UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. __)

| |

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| Check the appropriate box: |

|

Preliminary

Proxy Statement |

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

|

Definitive

Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Its

Charter)

(Name of person(s) filing proxy statement,

if other than the registrant)

| Payment of Filing Fee (Check the appropriate box): |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

(5) |

Total fee paid: |

|

Fee paid previously with preliminary materials. |

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount previously paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

NOTICE

OF AND AGENDA FOR 2019

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

DATE AND TIME

THURSDAY, SEPTEMBER 12, 2019

8:30 a.m. local time

PLACE

Sheraton Hotel, Schiphol Airport, Schiphol Blvd. 101, 1118 BG,

Amsterdam, the Netherlands

ITEMS OF BUSINESS

| 1. |

Authorize the repurchase of up to 10% of our outstanding shares; |

| 2. |

Authorize the cancellation of all or a portion of the shares held in our treasury account. |

By order of the Board,

CHARITY R. KOHL

Corporate Secretary

August 1, 2019

| HOW TO VOTE |

| Your vote is important. You are eligible to vote if you are a shareholder of record at the close of business on August 15, 2019. |

| |

|

|

|

|

| ONLINE |

BY PHONE |

BY MAIL |

IN PERSON |

| Visit the website

on your proxy card |

Call the telephone

number

on your proxy card |

Sign, date and return

your proxy

card in the enclosed envelope |

Attend the meeting in person

See pages 10-11 for instructions

on how to attend |

| |

| If

you are a registered shareholder, you may vote online at www.proxyvote.com, by telephone, or by mailing a proxy card.

If you hold your shares through a bank, broker, or other institution, you may vote your shares through the method specified

on the voting instruction form provided to you. You may also attend the extraordinary general meeting in person. If you intend

to attend the meeting, notice must be given to the Company no later than September 9, 2019. |

| |

| Important Notice Regarding Availability of Proxy Materials for the Extraordinary General Meeting |

| |

| This

proxy statement is available on our website at www.LyondellBasell.com by clicking “Investors,” then “Company

Reports.” This proxy statement is dated August 1, 2019 and is first being mailed to shareholders on or about August

2, 2019. |

DEAR SHAREHOLDER

BHAVESH (BOB) PATEL

Chief Executive Officer

August 1, 2019

On September 12, 2019, LyondellBasell Industries

N.V. (the “Company” or “LyondellBasell”) will hold an extraordinary general meeting of shareholders

(the “EGM”) to request authorization for (i) the repurchase of up to 10% of our outstanding shares as of the date of

the EGM and (ii) the cancellation of treasury shares.

LyondellBasell is committed to a

capital deployment strategy that balances value-driven growth with generous shareholder returns. Since 2011, the Company has

returned significant value to its shareholders through dividends and share repurchases while advancing its strategic growth

plan. Recent investments include new capacity under construction for Hyperzone high-density polyethylene and PO/TBA in

Texas; the 2017 launch of QCP, an innovative recycling joint venture with SUEZ; and the acquisition of A. Schulman,

Inc., which launched the Company’s Advanced Polymer Solutions segment in 2018.

Strategic share repurchases at advantageous

prices are one of many tools used by LyondellBasell to pursue optimal capital allocation and drive shareholder value. In July of

this year, we successfully repurchased 35.1 million shares through a modified Dutch auction tender offer. As a result of the tender

offer, approximately 95% of our current shareholder-approved repurchase authorization was completed. We are requesting you approve

a new share repurchase authorization as we believe it provides the Company with flexibility to continue to pursue opportunistic

share repurchases prior to our 2020 annual general meeting.

On behalf of the Company and our Board of

Directors, we thank you for your share ownership in LyondellBasell and your continued support of our Company.

Sincerely,

BHAVESH V. (BOB) PATEL

CEO

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). You can identify our forward-looking statements by the words “anticipate,” “estimate,”

“believe,” “continue,” “could,” “intend,” “may,” “plan,”

“potential,” “predict,” “should,” “will,” “expect,” “objective,”

“projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,”

“target” and similar expressions.

