Manitowoc reports Net Sales of $328.3

million; Adjusted EBITDA(1) of $7.8 million

Company to Host Earnings Call on Thursday,

August 6th, at 10:00 a.m. ET

The Manitowoc Company, Inc. (NYSE: MTW), (the “Company” or

“Manitowoc”) a leading global manufacturer of cranes and lifting

solutions, today reported a second-quarter net loss of $12.7

million, or $0.37 per diluted share. Second-quarter adjusted net

loss(1) of $16.2 million, or $0.47 per diluted share, declined

$49.7 million year-over-year.

Net sales in the second quarter, 2020 decreased 35%

year-over-year to $328.3 million. The COVID-19 pandemic coupled

with weak economic activity impacted demand in all regions.

Adjusted EBITDA(1) of $7.8 million, or 2.4% of sales, declined

$45.5 million mainly due to the sales decline and reduced

manufacturing activity in the quarter.

Second-quarter orders of $237.8 million declined 36.1% from the

prior year. Backlog as of June 30, 2020 totaled $430.5 million, a

decrease of 17% from March 31, 2020.

“Our second-quarter adjusted EBITDA of $7.8 million reflected

good operational performance and was in line with our expectations,

considering the vast challenges posed by the ongoing COVID-19

pandemic. I am proud of our team’s resilience as we continue to

operate with excellence and meet our customers’ expectations, while

protecting the well-being of our employees and partnering with our

supply chain during this global pandemic,” commented Aaron H.

Ravenscroft, President and Chief Executive Officer of The Manitowoc

Company, Inc.

“During our 117-year history, we have endured several unforeseen

crises, and I am confident we will successfully navigate this one

as evidenced by our prudent cash management and ample liquidity of

$375 million. The strengths that are core to Manitowoc's business –

our people, our products and brands, our network and our

operational excellence – guide every decision we make and position

us for success when demand returns,” concluded Ravenscroft.

2020 Outlook

As a result of the significant uncertainty around the future

impact that COVID-19 will have on the Company’s end market demand

and supply chain, full year 2020 guidance is not being

provided.

CEO Succession Plan

In a separate release issued today, the Company announced that

Aaron H. Ravenscroft, formerly the Company’s Executive Vice

President of Cranes, has been appointed President and CEO, and a

member of the Board of Directors, effective immediately. Mr.

Ravenscroft succeeds Barry L. Pennypacker, who is stepping down

from his role as President and Chief Executive Officer and as a

member of the Board as part of the Company’s leadership transition

plan. Mr. Pennypacker will continue to serve the Company in an

advisory role through December 31, 2020, to ensure a smooth

transition.

Investor Conference Call – New Date and Time

The Manitowoc Company will now host a conference call for

security analysts and institutional investors to discuss its

second-quarter earnings results on Thursday, August 6th, 2020, at

10:00 a.m. ET (9:00 a.m. CT). A live audio webcast of the call,

along with the related presentation, published in conjunction with

this press release, can be accessed in the Investor Relations

section of Manitowoc’s website at www.manitowoc.com. A replay of

the conference call will also be available at the same location on

the website.

About The Manitowoc Company, Inc.

The Manitowoc Company, Inc. was founded in 1902 and has over a

117-year tradition of providing high-quality, customer-focused

products and support services to its markets. Manitowoc is one of

the world's leading providers of engineered lifting solutions.

Manitowoc, through its wholly-owned subsidiaries, designs,

manufactures, markets, and supports comprehensive product lines of

mobile telescopic cranes, tower cranes, lattice-boom crawler cranes

and boom trucks under the Grove, Manitowoc, National Crane, Potain,

Shuttlelift and Manitowoc Crane Care brand names.

Footnote

(1)Adjusted net income (loss), diluted adjusted net income

(loss) per share, adjusted EBITDA, adjusted operating income

(loss), adjusted operating cash flows and free cash flows are

financial measures that are not in accordance with GAAP. For a

reconciliation to the comparable GAAP numbers please see schedule

of “Non-GAAP Financial Measures” at the end of this press release.

Manitowoc believes these non-GAAP financial measures provide

important supplemental information to both management and investors

regarding financial and business trends used in assessing its

results of operations. Manitowoc believes excluding specified items

provides a more meaningful comparison to the corresponding

reporting periods and internal budgets and forecasts, assists

investors in performing analysis that is consistent with financial

models developed by investors and research analysts, provides

management with a more relevant measure of operating performance

and is more useful in assessing management performance.

