Manitowoc reports Net Sales of $329.2

million; Adjusted EBITDA(1) of $16.3 million

The Manitowoc Company, Inc. (NYSE: MTW), (the “Company” or

“Manitowoc”) a leading global manufacturer of cranes and lifting

solutions, today reported a first-quarter net loss of $7.8 million,

or $0.22 per diluted share. First-quarter adjusted net loss(1) of

$6.3 million, or $0.18 per diluted share, declined $9.0 million

year-over-year. First-quarter adjusted net loss included $4.0

million of other expense – net, or $0.11 per diluted share,

primarily related to foreign currency losses. The Company also

reported net sales of $329.2 million and adjusted EBITDA(1) of

$16.3 million, or 5.0% of sales.

First-quarter orders of $375.0 million declined 15.0% from the

prior year. Orders were unfavorably impacted by approximately $5.1

million due to changes in foreign currency exchange rates. Backlog

as of March 31, 2020 totaled $520.9 million.

As of March 31, 2020, the Company had total liquidity of $382.0

million, including $103.6 million of cash, $244.2 million of

borrowing capacity on its Asset Based Lending revolving credit

facility and $38.2 million of availability on its non-committed

European overdraft lines. During the quarter, the Company did not

borrow on its Asset Based Lending revolving credit facility.

“Our first-quarter adjusted EBITDA of $16.3 million was in line

with our planned expectations, despite the unprecedented conditions

created by the COVID-19 pandemic. This was made possible by the

extraordinary commitment of our talented and resolute team. During

this pandemic, our primary goal remains unchanged, ensuring the

safety, health and well-being of all our employees, their families,

our suppliers and customers. Our dedicated teams are working hard

to deliver cranes and provide essential parts and services, and I

could not be prouder of their commitment to our high standards

while balancing personal challenges. We are grateful for the

efforts our healthcare providers and first responders are making,

and we are proud to support these front-line professionals by

committing $100,000 from The Manitowoc Company Foundation in the

fight against COVID-19,” commented Barry L. Pennypacker, President

and Chief Executive Officer of The Manitowoc Company, Inc.

“While we have remained operational in the U.S., our major

facilities in Europe began closing in mid-March which delayed our

ability to ship products. It is unclear how events unfold from

here, however with ample liquidity and no significant debt

maturities until 2026 we are well positioned to weather

circumstances like this crisis. We continue to analyze all of our

costs and take appropriate actions. We have substantially cut

discretionary spending, while eliminating salary increases across

the enterprise, including executives and board members. Furloughs,

as well as temporary plant shutdowns, are also being planned based

upon our order rates. In order to proactively manage our liquidity,

we are significantly cutting our capital spending this year as well

as suspending our share buyback program. Manitowoc entered this

uncertain period as a more agile company and market leader with a

strong balance sheet, and I am confident that we will emerge

stronger when end markets successfully recover,” concluded

Pennypacker.

2020 Outlook

Due to uncertainty related to the COVID-19 pandemic, the Company

withdrew guidance on March 27, 2020 and is not providing a

financial outlook for 2020 at this time. While Manitowoc, its

suppliers and customers operations have begun to resume activity,

the Company does expect a significant impact to its second quarter

and full year results due to the magnitude of supply chain and

business disruptions. For now, the Company anticipates weaker

demand levels to continue in the near term. In response to these

challenges, the Company has reduced its production levels and

initiated a set of cost reduction actions and will continue to

closely monitor market conditions and adjust its plans

accordingly.

Investor Conference Call

On Friday, May 8th, 2020, at 10:00 a.m. ET (9:00 a.m. CT), The

Manitowoc Company’s senior management will discuss its

first-quarter 2020 earnings results during a live conference call

for security analysts and institutional investors. A live audio

webcast of the call, along with the related presentation, published

in conjunction with this press release, can be accessed in the

Investor Relations section of Manitowoc’s website at

www.manitowoc.com. A replay of the conference call will also be

available at the same location on the website.

About The Manitowoc Company, Inc.

The Manitowoc Company, Inc. was founded in 1902 and has over a

117-year tradition of providing high-quality, customer-focused

products and support services to its markets. Manitowoc is one of

the world's leading providers of engineered lifting solutions.

Manitowoc, through its wholly-owned subsidiaries, designs,

manufactures, markets, and supports comprehensive product lines of

mobile telescopic cranes, tower cranes, lattice-boom crawler cranes

and boom trucks under the Grove, Manitowoc, National Crane, Potain,

Shuttlelift and Manitowoc Crane Care brand names.

