Current Report Filing (8-k)

March 03 2022 - 4:14PM

Edgar (US Regulatory)

0000314203

false

0000314203

2022-02-25

2022-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 25, 2022

McEWEN MINING INC.

(Exact name of registrant as specified in

its charter)

Colorado

(State or other jurisdiction of

incorporation or organization) |

|

001-33190

(Commission File

Number) |

|

84-0796160

(I.R.S. Employer

Identification No.) |

150 King Street West, Suite 2800

Toronto, Ontario, Canada M5H 1J9

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number including

area code: (866) 441-0690

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

MUX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item

1.01 | Entry

into a Material Definitive Agreement. |

On March 2, 2022,

McEwen Mining Inc. (the “Company”) entered into an Agency Agreement (the “Agency Agreement”) with Cantor Fitzgerald

Canada Corporation, as lead manager (“Lead Manager”), relating to a private placement (the “Offering”) of 14,500,000

shares of the Company’s common stock (the “Common Stock”). The shares of Common Stock sold in the Offering are

considered “flow-through” common shares for purposes of the Income Tax Act (Canada) in that they provide potential tax benefits

to the purchasers if the Company uses the proceeds of the Offering for qualified exploration expenses. The Company received

gross proceeds of approximately $15 million from the Offering, before deducting discounts and commissions and other estimated offering

expenses payable by the Company. The Company paid the Lead Manager a commission of four percent of the aggregate offering proceeds.

The Agency Agreement contains

customary representations, warranties and agreements by the Company and the Agents, including indemnification of the Agent by the Company

for liabilities arising under the Securities Act of 1933, as amended (the “Act”). The Agency Agreement has been filed with

this Current Report on Form 8-K to provide investors and security holders with information regarding its terms. It is not intended

to provide any other factual information about the Company. The representations, warranties and covenants contained in the Agency Agreement

were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to the Agency Agreement,

and may be subject to limitations agreed upon by the Company and the Agents.

The preceding summary

of the Agency Agreement is qualified in its entirety by reference to the full text of the Agency Agreement, a copy of which is attached

as Exhibit 1.1.

| Item 3.02 | Unregistered Sales of Equity Securities |

The disclosure contained

in Item 1.01 above is hereby incorporated into this Item 3.02 by reference. The Common Stock sold in the Offering was not registered under

the Act in reliance on the exemption provided by Rule 903 of Regulation S promulgated under the Act. The sale of the Common

Stock was made in an offshore transaction, was not offered or sold to a “U.S. Person” within the meaning of Regulation S and

offering restrictions were implemented.

Item 5.02 Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On

February 25, 2022, the board of directors of the Company appointed Merri Sanchez to the board. Ms. Sanchez will hold

that position until the next annual meeting of shareholders and until her successor is elected and qualified or until her death, resignation

or removal. The board will consider an appointment for Ms. Sanchez to one or more committees in the future.

In accordance with the Company’s current

Non-Employee Director Compensation Policy (“Policy”), Ms. Sanchez will receive cash compensation of $40,000 per year

for her services on the board. Ms. Sanchez will also be eligible

to receive an initial and annual grants of equity awards pursuant to, and in accordance with, the Policy and the Company’s Amended

and Restated Equity Incentive Plan.

In connection with her

appointment to the board, Ms. Sanchez entered into a standard indemnification agreement with the Company, in the form previously

approved by the board.

There

is no arrangement or understanding between Ms. Sanchez and any other persons pursuant to which she was elected as a director.

In addition, Ms. Sanchez is not a party to any transaction, or series of transactions, required to be disclosed pursuant to Item

404(a) of Regulation S-K. There are no family relationships between Ms. Sanchez and any of the Company’s directors

or executive officers.

| Item 7.01 | Regulation FD Disclosure. |

On March 2, 2022,

the Company issued a press release announcing the closing of the Offering, a copy of which is attached hereto as Exhibit 99.1.

The information furnished

under this Item 7.01, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall

be expressly set forth by reference to such filing.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. The following exhibits are filed or furnished with

this report: |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document (contained

in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d)

of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

McEWEN MINING INC. |

| |

|

| |

|

| Date: March 3, 2022 |

By: |

/s/ Carmen Diges |

| |

|

Carmen Diges, General Counsel |

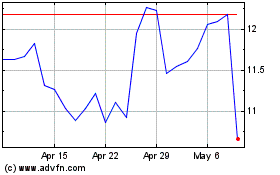

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

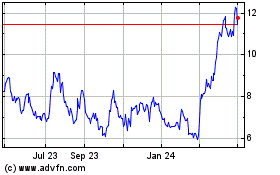

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2023 to Apr 2024