U.S. Banks, Card Companies Catch a Break in China Trade Deal -- Update

January 15 2020 - 10:50PM

Dow Jones News

By David Benoit, AnnaMaria Andriotis and Tim Puko

A trade deal with China has given U.S. banks and financial

companies new hope that their decadeslong attempts to crack the

Chinese market may bear fruit.

The deal signed Wednesday clears some of the obstacles that have

prevented U.S. banks, credit-card networks, insurance companies and

investors from doing business in China.

U.S. financial institutions have long talked up the prospect of

China, where earning even a small share of the massive market could

result in sizable gains. But they have struggled to navigate the

bureaucratic thicket to obtain the licenses they need to operate

there.

JPMorgan Chase & Co., the largest U.S. bank by assets, is

waiting on the Chinese government to grant it some of the licenses

it needs to build up its investment banking and wealth-management

divisions in China. Visa Inc. and Mastercard Inc., too, need the

government's stamp of approval to get their cards more widely

accepted in China.

While short on details, the deal broadly requires China to take

action on those applications. In some cases, it sets parameters on

what the Chinese government can consider in making licensing

decisions. It also gives U.S. distressed-debt investors more access

to the Chinese market, allowing them to buy troubled loans from

China's state-owned banks.

Visa and Mastercard, in particular, stand to gain. Their

applications to operate in the country have languished. The

agreement requires China to make a decision on their applications

and to provide a reason if it rejects them.

Mastercard is making "every effort to secure the requisite

license to be able to operate in China domestically," a company

spokesman said. "This deal is a step forward in the process."

"We see significant potential for Visa to support the continued

growth and evolution of digital payments in China," said a

spokesman for Visa.

U.S. credit-card companies have won cases against China before

the World Trade Organization, but China's efforts to comply with

the rulings resulted in a permitting process nearly two decades

long.

U.S. Trade Representative Robert Lighthizer, President Trump's

lead negotiator with China, called out the lengthy process in a

February report to Congress. He said China's treatment of U.S.

credit-card companies was a "conspicuous ongoing example" of its

failure to honor WTO obligations in a bid to protect UnionPay,

China's domestic card network.

Mr. Lighthizer's comments gave heart to industry lobbyists who

had pressed their case for years. But it wasn't until Tuesday that

they got word a resolution might be part of the trade

agreement.

"We will pop the champagne when a U.S. company -- an electronic

payment company's application is approved and they start operation

in China," said Scott Talbott, senior vice president of government

affairs at the Electronic Transactions Association. "We will cross

the finish line at that point."

U.S. financial companies face a number of challenges to gaining

meaningful market share in China.

China's state-owned banks dwarf U.S. banks in size, and many

Chinese consumers pay for goods and services using mobile wallets

WeChat Pay and Alipay that don't rely on traditional card

technology.

Even if China grants licenses, more hurdles await.

In 2018, American Express Co. became the first U.S. card network

to gain approval to set up card-clearing services in China. Its

joint venture with a Chinese financial-technology firm is seeking

approval for a business operating license. The People's Bank of

China has advised AmEx that it has formally received its

application, a move AmEx saw as an important step in the

process.

China already has been taking steps to open up to foreign banks

in an effort to expand and reform its own markets. The government,

for example, has allowed them to take control of joint ventures

with domestic partners.

"They want JPMorgan to be there to help set transparency and

standards and rules," JPMorgan Chief Executive James Dimon told Fox

Business in an interview this week. "And the Chinese need, they

want to, eliminate corruption, have efficient companies and capital

allocation, and they need very good financial markets."

At a press conference announcing the deal Wednesday, President

Trump told JPMorgan executives in attendance to say hello to Mr.

Dimon for him.

Write to David Benoit at david.benoit@wsj.com, AnnaMaria

Andriotis at annamaria.andriotis@wsj.com and Tim Puko at

Tim.Puko@wsj.com

(END) Dow Jones Newswires

January 15, 2020 22:35 ET (03:35 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

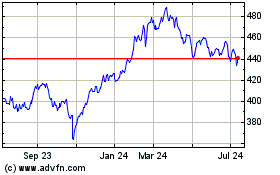

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

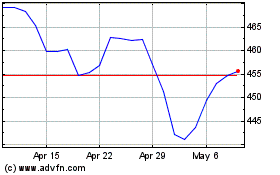

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024