Footnote

(1)Adjusted net income (loss), diluted adjusted net income

(loss) per share, adjusted EBITDA, adjusted operating cash flows

and free cash flows are financial measures that are not in

accordance with GAAP. For a reconciliation to the comparable GAAP

numbers please see schedule of “Non-GAAP Financial Measures” at the

end of this press release. Manitowoc believes these non-GAAP

financial measures provide important supplemental information to

both management and investors regarding financial and business

trends used in assessing its results of operations. Manitowoc

believes excluding specified items provides a more meaningful

comparison to the corresponding reporting periods and internal

budgets and forecasts, assists investors in performing analysis

that is consistent with financial models developed by investors and

research analysts, provides management with a more relevant measure

of operating performance and is more useful in assessing management

performance.

Forward-looking Statements

This press release includes “forward-looking statements”

intended to qualify for the safe harbor from liability under the

Private Securities Litigation Reform Act of 1995. Any statements

contained in this press release that are not historical facts are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on the current expectations of the management of the Company

and are subject to uncertainty and changes in circumstances.

Forward-looking statements include, without limitation, statements

typically containing words such as “intends,” “expects,”

“anticipates,” “targets,” “estimates,” and words of similar import.

By their nature, forward-looking statements are not guarantees of

future performance or results and involve risks and uncertainties

because they relate to events and depend on circumstances that will

occur in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. Factors

that could cause actual results and developments to differ

materially include, among others:

- The uncertain negative impacts COVID-19 will have on our

business, financial condition, cash flows, results of operations

and supply chain, as well as customer demand;

- actions of competitors;

- changes in economic or industry conditions generally or in the

markets served by Manitowoc;

- unanticipated changes in customer demand, including changes in

global demand for high-capacity lifting equipment, changes in

demand for lifting equipment in emerging economies, and changes in

demand for used lifting equipment;

- geographic factors and political and economic conditions and

risks;

- the ability to capitalize on key strategic opportunities and

the ability to implement Manitowoc’s long-term initiatives;

- government approval and funding of projects and the effect of

government-related issues or developments;

- unanticipated changes in the capital and financial

markets;

- unanticipated changes in revenues, margins and costs;

- the ability to increase operational efficiencies across

Manitowoc and to capitalize on those efficiencies;

- the ability to significantly improve profitability; and

- risks and factors detailed in Manitowoc's 2019 Annual Report on

Form 10-K and its other filings with the United States Securities

and Exchange Commission.

Manitowoc undertakes no obligation to update or revise

forward-looking statements, whether as a result of new information,

future events, or otherwise. Forward-looking statements only speak

as of the date on which they are made. Information on the potential

factors that could affect the Company's actual results of

operations is included in its filings with the Securities and

Exchange Commission, including but not limited to its Annual Report

on Form 10-K for the fiscal year ended December 31, 2019.

THE MANITOWOC COMPANY,

INC.

Unaudited Consolidated

Financial Information

For the three months ended March

31, 2020 and 2019

(In millions, except per share

and share amounts)

CONSOLIDATED STATEMENT OF

OPERATIONS

Three Months Ended

March 31,

2020

2019

Net sales

$

329.2

$

418.0

Cost of sales

266.0

337.8

Gross profit

63.2

80.2

Operating costs and expenses:

Engineering, selling and administrative

expenses

55.9

59.4

Amortization of intangible assets

0.1

0.1

Restructuring expense

1.5

4.5

Total operating costs and expenses

57.5

64.0

Operating income

5.7

16.2

Other expense:

Interest expense

(7.2

)

(10.9

)

Amortization of deferred financing

fees

(0.4

)

(0.4

)

Loss on debt extinguishment

—

(25.0

)

Other expense - net

(4.0

)

(3.3

)

Total other expense

(11.6

)

(39.6

)

Loss before income taxes

(5.9

)

(23.4

)

Provision for income taxes

1.9

3.3

Net loss

$

(7.8

)

$

(26.7

)

Per Share Data

Basic net loss per common share

$

(0.22

)

$

(0.75

)

Diluted net loss per common share

$

(0.22

)

$

(0.75

)

Weighted average shares outstanding -

basic

35,135,525

35,642,832

Weighted average shares outstanding -

diluted

35,135,525

35,642,832

THE MANITOWOC COMPANY,

INC.

