Annual Report of Employee Stock Plans (11-k)

June 30 2020 - 6:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2019

OR

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to __________

Commission File Number 1-11978

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

THE MANITOWOC COMPANY, INC. RETIREMENT SAVINGS PLAN

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

The Manitowoc Company, Inc.

11270 West Park Place

Suite 1000,

Milwaukee, WI 53224

REQUIRED INFORMATION

The following financial statement and schedules of The Manitowoc Company, Inc. Retirement Savings Plan, prepared in accordance with the financial reporting requirements of the Employee Retirement Income Securities Act of 1974, as amended, are filed herewith.

|

|

|

The Manitowoc Company, Inc.

Retirement Savings Plan

Milwaukee, Wisconsin

Financial Statements

Period Ended October 31, 2019 and Year Ended December 31, 2018

|

The Manitowoc Company, Inc. Retirement Savings Plan

Financial Statements

Period Ended October 31, 2019 and Year Ended December 31, 2018

Table of Contents

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

1

|

|

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

2

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

3

|

|

|

Notes to Financial Statements

|

4

|

Report of Independent Registered Public Accounting Firm

Plan Administrator

The Manitowoc Company, Inc. Retirement Savings Plan

Manitowoc, WI

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The Manitowoc Company, Inc. Retirement Savings Plan (the “Plan”) as of October 31, 2019 and December 31, 2018, and the related statements of changes in net assets available for benefits for the period ended October 31, 2019 and year ended December 31, 2018, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of October 31, 2019 and December 31, 2018, and the changes in net assets available for benefits for the period ended October 31, 2019 and year ended December 31, 2018, in conformity with accounting principles generally accepted in the United States.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ Wipfli LLP

We have served as the Plan’s auditor since 2003.

Radnor, Pennsylvania

June 29, 2020

Statements of Net Assets Available for Benefits as of October 31, 2019 and December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 31, 2019

|

|

December 31, 2018

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

Investments - Interest in The Manitowoc Company, Inc.

|

|

|

|

|

|

Employees’ Profit Sharing Trust

|

$0

|

|

$20,676,082

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

Interest

|

0

|

|

1,073

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$0

|

|

$20,677,155

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

6

Statements of Changes in Net Assets Available for Benefits for the Period Ended October 31,2019 and Year Ended December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period Ended

|

|

Year Ended

|

|

|

October 31, 2019

|

|

December 31, 2018

|

|

Investment income (loss) - Interest in net appreciation (depreciation) in fair value of The Manitowoc Company, Inc. Employee’s Profit Sharing Trust

|

$2,832,954

|

|

$(3,738,376)

|

|

|

|

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

Benefits paid to participants

|

4,124,430

|

|

3,673,843

|

|

Plan administrative expenses

|

52,016

|

|

59,327

|

|

Total deductions

|

4,176,446

|

|

3,733,170

|

|

|

|

|

|

|

Net decrease in net assets available for benefits

|

(1,343,492)

|

|

(7,471,546)

|

|

|

|

|

|

|

Transfer out to another plan

|

(19,333,663)

|

|

0

|

|

|

|

|

|

|

Net assets available for benefits at beginning of period/year

|

20,677,155

|

|

28,148,701

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits at end of period/year

|

$0

|

|

$20,677,155

|

See accompanying notes to financial statements.

7

Notes to Financial Statements

Plan Description

The following description of The Manitowoc Company, Inc. Retirement Savings Plan (the “Plan”) provides only general information. Participants should refer to the Plan Agreement for a more complete description of the Plan’s provisions.

General

The Plan was a retirement savings plan under Section 401(k) of the Internal Revenue Code (IRC). The Plan was available to all eligible employees of participating companies of The Manitowoc Company, Inc. (the “Company”). Eligible employees included hourly domestic employees who were covered by a collective bargaining agreement between the participating companies and the union representing employees of the participating companies. The Plan was subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA). The Company Retirement Plan Committee (the “Committee”) was responsible for oversight of the Plan. The Committee determined the appropriateness of the Plan’s investment offerings, monitored investment performance, and reported to the Board of Directors.

