Want to Invest in Space? Try These ETFs -- Journal Report

May 08 2021 - 9:29AM

Dow Jones News

By Bailey McCann

Thematic ETFs, exchange-traded funds that focus on specific

investment themes, are booming And one of the most-talked-about

themes lately is space. There is no shortage of ways to invest in

the final frontier.

The classics

Historically, the way to invest in space has been in aerospace

and defense ETFs.

Before Elon Musk was shooting cars into orbit, space exploration

was a purely governmental affair. Aerospace and defense companies

were building the rockets, and many of them still are.

Funds with large positions in companies like Boeing, Lockheed

Martin or Northrop Grumman tend to have lower volatility and

turnover than funds focused on the newer, high-growth companies

that compete in space. Aerospace and defense ETFs come in both

actively managed and passive, or index, varieties. On the passive

side, iShares U.S. Aerospace & Defense ETF (ITA) and SPDR

S&P Aerospace & Defense ETF (XAR) offer broad exposure to

the old guard of companies in this sector and low turnover. ITA has

an expense ratio of 0.44% and XAR 0.35%.

On the active side, the leveraged fund Direxion Daily Aerospace

& Defense Bull 3X Shares (DFEN) is designed for short-term

investing. This fund's goal is to provide triple the daily return

of the Dow Jones U.S. Select Aerospace & Defense Index; but it

can also triple the losses if the market goes the other way. You'll

also have to pay up for it: With an expense ratio of 0.99%, DFEN is

more expensive than an unleveraged ETF. Leveraged ETFs have grown

in popularity with investors in recent years, but it is best to

work with your financial adviser to determine whether a short-term

fund is best for your thematic investment goals.

The innovators

The space industry is still small relative to other parts of the

economy. But a number of high-profile private and listed companies

have emerged recently, with both a public-sector and consumer focus

on space -- including Mr. Musk's SpaceX, Jeff Bezos' Blue Origin,

and Virgin Galactic, founded by Richard Branson.

Even companies like Dish Network have a significant investment

in space through their use of low-orbit satellites to enhance

television and internet service. The launch of the U.S. Space Force

in 2019 has also opened a new avenue for government contracts for a

broader range of companies.

Two SPDR funds will give you passive or index-fund access to the

innovators -- SPDR S&P Kensho Future Security ETF (FITE) and

SPDR S&P Kensho Final Frontiers ETF (ROKT).

FITE has an expense ratio of 0.45% and invests in companies that

are focused on new areas of national-security importance, including

space. FITE is a bit of a combo platter in that it offers exposure

to companies that will respond to many of the mandates of the Space

Force. The fund has a mix of investments in aerospace and defense,

cybersecurity, drone development -- a range of companies that are

going to have a space tie-in even if they aren't making rockets or

supplying parts for rockets.

ROKT, meanwhile, is not a pure space play. The fund invests in

companies that explore "deep space and the deep sea," according to

its fact sheet. The fund's current investment weighting is about

66% aerospace and defense (or space), and 34% research, industrial

materials and other components used in space and deep-sea

exploration -- companies such as Hexcel Corp., which makes

high-performance composite materials and other components used in

both types of exploration. The fund has an expense ratio of

0.45%.

Procure Space ETF (UFO) from ProcureAM offers the most direct

exposure to space innovators. UFO invests only in companies that

derive a majority of their revenue from space. You'll get access to

Virgin Galactic in UFO, but also Dish, Sirius XM and Weathernews --

companies with significant investments in satellites for consumer

use. UFO is a bit pricier with an expense ratio of 0.75% and does

invest in smaller space-focused companies. which may be more

volatile.

Finally, the newest entrant: ARK Invest's ARK Space Exploration

& Innovation ETF (ARKX) will give you exposure to the

innovators and adjacent companies that are poised to benefit from

space exploration. Because ARKX has a broader mandate, you'll get

access to Virgin Galactic but also companies like Deere & Co.

which will benefit from improvements in GPS and other satellite

technologies. ARKX is actively managed, so the holdings may change

over time and the expense ratio is the same as UFO at 0.75%.

Ms. McCann is a writer in New York. She can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

May 08, 2021 09:14 ET (13:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

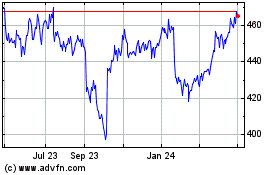

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

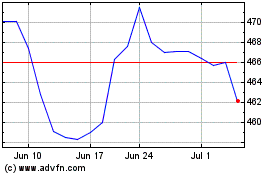

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024