For Walmart and Target, the Fed Holds the Keys to Faster Payments

December 06 2018 - 7:29AM

Dow Jones News

By AnnaMaria Andriotis

Walmart Inc. and Target Corp. want the Federal Reserve to help

them get paid in real time.

The retail giants are among the companies urging the Fed to

develop a service to settle interbank transfers in real time, 24

hours a day, seven days a week. Such a service could ultimately

eliminate the lag between when consumers use debit cards to pay for

items and stores receive the funds.

The Federal Reserve in October announced potential actions to

help develop a faster payments system in the U.S., including

creating a real-time settlement service. Walmart, Target and trade

groups including the National Retail Federation have been in

discussions with the Fed regarding faster payments for years,

according to people familiar with the matter.

The system could solve a problem that has long vexed retailers.

Merchants largely rely on card networks including Visa Inc. and

Mastercard Inc. that provide the rails for consumer card

transactions, as well as banks and other companies that process the

transactions and provide funds to the stores. Merchants often have

to wait one to three days to receive funds from debit-card

purchases. Payments for purchases made on a Saturday can take until

Tuesday to arrive.

Action by the Fed could enable merchants and others to develop

faster payment services that allow consumers to pay for items from

their checking account without using existing debit-card rails.

Potential options include payment services integrated into mobile

wallets and merchant smartphone apps with in-store rewards that

incentivize shoppers to use them.

This could become a problem for Visa and Mastercard, which could

lose transaction volume if such alternative payment methods take

off, and card-issuing banks, which reap fees from retailers when

shoppers use debit cards to pay for purchases.

Card issuers received an estimated $14.4 billion in debit card

interchange fees in 2017, up 5% from 2016, according to trade

publication the Nilson Report. Debit-card interchange fees, which

are set by card networks, were capped in 2011 after the 2010

Dodd-Frank law instructed the Fed to lower them for institutions

with $10 billion or more in assets.

A new payments system would face several hurdles to becoming

mainstream. Consumers are addicted to credit cards with generous

rewards, which could make it harder to convince them to switch to

new payment methods. Payment terminals, which merchants have

upgraded over the past few years to accept new chip-based cards,

may need to be updated to accommodate the new system.

What's more, the biggest U.S. banks last year began to deploy

their own real-time payments network, which so far is mostly being

used by companies to pay employees and suppliers. Consumers can

also use RTP to send money between their own checking accounts at

different banks. The RTP network, as it's known, was created by the

big-bank-owned The Clearing House.

"We just think in real time payments we are meeting the need,"

said Steve Ledford, senior vice president of products and strategy

at The Clearing House. "We just wonder why the Fed would need to

come into a market that is already being served."

In an October speech, Federal Reserve governor Lael Brainard

said the central bank has "the unique ability to provide the

infrastructure to reliably settle obligations between banks using

balances at the central bank. As such, we have a responsibility to

serve the broad public interest by providing a flexible and robust

payment infrastructure on which the private sector can

innovate."

The Fed's recent moves follow years of discussion between the

Fed, regional Fed banks, merchants, card companies and banks, among

other parties. The conversations mainly have focused on upgrading

the payments system in the U.S. so consumers and businesses can

receive funds when they are sent and to create a universal system

for money to be transferred in real time between financial

institutions, regardless of their size.

The Fed is soliciting feedback on the proposal through Dec.

14.

A Fed-backed system wouldn't replace credit and debit cards but

could become an alternative to them, especially at large merchants

with a loyal following. Target's debit REDcard, for example, links

directly to a customer's bank account and offers 5% discounts on

card purchases in stores and on the retailer's website.

Retailers increasingly are bypassing card networks with their

own debit-card offerings in an effort to cut down on fees.

Consumers spent some $15.6 billion on merchant-issued debit cards

last year, up 23% from 2016, according to the Nilson Report.

While such purchases accounted for a tiny sliver of the $2.7

trillion in U.S. debit-card transactions in 2017, their growth is a

worrying sign for the banks and card networks.

Merchants and card companies have long had a tense relationship.

Large merchants and trade groups have alleged that Visa and

Mastercard stifle lower-cost competition in payments and

circumvented debit-card regulation. Merchants including Target and

Amazon.com Inc. are likely to move forward with legal challenges to

credit-card interchange fees.

Paying merchants directly out of deposit accounts is commonplace

in markets abroad. In China, mobile wallets Alipay and WeChat Pay

command a large share of consumer payments and are often linked to

money that consumers have in deposit accounts.

Several U.K. banks are testing payments to merchants online that

are linked to consumers' checking accounts via a system powered by

Vocalink, a company recently acquired by Mastercard. In the U.S.,

Vocalink technology will be used to facilitate some real-time

online bill payments beginning next year.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

December 06, 2018 07:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

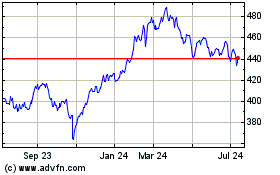

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

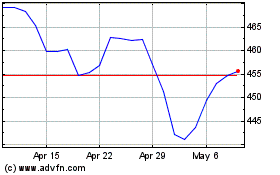

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024