Unaudited Consolidated

Financial Information

As of March 31, 2020 and December

31, 2019

(In millions, except share

amounts)

CONSOLIDATED BALANCE SHEETS

March 31,

2020

December 31,

2019

Assets

Current Assets:

Cash and cash equivalents

$

103.6

$

199.3

Accounts receivable, less allowances of

$8.7 and $7.9, respectively

169.3

168.3

Inventories — net

545.6

461.4

Notes receivable — net

15.1

17.4

Other current assets

29.2

26.0

Total current assets

862.8

872.4

Property, plant and equipment — net

277.6

289.9

Operating lease right-of-use assets

44.9

47.6

Goodwill

230.3

232.5

Other intangible assets — net

114.9

116.3

Other long-term assets

53.5

59.0

Total assets

$

1,584.0

$

1,617.7

Liabilities and Stockholders'

Equity

Current Liabilities:

Accounts payable and accrued expenses

$

358.4

$

340.8

Short-term borrowings and current portion

of long-term debt

3.9

3.8

Product warranties

47.1

47.2

Customer advances

21.0

25.8

Other liabilities

21.5

23.3

Total current liabilities

451.9

440.9

Non-Current Liabilities:

Long-term debt

307.9

308.4

Operating lease liabilities

35.0

37.6

Deferred income taxes

3.2

5.5

Pension obligations

83.7

86.4

Postretirement health and other benefit

obligations

15.8

16.4

Long-term deferred revenue

25.7

30.3

Other non-current liabilities

44.1

46.3

Total non-current liabilities

515.4

530.9

Stockholders' Equity:

Preferred stock (authorized 3,500,000

shares of $.01 par value;

none outstanding)

—

—

Common stock (75,000,000 shares

authorized, 40,793,983 shares issued, 34,508,504

and 35,374,537 shares outstanding,

respectively)

0.4

0.4

Additional paid-in capital

593.7

592.2

Accumulated other comprehensive loss

(133.4

)

(121.0

)

Retained earnings

228.2

236.2

Treasury stock, at cost (6,285,479 and

5,419,446 shares, respectively)

(72.2

)

(61.9

)

Total stockholders' equity

616.7

645.9

Total liabilities and stockholders'

equity

$

1,584.0

$

1,617.7

THE MANITOWOC COMPANY,

INC.

Unaudited Consolidated

Financial Information

For the three months ended March

31, 2020 and 2019

(In millions)

CONSOLIDATED STATEMENT OF CASH

FLOWS

Three Months Ended

March 31,

2020

2019

Cash Flows from Operating

Activities:

Net loss

$

(7.8

)

$

(26.7

)

Adjustments to reconcile net loss to cash

used for operating activities:

Depreciation

9.0

8.8

Amortization of intangible assets

0.1

0.1

Amortization of deferred financing

fees

0.4

0.4

Loss on debt extinguishment

—

25.0

(Gain) loss on sale of property, plant and

equipment

(0.1

)

0.4

Other

3.4

3.7

Changes in operating assets and

liabilities

Accounts receivable

(5.6

)

(195.7

)

Inventories

(88.5

)

(94.5

)

Notes receivable

2.6

—

Other assets

(1.7

)

14.1

Accounts payable

28.1

26.6

Accrued expenses and other liabilities

(18.5

)

(29.5

)

Net cash used for operating activities

(78.6

)

(267.3

)

Cash Flows from Investing

Activities:

Capital expenditures

(3.6

)

(4.4

)

Proceeds from sale of fixed assets

0.1

4.8

Cash receipts on sold accounts

receivable

—

126.3

Net cash provided by (used for) investing

activities

(3.5

)

126.7

Cash Flows from Financing

Activities:

Proceeds from revolving credit

facility

—

58.0

Payments on revolving credit facility

—

(25.0

)

Payments on long-term debt

—

(277.8

)

Proceeds from long-term debt

—

300.0

Other debt - net

(0.5

)

—

Debt issuance costs

—

(5.6

)

Exercises of stock options

0.1

0.1

Common stock repurchases

(12.0

)

—

Net cash provided by (used for) financing

activities

(12.4

)

49.7

Effect of exchange rate changes on

cash

(1.3

)

(0.4

)

Net decrease in cash and cash

equivalents

(95.8

)

(91.3

)

Cash and cash equivalents at beginning of

period

199.3

140.3

Cash and cash equivalents at end of

period

$

103.6

$

49.0

Non-GAAP Financial Measures

Non-GAAP Items

Adjusted net income (loss), diluted adjusted net income (loss)

per share, adjusted EBITDA, adjusted operating cash flows and free

cash flows are financial measures that are not in accordance with

GAAP. Manitowoc believes these non-GAAP financial measures provide

important supplemental information to both management and investors

regarding financial and business trends used in assessing its

results of operations. Manitowoc believes excluding specified items

provides a more meaningful comparison to the corresponding

reporting periods and internal budgets and forecasts, assists

investors in performing analysis that is consistent with financial

models developed by investors and research analysts, provides

management with a more relevant measure of operating performance

and is more useful in assessing management performance.

