UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM ll-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

PURCHASE, SAVINGS AND SIMILAR PLANS

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

(Mark One):

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

For the fiscal year ended December 31, 2020

|

|

|

|

|

OR

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

For the transition period from _____________ to _____________

|

|

|

|

|

|

|

|

Commission file number 1-5794

|

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

|

|

|

|

Masco Corporation 401(k) Plan

|

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

|

|

|

|

Masco Corporation

|

|

17450 College Parkway

|

|

Livonia, Michigan 48152

|

MASCO CORPORATION 401(k) PLAN

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

Page No.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are not applicable.

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Plan Administrator and Plan Participants

Masco Corporation 401(k) Plan

Opinion on the financial statements

We have audited the accompanying statements of net assets available for benefits of Masco Corporation 401(k) Plan (the “Plan”) as of December 31, 2020 and 2019, the related statement of changes in net assets available for benefits for the year ended December 31, 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental information

The Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2020 (“supplemental information”) has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Grant Thornton LLP

We have served as the Plan’s auditor since 2013.

Southfield, Michigan

June 11, 2021

MASCO CORPORATION 401(k) PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

December 31, 2020 and 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

1,371,344,267

|

|

|

$

|

1,243,805,739

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

Notes receivable from participants

|

|

23,927,868

|

|

|

25,913,576

|

|

|

Participant contributions

|

|

798,983

|

|

|

—

|

|

|

Employer contributions

|

|

19,766,836

|

|

|

17,813,754

|

|

|

Total receivables

|

|

44,493,687

|

|

|

43,727,330

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

1,415,837,954

|

|

|

$

|

1,287,533,069

|

|

The accompanying notes are an integral part of the financial statements.

4

MASCO CORPORATION 401(k) PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

For the year ended December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

ADDITIONS

|

|

|

|

|

|

|

|

Investment income:

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

124,644,028

|

|

|

Interest and dividend income

|

|

38,966,276

|

|

|

Total investment income

|

|

163,610,304

|

|

|

|

|

|

|

Contributions:

|

|

|

|

Participant

|

|

37,189,155

|

|

|

Participant rollover

|

|

2,994,870

|

|

|

Employer

|

|

37,009,344

|

|

|

Total contributions

|

|

77,193,369

|

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

843,481

|

|

|

|

|

|

|

Total additions

|

|

241,647,154

|

|

|

|

|

|

|

DEDUCTIONS

|

|

|

|

|

|

|

|

Benefit payments

|

|

(116,894,924)

|

|

|

Other, net

|

|

(370,943)

|

|

|

Total deductions

|

|

(117,265,867)

|

|

|

|

|

|

|

Net increase in net assets available for benefits

|

|

124,381,287

|

|

|

|

|

|

|

Transfer in from the Masco Corporation Hourly 401(k) Plan (Note A)

|

|

158,530,811

|

|

|

Net transfers out of the Plan (Note A)

|

|

(154,607,213)

|

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

Beginning of year

|

|

1,287,533,069

|

|

|

|

|

|

|

End of year

|

|

$

|

1,415,837,954

|

|

The accompanying notes are an integral part of the financial statements.

5

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

A.DESCRIPTION OF PLAN

The following description of the Masco Corporation ("Company") 401(k) Plan ("Plan") provides only general information. Participants should refer to the Plan document for a more complete description of the Plan's provisions.

1.General. The Plan is a defined contribution plan covering hourly and salaried employees at certain divisions and subsidiaries of the Company. Eligible employees may participate in the Plan upon their date of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA").

2.Contributions. Participants may contribute (on either a pre-tax or Roth after-tax basis) up to 75 percent of their pretax annual compensation, as defined in the Plan. All employees who are eligible to participate under this Plan and who have attained the age of 50 before the end of the plan year shall be eligible to make catch-up contributions. Participants may also make rollover contributions representing distributions from individual retirement accounts, simplified employee pension plans, 403(b) and 457 plans or other employers' tax-qualified plans. The Company makes matching and/or profit sharing employer contributions in accordance with the provisions of the Plan. These employer contributions, if applicable, vary by division or subsidiary and are invested pursuant to the participant's investment election. At December 31, 2020 and 2019, employer profit sharing contributions receivable totaled $18,543,600 and $17,093,920, respectively. Contributions are subject to certain Internal Revenue Service ("IRS") limitations. Participants may direct contributions in one percent increments in any of the various investment options. Participants may change their investment options daily.