We based forward-looking statements on our current expectations,

estimates and projections of our business and the industries in which we operate. We caution you that these statements are not

guarantees of future performance. They involve assumptions about future events that, while made in good faith, may prove to be

incorrect, and involve risks and uncertainties we cannot predict. Our actual outcomes and results may differ materially from what

we have expressed or forecast in the forward-looking statements. Any differences could result from a variety of factors, including

the following:

|

the cost of raw materials represents a substantial portion of our operating expenses, and energy costs generally follow price trends of crude oil, natural gas liquids and/or natural gas; price volatility can significantly affect our results of operations and we may be unable to pass raw material and energy cost increases on to our customers due to the significant competition that we face, the commodity nature of our products and the time required to implement pricing changes; |

|

our operations in the United States (“U.S.”) have benefited from low-cost natural gas and natural gas liquids; decreased availability of these materials (for example, from their export or regulations impacting hydraulic fracturing in the U.S.) could reduce the current benefits we receive; |

|

if crude oil prices fall materially, or decrease relative to U.S. natural gas prices, we would see less benefit from low-cost natural gas and natural gas liquids and it could have a negative effect on our results of operations; |

|

industry production capacities and operating rates may lead to periods of oversupply and low profitability; for example, substantial capacity expansions are underway in the U.S. olefins industry; |

|

we may face unplanned operating interruptions (including leaks, explosions, fires, weather-related incidents, mechanical failures, unscheduled downtime, supplier disruptions, labor shortages, strikes, work stoppages or other labor difficulties, transportation interruptions, spills and releases and other environmental incidents) at any of our facilities, which would negatively impact our operating results; for example, because the Houston refinery is our only refining operation, we would not have the ability to increase production elsewhere to mitigate the impact of any outage at that facility; |

|

changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate could increase our costs, restrict our operations and reduce our operating results; |

|

execution of our organic growth plans may be negatively affected by our ability to complete projects on time and on budget; |

|

our growth depends on the opportunities available to acquire new businesses and assets and our ability to integrate them into our existing operations; |

|

uncertainties associated with worldwide economies could create reductions in demand and pricing, as well as increased counterparty risks, which could reduce liquidity or cause financial losses resulting from counterparty default; |

|

the negative outcome of any legal, tax, and environmental proceedings or changes in laws or regulations regarding legal, tax and environmental matters may increase our costs, reduce demand for our products, or otherwise limit our ability to achieve savings under current regulations; |

|

any loss or non-renewal of favorable tax treatment under tax agreements or tax treaties, or changes in tax laws, regulations or treaties, may substantially increase our tax liabilities; |

|

we may be required to reduce production or idle certain facilities because of the cyclical and volatile nature of the supply-demand balance in the chemical and refining industries, which would negatively affect our operating results; |

|

we rely on continuing technological innovation, and an inability to protect our technology, or others’ technological developments, could negatively impact our competitive position; |

|

we have significant international operations, and fluctuations in exchange rates, valuations of currencies and our possible inability to access cash from operations in certain jurisdictions on a tax-efficient basis, if at all, could negatively affect our liquidity and our results of operations; |

|

we are subject to the risks of doing business at a global level, including wars, terrorist activities, political and economic instability and disruptions and changes in governmental policies, which could cause increased expenses, decreased demand or prices for our products and/or disruptions in operations, all of which could reduce our operating results; |

|

increased regulation or deselection of plastic could lead to a decrease in demand growth for some of our products, which could negatively affect our operating results; |

LYONDELLBASELL

2019 PROXY STATEMENT 4

|

if we are unable to comply with the terms of our credit facilities, indebtedness and other financing arrangements, those obligations could be accelerated, which we may not be able to repay; and |

|

we may be unable to incur additional indebtedness or obtain financing on terms that we deem acceptable, including for refinancing of our current obligations; higher interest rates and costs of financing would increase our expenses. |

Any of these factors, or a combination of

these factors, could materially affect our future results of operations, our share repurchases, and the ultimate accuracy of the

forward-looking statements. Our management cautions against putting undue reliance on forward-looking statements or projecting

any future results based on such statements or present or prior earnings levels.

All subsequent written and oral forward-looking

statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section and any other cautionary statements that may accompany such forward-looking statements.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements. Additional factors

that could cause results to differ materially from those described in the forward-looking statements can be found in the “Risk

Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2018 and in other reports we file with

the U.S. Securities and Exchange Commission (the “SEC”).