Participants in the Plan included former collectively bargained employees of Manitowoc Cranes, LLC., which was a wholly owned subsidiary or division of the Company, which effective January 1, 2019 became part of Grove U.S. LLC. Effective January 1, 2018, The Manitowoc Company, Inc. no longer had collectively bargained employees and no contributions were being made to this Plan.

Effective October 31, 2019, the Plan merged into The Manitowoc Company, Inc., 401(k) Retirement Plan, effectively terminating the Plan. As of October 31, 2019, all assets and liabilities of the Plan were transferred to The Manitowoc Company, Inc., 401(k) Retirement Plan.

Contributions

Effective January 1, 2018, there were no union employees; therefore, there were no employee contributions and no Company matching and discretionary profit sharing contributions allocated for the 2019 or 2018 plan years.

8

Notes to Financial Statements

Plan Description (Continued)

Participants’ Accounts

Each participant’s account was credited with the participant’s contributions, the Company’s contributions, and with an allocation of plan earnings/losses and reduced for withdrawals and an allocation of investment expenses (based on account balances and participant investment elections). Participants were entitled to the benefit in their respective accounts to an extent vested.

Vesting

All employee and rollover contributions and related earnings were 100% vested immediately. Company contributions vested subject to a six-year graded vesting schedule.

Participants who left the Company because of normal retirement, disability, or death were 100% vested.

Notes Receivable From Participants

In the event of financial hardship, as defined by IRS regulations, Plan participants were able to borrow from their fund accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their employee and rollover contributions account balance. The notes were secured by the balance in the participant’s account and carried interest at prime rate plus 1%. At October 31, 2019 and December 31, 2018, there were no outstanding notes. Notes were repaid through payroll deductions over a period not to exceed five years.

Payment of Benefits

Plan participants’ vested account balances were available at normal retirement (age 65), disability retirement, death, and termination of employment. Benefits were payable in one lump sum, direct rollover, equal installments over a period of years, or an insurance company single premium nontransferable annuity contract. The Plan also allowed for in-service distributions upon attaining age 59½. Distributions were made as soon as administratively feasible.

.

9

Notes to Financial Statements

Plan Description (Continued)

There were no forfeited non-vested accounts at October 31, 2019. At December 31, 2018, forfeited non-vested accounts totaled $28,514. Assets in forfeiture accounts were used to reduce future employer contributions or to pay plan eligible expenses. During 2019 and 2018, no amounts were used to reduce employer contributions. During 2019 and 2018, forfeitures used to offset plan expenses were $28,392 and $44,858, respectively.

Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States (GAAP).

Use of Estimates

The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Investments were reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Plan’s Committee determined the Plan’s valuation policies utilizing information provided by its investment advisors and trustee. See Note 4 for discussion of fair value measurements.

Purchases and sales of securities were recorded on a trade-date basis. Net appreciation (depreciation) includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable From Participants

There were no notes receivable as of October 31, 2019 and December 31, 2018.

10

Notes to Financial Statements

Summary of Significant Accounting Policies (Continued)

Administrative Expenses

Administrative expenses and audit fees incurred by the Plan were paid from the assets of the Plan. Fees related to the administration of notes receivable from participants were charged directly to the participant’s account and were included in administrative expenses. Investment related expenses were paid directly from the assets of the Master Trust.

Subsequent Events

Subsequent events have been evaluated through the date the financial statements were issued.

New Accounting Pronouncement

In February 2017, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) 2017-06, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting (a consensus of the Emerging Issues Task Force). ASU No. 2017-06 clarifies the presentation requirements for a plan's interest in a master trust and requires more detailed disclosure of the plan's interest in the master trust. ASU No. 2017-06 is effective for fiscal years beginning after December 15, 2018, with early adoption permitted, and will be applied retrospectively to all periods presented. The Company has adopted this guidance on the Plan’s financial statements effective for the period ended October 31, 2019.