3.Participant Accounts. Each active participant's account is credited with the participant's contributions and allocations of (a) employer contributions (if applicable), and (b) investment earnings (losses), as defined in the Plan. Plan administrative expenses are paid by the Company and not charged to participants' accounts. Certain expenses may be incurred by individual participants for special services relating to their accounts. These costs are charged directly to the individual participant's account. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account.

4.Vesting and Forfeited Employer Contributions. Participants are immediately vested in their contributions plus actual earnings thereon. Participants are also immediately vested in the Company matching contribution plus earnings thereon. Vesting in Company profit sharing contributions occurs after three years of service commencing at date of hire. At December 31, 2020 and 2019, forfeited nonvested accounts totaled $678,135 and $787,126, respectively. During 2020, employer contributions were reduced by $749,848 from forfeited nonvested accounts.

5.Voting Rights. Each participant who has an interest in the Masco Corporation Company Stock Fund is entitled to exercise voting rights attributable to the shares allocated to his or her Stock Fund account and is notified by the Trustee, Fidelity Management Trust Company ("Fidelity"), as defined by the Plan, prior to the time that such rights are to be exercised. If the Trustee does not receive timely instructions, the Trustee itself or by proxy shall vote all such shares in the same ratio as the shares with respect to which instructions were received from participants.

6.Notes Receivable from Participants. Generally, participants may borrow from their account a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50 percent of their vested account balance at the time of the loan. Loan terms generally range from 1-5 years, or up to 20 years in limited circumstances. The loans are collateralized by the balance in the participant's account and generally bear interest at a rate equal to the Prime Rate on the last business day of the month prior to the date of the loan application. Principal and interest are paid ratably through payroll deductions.

In response to coronavirus disease 2019, the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was signed into law on March 27, 2020. The CARES Act permitted qualified Plan participants to withdraw penalty-free distributions of up to $100,000 during 2020, increased the loan cap to the lesser of 100% of the vested balance or $100,000, and allowed for certain participant loan repayments to be delayed up to one year. The Plan Administrator has elected to implement these provisions of the CARES Act.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

A. DESCRIPTION OF PLAN (Concluded)

7. Payment of Benefits. Generally, after separation from service due to termination, death, disability or retirement, a participant may elect to receive an amount equal to the value of the participant's vested interest in his or her account in a single lump-sum amount, in annual installments over a period not to exceed five years, or in partial distributions (up to 6 per year). In-service and hardship withdrawals are distributed in a single payment.

8. Plan Merger. In 2020, Masco executed amendments to merge the Masco Corporation Hourly 401(k) Plan into the Masco Corporation 401(k) Plan effective December 30, 2020. Net assets totaling $158,530,811 were transferred into the Plan.

9. Transfers. Effective March 2020, net assets available for benefits totaling $42,874,322 and $112,307,134 were transferred out of the Plan and into the MI Windows and Doors 401(k) Plan and ACProducts 401(k) Plan, respectively, as a result of the divestiture of our Milgard Windows and Doors business in 2019 and our Masco Cabinetry business in February 2020.

Total transfers of net assets out of the Plan, including those related to the divestitures disclosed above, amounted to $154,607,213 for the year ended December 31, 2020.

B. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies in accordance with accounting principles generally accepted in the United States of America ("GAAP") followed in the preparation of these financial statements.

Basis of Accounting. The accompanying financial statements are prepared on the accrual basis of accounting.

Use of Estimates. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of additions and deductions during the reporting period. Actual results could differ from these estimates and assumptions.

Risks and Uncertainties. The Plan provides for various investment options in collective trust funds, mutual funds, a stock fund and other investment securities. Investment securities are exposed to various risks, including interest rate, market and credit risks. Due to the level of risk associated with certain collective trust funds, mutual funds, stock funds and other investment securities and the level of uncertainty related to changes in the value of investment securities, it is reasonably possible that changes in risks in the near term could materially affect participants' account balances and the amounts reported in the statements of net assets available for benefits and the statement of changes in net assets available for benefits.

Investment Valuation and Income Recognition. Investments are stated at fair value. See Note C for a summary of the valuation method by type of fund.

