|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of the Registrant: Lockheed Martin Corp. (LMT)

Name of persons relying on exemption: As You Sow

Address of persons relying on exemption: Main Post Office, P.O. Box 751, Berkeley, CA 94704

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

Lockheed Martin

Corp. (LMT)

Vote Yes: Item #7 – Stockholder Proposal to Issue a Report on the Company’s Intention to Reduce Full Value Chain GHG Emissions

Annual Meeting:

April 27, 2023

CONTACT: David Shugar | david@asyousow.org

THE RESOLUTION

BE IT RESOLVED: Shareholders request the Board issue a report,

at reasonable expense and excluding confidential information, disclosing how the Company intends to reduce its full value chain greenhouse

gas emissions in alignment with the Paris Agreement's 1.5°C degree goal requiring Net Zero emissions by 2050.

SUPPORTING STATEMENT: Proponents suggest, at Board and Company

discretion, that the report include:

| · | Disclosure of all relevant Scope 3 emissions; |

| · | A timeline for setting 1.5°C-aligned Scope 3 reduction goals; |

| · | A climate transition plan to achieve emissions reductions goals across all relevant emissions scopes; |

| · | Annual reports demonstrating progress towards meeting emissions reduction goals. |

SUMMARY

The window for limiting global warming to 1.5 degrees is quickly narrowing,1

requiring immediate, dramatic emissions reduction from all market sectors.2 Failure to reach Net Zero emissions by 2050 is

projected to have disastrous economic consequences,3 impacting companies and investor portfolios.

_____________________________

1 https://www.ipcc.ch/2021/08/09/ar6-wg1-20210809-pr/

2 https://report.ipcc.ch/ar6wg3/pdf/IPCC_AR6_WGIII_FinalDraft_FullReport.pdf

3 https://www.nytimes.com/2021/04/22/climate/climate-change-economy.html

|

2023

Proxy Memo

Lockheed Martin Corp | Stockholder Proposal to Issue a Report on the Company’s Intention

to Reduce Full Value Chain GHG Emissions

|

Shareholders are increasingly concerned about material climate risk

to their companies and to their portfolios and seek clear, consistent disclosures and action from the companies in which they invest.

The Climate Action 100+ initiative, a coalition of more than 700 investors with over $68 trillion in assets under management, launched

a Net Zero Company Benchmark (“the Benchmark”) to assess and compare company progress on climate. The Benchmark calls on the

largest carbon-emitting companies globally, including Lockheed Martin, to align with the Paris Agreement’s 1.5°C goal by setting

and disclosing an ambition to achieve Net Zero GHG emissions by 2050 or sooner, inclusive of Scope 1, 2, and 3 emissions, and provide

a transparent transition plan.4 Currently, Lockheed does not fully meet any criteria outlined in the Benchmark.5

Climate change presents growing risk to Lockheed, one of the largest

global aerospace and defense manufacturers. The Company is exposed to industry-specific, climate-related regulatory risk, as well as competitive

and physical risks. Its key areas of business, including sales of aerospace and defense technology, are associated with emission-intensive

products that could lock in large sources of emissions for decades to come.

In 2022, the U.S. Department of Defense (“DOD”) awarded

Lockheed the highest amount of contract funds, demonstrating the materiality of such contracts to Lockheed’s business.6

The U.S. and other governments acknowledge climate change is a major security threat and have accordingly set emission reduction goals

inclusive of defense suppliers. The U.S. government, for instance, has committed to reducing emissions across federal operations to net

zero by 20507 while increasing the sustainability of federal supply chains.8 In particular, emissions from the DOD

represent approximately 80% of emissions from the federal government. To implement its climate change goals, the U.S. has developed, among

other climate-related policies, supply chain initiatives that include major contractor greenhouse gas (GHG) emission disclosures paired

with science-based targets, a "buy clean" initiative for low-carbon materials, and a sustainable products policy. The DOD is

also elevating climate change as a national security priority and integrating climate considerations into policies, strategies and partner

engagements.9 Together, these programs will advance America's industrial competitiveness in supplying the low-carbon and sustainable

goods of the future. If Lockheed does not meet emerging regulations, it could lose significant contract opportunities.

