AM Best Assigns Issue Credit Rating to Markel Corporation’s Recently Announced Senior Unsecured Notes

May 05 2021 - 12:40PM

Business Wire

AM Best has assigned a Long-Term Issue Credit Rating of

“bbb+” to $600 million of 3.45% senior unsecured notes due 2052

issued by Markel Corporation (Markel) (Glen Allen, Virginia) [NYSE:

MKL]. The outlook assigned to this Credit Rating (rating) is

stable. The debt ranks pari passu with the company’s outstanding

senior unsecured notes.

The proceeds will be used to prefund the scheduled retirement of

Markel’s $350 million of senior unsecured notes due July 2022, and

for general corporate purposes. The rating assignment considers the

rating profile of Markel’s principal insurance subsidiary units, as

well as the parent company’s financial leverage, coverage and

overall debt servicing profile, and the application of appropriate

notching to reflect structural subordination of the holding

company’s senior debt.

Markel’s financial leverage, as calculated by AM Best, was in

the low-to-mid 20% range at year-end 2020, and will remain in the

mid-to-upper 20% range following the new debt offering, prior to

consideration of proceeds held to pre-fund the retirement of

maturing debt in mid-2022. Earnings before interest, preferred

dividends and taxes interest coverage has been strong, averaging

3.9 times over the past three years, albeit declining to 2.9 times

in 2020. AM Best expects Markel’s coverage ratio to remain within

guidance. The company’s 2020 net operating earnings results were

affected by net claim losses associated with natural catastrophes,

pandemic-related event cancellation and business interruption

claims, and other losses sustained by its international and U.S.

insurance and reinsurance operations.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best’s

Credit Ratings. For information on the proper media use of Best’s

Credit Ratings and AM Best press releases, please view Guide for

Media - Proper Use of Best’s Credit Ratings and AM Best Rating

Action Press Releases.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2021 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210505005890/en/

Alan Murray Senior Financial Analyst +1 908 439

2200, ext. 5535 alan.murray@ambest.com

Jennifer Marshall Director +1 908 439 2200,

ext. 5327 jennifer.marshall@ambest.com

Christopher Sharkey Manager, Public Relations

+1 908 439 2200, ext. 5159

christopher.sharkey@ambest.com

Jim Peavy Director, Communications +1 908 439

2200, ext. 5644 james.peavy@ambest.com

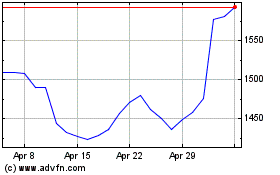

Markel (NYSE:MKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

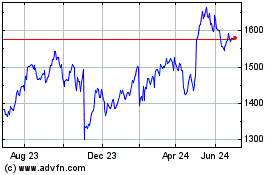

Markel (NYSE:MKL)

Historical Stock Chart

From Apr 2023 to Apr 2024