Investment transactions are reflected on a trade-date basis. Interest income is recognized on the accrual basis of accounting. Dividend income is recorded on the ex-dividend date. Income from other securities is recorded as earned on an accrual basis.

The Plan presents in the statement of changes in net assets available for benefits the net appreciation (depreciation) in the fair value of its investments, which consists of the realized gains or losses and the unrealized appreciation (depreciation) of those investments.

Notes Receivable from Participants. Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. No allowance for credit losses has been recorded as of December 31, 2020 or 2019. Delinquent notes receivable from participants that had a distributable event are recorded as benefit payments based upon the terms of the Plan.

Payment of Benefits. Benefits are recorded when paid.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

B. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Concluded)

Recently Adopted Accounting Pronouncements. In August 2018, the Financial Accounting Standards Board issued Accounting Standards Update 2018-13 (“ASU 2018-13”), “Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement,” which modifies the disclosure requirements of Accounting Standards Codification Topic 820. The Plan adopted ASU 2018-13 on January 1, 2020. The adoption of the standard did not have an impact on the Plan's financial statements.

C. FAIR VALUE MEASUREMENTS

Accounting Policy. The Plan follows fair value guidance (ASC 820) that defines fair value, establishes a framework for measuring fair value and requires certain disclosures about fair value measurements. The guidance defines fair value as "the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date." Further, it defines a fair value hierarchy, as follows: Level 1 inputs as quoted prices in active markets for identical assets or liabilities; Level 2 inputs as observable inputs other than Level 1 prices, such as quoted market prices for similar assets or liabilities or other inputs that are observable or can be corroborated by market data; and Level 3 inputs as unobservable inputs that are supported by little or no market activity and that are financial instruments whose value is determined using pricing models or instruments for which the determination of fair value requires significant management judgment or estimation.

A description of the valuation methodologies used for assets measured at fair value is as follows:

Collective trust funds: Valued based on Net Asset Value ("NAV") of units held in the collective trust, which is used as a practical expedient to estimate fair value as of December 31, 2020 and 2019. The value is determined by reference to the respective fund’s underlying assets, with the exception of the Plan’s stable value collective trust investment where the collective trust’s contract value NAV represents fair value since this is the amount at which the Plan transacts with the collective trust.

Mutual funds: Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission ("SEC"). These funds are required to publish their daily NAV and transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Stock fund: Valued at the closing price as reported on the active market on which the security is traded.

Self-directed brokerage account: Participant-directed investments that primarily include common stocks, mutual funds, certificates of deposit (CDs), and cash. Common stocks are valued at the closing price as reported on the active market on which the individual securities are traded. Mutual funds are valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the SEC. These funds are required to publish their daily NAV and transact at that price. The mutual funds held by the Plan are deemed to be actively traded. CDs are valued at amortized cost, which approximates fair value.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

C. FAIR VALUE MEASUREMENTS (Concluded)

The following tables set forth by level, within the fair value hierarchy, the Plan's assets at fair value as of December 31, 2020 and 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2020

|

|

|

Level 1

|

Level 2

|

Level 3

|

Measured at NAV

|

Total

|

|

Collective trust funds

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

636,006,599

|

|

$

|

636,006,599

|

|

|

Mutual funds

|

665,892,735

|

|

—

|

|

—

|

|

—

|

|

665,892,735

|

|

|

Stock fund

|

26,770,072

|

|

—

|

|

—

|

|

—

|

|

26,770,072

|

|

|

Self-directed brokerage account

|

42,674,861

|

|

—

|

|

—

|

|

—

|

|

42,674,861

|

|

|

Total assets at fair value

|

$

|

735,337,668

|

|

$

|

—

|

|

$

|

—

|

|

$

|

636,006,599

|

|

$

|

1,371,344,267

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2019

|

|

|

Level 1

|

Level 2

|

Level 3

|

Measured at NAV

|

Total

|

|

Collective trust funds

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

596,305,971

|

|

$

|

596,305,971

|

|

|

Mutual funds

|

590,784,362

|

|

—

|

|

—

|

|

—

|

|

590,784,362

|

|

|

Stock fund

|

24,711,542

|

|

—

|

|

—

|

|

—

|

|

24,711,542

|

|

|

Self-directed brokerage account

|

32,003,864

|

|

—

|

|

—

|

|

—

|

|

32,003,864

|

|

|

Total assets at fair value

|

$

|

647,499,768

|

|

$

|

—

|

|

$

|

—

|

|

$

|

596,305,971

|

|

$

|

1,243,805,739

|

|

The following table summarizes investments measured at fair value using the NAV per share practical expedient as of December 31, 2020 and 2019. Were the Plan to initiate a full redemption of the collective trust funds, the investment adviser reserves the right to temporarily delay withdrawal from the trust in order to ensure the securities liquidations will be carried out in an orderly business manner.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value at December 31,

