the meaningful recovery in patient volumes

experienced during the third quarter demonstrates the critical

nature of services our affiliated physicians and clinicians provide

to their patients across the spectrum of women’s and children’s

care,” said Mark S. Ordan, Chief Executive Officer of MEDNAX. “In

addition, we achieved several important milestones, in particular

our announced definitive agreement to sell MEDNAX Radiology

Solutions. This transaction will enable us to focus fully on our

core services within our Pediatrix and Obstetrix Medical Groups,

which we believe will enable us to support our practices, grow

efficiently and effectively, and drive strong bottom line

results.”

Operating Results from Continuing Operations – Three Months

Ended September 30, 2020

In addition to the announced agreement to sell MEDNAX Radiology

Solutions, as previously disclosed, on May 6, 2020, MEDNAX

completed the sale of its anesthesiology medical group, American

Anesthesiology. The Company’s discussion of its results from

continuing operations for the three and nine months ended September

30, 2020 and the prior-year periods excludes the operating results

from these businesses. Additionally, quarterly results from

continuing operations, including non-GAAP metrics and a

reconciliation to the most directly comparable GAAP measures, for

2019 and 2020 are available on the Company’s website.

During the 2020 third quarter, MEDNAX’s operations continued to

be impacted by reductions in patient volumes and revenue as a

result of the COVID-19 pandemic, although this impact was less

significant than that experienced during the first half of 2020.

The impact to net revenue was relatively consistent throughout the

quarter.

MEDNAX’s net revenue for the three months ended September 30,

2020 was $460.6 million, compared to $454.9 million for the

prior-year period. MEDNAX’s overall same-unit revenue declined by

0.4 percent, offset by growth attributable to recent acquisitions.

During the 2020 third quarter, the Company received $14.2 million

from the provider relief fund established by the Coronavirus Aid,

Relief, and Economic Security (“CARES”) Act, which was recorded as

miscellaneous revenue and increased the Company’s same-unit revenue

from net reimbursement-related factors by 3.1 percent.

Same-unit revenue attributable to patient volume decreased by

4.3 percent for the 2020 third quarter as compared to the

prior-year period, and as compared to a decrease of approximately

9.0 percent for the 2020 second quarter. In each case this decline

was primarily attributable to the impacts from the COVID-19

pandemic.

For the quarter, same-unit patient volumes within the Company’s

hospital-based Pediatrix and Obstetrix services lines, which

include neonatal intensive care unit (NICU) and other NICU related

services, declined by approximately five percent.

Within hospital-based services, NICU patient days decreased by

3.9 percent for the third quarter compared to the prior-year

period, which reflects lower births at the hospitals where

MEDNAX-affiliated practices provide neonatology services and a

lower rate of admission into the NICU, partially offset by a modest

increase in average length of stay. For the 2020 third quarter,

total births at the hospitals where MEDNAX-affiliated practices

provide neonatology services declined year-over-year by 3.2

percent, as compared to an increase of 1.7 percent year-over-year

for the 2019 third quarter.

For the quarter, same-unit patient volumes within the Company’s

office-based service lines, which include maternal-fetal medicine,

pediatric cardiology and other pediatric subspecialty services,

declined by approximately five percent. This decline was driven by

declines in pediatric cardiology and other patient volumes and only

a slight decline in maternal-fetal medicine patient volumes.

Same-unit revenue from net reimbursement-related factors

increased by 3.9 percent for the 2020 third quarter as compared to

the prior-year period. The net increase in revenue from net

reimbursement-related factors reflects funds received under the

CARES Act and modest improvements in managed care contracting,

partially offset by a reduction in revenue from a decrease in the

percentage of services reimbursed by commercial and other

non-government payors. The percentage of patients reimbursed under

commercial and other non-government programs decreased by

approximately 85 basis points compared with the prior-year

period.

For the 2020 third quarter, practice salaries and benefits

expense was $309.9 million, compared to $301.3 million for the

prior-year period, an increase of $8.6 million. This increase

primarily reflects approximately $6 million related to the

incentive compensation impact from provider relief funds received

under the CARES Act during the third quarter of 2020.

For the 2020 third quarter, general and administrative expenses

were $66.3 million, as compared to $63.3 million for the prior-year

period. General and administrative expenses for the 2020 third

quarter include approximately $10 million in expenses incurred as

part of the Company’s transitional services being provided to the

buyer of American Anesthesiology, partially offset by salary and

net staffing reductions. MEDNAX was reimbursed for these transition

services expenses and recorded such reimbursement as a component of

investment and other income within non-operating income.