11

Notes to Financial Statements

Investments in the Master Trust

The Plan’s investments were in the Master Trust until October 31, 2019, which was established for the investment of assets of the Plan and other retirement plans sponsored by The Manitowoc Company, Inc. Each participating retirement plan had an undivided interest in the Master Trust. The assets of the Master Trust were held by BMO Harris Bank, N.A. (“BMO”).

Effective October 31, 2019, assets of the Master Trust moved to Fidelity and the assets of The Manitowoc Company, Inc. Retirement Savings Plan were transferred out of the Master Trust at BMO to Fidelity and merged with assets of The Manitowoc Company, Inc. 401(k) Retirement Plan trust’s assets at Fidelity.

The value of the Plan’s interest in the Master Trust at December 31, 2018 was based on the beginning of year value of the Plan’s interest in the Master Trust plus actual contributions and allocated investment income (loss), actual distributions, and allocated administrative expenses.

Trust and certain administrative expenses and transfers out of the Master Trust, were specifically identified with the particular plan. Investment income (loss) and certain administrative expense relating to the Master Trust were allocated to the individual plans based on the ratio of the investment balances of the plans.

Net assets held by the Master Trust at October 31, 2019 and December 31, 2018, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

2018

|

|

Investments with fair value determined by quoted market price:

|

|

|

|

|

|

|

|

|

|

|

Common/collective trust funds

|

|

$0

|

|

|

$69,551,542

|

|

|

|

|

Mutual funds

|

|

0

|

|

|

158,984,721

|

|

|

|

|

Total

|

|

0

|

|

|

228,536,263

|

|

|

|

|

Cash

|

|

0

|

|

|

183,388

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets of the Master Trust

|

|

0

|

|

|

228,719,651

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less - Net assets allocated to

The Manitowoc Company, Inc. 401(k) Retirement Plan

|

|

0

|

|

|

208,043,569

|

|

|

|

Net assets allocated to the Plan at fair value

|

|

$0

|

|

$20,676,082

|

|

12

Notes to Financial Statements

Investments in the Master Trust (Continued)

|

|

|

|

|

|

|

|

At December 31, 2018, net assets allocated to the Plan consisted of $21,566 of cash, $11,012,495 of common/collective trust funds and $9,642,021 of mutual funds.

Investment income (loss) recognized by the Master Trust for the period ended October 31, 2019 and year ended December 31, 2018 was allocated as follows:

|

|

|

2019

|

|

2018

|

|

|

Investment income (loss):

|

|

|

|

|

|

Interest and dividends

|

$2,155,667

|

|

$3,147,814

|

|

|

Net appreciation (depreciation)

in fair value of investments

|

31,834,162

|

|

(39,180,213)

|

|

|

Less investment expenses of the Master Trust

|

(41,250)

|

|

(74,482)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investment income (loss) of the Master Trust

|

33,948,759

|

|

(36,106,881)

|

|

|

|

|

|

|

|

|

Less - Investment income (loss) allocated to The Manitowoc Company, Inc. 401(k) Retirement Plan

|

31,126,875

|

|

(32,353,505)

|

|

|

Net investment income(loss) allocated to the Plan

|

$2,821,704

|

|

($3,753,376)

|

|

|

|

|

|

|

13

Notes to Financial Statements

Investments in the Master Trust (Continued)

|

|

|

|

|

|

|

|

|

The following are the changes in net assets for the Master Trust for period ended October 31, 2019 and year ended December 31, 2018:

|

|

|

|

2019

|

|

2018

|

|

Interest and dividends

|

$2,155,667

|

|

$3,147,814

|

|

Net appreciation (depreciation)