|

|

|

|

|

|

2020

|

2019

|

Unfunded Commitments

|

Redemption Frequency

|

Redemption Notice Period

|

|

Collective trust funds:

|

|

|

|

|

|

|

FIAM Small Capitalization Core Commingled Pool Class D

|

$

|

21,747,971

|

|

$

|

29,250,865

|

|

None

|

Daily

|

30 days

|

|

Fidelity® Diversified International Commingled Pool

|

49,479,415

|

|

45,654,377

|

|

None

|

Daily

|

30 days

|

|

Fidelity® Low-Priced Stock Commingled Pool

|

26,398,200

|

|

31,063,840

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2005 Commingled Pool Class X

|

1,545,857

|

|

895,602

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2010 Commingled Pool Class X

|

5,797,440

|

|

5,395,668

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2015 Commingled Pool Class X

|

9,946,631

|

|

8,180,082

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2020 Commingled Pool Class X

|

39,095,914

|

|

38,779,449

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2025 Commingled Pool Class X

|

63,143,389

|

|

55,034,813

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2030 Commingled Pool Class X

|

94,263,947

|

|

86,124,612

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2035 Commingled Pool Class X

|

67,195,038

|

|

63,179,788

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2040 Commingled Pool Class X

|

60,159,380

|

|

56,668,985

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2045 Commingled Pool Class X

|

56,497,058

|

|

49,288,185

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2050 Commingled Pool Class X

|

36,800,820

|

|

33,238,039

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2055 Commingled Pool Class X

|

21,182,042

|

|

14,825,061

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date 2060 Commingled Pool Class X

|

9,100,039

|

|

4,124,020

|

|

None

|

Daily

|

30 days

|

|

FIAM Blend Target Date Income Commingled Pool Class X

|

5,579,203

|

|

5,970,959

|

|

None

|

Daily

|

30 days

|

|

FIAM Core Plus Commingled Pool Class K

|

54,616,292

|

|

58,318,897

|

|

None

|

Daily

|

30 days

|

|

Managed Income Portfolio Class II

|

13,457,963

|

|

10,312,729

|

|

None

|

Daily

|

12 months

|

|

Total investments measured at NAV

|

$

|

636,006,599

|

|

$

|

596,305,971

|

|

|

|

|

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Continued

D. INCOME TAX STATUS

The IRS determined and informed the Company by letter dated March 31, 2014 that the Plan is designed in accordance with the applicable sections of the Internal Revenue Code ("Code"). The Plan has since been amended; however, the Plan Administrator believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the Code. Therefore, no provision for income taxes has been included in the Plan's financial statements.

Accounting principles generally accepted in the United States of America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2020 and 2019, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax period in progress.

E. PLAN TERMINATION

Although the Company has not expressed an intent to do so, the Company has the right at any time to discontinue its contributions and to terminate the Plan, subject to the provisions of ERISA. At the date of any such termination, all participants would become fully vested in their accounts and the Administrative Committee of the Plan shall direct the Trustee to distribute to the participants all assets of the Plan, net of any termination expenses.

F. RELATED PARTY AND PARTY-IN-INTEREST TRANSACTIONS

Certain Plan investments are in shares of collective trust funds and mutual funds managed by Fidelity or an affiliate thereof. Fidelity is also the Trustee as defined by the Plan and, therefore, these purchases and sales qualify as party-in-interest transactions. There were no fees paid by the Plan for investment management services for the year ended December 31, 2020. Notes receivable from participants are also considered party-in-interest transactions.

The Plan invests in a Masco Corporation Common Stock Fund. As of December 31, 2020 and 2019, the value of the Masco Corporation Common Stock Fund, which exclusively included Masco Corporation Common Stock, was $26,770,072 and $24,711,542, respectively. For the year ended December 31, 2020, the Masco Corporation Common Stock Fund appreciated in value by $2,751,372 and earned dividend income of $266,210.