As previously disclosed, MEDNAX has incurred certain expenses

related to transformational and restructuring activities. For the

third quarter of 2020, these expenses totaled $34.3 million,

compared to $12.8 million for the third quarter of 2019. Of the

expense recorded during the third quarter of 2020, $26.7 million

related to executive management and board of directors

restructuring, while the remainder related to third-party

consulting fees, contract termination fees, and position

eliminations.

Adjusted EBITDA from continuing operations, which is defined as

earnings from continuing operations before interest, taxes,

depreciation and amortization, and transformational and

restructuring related expenses, was $72.7 million for the 2020

third quarter, compared to $69.3 million for the prior-year period.

Funds received from the provider relief fund established by the

CARES Act impacted Adjusted EBITDA positively by approximately $8

million for the 2020 third quarter.

Depreciation and amortization expense was $7.2 million for the

third quarter of 2020 compared to $6.4 million for the third

quarter of 2019.

Investment and other income was $10.5 million for the third

quarter of 2020 compared to $0.8 million for the third quarter of

2019. This increase primarily represents the reimbursement related

to the transition services being provided to American

Anesthesiology.

Interest expense was $27.3 million for the third quarter of 2020

compared to $29.9 million for the third quarter of 2019. This

decline primarily reflects lower average borrowings compared to the

prior-year period.

MEDNAX generated a loss from continuing operations of $2.7

million, or $0.03 per diluted share, for the 2020 third quarter,

based on a weighted average 83.9 million shares outstanding. This

compares with income from continuing operations of $12.9 million,

or $0.16 per diluted share, for the 2019 third quarter, based on a

weighted average 82.9 million shares outstanding.

For the third quarter of 2020, MEDNAX reported Adjusted EPS from

continuing operations of $0.37, compared to $0.38 for the third

quarter of 2019. For these periods, Adjusted EPS from continuing

operations is defined as diluted (loss) income from continuing

operations per common and common equivalent share excluding

non-cash amortization expense, stock-based compensation expense,

transformational and restructuring related expenses and discrete

tax items.

Operating Results from Continuing Operations – Nine Months Ended

September 30, 2020

For the nine months ended September 30, 2020, MEDNAX generated

revenue from continuing operations of $1.32 billion, effectively

unchanged from the prior-year period. Adjusted EBITDA from

continuing operations for the nine months ended September 30, 2020

was $161.6 million, compared to $187.0 million for the prior year.

MEDNAX reported a loss from continuing operations of $14.1 million,

or $0.17 per share, for the nine months ended September 30, 2020,

based on a weighted average 83.3 million shares outstanding, which

compares to income from continuing operations of $32.3 million, or

$0.38 per share, based on a weighted average 84.3 million shares

outstanding for the first nine months of 2019. For the nine months

ended September 30, 2020, MEDNAX reported Adjusted EPS from

continuing operations of $0.70, compared to $0.96 for the same

period of 2019.

Financial Position and Cash Flow – Continuing Operations

MEDNAX had cash and cash equivalents of $294.5 million at

September 30, 2020, compared to $132.2 million on June 30, 2020,

and net accounts receivable were $267.1 million.

During the third quarter of 2020, MEDNAX generated cash from

continuing operations of $127.1 million, compared to $56.7 million

during the third quarter of 2019, primarily reflecting lower income

tax payments in 2020.

At September 30, 2020, MEDNAX had no outstanding borrowings

under its $1.2 billion revolving credit facility and had total debt

outstanding of $1.75 billion, consisting solely of its senior

notes, and net debt of $1.46 billion.

“Our cash inflows and reduced net debt demonstrate MEDNAX’s

strong financial profile, especially given the challenges presented

to the Company and all healthcare providers thus far in 2020,” said

Marc Richards, Executive Vice President and Chief Financial

Officer. “Including the anticipated proceeds from the sale of

MEDNAX Radiology Solutions, we expect to be well positioned to

reduce our total borrowings, support our practices internally, and

fund our strategic growth in the future.”

Discontinued Operations

The results for MEDNAX Radiology Solutions, American

Anesthesiology and MedData, the Company’s former management

services organization, are presented as discontinued operations for

the three and nine months ended September 30, 2020 and all prior

periods as relevant.

During the third quarter of 2020, the Company reported a loss

from discontinued operations of $38.4 million, which predominantly

reflects a loss on the classification of MEDNAX Radiology Solutions

as assets held for sale as of September 30, 2020.

Non-GAAP Measures

A reconciliation of Adjusted EBITDA from continuing operations

and Adjusted EPS from continuing operations to the most directly

comparable GAAP measures for the three and nine months ended

September 30, 2020 and 2019 and Adjusted EBITDA for MEDNAX

Radiology Solutions to the most directly comparable GAAP measure

for the three months ended September 30, 2020 is provided in the

financial tables of this press release.