Reconciliation of Adjusted Net Income

(Loss) to Net Income (Loss)

(in millions, except per share

amounts)

Three Months Ended

March 31,

2020

2019

As reported

Adjustments

Adjusted

As reported

Adjustments

Adjusted

Gross profit

$

63.2

$

—

$

63.2

$

80.2

$

—

$

80.2

Engineering, selling and administrative

expenses

(55.9

)

—

(55.9

)

(59.4

)

—

(59.4

)

Amortization of intangible assets

(0.1

)

—

(0.1

)

(0.1

)

—

(0.1

)

Restructuring expense (1)

(1.5

)

1.5

—

(4.5

)

4.5

—

Operating income

5.7

1.5

7.2

16.2

4.5

20.7

Interest expense

(7.2

)

—

(7.2

)

(10.9

)

—

(10.9

)

Amortization of deferred financing

fees

(0.4

)

—

(0.4

)

(0.4

)

—

(0.4

)

Loss on debt extinguishment (2)

—

—

—

(25.0

)

25.0

—

Other expense - net

(4.0

)

—

(4.0

)

(3.3

)

—

(3.3

)

Income (loss) before income

taxes

$

(5.9

)

$

1.5

$

(4.4

)

$

(23.4

)

$

29.5

$

6.1

Provision for income taxes (3)

(1.9

)

—

(1.9

)

(3.3

)

(0.1

)

(3.4

)

Net income (loss)

$

(7.8

)

$

1.5

$

(6.3

)

$

(26.7

)

$

29.4

$

2.7

Diluted net income (loss) per share

$

(0.22

)

$

(0.18

)

$

(0.75

)

$

0.08

(1)

The adjustment in 2020 and 2019 represents

the add back of restructuring related charges.

(2)

The adjustment in 2019 represents the

removal of charges related to the Company’s refinancing of its

Asset Based Lending Revolving Credit Facility and senior secured

second lien notes.

(3)

The adjustment in 2019 represent the

income tax impacts of items (1) and (2).

Adjusted Operating Cash Flows and Free Cash Flows

(In millions)

Three Months Ended

March 31,

2020

2019

Net cash used for operating activities

$

(78.6

)

$

(267.3

)

Cash receipts on sold accounts

receivable

—

126.3

Net payments on accounts receivable

securitization program

—

75.0

Adjusted operating cash flows

(78.6

)

(66.0

)

Capital expenditures

(3.6

)

(4.4

)

Free cash flows

$

(82.2

)

$

(70.4

)

Adjusted EBITDA and Adjusted Operating Income

The Company defines adjusted EBITDA as net income (loss) before

interest, income taxes, depreciation and amortization, plus an

addback of restructuring and certain other charges. The

reconciliation of net income (loss) to adjusted EBITDA and

operating income to adjusted operating income for the three months

ended March 31, 2020 and 2019, is as follows (in millions):

Three Months Ended

March 31,

Trailing Twelve

2020

2019

Months

Net income (loss)

$

(7.8

)

$

(26.7

)

$

65.5

Interest expense and amortization of

deferred financing fees

7.6

11.3

30.5

Provision for income taxes

1.9

3.3

11.0

Depreciation expense

9.0

8.8

35.2

Amortization of intangible assets

0.1

0.1

0.3

EBITDA

10.8

(3.2

)

142.5

Restructuring expense

1.5

4.5

6.8

Loss on debt extinguishment

—

25.0

—

Other non-recurring charges (1)

—

—

3.1

Other (income) expense - net (2)

4.0

3.3

(9.1

)

Adjusted EBITDA

16.3

29.6

143.3

Depreciation expense

(9.0

)

(8.8

)

(35.2

)

Amortization of intangible assets

(0.1

)

(0.1

)

(0.3

)

Adjusted operating income

7.2

20.7

107.8

Restructuring expense

(1.5

)

(4.5

)

(6.8

)

Other non-recurring charges (1)

—

—

(3.1

)

Operating income

$

5.7

$

16.2

$

97.9

Adjusted EBITDA margin percentage

5.0

%

7.1

%

8.2

%

Adjusted operating income margin

percentage

2.2

%

5.0

%

6.2

%

(1)

Other non-recurring charges includes

losses from a long-term note receivable resulting from the 2014

divestiture of the Company’s Chinese joint venture and other

charges included in engineering, selling and administrative

expenses in the third and fourth quarter 2019.

(2)

Other (income) expense - net includes the

settlement of a legal matter recorded in the second quarter of

2019, along with net foreign currency losses, other components of

net periodic pension costs and other miscellaneous items recorded

in 2020 and 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200507006133/en/

Ion Warner VP, Marketing and Investor Relations +1

414-760-4805

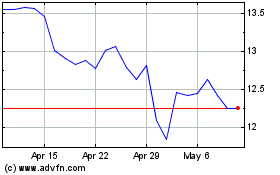

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

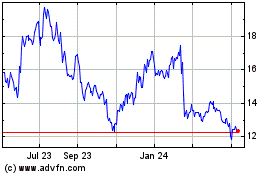

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Apr 2023 to Apr 2024