WHERE

YOU CAN FIND MORE INFORMATION

LyondellBasell is a global, independent chemical

company that is one of the world’s top independent chemical companies based on revenues. We participate globally across the

petrochemical value chain and are an industry leader in many of our product lines. Our chemicals businesses consist primarily of

large processing plants that convert large volumes of liquid and gaseous hydrocarbon feedstocks into plastic resins and other chemicals.

Our chemical products tend to be basic building blocks for other chemicals and plastics, while our plastic products are typically

used in large volume applications. Our customers use our plastics and chemicals to manufacture a wide range of products that people

use in their everyday lives including food packaging, home furnishings, automotive components, paints and coatings. Our refining

business consists of our Houston refinery, which processes crude oil into refined products such as gasoline, diesel and jet fuel.

Our principal executive offices are

located at (i) London: Fourth Floor, One Vine Street, London, WIJ 0AH, United Kingdom (telephone:

44 (0) 207 220 2600); (ii) Rotterdam: Delftseplein 27E, 3013 AA Rotterdam, The Netherlands (telephone: 31 (0)

10 275 5500); and (iii) Houston: 1221 McKinney St., Suite 300, Houston, Texas USA 77010 (telephone: (713) 309-7200). Our

website is located at www.LyondellBasell.com.

We are subject to the informational filing

requirements of the Exchange Act which obligates us to file reports, statements and other information with the SEC relating to

our business, financial condition and other matters. Information, as of particular dates, concerning our directors and officers,

their remuneration, options granted to them, the principal holders of our securities and any material interest of these persons

in transactions with us is required to be disclosed in proxy statements distributed to our stockholders and filed with the SEC.

These reports, statements and other information are available on the SEC’s website on the Internet at www.sec.gov.

You may also find copies of our filings with the SEC and additional information by visiting our website at www.LyondellBasell.com.

Information on our website is not incorporated by reference in this proxy statement.

LYONDELLBASELL

2019 PROXY STATEMENT 5

ITEM 1 AUTHORIZATION

TO CONDUCT SHARE REPURCHASES

|

The Board recommends that you vote FOR

the proposal to grant authority to the Board to repurchase up to 10% of our outstanding shares until March 12, 2021. |

Under Dutch law and our Articles of Association,

shareholder approval is necessary to authorize our Board of Directors to repurchase shares. At the annual meeting on May 31, 2019,

consistent with prior annual meetings, shareholders authorized repurchases of up to 10% of our outstanding shares, or approximately

37.0 million shares. As of the date of this proxy statement, we have repurchased an aggregate of approximately 35.1 million shares

pursuant to that authorization, through a tender offer that settled on July 12, 2019. As a result of the tender offer, we may not

have sufficient authorization remaining to continue our program of opportunistic share repurchases from now until the 2020 annual

meeting.

Adoption of this Proposal 1 will give us

the flexibility to continue to repurchase shares if we believe it is an appropriate use of our excess cash. The number of shares

repurchased, if any, and the timing and manner of any repurchases will be determined by our management and the Board, taking into

consideration prevailing market conditions, our available resources, and other factors that cannot now be predicted.

In order to provide us with sufficient flexibility,

we propose that shareholders grant authority for the repurchase of up to 10% of our outstanding shares as of the date of the EGM

(or, based on the number of shares outstanding as of the date of this proxy statement, approximately 33.5 million shares) on the

open market, through privately negotiated repurchases, in self-tender offers, or through accelerated repurchase arrangements, at

prices ranging from the nominal value of our shares up to 110% of the market price for our shares; provided that (i) for open market

or privately negotiated repurchases, the market price shall be the price for our shares on the New York Stock Exchange (the “NYSE”)

at the time of the transaction; (ii) for self-tender offers, the market price shall be the volume weighted average price (“VWAP”)

for our shares on the NYSE during a period, determined by the Board, of no less than one and no greater than five consecutive trading

days immediately prior to the expiration of the tender offer; and (iii) for accelerated repurchase arrangements, the market price

shall be the VWAP for our shares on the NYSE over the term of the arrangement. The VWAP for any number of trading days shall be

calculated as the arithmetic average of the daily VWAP on those trading days.