Given the impact of climate change on the economy, the increase in

climate-related regulation, and Lockheed’s status in the CA100+ as a major emitter, Lockheed has a clear responsibility to provide

a 1.5oC-aligned transition plan covering the full range of its material value chain emissions. Lockheed’s failure to

set emission reduction targets that cover its Scope 3 emissions demonstrates a lack of adherence to its stakeholder’s

clear expectations. We urge a “Yes” vote on this proposal.

_____________________________

4 https://www.climateaction100.org/wp-content/uploads/2023/03/Climate-Action-100-Net-Zero-Company-Benchmark-Framework-2.0..pdf

5 https://www.climateaction100.org/company/lockheed-martin-corporation/

6 https://dsm.forecastinternational.com/wordpress/2023/02/22/top-100-defense-contractors-2022/

7 https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/decarbonizing-defense-imperative-and-opportunity

8 https://www.sustainability.gov/federalsustainabilityplan/procurement.html

9 https://www.defense.gov/Spotlights/Tackling-the-Climate-Crisis/

|

2023

Proxy Memo

Lockheed Martin Corp | Stockholder Proposal to Issue a Report on the Company’s Intention

to Reduce Full Value Chain GHG Emissions

|

RATIONALE FOR A YES

VOTE

| 1. | Lockheed faces climate-related regulatory, competitive, and physical risks that will drastically impact its business. |

| 2. | Lockheed is falling behind peers in addressing the impact of its emissions. |

| 3. | Lockheed does not disclose a plan or goal to reduce its full value chain of emissions in alignment with the Paris Agreement's 1.5°C

degree goal requiring Net Zero emissions by 2050. |

DISCUSSION

| 1. | Lockheed faces climate-related regulatory, competitive, and physical risks that will drastically impact its business. |

Regulatory risks

Climate-related policies are gaining traction globally. 70 foreign

governments have net zero ambitions,10 and 47 national jurisdictions are covered by carbon tax legislation.11 In

its 10-K, Lockheed acknowledges exposure to multiple climate-related regulatory risks that could hurt its business. Lockheed acknowledges

that increased climate laws and regulations regarding GHG emissions and carbon pricing have a high likelihood of being implemented and

may impact Lockheed’s product affordability, cost competitiveness, and supply chain costs.12 Countries around the world,

including the U.S. and U.K. government, are issuing policies requiring that suppliers commit to achieving Net Zero by 2050 or be barred

from consideration on contracts.13 Lockheed has major assets based in the U.K. and recognizes that such policy directly impacts

a strategic customer in the Company’s international operations.14 The U.S. government also

proposed changes to its supplier regulations which would require major defense suppliers, including Lockheed, to report all Scope 3 emissions

sources and set science-based emissions reduction targets.15

_____________________________

10 https://www.un.org/en/climatechange/net-zero-coalition

11 https://carbonpricingdashboard.worldbank.org/map_data

12 https://www.cdp.net/en/formatted_responses/responses?campaign_id=79520704&discloser_id=973905&locale=en&organization_name=Lockheed+Martin+Corporation&organization_number=10820&

program=Investor&project_year=2022&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2022%2F6wz4wms4%2F211119&survey_id=78646008

13 https://www.gov.uk/government/publications/procurement-policy-note-0621-taking-account-of-carbon-reduction-plans-in-the-procurement-of-major-government-contracts

14 https://www.cdp.net/en/formatted_responses/responses?campaign_id=79520704&discloser_id=973905&locale=en&organization_name=Lockheed+Martin+Corporation&organization_number=10820&

program=Investor&project_year=2022&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2022%2F6wz4wms4%2F211119&survey_id=78646008

C2.2a

15 https://www.federalregister.gov/documents/2022/11/14/2022-24569/federal-acquisition-regulation-disclosure-of-greenhouse-gas-emissions-and-climate-related-financial

|

2023

Proxy Memo

Lockheed Martin Corp | Stockholder Proposal to Issue a Report on the Company’s Intention

to Reduce Full Value Chain GHG Emissions

|

Lockheed has yet to set targets for its material Scope 3 emissions.16

Lockheed discloses in its most recent 10-K that sales to the U.S. government made up 73% of Lockheed’s total net sales and that

the US government represents a substantial majority of Lockheed’s total defense sales.17 Its major customers, including

the U.S. government18 and the NATO member countries,19 are clear that they consider climate change a security threat

and are acting to cut emissions. If Lockheed is disqualified from bids by its major customers, it would likely experience significant

negative financial impact on its ability to generate business and therefore impair its profitability. Overall, the Company’s failure

to fully address material Scope 3 emissions may leave the Company vulnerable to regulatory risks and lose important opportunities to show

its leadership.

