Current Report Filing (8-k)

March 17 2023 - 6:02AM

Edgar (US Regulatory)

false00000189260000794323 0000018926 2023-03-16 2023-03-16 0000018926 lumn:Level3ParentLlcMember 2023-03-16 2023-03-16 0000018926 us-gaap:CommonStockMember 2023-03-16 2023-03-16 0000018926 us-gaap:PreferredStockMember 2023-03-16 2023-03-16

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation) |

|

|

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

|

(Registrant’s telephone number, including area code)

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation) |

|

|

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

|

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligations of any registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered by Lumen Technologies, Inc. pursuant to Section 12(b) of the Act:

|

|

|

|

|

| |

|

|

|

Name of Each Exchange

on Which Registered |

Common Stock, par value $1.00 per share |

|

LUMN |

|

New York Stock Exchange |

Preferred Stock Purchase Rights |

|

N/A |

|

New York Stock Exchange |

Indicate by check mark whether any registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On March 16, 2023, Lumen Technologies, Inc. (“Lumen” or the “Company”) announced that its indirect wholly owned subsidiary, Level 3 Financing, Inc. (“Level 3 Financing”), had commenced offers to issue up to $1,100,000,000 principal amount of Level 3 Financing’s 10.500% Senior Secured Notes due 2030 (the “New Notes”) in exchange, subject to various caps and acceptance priority levels, for Lumen’s outstanding unsecured 5.625% Senior Notes, Series X, due 2025, 7.200% Senior Notes, Series D, due 2025, 5.125% Senior Notes due 2026, 6.875% Debentures, Series G, due 2028, 5.375% Senior Notes due 2029, 4.500% Senior Notes due 2029, 7.600% Senior Notes, Series P, due 2039 and 7.650% Senior Notes, Series U, due 2042 validly tendered in the exchange offers by eligible holders upon the terms and conditions set forth in Level 3 Financing’s offering memorandum, dated March 16, 2023 (the “Exchange Offers”). The Exchange Offers will only be made, and the New Notes are only being offered and will only be issued, (1) to persons reasonably believed to be “qualified institutional buyers” as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), or (2) to

non-U.S.

persons outside the United States as defined in Rule 902 under the Securities Act in transactions in compliance with Regulation S under the Securities Act, who are

“non-U.S.

qualified offerees”.

|

Regulation FD Disclosure. |

In connection with the Exchange Offers, the Company is providing the following information regarding certain corporate developments since Lumen filed its Annual Report on Form

10-K

on February 23, 2023.

On February 24, 2023, Moody’s Investor Service, Inc. downgraded the ratings of Lumen and its affiliates, including, without limitation, downgrading Lumen’s senior unsecured rating from B2 to Caa1 and Level 3 Financing’s senior secured rating from Ba1 to Ba2.

On March 3, 2023, a purported shareholder of Lumen filed a putative class action complaint captioned

Voigt v. Lumen Technologies, Inc., et al.

, Case

in the U.S. District Court for the Western District of Louisiana. The complaint alleges that Lumen and certain of its current or former officers violated the federal securities laws by omitting or misstating material information related to Lumen’s expansion of its Quantum Fiber business. The complaint seeks money damages, attorneys’ fees and costs, and other relief.

Lumen regularly evaluates its consolidated capital structure, and will continue to do so in light of market conditions and the results of the Exchange Offers. Lumen may determine from time to time to undertake additional debt issuances. Any such debt issuance could be in the near future, could include one or more offerings of additional New Notes or one or more other debt issuances by Level 3 Financing, and, subject to any applicable restrictive covenants, could be used to purchase, repay, redeem or otherwise retire outstanding indebtedness of any of Lumen, Level 3 Financing or their respective subsidiaries.

The information in Item 7.01 of this Current Report on Form

8-K

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

The explanatory note above is incorporated into this Item 7.01. A copy of the Company’s press release announcing the commencement of the Exchange Offers is attached herewith as Exhibit 99.1 and is also incorporated herein by reference.

|

Financial Statements and Exhibits. |

|

|

|

|

|

|

|

|

99.1 |

|

|

|

|

104 |

|

Cover page formatted in Inline XBRL and contained in Exhibit 101. |

Pursuant to the requirements of the Securities Exchange Act of 1934, Lumen Technologies, Inc. and Level 3 Parent, LLC have duly caused this Current Report on Form

8-K

to be signed on their behalf by the undersigned officer hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

|

Stacey W. Goff |

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

Dated: March 16, 2023 |

|

|

|

By: |

|

|

|

|

|

|

|

|

Stacey W. Goff |

|

|

|

|

|

|

Executive Vice President and General Counsel |

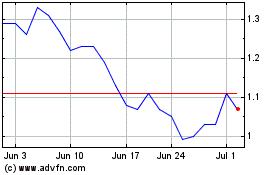

Lumen Technologies (NYSE:LUMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

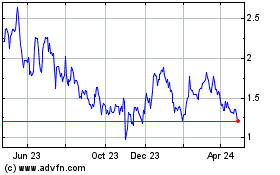

Lumen Technologies (NYSE:LUMN)

Historical Stock Chart

From Apr 2023 to Apr 2024