If approved, the authority will extend for

18 months from the date of the EGM, or until March 12, 2021, and will supersede the authority remaining under the prior authorization

granted by shareholders at the annual general meeting on May 31, 2019. Any shares repurchased under this authority may be cancelled

pursuant to the authorization to cancel shares requested under Item 2 below.

ITEM

2 CANCELLATION OF SHARES

|

The Board recommends that you vote FOR the proposal to cancel all

or a portion of the shares in our treasury account. |

Under Dutch law and our Articles of Association,

shareholder approval is necessary to cancel ordinary shares that are held in treasury by us, or that may in the future be held

in treasury by us as a result of share repurchases. Also under Dutch law, the number of shares held by us, or our subsidiaries,

may not exceed 50% of our issued share capital at any time.

As of August 1, 2019, we held approximately

65.0 million shares in our treasury account, primarily as the result of share repurchases. Treasury shares, if not cancelled,

may be used for general corporate purposes, including for issuance under our equity compensation plans.

We are requesting that shareholders approve

the cancellation of all or any portion of shares held in our treasury account or that may be repurchased pursuant to the authority

requested under Item 1, above. If this Proposal 2 is adopted, our Board intends to cancel 90% of the shares held in treasury by

us as of the date of the EGM, including those repurchased in the recently completed tender offer. The Board may also cancel shares

repurchased in the future pursuant to the authority requested under Item 1, if determined advisable and in the best interests of

our shareholders taking into account our share repurchase activity, use of treasury shares, and other factors.

If this Proposal 2 is adopted, the cancellation

of treasury shares may be executed in one or more tranches. In order to cancel our shares, we will follow the procedure set forth

under Dutch law to cancel treasury shares from time to time. In accordance with Dutch statutory provisions, the cancellation of

treasury shares will not be effective until two months after the resolution to cancel treasury shares has been filed with the Dutch

Trade Register and announced in a Dutch national daily newspaper. Once the procedure is complete, the relevant treasury shares

will be cancelled. If this Proposal 2 is not approved, we will not cancel any treasury shares unless the general meeting of shareholders

approves such cancellation at a later date.

LYONDELLBASELL

2019 PROXY STATEMENT 6

SECURITIES

OWNERSHIP

SIGNIFICANT SHAREHOLDERS

The table below shows information for shareholders

known to us to beneficially own more than 5% of our shares.

| | |

Shares Beneficially Owned |

| Name and Address | |

Number | |

Percentage(1) |

|

Certain affiliates of Access Industries, LLC(2)

730

Fifth Ave., 20th Floor, New York, NY 10019 | |

76,693,367 | |

22.9% |

|

The Vanguard Group(3)

100 Vanguard Blvd., Malvern, PA 19355 | |

24,805,145 | |

7.4% |

|

BlackRock, Inc.(4)

55 East 52nd Street, New York, NY 10055 | |

22,575,050 | |

6.7% |

|

Capital World Investors(5)

333 South Hope Street, Los Angeles, CA 90071 | |

20,068,059 | |

6.0% |

|

| (1) |

All percentages are based on 335,245,722 shares

outstanding as of August 1, 2019. |

| (2) |

Information is based on a Schedule 13D/A filed with the SEC on July 15, 2019.

Access Industries is a privately-held U.S. industrial group which controls directly or indirectly AI International Chemicals

S.à r.l. and certain other entities that are recordholders of our outstanding shares (collectively, the “Access

Recordholders”). Len Blavatnik controls Access Industries and may be deemed to beneficially own the shares held by one

or more of the Access Recordholders. Access Industries and each of its affiliated entities and the officers, partners, members,

and managers thereof (including, without limitation, Mr. Blavatnik), other than the applicable Access Recordholder, disclaim

beneficial ownership of any shares owned by the Access Recordholders. |

| (3) |

Information is based on a Schedule 13G/A filed with the SEC on February

12, 2019 by The Vanguard Group reporting beneficial ownership of the Company’s stock as of December 31, 2018, on

behalf of its direct and indirect subsidiaries including Vanguard Fiduciary Trust Company and Vanguard Investments