On the other hand, proactively addressing climate risk can benefit

the company. Lockheed states in its most recent CDP submission that resource efficiency is a climate-related opportunity that could make

the Company more competitive, inform future R&D investments, and improve revenue.20

Competitive risks

Setting full value chain emissions reduction targets will increase

Lockheed’s ability to retain its position as an industry leader as market expectations and new climate regulations necessitate science-based

climate transition plans. Emission reduction performance is a key tool in competing for the best contracts and reducing competitive risk.

Lockheed recognizes that it faces competition risks as its competitors respond to climate-related policies and customer demand changes.21

Lockheed emphasizes its efforts to reduce emissions associated with

the use of products but lacks a concrete goal to drive value chain emissions reductions. As outlined below, multiple peers are setting

targets to reduce emissions associated with the use of their products and incentivizing low-carbon innovation that can contribute to their

customers’ emission reduction goals and increase competitive advantage. Lack of disclosure on a value chain emissions mitigation

plan will reduce its ability to succeed over competitors.

Physical risks

The Company’s 10-k acknowledges a vulnerability to supply chain

risks, which may be exacerbated by climate change. Increasing frequency and severity of extreme weather events caused by climate change

may also negatively impact Lockheed’s suppliers, subcontractors, service providers, distributors, and customers. Such factors may

affect Lockheed’s ability to procure necessary materials, distribute products to customers timely,

and could materially decrease revenues. Improving climate resiliency in supply chain and logistics is critical to Lockheed’s ability

to efficiently complete business contracts.

_____________________________

16 https://www.cdp.net/en/formatted_responses/responses?campaign_id=79520704&discloser_id=973905&locale=en&organization_name=Lockheed+Martin+Corporation&organization_number=10820&

program=Investor&project_year=2022&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2022%2F6wz4wms4%2F211119&survey_id=78646008

17 https://www.sec.gov/ix?doc=/Archives/edgar/data/936468/000093646823000009/lmt-20221231.htm

p.79

18 https://www.sustainability.gov/federalsustainabilityplan/emissions.html

19 https://www.nato.int/cps/en/natohq/news_197175.htm

20 https://www.cdp.net/en/formatted_responses/responses?campaign_id=79520704&discloser_id=973905&locale=en&organization_name=Lockheed+Martin+Corporation&organization_number=10820&

program=Investor&project_year=2022&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2022%2F6wz4wms4%2F211119&survey_id=78646008

21 https://www.sec.gov/ix?doc=/Archives/edgar/data/936468/000093646823000009/lmt-20221231.htm#i692d08b87629410bb3c9a1eb5b8d3191_13

p.15, 23

|

2023

Proxy Memo

Lockheed Martin Corp | Stockholder Proposal to Issue a Report on the Company’s Intention

to Reduce Full Value Chain GHG Emissions

|

| 2. | Lockheed is falling behind

peers in addressing the impact of its emissions. |

Exclusion of Scope 3 emissions sources in the Company’s emission

reduction targets puts it behind global peers in setting Paris-aligned climate goals. The defense and aerospace company BAE Systems signed

onto the Science Based Targets initiative (“SBTi”) and is working towards a net zero value chain by 2050 goal.22

Safran S.A. committed to reduce the intensity of Scope 3 GHG emissions from the use of sold products and indirect use phase 40% by 2035.23

Deere & Company, which is a heavy industry company and a compensation peer identified by Lockheed, committed to the SBTi-validated

goal of reducing absolute Scope 3 emissions from purchased goods and services and use of sold products 30% by 2030.24 General