Forward-looking Statements

This press release includes “forward-looking statements”

intended to qualify for the safe harbor from liability under the

Private Securities Litigation Reform Act of 1995. Any statements

contained in this press release that are not historical facts are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on the current expectations of the management of the Company

and are subject to uncertainty and changes in circumstances.

Forward-looking statements include, without limitation, statements

typically containing words such as “intends,” “expects,”

“anticipates,” “targets,” “estimates,” and words of similar import.

By their nature, forward-looking statements are not guarantees of

future performance or results and involve risks and uncertainties

because they relate to events and depend on circumstances that will

occur in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. Factors

that could cause actual results and developments to differ

materially include, among others:

- The negative impacts COVID-19 has had and will continue to have

on our business, financial condition, cash flows, results of

operations and supply chain, as well as customer demand (including

future uncertain impacts);

- actions of competitors;

- changes in economic or industry conditions generally or in the

markets served by Manitowoc;

- unanticipated changes in customer demand, including changes in

global demand for high-capacity lifting equipment, changes in

demand for lifting equipment in emerging economies, and changes in

demand for used lifting equipment;

- geographic factors and political and economic conditions and

risks;

- the ability to capitalize on key strategic opportunities and

the ability to implement Manitowoc’s long-term initiatives;

- government approval and funding of projects and the effect of

government-related issues or developments;

- unanticipated changes in capital and financial markets;

- unanticipated changes in revenues, margins and costs;

- the ability to increase operational efficiencies across

Manitowoc and to capitalize on those efficiencies;

- the ability to significantly improve profitability; and

- risks and factors detailed in Manitowoc's 2019 Annual Report on

Form 10-K, as such were previously supplemented and amended in

Manitowoc’s Quarterly Report on Form 10-Q for the quarterly period

ended March 31, 2020 and its other filings with the United States

Securities and Exchange Commission.

Manitowoc undertakes no obligation to update or revise

forward-looking statements, whether as a result of new information,

future events, or otherwise. Forward-looking statements only speak

as of the date on which they are made. Information on the potential

factors that could affect the Company's actual results of

operations is included in its filings with the Securities and

Exchange Commission, including but not limited to its Annual Report

on Form 10-K for the fiscal year ended December 31, 2019, as

supplemented and amended in its Quarterly Report on Form 10-Q for

the quarterly period ended March 31, 2020.

THE MANITOWOC COMPANY,

INC.

Unaudited Consolidated

Financial Information

For the three and six months

ended June 30, 2020 and 2019

(In millions, except per share

and share amounts)

CONSOLIDATED STATEMENT OF

OPERATIONS

Three Months Ended

June 30,

Six Months Ended

June 30,

2020

2019

2020

2019

Net sales

$

328.3

$

504.7

$

657.5

$

922.7

Cost of sales

279.9

409.5

545.9

747.3

Gross profit

48.4

95.2

111.6

175.4

Operating costs and expenses:

Engineering, selling and administrative

expenses

49.7

50.5

105.6

109.9

Amortization of intangible assets

0.1

0.1

0.2

0.2

Restructuring expense

0.2

2.7

1.7

7.2

Total operating costs and expenses

50.0

53.3

107.5

117.3

Operating income (loss)

(1.6

)

41.9

4.1

58.1

Other income (expense):

Interest expense

(7.2

)

(7.5

)

(14.4

)

(18.4

)

Amortization of deferred financing

fees

(0.3

)

(0.4

)

(0.7

)

(0.8

)

Loss on debt extinguishment

—

—

—

(25.0

)

Other income (expense) - net

(2.9

)

15.9

(6.9

)

12.6

Total other income (expense)

(10.4

)

8.0

(22.0

)

(31.6

)

Income (loss) before income taxes

(12.0

)

49.9

(17.9

)

26.5

Provision for income taxes

0.7

3.9

2.6

7.2

Net income (loss)

$

(12.7

)

$

46.0

$

(20.5

)

$

19.3

Per Share Data

Basic income (loss) per common share

$

(0.37

)

$

1.29

$

(0.59

)

$

0.54

Diluted income (loss) per common share

$

(0.37

)

$

1.29

$

(0.59

)

$

0.54

Weighted average shares outstanding -

basic

34,519,889

35,595,718

34,827,582

35,619,145

Weighted average shares outstanding -

diluted

34,519,889

35,725,908

34,827,582

35,799,089

THE MANITOWOC COMPANY,

INC.