Australia, Ltd. The shareholder reports sole voting power with respect to 380,216 shares and sole dispositive power with

respect to 24,352,626 shares. |

| (4) |

Information is based on a Schedule 13G/A filed with the SEC on February 6, 2019

by BlackRock, Inc. reporting beneficial ownership of the Company’s stock as of December 31, 2018, on behalf of its direct

and indirect subsidiaries including BlackRock Life Limited, BlackRock International Limited, BlackRock Advisors, LLC, BlackRock

(Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited,

BlackRock Financial Management, Inc., iShares (DE) I Investmentaktiengesellschaft mit Teilgesellsc, BlackRock Japan Co., Ltd.,

BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, FutureAdvisor, Inc., BlackRock Investment Management

(UK) Limited, BlackRock Asset Management Canada Limited, BlackRock Asset Management Deutschland AG, BlackRock (Luxembourg)

S.A., BlackRock Investment Management (Australia) Limited, BlackRock Advisors (UK) Limited, BlackRock Fund Advisors, BlackRock

Asset Management North Asia Limited, BlackRock (Singapore) Limited, and BlackRock Fund Managers Ltd. The shareholder reports

sole voting power with respect to 19,706,802 shares and sole dispositive power with respect to 22,575,050 shares. |

| (5) |

Information is based on a Schedule 13G/A filed with the SEC on February 14,

2019 by Capital World Investors reporting beneficial ownership of the Company’s stock as of December 31, 2018. The shareholder

reports sole voting power and sole dispositive power with respect to 20,068,059 shares. |

LYONDELLBASELL 2019 PROXY STATEMENT 7

BENEFICIAL OWNERSHIP

Information relating to the beneficial

ownership of our shares by each of our directors and named executive officers is included below, as is information with respect

to all of these individuals and all other executive officers of the Company, as a group. Shares are considered to be beneficially

owned by a person if he or she, directly or indirectly, has sole or shared voting or investment power with respect to such shares.

In addition, a person is deemed to beneficially own shares if that person has the right to acquire such shares within 60 days

of August 1, 2019. The individuals set forth in the table below, individually and in the aggregate, beneficially own less than

1% of our outstanding shares as of August 1, 2019.

| Name | |

Shares | |

RSUs (units each

equivalent to a

share) vesting

within 60 days | |

Stock Options

Exercisable Within

60 days |

| Jacques Aigrain | |

9,483 | |

– | |

– |

| Lincoln Benet | |

3,766 | |

– | |

– |

| Jagjeet Bindra(1) | |

16,172 | |

– | |

– |

| Robin Buchanan | |

41,762 | |

– | |

– |

| Stephen Cooper | |

26,792 | |

– | |

– |

| Nance Dicciani | |

17,093 | |

– | |

– |

| Claire Farley | |

10,553 | |

– | |

– |

| Isabella Goren | |

8,474 | |

– | |

– |

| Michael Hanley | |

328 | |

– | |

– |

| Albert Manifold | |

– | |

– | |

– |

| Bhavesh (Bob) Patel(2) | |

201,140 | |

– | |

476,631 |

| Rudy van der Meer | |

15,671 | |

– | |

– |

| Thomas Aebischer | |

20,174 | |

– | |

80,215 |

| Daniel Coombs | |

12,625 | |

– | |

44,826 |

| Jeffrey Kaplan | |

18,646 | |

– | |

37,552 |

| James Guilfoyle | |

9,208 | |

– | |

20,935 |

| ALL

DIRECTORS AND EXECUTIVE OFFICERS AS A GROUP (25 PERSONS) | |

463,368 | |

– | |

707,380 |

| (1) |

Includes 9,200 shares owned by the Bindra Family Revocable Trust. Mr. Bindra disclaims

beneficial ownership of such shares except to the extent of any pecuniary interest therein. |

| (2) |

Includes 188,129 shares held in a family trust. Mr. Patel disclaims beneficial ownership of

such shares except to the extent of any pecuniary interest therein. |

LYONDELLBASELL 2019 PROXY STATEMENT 8

QUESTIONS

AND ANSWERS ABOUT THE EXTRAORDINARY GENERAL MEETING

Who is soliciting my vote?