Electric, one of the top 20 companies that received the most contracts from the DOD,25 announced its ambition to be net zero

by 2050, including its operations and Scope 3 use of sold products.26 In 2022, a similar resolution requesting Scope 3 target

setting was filed at Boeing and received 91.4% vote in favor.27 Boeing management supported the resolution.28

The aerospace, defense, and heavy industry are advancing to better

account for their climate impacts and incorporate them into climate transition strategies. To remain competitive, Lockheed must follow

peers in accounting for and setting reduction targets for its material Scope 3 GHG emissions.

| 3. | Lockheed does not disclose a plan or goal to reduce its full value chain emissions in alignment with the Paris Agreement's 1.5°C

degree goal requiring Net Zero emissions by 2050. |

Lockheed’s Targets fail to address its full range of material

value chain emissions.

Despite Scope 3 emissions making up approximately 98% of Lockheed’s

total emissions footprint,29 Lockheed lacks a Scope 3 reduction goal that aligns with 1.5°C and covers its material value

chain emissions. In its opposition statement, Lockheed states it is adopting a goal to reduce Scope 1 and 2 GHG emissions by 36% by 2030.

While an improvement from Lockheed’s previous intensity target for Scope 1 and 2,30 this goal still falls short of the

50% Scope 1-2 emissions reductions by 2030 needed to meet a 1.5°C-aligned pathway. Furthermore, by excluding Scope 3 emissions, this

target only addresses 2% of Lockheed’s total emissions. In fact, Lockheed Martin’s Scope 3 emissions

increased by 20% over the past four years, while revenue increased 10% and inflation-adjusted revenue decreased 4% from 2019 to 2022.31

_____________________________

22 https://www.baesystems.com/en/sustainability/environment-and-climate-change

23 https://www.safran-group.com/group/commitments/decarbonizing-aeronautics

24 https://sciencebasedtargets.org/companies-taking-action

25 https://dsm.forecastinternational.com/wordpress/2021/02/02/top-100-defense-contractors-2020/

26 https://www.ge.com/sites/default/files/ge2021_sustainability_report.pdf

p.3

27 https://www.asyousow.org/press-releases/2022/5/3/boeing-shareholders-support-net-zero-climate-report

28 https://www.asyousow.org/press-releases/2022/5/3/boeing-shareholders-support-net-zero-climate-report

29 https://www.cdp.net/en/formatted_responses/responses?campaign_id=79520704&discloser_id=973905&locale=en&organization_name=Lockheed+Martin+Corporation&organization_number=10820&

program=Investor&project_year=2022&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2022%2F6wz4wms4%2F211119&survey_id=78646008

30 https://www.cdp.net/en/formatted_responses/responses?campaign_id=79520704&discloser_id=973905&locale=en&organization_name=Lockheed+Martin+Corporation&organization_number=10820&

program=Investor&project_year=2022&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2022%2F6wz4wms4%2F211119&survey_id=78646008

C4.1a

31 https://sustainability.lockheedmartin.com/sustainability/content/Lockheed_Martin_2021_Sustainability_Report.pdf

p.68 (used for independent calculations)

|

2023

Proxy Memo

Lockheed Martin Corp | Stockholder Proposal to Issue a Report on the Company’s Intention

to Reduce Full Value Chain GHG Emissions

|

SBTi is widely considered as the global standard of science-aligned

target setting. Over 2,600 businesses and financial institutions are currently committed to, or working to, becoming validated through

the organization. SBTi’s standard states that if Scope 3 emissions make up 40 percent or more of a company’s total emissions,

they must be incorporated into company reduction targets.32 Similarly, the CA100+ Benchmark requires net zero targets across

all scopes of emissions.33

While Lockheed Martin is pursuing steps such as research and development

of sustainable aviation fuel, increasing renewable electricity procurement for its suppliers, and engaging suppliers, it does not communicate

to investors the anticipated emission reductions associated with these Scope 3-related actions, leaving investors unable to conclude whether

these actions are adequate to substantially manage climate risk associated with the company’s Scope 3 emissions. This stands in

contrast to its disclosures related to Scope 1 and 2 emissions reductions efforts, such as increased building efficiency, with regard

to which Lockheed Martin discloses anticipated emission reductions.34 Lockheed Martin’s Scope 3 emissions are consistently

increasing, demonstrating that its current efforts are not impacting Scope 3 emissions levels.