Unaudited Consolidated

Financial Information

As of June 30, 2020 and December

31, 2019

(In millions, except share

amounts)

CONSOLIDATED BALANCE SHEETS

June 30, 2020

December 31, 2019

Assets

Current Assets:

Cash and cash equivalents

$

128.3

$

199.3

Accounts receivable, less allowances of

$9.4 and $7.9, respectively

171.9

168.3

Inventories — net

534.5

461.4

Notes receivable — net

14.0

17.4

Other current assets

33.0

26.0

Total current assets

881.7

872.4

Property, plant and equipment — net

277.8

289.9

Operating lease right-of-use assets

42.8

47.6

Goodwill

232.0

232.5

Other intangible assets — net

115.9

116.3

Other non-current assets

54.7

59.0

Total assets

$

1,604.9

$

1,617.7

Liabilities and Stockholders'

Equity

Current Liabilities:

Accounts payable and accrued expenses

$

332.6

$

340.8

Short-term borrowings and current portion

of long-term debt

4.3

3.8

Product warranties

45.8

47.2

Customer advances

15.8

25.8

Other liabilities

22.2

23.3

Total current liabilities

420.7

440.9

Non-Current Liabilities:

Long-term debt

356.9

308.4

Operating lease liabilities

33.3

37.6

Deferred income taxes

4.3

5.5

Pension obligations

83.7

86.4

Postretirement health and other benefit

obligations

15.6

16.4

Long-term deferred revenue

27.4

30.3

Other non-current liabilities

47.3

46.3

Total non-current liabilities

568.5

530.9

Stockholders' Equity:

Preferred stock (authorized 3,500,000

shares of $.01 par value; none outstanding)

—

—

Common stock (75,000,000 shares

authorized, 40,793,983 shares issued, 34,521,063 and 35,374,537

shares outstanding, respectively)

0.4

0.4

Additional paid-in capital

596.0

592.2

Accumulated other comprehensive loss

(124.1

)

(121.0

)

Retained earnings

215.5

236.2

Treasury stock, at cost (6,272,920 and

5,419,446 shares, respectively)

(72.1

)

(61.9

)

Total stockholders' equity

615.7

645.9

Total liabilities and stockholders'

equity

$

1,604.9

$

1,617.7

THE MANITOWOC COMPANY,

INC.

Unaudited Consolidated

Financial Information

For the three and six months

ended June 30, 2020 and 2019

(In millions)

CONSOLIDATED STATEMENT OF CASH

FLOWS

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

Cash Flows from Operating

Activities:

Net income (loss)

$

(12.7

)

$

46.0

$

(20.5

)

$

19.3

Adjustments to reconcile net income (loss)

to cash provided by (used for) operating activities:

Depreciation

9.1

8.6

18.1

17.4

Amortization of intangible assets

0.1

0.1

0.2

0.2

Amortization of deferred financing

fees

0.3

0.4

0.7

0.8

Loss on debt extinguishment

—

—

—

25.0

(Gain) loss on sale of property, plant and

equipment

0.1

(0.4

)

—

—

Other

2.5

2.3

5.9

6.0

Changes in operating assets and

liabilities

Accounts receivable

(0.8

)

(26.9

)

(6.4

)

(222.6

)

Inventories

15.1

(12.0

)

(73.4

)

(106.5

)

Notes receivable

3.0

(2.3

)

5.6

(2.3

)

Other assets

(4.8

)

12.0

(6.4

)

26.1

Accounts payable

(34.6

)

(4.5

)

(6.5

)

22.1

Accrued expenses and other liabilities

2.5

8.6

(16.0

)

(20.9

)

Net cash provided by (used for) operating

activities

(20.2

)

31.9

(98.7

)

(235.4

)

Cash Flows from Investing

Activities:

Capital expenditures

(4.4

)

(5.3

)

(8.0

)

(9.7

)

Proceeds from fixed assets

—

—

0.1

4.8

Cash receipts on sold accounts

receivable

—

—

—

126.3

Net cash provided by (used for) investing

activities

(4.4

)

(5.3

)

(7.9

)

121.4

Cash Flows from Financing

Activities:

Proceeds from revolving credit

facility

50.0

24.8

50.0

82.8

Payments on revolving credit facility

—

(57.8

)

—

(82.8

)

Payments on long-term debt

—

—

—

(276.6

)

Proceeds from long-term debt

—

—

—

300.0

Other debt - net

(1.0

)

3.1

(1.5

)

1.9

Debt issuance costs

—

(2.6

)

—

(8.2

)

Exercise of stock options

—

—

0.1

0.1

Common stock repurchases

—

(7.4

)

(12.0

)

(7.4

)

Net cash provided by (used for) financing

activities

49.0

(39.9

)

36.6

9.8

Effect of exchange rate changes on cash

and cash equivalents

0.3

(0.7

)

(1.0

)

(1.1

)

Net increase (decrease) in cash and cash

equivalents

$

24.7

$

(14.0

)

$

(71.0

)

$

(105.3

)

Non-GAAP Financial Measures

Non-GAAP Items

Adjusted net income (loss), adjusted EBITDA, adjusted operating

income (loss), adjusted operating cash flows and free cash flows

are financial measures that are not in accordance with GAAP.