Our Board is soliciting your vote on the

two proposals described in this proxy statement (the “proposals”).

Whom should I contact if I have any questions about the EGM,

the proxy materials or voting?

If you have any questions about the proposals

or if you need assistance submitting your proxy or voting your shares or need additional copies of this proxy statement or a proxy

card, please contact LyondellBasell Investor Relations at +1 (713) 309-7141 or investorrelations@lyb.com or our

proxy solicitor, Georgeson LLC, toll free at +1 (866) 482-4943.

Why are these matters being submitted for voting?

As a company incorporated in the Netherlands

and in accordance with Dutch law, our Board may only repurchase and cancel shares with shareholder authorization. Of the Board’s

existing share repurchase authorization, approved by shareholders at the Company’s annual general meeting of shareholders

on May 31, 2019, only approximately 5% remains available for potential further repurchases following completion of a tender offer

in July 2019.

How does the Board of Directors recommend that I vote my shares?

The Board of Directors recommends that you vote FOR

each proposal.

Unless you give other instructions on your

proxy card, the persons named as proxy holders on the proxy card will vote in favor of the proposals in accordance with the recommendation

of the Board.

Who is entitled to vote?

You may vote your LyondellBasell shares

at the EGM if you are the record owner of such shares as of the close of business on August 15, 2019 (the “Record Date”).

You are entitled to one vote for each share of LyondellBasell common stock that you own. As of August 1, 2019, there were 335,245,722

shares of LyondellBasell common stock outstanding and entitled to vote at the EGM.

How many votes must be present to hold the meeting?

Your shares are counted as present at the

EGM if you held such shares as of the Record Date and (i) properly notify us of your intention to attend the EGM, attend the EGM,

and vote in person or (ii) properly return a proxy by Internet, telephone, or mail. There are no quorum requirements under Dutch

law and, as a result, we may hold our meeting regardless of the number of shares that are present in person or by proxy.

How many votes are needed to approve the proposals?

Each proposal requires the affirmative vote of a majority of the

votes cast by shareholders in order to be approved.

If, however, less than 50% of the Company’s

issued share capital (which for this purpose includes only our outstanding shares) is represented at the EGM, the cancellation

of shares held in our treasury account (Proposal 2) will require the affirmative vote of at least two-thirds of the votes cast.

LYONDELLBASELL 2019 PROXY STATEMENT 9

How do I vote?

You can vote either in person at the meeting

or by proxy without attending the meeting. To vote by proxy, you must vote over the Internet, by telephone, or by mail. Instructions

for each method of voting are included on the proxy card.

If you hold your LyondellBasell shares in

a brokerage account (that is, you hold your shares in “street name”), your ability to vote by telephone or over the

Internet depends on your broker’s voting process. Please follow the directions on your proxy card or voter instruction form.

Even if you plan to attend the EGM, we encourage

you to vote your shares by proxy in advance. If you plan to vote in person at the EGM and you hold your LyondellBasell shares in

street name, you must obtain a proxy from your broker and bring that proxy to the meeting.

Can I change my vote?

Yes. You can change or revoke your vote at

any time before the polls close at the EGM. You can do this by:

|

Entering a new vote by telephone or over the Internet prior to 11:59 p.m. Eastern Time on September 10, 2019; |

|

Signing another proxy card with a later date and returning it to us by a method that allows us to receive the proxy prior to the EGM; |

|

Sending us a written document revoking your earlier proxy; or |

|

Attending the EGM and voting your shares in person (attendance at the EGM will not, by itself, revoke a proxy previously given by you). |

Who counts the votes?

We have hired Broadridge Financial Solutions,

Inc. to count the votes represented by proxies and cast by ballot at the EGM.

Will my shares be voted if I do not provide my proxy and do

not attend the EGM?

If you do not provide a proxy or vote your

shares in person, the shares held in your name will not be voted.

If you hold your shares in street name, your

broker may be able to vote your shares even if you do not provide the broker with voting instructions. We believe that, pursuant

to NYSE rules, each proposal is considered a routine matter. However, it is important that you act to ensure your shares are voted.

What is a broker non-vote?