in fair value of investments

|

31,834,162

|

|

(39,180,213)

|

|

Net investment income(loss)

|

33,989,829

|

|

(36,032,399)

|

|

|

|

|

|

|

Master Trust expenses

|

(41,250)

|

|

(74,482)

|

|

|

|

|

|

|

Net transfers

|

(262,668,230)

|

|

(18,883,799)

|

|

|

|

|

|

|

Decrease in assets

|

(228,719,651)

|

|

(54,990,680)

|

|

|

|

|

|

|

Net assets

|

|

|

|

|

Beginning of Period/Year

|

228,719,651

|

|

283,710,331

|

|

End of Period/Year

|

$0

|

|

$228,719,651

|

|

|

|

|

|

14

Notes to Financial Statements

Fair Value Measurements

The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under Financial Accounting Standards Board Accounting Standards Codification 820 are described as follows:

|

Level 1

|

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

|

|

Level 2

|

Inputs to the valuation methodology include:

|

|

|

•

|

Quoted prices for similar assets or liabilities in active markets.

|

|

|

•

|

Quoted prices for identical or similar assets or liabilities in inactive markets.

|

|

|

•

|

Inputs other than quoted prices that are observable for the asset or liability.

|

|

|

•

|

Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

|

If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

|

Level 3

|

Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

|

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

15

Notes to Financial Statements

Fair Value Measurements (Continued)

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in methodologies used at October 31, 2019 and December 31, 2018.

Mutual funds: Valued at the net asset value (‘NAV’) provided by the administrator of the fund. The NAV is a quoted price in an active market.

Common/collective trust funds: Valued at the NAV of units held by the Plan at year-end, provided by the administrator of the fund. The NAV was based on the value of the underlying assets of the fund, minus its liabilities, and then divided by the number of units outstanding. The NAV’s unit price was quoted on a private market that was not active; however, the unit price was based on underlying investments which are traded on an active market.

The Master Trust’s assets at fair value as of October 31, 2019 were $0. The table below sets forth by level, within the fair value hierarchy, the Master Trust’s assets at fair value as of December 31, 2018:

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at December 31, 2018

|

|

|

(Level 1)

|

(Level 2)

|

(Level 3)

|

Total

|

|

|

|

|

|

|

|

Total mutual funds

|

$158,984,721

|

0

|

0

|

$158,984,721

|

|

Investments measured

|

|

|

|

|

|

at net asset value (a)

|

0

|

0

|

0

|

69,551,542

|

|

|

|

|

|

|

|

Total assets at fair value

|

$158,984,721

|

$0

|

$0

|

$228,536,263

|

|

|

|

|

|

|

|

|

(a)

|

In accordance with Subtopic 820-10, certain investments that were measured at net asset value per share (or equivalent) have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the statements of net assets available for benefits.

|

16

Notes to Financial Statements

Net Asset Value Per Share

The asset value per share as of October 31, 2019 was $0. The table below sets forth additional disclosures of the Master Trust’s investments whose fair value was estimated using net asset value per share as of December 31, 2018:

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Estimated Using Net Asset Value

|

|

|

|

|

per Share as of December 31, 2018

|

|

|

|

Investment

|

Fair Value

|

Unfunded Commitment

|

Redemption Frequency

|

Other Redemption Restrictions

|

Redemption Notice Period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manitowoc Company, Inc. Common Stock Fund (a)

|

$11,124,982

|

0

|

Daily

|

Written or telephone notice

|

1 day

|

|

|

Welbilt Stock Fund - FBO Cranes (a)

|

$10,242,291

|

0

|

Daily

|

Written or telephone notice

|

1 day

|

|

|

Goldman Sachs Stable Value Fund (c)

|

$48,184,269

|

0

|

Daily

|

Written or telephone notice

|

1 day

|

|

|

(a)

|

Single stock portfolio that tracks the performance of The Manitowoc Company, Inc. common stock, or Welbilt Company stock.