While Lockheed Martin is among the CA100+ largest corporate emitters,

it has yet to fully meet any of the criteria that signal Paris-alignment. For instance, it lacks: a net zero by 2050 ambition that includes

all Scopes of emissions; interim GHG reduction targets aligned with 1.5°C across all Scopes of emissions; a decarbonization strategy

for achieving its emission reduction targets; and capital allocation aligned with the Paris Agreement objectives.35 Its failure

to make such disclosures means that investors lack critical information and indicators on the state of Lockheed Martin’s emission

reduction strategy and its mitigation of climate risk across its value chain.

Nor are Lockheed Martin’s plans to offset its business travel-related

emissions through the purchase of carbon offsets a true solution. Leading experts, such as the UN High Level Expert Group, the CA100+,

and SBTi are clear that companies should not purchase carbon credits as a replacement for reducing value chain emissions. 36

Overall, Lockheed’s current disclosures and actions fail to communicate

a comprehensive plan to address 98% of its total emissions. It is imperative for Lockheed to incorporate its full Scope 3 value-chain

emissions into its emission reduction strategies to ensure that large material sources of emissions are adequately managed now and into

the future. By not including Scope 3 emissions in its interim and long-term emission reduction goals, it

remains unclear to investors how Lockheed plans to align its value chain emissions to the goals of the Paris Agreement, to meet customer

expectations (including UK and US contracting requirements), or to remain competitive with peers.

_____________________________

32 https://sciencebasedtargets.org/resources/files/SBTi-criteria.pdf

I.III C4

33 https://www.climateaction100.org/wp-content/uploads/2023/03/Climate-Action-100-Net-Zero-Company-Benchmark-Framework-2.0..pdf

34 https://www.cdp.net/en/formatted_responses/responses?campaign_id=79520704&discloser_id=973905&locale=en&organization_name=Lockheed+Martin+Corporation&organization_number=10820&

program=Investor&project_year=2022&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2022%2F6wz4wms4%2F211119&survey_id=78646008

C4.3a,b

35 https://www.climateaction100.org/company/lockheed-martin-corporation/

36 https://www.climateaction100.org/wp-content/uploads/2021/03/Climate-Action-100-Benchmark-Indicators-FINAL-3.12.pdf#:~:text=Metric%20a%29%3A%20The%20company%20has%20specified%

20that%20this,methodology%20used%20to%20establish%20any%20scope%203%20target

https://www.un.org/sites/un2.un.org/files/high-levelexpertgroupupdate7.pdf p.19; https://sciencebasedtargets.org/resources/files/Beyond-Value-Chain-Mitigation-FAQ.pdf

p.1

|

2023

Proxy Memo

Lockheed Martin Corp | Stockholder Proposal to Issue a Report on the Company’s Intention

to Reduce Full Value Chain GHG Emissions

|

RESPONSE TO LOCKHEED’s

BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION

In Lockheed’s opposition statement, the Company states it cannot

support the proposal for a number of reasons outlined below. However, these reasons are insufficient, and it is in the best interest of

the Company and stockholders for Lockheed to disclose a full value chain emissions reduction plan that fulfills the request of the proposal.

The shareholder proposal is not duplicative to existing efforts.

This proposal requests information to fill in major gaps in the Company’s current reporting on its comprehensive emission reductions

strategy and climate-risk mitigation strategy. Scope 3 emissions represent 98% of Lockheed’s total emissions, yet Lockheed does

not have a Scope 3 reduction goal and fails to communicate a comprehensive plan to reduce value-chain emissions and avoid associated regulatory

and competitive risk. Lockheed’s disclosures specifically lack a 1.5°C-aligned transition plan across its business as well as

transparency around anticipated emission reductions of current actions for its Scope 3 emissions.