If a broker does not have discretion to vote

shares held in street name on a particular proposal and does not receive instructions from the beneficial owner on how to vote

those shares, the broker may return the proxy card without voting on that proposal. This is known as a broker non-vote. Broker

non-votes will have no effect on the vote for either proposal.

What if I return my proxy but don’t vote for some of

the matters listed on my proxy card?

If you return a signed proxy card without

indicating your vote on both matters listed, your shares will be voted FOR each proposal

for which you did not vote.

How are votes counted?

You may vote FOR,

AGAINST, or ABSTAIN on each proposal. A vote

to abstain does not count as a vote cast, and therefore will not have any effect on the outcome of any matter to be voted on at

the EGM.

Could other matters be decided at the EGM?

No. Any matters to be decided at the EGM

must be included in the agenda for the meeting as described in this proxy statement.

LYONDELLBASELL 2019 PROXY STATEMENT 10

Who can attend the EGM?

The EGM is open to all LyondellBasell shareholders

who hold shares as of the close of business on August 15, 2019, the Record Date. If you would like to attend the EGM, you must

inform us in writing of your intention to do so prior to September 9, 2019, three days prior to the date of the meeting. The notice

may be emailed to investorrelations@lyb.com. Admittance of shareholders will be governed by Dutch law.

What is the cost of this proxy solicitation?

The Company will pay the cost of soliciting

proxies for the EGM. Our directors, officers, and employees may solicit proxies by mail, by email, by telephone, or in person for

no additional compensation. In addition, we have retained Georgeson LLC to assist in the solicitation of proxies for a fee of $12,500,

plus reimbursement of reasonable expenses.

Why did my household receive a single set of proxy materials?

SEC rules permit us to deliver a single copy

of our proxy statement to any household at which two or more shareholders reside, if we believe the shareholders are members of

the same family.

If you prefer to receive your own copy

of proxy materials now or in the future, please request a duplicate set by phone at +1 (800) 579-1639, through the Internet

at www.proxyvote.com, or by email to sendmaterial@proxyvote.com. If you hold your shares in street name

and you received more than one set of proxy materials at your address, you may need to contact your broker or nominee

directly if you wish to discontinue duplicate mailings to your household.

Why did I receive a “notice of internet availability

of proxy materials” but no proxy materials?

We distribute our proxy materials to

certain shareholders via the Internet using the “Notice and Access” approach permitted by rules of the SEC. This approach

conserves natural resources and reduces our distribution costs, while providing our shareholders with a timely and convenient

method of accessing the materials and voting. On or before August 2, 2019, we mailed a “Notice of Internet Availability

of Proxy Materials” to participating shareholders, containing instructions on how to access the proxy materials on the Internet.

Can I submit a proposal for the Company’s annual shareholder

meeting?

The Company held its 2019 annual general

meeting of shareholders on May 31, 2019.

Our Articles of Association provide that

a shareholder representing at least one percent of our issued share capital can submit an agenda item for consideration at our

2020 annual meeting. Any such request must be received at least 60 days prior to the date of the annual meeting.

Under SEC rules, if a shareholder

wishes to include a proposal in our proxy materials for presentation at our 2020 annual general meeting, the proposal must be

received at our offices at 1221 McKinney Street, Suite 300, Houston, Texas 77010, Attention: Corporate Secretary, by December

11, 2019. All proposals must comply with Rule 14a-8 under the Exchange Act.

Although our Board nominates candidates for

election to the Board, candidates may be proposed by our shareholders. Any shareholder who wishes to recommend a director candidate

should submit a written recommendation to our Corporate Secretary at the address noted above. The recommendation must include the

name of the nominated individual, relevant biographical information, and the individual’s consent to nomination. For our

2020 annual general meeting of shareholders, recommendations must be received by December 11, 2019 to be considered.

LYONDELLBASELL 2019 PROXY STATEMENT 11

This regulatory filing also includes additional resources:

llyb2019_def14a.pdf

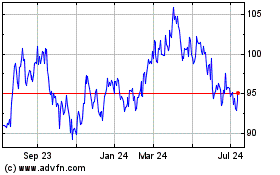

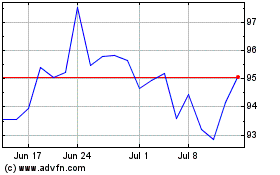

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024