Manitowoc believes these non-GAAP financial measures provide

important supplemental information to both management and investors

regarding financial and business trends used in assessing its

results of operations. Manitowoc believes excluding specified items

provides a more meaningful comparison to the corresponding

reporting periods and internal budgets and forecasts, assists

investors in performing analysis that is consistent with financial

models developed by investors and research analysts, provides

management with a more relevant measure of operating performance

and is more useful in assessing management performance.

Reconciliation of Adjusted Net Income

(Loss) to Net Income (Loss)

(in millions, except per share

amounts)

Three Months Ended

June 30,

2020

2019

As reported

Adjustments

Adjusted

As reported

Adjustments

Adjusted

Gross profit

$

48.4

$

—

$

48.4

$

95.2

$

—

$

95.2

Engineering, selling and administrative

expenses

(49.7

)

—

(49.7

)

(50.5

)

—

(50.5

)

Amortization of intangible assets

(0.1

)

—

(0.1

)

(0.1

)

—

(0.1

)

Restructuring expense (1)

(0.2

)

0.2

—

(2.7

)

2.7

—

Operating income (loss)

(1.6

)

0.2

(1.4

)

41.9

2.7

44.6

Interest expense

(7.2

)

—

(7.2

)

(7.5

)

—

(7.5

)

Amortization of deferred financing

fees

(0.3

)

—

(0.3

)

(0.4

)

—

(0.4

)

Other income (expense) - net (2)

(2.9

)

—

(2.9

)

15.9

(15.5

)

0.4

Income (loss) before income

taxes

(12.0

)

0.2

(11.8

)

49.9

(12.8

)

37.1

(Provision) benefit for income taxes

(3)

(0.7

)

(3.7

)

(4.4

)

(3.9

)

0.3

(3.6

)

Net income (loss)

$

(12.7

)

$

(3.5

)

$

(16.2

)

$

46.0

$

(12.5

)

$

33.5

Diluted net income (loss) per share

$

(0.37

)

$

(0.47

)

$

1.29

$

0.94

(1)

The adjustments in 2020 and 2019 represent

the add back of restructuring related charges.

(2)

The adjustment in 2019 represents the

removal of a gain associated with the settlement of a legal

matter.

(3)

The adjustments in 2020 represent the net

income tax impacts of item (1) and the removal of an income tax

benefit related to the Coronavirus Aid, Relief and Economic

Security Act (“CARES Act”). The adjustments in 2019 represent the

net income tax impact of items (1) and (2).

Six Months Ended June

30,

2020

2019

As reported

Adjustments

Adjusted

As reported

Adjustments

Adjusted

Gross profit

$

111.6

$

—

$

111.6

$

175.4

$

—

$

175.4

Engineering, selling and administrative

expenses

(105.6

)

—

(105.6

)

(109.9

)

—

(109.9

)

Amortization of intangible assets

(0.2

)

—

(0.2

)

(0.2

)

—

(0.2

)

Restructuring expense (1)

(1.7

)

1.7

—

(7.2

)

7.2

—

Operating income

4.1

1.7

5.8

58.1

7.2

65.3

Interest expense

(14.4

)

—

(14.4

)

(18.4

)

—

(18.4

)

Amortization of deferred financing

fees

(0.7

)

—

(0.7

)

(0.8

)

—

(0.8

)

Loss on debt extinguishment (2)

—

—

—

(25.0

)

25.0

—

Other income (expense) - net (3)

(6.9

)

—

(6.9

)

12.6

(15.5

)

(2.9

)

Income (loss) before income

taxes

(17.9

)

1.7

(16.2

)

26.5

16.7

43.2

(Provision) benefit for income taxes

(4)

(2.6

)

(3.7

)

(6.3

)

(7.2

)

0.4

(6.8

)

Net income (loss)

$

(20.5

)

$

(2.0

)

$

(22.5

)

$

19.3

$

17.1

$

36.4

Diluted income (loss) per share

$

(0.59

)

$

(0.65

)

$

0.54

$

1.02

(1)

The adjustments in 2020 and 2019 represent

the add back of restructuring related charges.