G. RECONCILIATION OF PLAN'S FINANCIAL STATEMENTS TO FORM 5500

Participant loans are shown net of deemed distributions on Form 5500. The following is a reconciliation of net assets per the financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

|

2020

|

|

2019

|

|

Net assets available for benefits per the financial statements

|

|

$

|

1,415,837,954

|

|

|

$

|

1,287,533,069

|

|

|

Less: Deemed distributions

|

|

400,238

|

|

|

390,279

|

|

|

Net assets per Form 5500

|

|

$

|

1,415,437,716

|

|

|

$

|

1,287,142,790

|

|

The following is a reconciliation of the net increase in net assets available for benefits per the financial statements to net income per Form 5500 for the year ended December 31:

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

Net increase in net assets available for benefits per the financial statements

|

|

$

|

124,381,287

|

|

|

Less: Change in deemed distributions

|

|

9,959

|

|

|

Net income per Form 5500

|

|

$

|

124,371,328

|

|

MASCO CORPORATION 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS, Concluded

H. SUBSEQUENT EVENTS

The Plan Administrator has evaluated subsequent events through June 11, 2021, the date the financial statements were issued, and determined that no subsequent events have occurred requiring adjustments to the financial statements or disclosures.

MASCO CORPORATION 401(k) PLAN

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue,

Borrower or

Similar Party

|

|

(c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value and Number of Shares Outstanding

|

|

(d)

Cost*

|

|

(e)