|

The prices of the stocks can fluctuate from day to day or month to month and was designed for individuals who invest for the long term and can tolerate short-term volatility.

|

(b)

|

The objective of this investment is to seek safety of principal and consistency of return while attempting to maintain minimal volatility.

|

|

(c)

|

The objective of this investment is to earn income, while seeking to preserve capital and stability of principal.

|

17

Notes to Financial Statements

Party-in-Interest Transactions

Transactions involving The Manitowoc Company, Inc. common stock and notes receivable from participants were considered party-in-interest transactions. These transactions were not, however, considered prohibited transactions under 29 CFR 408(b) of ERISA regulations.

Certain Plan investments were common/collective trust funds and a money market fund managed by BMO. BMO was the trustee as defined by the Plan and, therefore, these transactions qualified as party-in-interest transactions. There were no fees paid by the Plan to the trustee directly for administrative expenses for 2019 or 2018, nor were there fees paid to the trustee through revenue sharing for 2019 or 2018. The Plan paid fees directly to Morgan Stanley Global Banking for investment advisory services in the amount of $11,250 for 2019 and $15,000 for 2018. The Plan paid recordkeeping fees to OneAmerica in the amount of $26,640 for 2019 and $29,291 for 2018 and paid audit fees to Wipfli LLP in the amount of $12,075 and $12,075 for the period ended October 31, 2019 and year ended December 31, 2018, respectively. The Plan paid administrative fees to Willis of Illinois in the amount of $2,051 for 2019 and $2,961 for 2018.

Tax-Exempt Status of the Plan

On November 9, 2017 the IRS declared that the Plan was qualified pursuant to Section 401 of the IRC. Plan management believes any amendments and events since the effective date of the last IRS determination letter did not affect the qualified status of the Plan. Accordingly, the Plan was exempt from federal and state income taxes under current provisions of their respective laws.

18

Notes to Financial Statements

Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements at October 31, 2019 and December 31, 2018, to Form 5500:

|

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

Net assets available for benefits per the financial statements

|

$0

|

|

$20,677,155

|

|

Pending distributions

|

0

|

|

(21,407)

|

|

|

|

|

|

|

Net assets available for benefits per Form 5500

|

$0

|

|

$20,655,748

|

The following is a reconciliation of the change in net assets available for benefits per the financial statements for the period ended October 31, 2019 and year ended December 31, 2018, to Form 5500:

|

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

Net decrease in net assets available for benefits per the financial statements

|

($1,343,492)

|

|

($7,471,546)

|

|

Pending distributions

|

21,407

|

|

23,785

|

|

|

|

|

|

|

Change in net assets per Form 5500

|

($1,322,085)

|

|

($7,447,761)

|

Risks and Uncertainties

The Plan’s investments were exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it was at least reasonably possible that changes in the values of investment securities would occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

19

20

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Administrative Committee, which administers the Plan, has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Milwaukee, and State of Wisconsin on the 29th day of June, 2020.

|

Date: June 29, 2020

|

The Manitowoc Company, Inc.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

/s/ Barry L. Pennypacker

|

|

|

Barry L. Pennypacker

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

|

|

/s/ David J. Antoniuk

|

|

|

David J. Antoniuk

|

|

|

Senior Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

|

/s/ Thomas L. Doerr, Jr.

|

|

|

Thomas L. Doerr, Jr.

|

|

|

Senior Vice President, General Counsel & Secretary

|

21

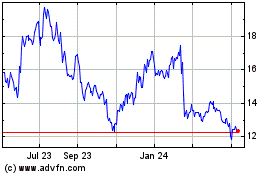

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

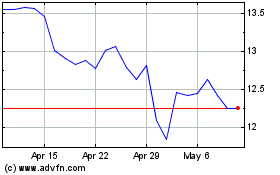

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Apr 2023 to Apr 2024