The proposal is not prescriptive or premature. Lockheed argues

that the proposal is prescriptive. On the contrary, the proposal does not require specific short, medium, or long-term emissions reduction

targets, allowing Lockheed to develop a science-based, 1.5o C climate transition plan appropriate to its business. The Company

also claims the proposal is premature. However, peers Safran S.A. and BAE Systems were able to establish and work towards Scope 3 reduction

targets without a sector-specific framework, proving that setting and working towards Scope 3 reduction targets is achievable within the

defense sector. Lockheed is already engaging with many of its suppliers and industry associations to work towards its current sustainability

commitments. Additionally, Lockheed was able to drive system-level change for its Supplier Renewable Energy Program, showing that enterprise-wide

innovation is possible. Climate mitigation and adaptation demand immediate investment to adequately protect Lockheed from increasing risks

and costs. If Lockheed does not embrace shifting market expectations, it may fall behind peers and lose significant opportunities. By

establishing a Scope 3 reduction target and a plan to achieve it, Lockheed can keep pace with peers already acting in this area and build

on its current momentum to meet major customer climate-related requirements.

The Aerospace and Defense industry is not exempt from expectations

for value-chain wide emission reductions. Investor groups, such as the CA 100+, and experts, such as SBTi and the UN, are clear that

credible climate action must take Scope 3 emissions into account, especially when those emissions make up a significant majority of a

company’s total footprint. Lockheed states that the defense industry’s ability to address Scope 3 emissions rests on the support

and partnership of its customers. The increasing number of net zero commitments, carbon tax legislation, and climate-related acquisition

regulations for defense contractors is a clear signal that Lockheed’s customers value low-carbon innovation. Early movers that act

on this desire and invest in comprehensive decarbonization will gain significant opportunities and competitive advantage in winning contracts.

Companies that continue to soft-pedal acting on risks and opportunities in their value chain will lose their competitive ability and their

ability to win bids.

|

2023

Proxy Memo

Lockheed Martin Corp | Stockholder Proposal to Issue a Report on the Company’s Intention

to Reduce Full Value Chain GHG Emissions

|

Lockheed also states that “defense contractors face unique issues,”

such as not having control over product specifications, and challenges around tracking certain customer emissions. Every sector, and every

business, faces unique challenges in meeting the needs of their customers and operating their business. Similarly, each company faces

unique challenges on their individual decarbonization journeys. Overcoming such challenges is possible and necessary. As discussed, BAE

Systems, Europe’s largest defense contractor, committed to achieve a net zero value chain. Safran S.A., another aerospace and defense

company that produces aircraft and rocket engines, established a Scope 3 reduction target. Peers in the aerospace and defense industry

are addressing decarbonization challenges and risks throughout their value chains. Like its peers, Lockheed can find levers to address

its value chain emissions to remain competitive. Lockheed has control over its own procurement policies. It can engage with suppliers

of its raw materials to move its value chain towards carbon efficiency. Lockheed further has control over its own research and development

investments and can test new materials the same way it is researching sustainable aviation fuel. Lockheed may be bound by certain contracts

now, but its success rests on developing and marketing products for the future. Setting a Scope 3 goal will push innovation and maintain

long-term competitiveness and value.

Lockheed also states that it is inappropriate to include defense contractors

in comparison to a broader sector of peers. While this memo does identify two aerospace and defense-specific peers, it also takes into

account peers in industrials. All peers identified share similar challenges of needing to meet specifications for their products, sourcing

raw materials with large emission footprints, and marketing products with large customer emissions. All businesses are unique, but defense

and aerospace companies are not exempt from considering climate-related risks and preparing adequate climate transition plans.

CONCLUSION

Lockheed’s failure to set emission reduction targets that cover

its Scope 3 emissions demonstrates a lack of adherence to its stakeholder’s clear expectations and exposes Lockheed to serious regulatory

and competitive risks. We urge a “Yes” vote on this proposal.

Vote “Yes” on this Shareholder Proposal 7

--

For questions, please contact David Shugar, As You Sow, david@asyousow.org

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE,

U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION

OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR

MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY,

PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

8

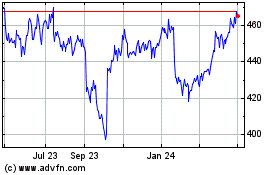

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

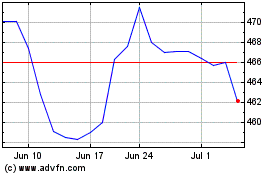

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024