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Artisan Mid Cap Fund -

|

|

Mutual fund

|

|

|

|

|

|

|

|

Institutional Class

|

|

1,680,861 shares

|

|

|

|

$

|

93,405,447

|

|

|

|

|

JP Morgan Mid Cap Value Fund - Class L

|

|

Mutual fund

|

|

|

|

|

|

|

|

|

|

635,005 shares

|

|

|

|

23,457,081

|

|

|

|

|

Vanguard Wellington Fund™ -

|

|

Mutual fund

|

|

|

|

|

|

|

|

Admiral™ Shares

|

|

465,228 shares

|

|

|

|

35,636,501

|

|

|

|

|

Dodge & Cox Stock Fund

|

|

Mutual fund

|

|

|

|

|

|

|

|

|

|

258,024 shares

|

|

|

|

49,685,076

|

|

|

|

|

Harbor Capital Appreciation Fund -

|

|

Mutual fund

|

|

|

|

|

|

|

|

Retirement Class

|

|

1,659,146 shares

|

|

|

|

172,949,412

|

|

|

**

|

|

Fidelity® Extended Market Index Fund

|

|

Mutual fund

|

|

|

|

|

|

|

|

|

|

78,376 shares

|

|

|

|

6,542,854

|

|

|

**

|

|

Fidelity® Institutional Money Market

|

|

Mutual fund

|

|

|

|

|

|

|

|

Government Portfolio - Institutional Class

|

|

63,651,580 shares

|

|

|

|

63,651,580

|

|

|

**

|

|

Fidelity® Independence Fund - Class K

|

|

Mutual fund

|

|

|

|

|

|

|

|

|

|

1,014,038 shares

|

|

|

|

47,051,357

|

|

|

**

|

|

Fidelity® 500 Index Fund

|

|

Mutual fund

|

|

|

|

|

|

|

|

|

|

863,945 shares

|

|

|

|

112,459,682

|

|

|

**

|

|

Fidelity® Emerging Markets Fund - Class K

|

|

Mutual fund

|

|

|

|

|

|

|

|

|

|

567,979 shares

|

|

|

|

25,950,971

|

|

|

**

|

|

Fidelity® International Index Fund -

|

|

Mutual fund

|

|

|

|

|

|

|

|

Institutional Class

|

|

121,052 shares

|

|

|

|

5,521,187

|

|

|

**

|

|

Fidelity® U.S. Bond Index Fund

|

|

Mutual fund

|

|

|

|

|

|

|

|

|

|

2,376,031 shares

|

|

|

|

29,581,587

|

|

|

**

|

|

Managed Income Portfolio Class II

|

|

Collective trust fund

|

|

|

|

|

|

|

|

|

|

13,457,963 shares

|

|

|

|

13,457,963

|

|

|

**

|

|

Fidelity® Diversified International

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool

|

|

2,878,384 shares

|

|

|

|

49,479,415

|

|

|

**

|

|

Fidelity® Low-Priced Stock

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool

|

|

1,489,740 shares

|

|

|

|

26,398,200

|

|

|

**

|

|

FIAM Small Capitalization Core

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class D

|

|

129,099 shares

|

|

|

|

21,747,971

|

|

|

**

|

|

FIAM Blend Target Date Income

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

341,444 shares

|

|

|

|

5,579,203

|

|

|

**

|

|

FIAM Core Plus

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class K

|

|

2,310,334 shares

|

|

|

|

54,616,292

|

|

|

|

|

|

|

|

|

|

|

|

MASCO CORPORATION 401(k) PLAN

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR), Concluded

December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue,

Borrower or

Similar Party

|

|

(c)

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value and Number of Shares Outstanding

|

|

(d)

Cost*

|

|

(e)

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

**

|

|

FIAM Blend Target Date 2005

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

86,603 shares

|

|

|

|

1,545,857

|

|

|

**

|

|

FIAM Blend Target Date 2010

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

292,210 shares

|

|

|

|

5,797,440

|

|

|

**

|

|

FIAM Blend Target Date 2015

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

481,444 shares

|

|

|

|

9,946,631

|

|

|

**

|

|

FIAM Blend Target Date 2020

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

1,881,420 shares

|

|

|

|

39,095,914

|

|

|

**

|

|

FIAM Blend Target Date 2025

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,868,850 shares

|

|

|

|

63,143,389

|

|

|

**

|

|

FIAM Blend Target Date 2030

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

4,221,404 shares

|

|

|

|

94,263,947

|

|

|

**

|

|

FIAM Blend Target Date 2035

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,825,695 shares

|

|

|

|

67,195,038

|

|

|

**

|

|

FIAM Blend Target Date 2040

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,530,895 shares

|

|

|

|

60,159,380

|

|

|

**

|

|

FIAM Blend Target Date 2045

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

2,364,883 shares

|

|

|

|

56,497,058

|

|

|

**

|

|

FIAM Blend Target Date 2050

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

1,563,331 shares

|

|

|

|

36,800,820

|

|

|

**

|

|

FIAM Blend Target Date 2055

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

838,893 shares

|

|

|

|

21,182,042

|

|

|

**

|

|

FIAM Blend Target Date 2060

|

|

Collective trust fund

|

|

|

|

|

|

|

|

Commingled Pool Class X

|

|

537,510 shares

|

|

|

|

9,100,039

|

|

|

**

|

|

Masco Corporation Company Stock Fund

|

|

Stock fund

|

|

|

|

|

|

|

|

|

|

487,349 shares

|

|

|

|

26,770,072

|

|

|

**

|

|

Fidelity BrokerageLink®

|

|

Self-directed brokerage account

|

|

|

|

|

|

|

|

|

|

42,674,861 shares

|

|

|

|

42,674,861

|

|

|

**

|

|

Notes Receivable from Participants

|

|

Ranging 1-20 years maturity with

|

|

|

|

|

|

|

|

|

|

rates of interest, 3.25% - 8.25%

|

|

|

|

23,927,868

|

|

|

|

|

|

|

|

|

|

|

$

|

1,395,272,135

|

|

* Historical cost information is not required on the Schedule of Assets (Held at End of Year) for participant-directed investments.

** These investments are with a party-in-interest.

MASCO CORPORATION 401(k) PLAN

SIGNATURE

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Masco Corporation 401(k) Plan

|

|

|

|

|

|

|

|

|

By:

|

Masco Corporation, Plan Administrator of the Masco Corporation 401(k) Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

June 11, 2021

|

By:

|

/s/ John G. Sznewajs

|

|

|

|

|

John G. Sznewajs

|

|

|

|

|

Vice President, Chief Financial Officer

|

|

|

|

|

Authorized Signatory

|

MASCO CORPORATION 401(k) PLAN

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

Consent of Grant Thornton LLP relating to the Plan's financial statements

|

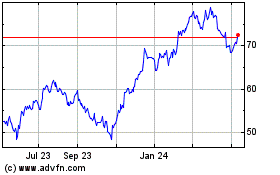

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

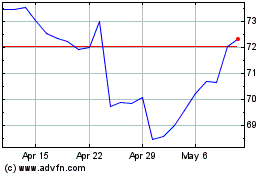

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024