Earnings Conference Call

MEDNAX, Inc. will host an investor conference call to discuss

the quarterly results at 9 a.m., ET today. The conference call

Webcast may be accessed from the Company’s Website, www.mednax.com.

A telephone replay of the conference call will be available from

1:00 p.m. ET today through midnight ET November 19, 2020 by dialing

866.207.1041, access Code 6818509. The replay will also be

available at www.mednax.com.

ABOUT MEDNAX

MEDNAX, Inc. is a national health solutions partner comprised of

the nation's leading providers of physician services. Physicians

and advanced practitioners practicing as part of MEDNAX are

reshaping the delivery of care within their specialties and

subspecialties, using evidence-based tools, continuous quality

initiatives, consulting services, clinical research and

telemedicine to enhance patient outcomes and provide high-quality,

cost-effective care. The Company was founded in 1979, and today,

through its affiliated professional corporations, MEDNAX provides

services through a network of more than 3,000 physicians in all 50

states and Puerto Rico. Additional information is available at

www.mednax.com.

Certain statements and information in this press release may be

deemed to contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements may include, but are not limited to,

statements relating to the Company’s objectives, plans and

strategies, and all statements, other than statements of historical

facts, that address activities, events or developments that we

intend, expect, project, believe or anticipate will or may occur in

the future. These statements are often characterized by terminology

such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,”

“plan,” “will,” “expect,” “estimate,” “project,” “positioned,”

“strategy” and similar expressions, and are based on assumptions

and assessments made by the Company’s management in light of their

experience and their perception of historical trends, current

conditions, expected future developments and other factors they

believe to be appropriate. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no duty to update or revise any such statements, whether

as a result of new information, future events or otherwise.

Forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties. Important factors that

could cause actual results, developments, and business decisions to

differ materially from forward-looking statements are described in

the Company’s most recent Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q, including the sections entitled

“Risk Factors”, as well the Company’s current reports on Form 8-K,

filed with the Securities and Exchange Commission, and include the

impact of the COVID-19 outbreak on the Company and its financial

condition and results of operations; the effects of economic

conditions on the Company’s business; the effects of the Affordable

Care Act and potential changes thereto or a repeal thereof; the

Company’s relationships with government-sponsored or funded

healthcare programs, including Medicare and Medicaid, and with

managed care organizations and commercial health insurance payors;

the Company’s ability to comply with the terms of its debt

financing arrangements; the impact of the divestiture of the

Company’s anesthesiology medical group; whether the Company will be

able to complete the divestiture of its radiology medical group and

the potential uses of proceeds thereof; the impact of management

transitions; the timing and contribution of future acquisitions;

the effects of share repurchases; and the effects of the Company’s

transformation initiatives, including its reorientation on, and

growth strategy for, its pediatrics and obstetrics business.

MEDNAX, INC.

Consolidated Statements of

Income

(in thousands, except per

share data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

Net revenue

$

460,635

$

454,913

$

1,317,321

$

1,321,159

Operating expenses:

Practice salaries and benefits

309,904

301,306

909,168

880,686

Practice supplies and other operating

expenses

22,440

22,581

66,455

72,688

General and administrative expenses

66,346

63,284

194,276

185,318

Depreciation and amortization

7,195

6,408

20,749

18,830

Transformational and restructuring related

expenses

34,291

12,766

60,846

32,025

Total operating expenses

440,176

406,345

1,251,494

1,189,547

Income from operations

20,459

48,568

65,827

131,612

Investment and other income

10,534

802

13,064

2,777

Interest expense

(27,250)

(29,909)

(83,180)

(91,271)

Equity in earnings of unconsolidated

affiliate

282

786

1,081

1,753

Total non-operating expenses

(16,434)

(28,321)

(69,035)

(86,741)

Income (loss) from continuing operations

before income taxes

4,025

20,247

(3,208)

44,871

Income tax provision

(6,677)

(7,360)

(10,859)

(12,590)

(Loss) income from continuing

operations

(2,652)

12,887

(14,067)

32,281

Loss from discontinued operations, net of

tax

(38,392)

(1,268,803)

(718,125)

(1,539,314)

Net loss

$

(41,044)

$

(1,255,916)

$

(732,192)

$

(1,507,033)

Per common and common equivalent share

data (diluted):

(Loss) income from continuing

operations

$

(0.03)

$

0.16

$

(0.17)

$

0.38

Loss from discontinued operations

$

(0.46)

$

(15.31)

$

(8.62)

$

(18.26)

Net loss

$

(0.49)

$

(15.15)

$

(8.79)

$

(17.88)

Weighted average diluted shares

outstanding

83,862

82,883

83,260

84,302

MEDNAX, Inc.

