LSB Industries, Inc. Adopts Shareholder Rights Plan Designed to Protect the Availability of Its Net Operating Losses

July 06 2020 - 4:05PM

Business Wire

- Preserving long-term shareholder value by adopting a rights

plan intended to protect tax assets by reducing the likelihood of

an ownership change (1)

- Rights plan in effect immediately; will be submitted for

shareholder ratification at 2021 annual meeting

- If ratified by shareholders, rights plan intended to remain

in effect until July 6, 2023

LSB Industries, Inc. (“LSB”) (NYSE: LXU) announced today that

its Board of Directors adopted a shareholder rights plan designed

to protect the availability of LSB’s net operating loss

carryforwards (“NOLs”) and other tax attributes under the Internal

Revenue Code (“Section 382 Rights Plan”).

As of December 31, 2019, LSB had approximately $611 million of

U.S. federal NOLs that could be available to offset its future

federal taxable income. LSB’s ability to use these NOLs would be

substantially limited if it experienced an “ownership change”

within the meaning of Section 382 of the Internal Revenue Code. In

general, a company would undergo an ownership change if its

“5-percent shareholders” (determined under Section 382) increased

their ownership of the value of such company’s stock by more than

50 percentage points over a rolling three-year period. The Section

382 Rights Plan is intended to reduce the likelihood of such an

ownership change at LSB by deterring any person or group from

acquiring beneficial ownership of 4.9% or more of LSB’s outstanding

common stock unless approved by the Board.

The Section 382 Rights Plan is similar to those adopted by

numerous other public companies with significant NOLs. The Section

382 Rights Plan is not designed to prevent any action that the

Board determines to be in the best interest of LSB and its

shareholders, and will help to ensure that the Board of Directors

remains in the best position to discharge its fiduciary duties.

Under the Section 382 Rights Plan, the rights will initially

trade with LSB’s common stock and will generally become exercisable

only if a person (or any persons acting as a group) acquires 4.9%

or more of LSB’s outstanding common stock. The Section 382 Rights

Plan does not aggregate the ownership of shareholders “acting in

concert” unless and until they have formed a group under applicable

securities laws. If the rights become exercisable, all holders of

rights (other than any triggering person) will be entitled to

acquire shares of common stock at a 50% discount or LSB may

exchange each right held by such holders for one share of common

stock. Under the Section 382 Rights Plan, any person which

currently owns 4.9% or more of LSB’s common stock may continue to

own its shares of common stock but may not acquire any additional

shares without triggering the Section 382 Rights Plan. LSB’s Board

of Directors has the discretion to exempt any person or group from

the provisions of the Section 382 Rights Plan.

LSB intends to submit the Plan to a vote of its shareholders at

its 2021 annual meeting. The Section 382 Rights Plan will expire on

the day following the certification of the voting results for LSB’s

2021 annual meeting of shareholders, unless LSB’s shareholders

ratify the Section 382 Rights Plan at or prior to such meeting, in

which case the Section 382 Rights Plan will continue in effect

until July 6, 2023, unless terminated earlier in accordance with

its terms.

Additional information about the Section 382 Rights Plan will be

available on a Form 8-K to be filed by LSB with the U.S. Securities

and Exchange Commission.

About LSB Industries,

Inc.

LSB Industries, Inc., headquartered in Oklahoma City, Oklahoma,

manufactures and sells chemical products for the agricultural,

mining, and industrial markets. The Company owns and operates

facilities in Cherokee, Alabama, El Dorado, Arkansas and Pryor,

Oklahoma, and operates a facility for a global chemical company in

Baytown, Texas. LSB’s products are sold through distributors and

directly to end customers throughout the United States. Additional

information about the Company can be found on its website at

www.lsbindustries.com.

Forward-Looking

Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements generally are

identifiable by use of the words “may,” “believe,” “expect,”

“intend,” “plan to,” “estimate,” “project” or similar expressions,

and include but are not limited to: financial performance

improvement; view on sales to mining customers; estimates of

consolidated depreciation and amortization and future Turnaround

expenses; our expectation of production consistency and enhanced

reliability at our Facilities; our projections of trends in the

fertilizer market; improvement of our financial and operational

performance; our planned capital expenditures for 2019; reduction

of SG&A expenses; volume outlook and our ability to complete

plant repairs as anticipated.

Investors are cautioned that such forward-looking statements are

not guarantees of future performance and involve risk and

uncertainties. Though we believe that expectations reflected in

such forward-looking statements are reasonable, we can give no

assurance that such expectation will prove to be correct. Actual

results may differ materially from the forward-looking statements

as a result of various factors. These and other risk factors are

discussed in the Company’s filings with the Securities and Exchange

Commission (SEC), including those set forth under “Risk Factors”

and “Special Note Regarding Forward-Looking Statements” in our Form

10-K for the year ended December 31, 2019 and, if applicable, our

Current Reports on Form 8-K. All forward-looking statements

included in this press release are expressly qualified in their

entirety by such cautionary statements. We expressly disclaim any

obligation to update, amend or clarify any forward-looking

statement to reflect events, new information or circumstances

occurring after the date of this press release except as required

by applicable law.

(1) As defined by the Internal Revenue

Code.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200706005529/en/

LSB Contact: Mark Behrman, President & CEO Cheryl Maguire,

Executive Vice President & CFO (405) 235-4546

Investor Relations Contact: The Equity Group Inc. Fred

Buonocore, CFA (212) 836-9607 Michael Gaudreau (212) 836-9620

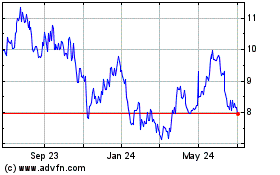

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Mar 2024 to Apr 2024

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Apr 2023 to Apr 2024