(2)

The adjustment in 2019 represents the

removal of charges related to the Company’s refinancing of its

Asset Based Lending Revolving Credit Facility and senior secured

second lien notes.

(3)

The adjustment in 2019 represents the

removal of a gain associated with the settlement of a legal

matter.

(4)

The adjustments in 2020 represent the net

income tax impacts of item (1) and the removal of an income tax

benefit related to the CARES Act. The adjustments in 2019 represent

the net income tax impact of items (1) through (3).

Adjusted Operating Cash Flows and Free

Cash Flows

(In millions)

Three Months Ended

June 30,

Six Months Ended

June 30,

2020

2019

2020

2019

Net cash provided by (used for) operating

activities

$

(20.2

)

$

31.9

$

(98.7

)

$

(235.4

)

Cash receipts on sold accounts

receivable

—

—

—

126.3

Net payments on accounts receivable

securitization program

—

—

—

75.0

Adjusted operating cash flows

(20.2

)

31.9

(98.7

)

(34.1

)

Capital expenditures

(4.4

)

(5.3

)

(8.0

)

(9.7

)

Free cash flows

$

(24.6

)

$

26.6

$

(106.7

)

$

(43.8

)

Adjusted EBITDA and Adjusted Operating Income (Loss)

The Company defines adjusted EBITDA as earnings before interest,

income taxes, depreciation and amortization, plus an addback of

certain restructuring and other charges. The reconciliation of net

income (loss) to adjusted EBITDA and operating income (loss) to

adjusted operating income (loss) for the three and six months ended

June 30, 2020 and 2019 and trailing twelve months, is as follows.

All dollar amounts are in millions of dollars:

Three Months Ended

June 30,

Six Months Ended

June 30,

Trailing Twelve

2020

2019

2020

2019

Months

Net income (loss)

$

(12.7

)

$

46.0

$

(20.5

)

$

19.3

$

6.8

Interest expense and amortization of

deferred financing fees

7.5

7.9

15.1

19.2

30.1

Provision for income taxes

0.7

3.9

2.6

7.2

7.8

Depreciation expense

9.1

8.6

18.1

17.4

35.7

Amortization of intangible assets

0.1

0.1

0.2

0.2

0.3

EBITDA

4.7

66.5

15.5

63.3

80.7

Restructuring expense

0.2

2.7

1.7

7.2

4.3

Loss on debt extinguishment

—

—

—

25.0

—

Other non-recurring charges (1)

—

—

—

—

3.1

Other (income) expense - net (2)

2.9

(15.9

)

6.9

(12.6

)

9.7

Adjusted EBITDA

7.8

53.3

24.1

82.9

97.8

Depreciation expense

(9.1

)

(8.6

)

(18.1

)

(17.4

)

(35.7

)

Amortization of intangible assets

(0.1

)

(0.1

)

(0.2

)

(0.2

)

(0.3

)

Adjusted operating income (loss)

(1.4

)

44.6

5.8

65.3

61.8

Restructuring expense

(0.2

)

(2.7

)

(1.7

)

(7.2

)

(4.3

)

Other non-recurring charges

—

—

—

—

(3.1

)

Operating income (loss)

$

(1.6

)

$

41.9

$

4.1

$

58.1

$

54.4

Adjusted EBITDA margin percentage

2.4

%

10.6

%

3.7

%

9.0

%

6.2

%

Adjusted operating income (loss) margin

percentage

(0.4

)%

8.8

%

0.9

%

7.1

%

3.9

%

(1)

Other non-recurring charges includes

losses from a long-term note receivable resulting from the 2014

divestiture of the Company’s Chinese joint venture and other

charges included in engineering, selling and administrative

expenses in the third and fourth quarter 2019.

(2)

Other (income) expense - net includes the

settlement of a legal matter in 2019, along with net foreign

currency gains (losses), other components of net periodic pension

costs and other miscellaneous items recorded in 2020 and 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200805006068/en/

Ion Warner VP, Marketing and Investor Relations +1

414-760-4805

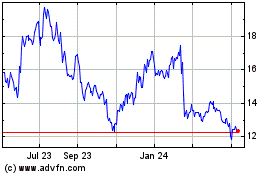

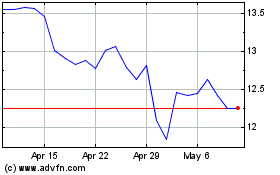

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Apr 2023 to Apr 2024