Reconciliation of (Loss)

Income from Continuing Operations

to Adjusted EBITDA from

Continuing Operations

(in thousands)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

(Loss) income from continuing

operations

$

(2,652

)

$

12,887

$

(14,067

)

$

32,281

Interest expense

27,250

29,909

83,180

91,271

Income tax provision

6,677

7,360

10,859

12,590

Depreciation and amortization

7,195

6,408

20,749

18,830

Transformational and restructuring related

expenses

34,291

12,766

60,846

32,025

Adjusted EBITDA from continuing

operations

$

72,761

$

69,330

$

161,567

$

186,997

MEDNAX, Inc.

Reconciliation of Diluted

(Loss) Income from Continuing Operations per Share

to Adjusted Income from

Continuing Operations per Diluted Share (“Adjusted EPS”)

(in thousands, except per

share data)

(Unaudited)

Three Months Ended

September 30,

2020

2019

Weighted average diluted shares

outstanding

83,862

82,883

(Loss) income from continuing operations

and diluted (loss) income from continuing operations per share

$

(2,652

)

$

(0.03

)

$

12,887

$

0.16

Adjustments (1):

Amortization (net of tax of $601 and

$444)

1,802

0.02

1,333

0.02

Stock-based compensation (net of tax of

$1,132 and $1,902)

3,398

0.04

5,706

0.07

Transformational and restructuring related

expenses (net of tax

of $8,573 and $3,191)

25,718

0.31

9,575

0.12

Net impact from discrete tax events

2,905

0.03

1,784

0.01

Adjusted income and diluted EPS from

continuing operations

$

31,171

$

0.37

$

31,285

$

0.38

(1)

Our blended statutory tax rate of 25% was

used to calculate the tax effects of the adjustments for the three

months ended September 30, 2020 and 2019.

Nine Months Ended

September 30,

2020

2019

Weighted average diluted shares

outstanding

83,260

84,302

(Loss) income from continuing operations

and diluted (loss) income from continuing operations per share

$

(14,067

)

$

(0.17

)

$

32,281

$

0.38

Adjustments (1):

Amortization (net of tax of $1,632 and

$1,289)

4,896

0.06

3,867

0.05

Stock-based compensation (net of tax of

$4,550 and $6,893)

13,652

0.16

20,672

0.25

Transformational and restructuring related

expenses (net of tax

of $15,211 and $8,006)

45,635

0.55

24,019

0.28

Net impact from discrete tax events

7,849

0.10

(5

)

—

Adjusted income and diluted EPS from

continuing operations

$

57,965

$

0.70

$

80,834

$

0.96

(1)

Our blended statutory tax rate of 25% was

used to calculate the tax effects of the adjustments for the nine

months ended September 30, 2020 and 2019.

MEDNAX, INC.

Balance Sheet

Highlights

(in thousands)

(Unaudited)

As of

As of

September 30, 2020

December 31, 2019

Assets:

Cash and cash equivalents

$

294,512

$

107,870

Investments

81,574

74,510

Accounts receivable, net

267,125

434,266

Other current assets

56,401

28,945

Intangible assets, net

27,665

28,587

Operating lease right-of-use assets

58,993

56,413

Goodwill, other assets, property and

equipment

1,687,008

1,687,814

Assets held for sale

951,548

1,727,496

Total assets

$

3,424,826

$

4,145,901

Liabilities and shareholders’

equity:

Accounts payable and accrued expenses

$

388,517

$

410,637

Total debt, net

1,744,703

1,730,238

Operating lease liabilities

58,915

62,897

Other liabilities

348,973

290,240

Liabilities held for sale

78,712

152,893

Total liabilities

2,619,820

2,646,905

Total equity

805,006

1,498,996

Total liabilities and equity

$

3,424,826

$

4,145,901

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201106005095/en/

Charles Lynch Senior Vice President, Finance and Strategy

954-384-0175, x 5692 charles_lynch@mednax.com

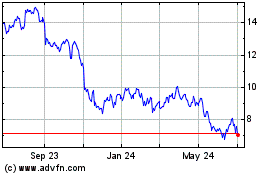

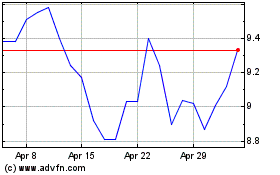

Pediatrix Medical (NYSE:MD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pediatrix Medical (NYSE:MD)

Historical Stock Chart

From Apr 2023 to Apr 2024