By Vipal Monga and Nina Trentmann

To help shield themselves from the economic damage caused by the

coronavirus pandemic, some big U.S. manufacturers are trying

something different: They are paying their bills early.

Businesses such as Lockheed Martin Corp. and Micron Technology

Inc. that depend on complex global networks for parts and services

are worried the prolonged economic slowdown could disrupt their

supply chains. Looking to deepen ties with their suppliers, reduce

risks or grab market share, the companies are pumping money to

smaller businesses that could fail otherwise.

Perfekta Inc., a Wichita, Kan., aerospace company, received a

lifeline in early June, when Lockheed started paying its invoices

in half the time it usually takes, said Brian Bentley, Perfekta's

vice president of operations.

The maker of jet parts had already laid off 15% of its roughly

200 workers when Lockheed's payments arrived early. "This was a

pleasant surprise," Mr. Bentley said. After the cash injection,

Perfekta avoided cutting more jobs and continued making the parts

that Lockheed needs to keep its jet fighters rolling off the

assembly line.

During the second quarter, Lockheed accelerated payments

totaling about $1.3 billion to its supplier network, said Lockheed

finance chief Ken Possenriede. "We have given priority to small and

vulnerable suppliers," he said.

Such moves go against the tide of a cash-management practice

that has gained strength in many corporate treasury departments in

recent years. It is more common for companies to delay payments to

boost short-term capital they can then use for other investments.

That is especially true in times of crisis.

On average, the 849 largest nonfinancial U.S. companies took 60

days in the second quarter to pay suppliers -- a 10-year record --

according to Hackett Group, a consulting firm. The average rose 10%

from a year earlier, when U.S. companies took about 54.7 days to

pay.

Much of the recent increase is being driven by retailers,

airlines and industries that have been hurt by the pandemic.

JetBlue Airways Corp., for example, is pushing its suppliers to

take payments 90 to 120 days after invoicing, up from an average of

30 days.

"That helps you reduce your cash burn," said JetBlue Chief

Financial Officer Steve Priest, who said he isn't concerned about

the financial health of the supplier network. "We drive a hard

bargain at JetBlue."

The flexibility that extended payment terms give JetBlue and

others comes at the expense of suppliers. Those smaller companies

are often forced to tie up more of their own cash in receivables or

to eat interest costs. In some cases, the stress is too much to

bear.

Sportswear-technology company Hologenix LLC was forced into

bankruptcy protection this April when sportswear brand Under Armour

Inc. doubled the number of days it took to pay its invoices to 90

days. "It was a tough situation," said Seth Casden, Hologenix's

founder.

Under Armour said it extended vendor payment terms as its own

customers delayed payments. "As our customers are now beginning to

pay us back on normal terms, we're simultaneously doing the same

with our vendors and suppliers," a company spokesman said.

During the pandemic, where the economic damage has spread

widely, there is more danger that squeezing suppliers can rebound

on companies, said Carlos Mendez, co-founder of Crayhill Capital

Management LP, a New York asset-management firm that invests in

supply-chain financing companies.

"Companies know it's a tenuous situation," Mr. Mendez said.

"They can't continue to extend payment periods so much that they

hurt themselves."

The Pentagon set up a program to pay its big contractors, such

as Lockheed and General Dynamics Corp., in advance so they could do

the same with suppliers. General Dynamics, which makes Abrams tanks

and Gulfstream business jets, now settles its bills as soon as it

gets its orders, instead of waiting as long as 60 days to pay its

invoices.

"We are in a symbiotic relationship," said Jason Aiken, General

Dynamics' finance chief. "Any failure can cause much greater

damage." The company plans to continue the early payments at least

until the end of the year, he said.

Micron, a computer-chip maker, relies on a complex network of

companies for chemicals, semiconductor raw materials and

manufacturing support. To protect those suppliers, Micron has been

paying some of them in 10 days, compared with a previous average of

about 50 days, said Chief Financial Officer David Zinsner. The

company has advanced about $200 million in supplier payments since

late March.

Like the defense contractors, Micron's business has fared well

despite short-term disruptions from the pandemic. The memory-chip

giant's fiscal third-quarter revenue rose 14% from a year earlier,

and it has forecast higher sales in the current quarter.

In some cases, suppliers are the ones giving their customers a

break. Garbage-collection and recycling company Waste Management

Inc. in March began reaching out to small and midsize customers in

the hard-hit restaurant, hotel and education sectors. Many needed

fewer garbage collections or a pause in service while their

businesses were locked down, and Waste Management obliged, said

Chief Executive Jim Fish.

Revenue for the company declined roughly $10 million in June and

July because it paused fees, reduced some prices and gave some

customers a free month of service. Mr. Fish said the company had

been paying down debt and building cash reserves to give it a

buffer for difficult times, and used some of it to help its

customers.

"We're not overly concerned about the cost," Mr. Fish said.

"This pays itself back over time."

Write to Vipal Monga at vipal.monga@wsj.com and Nina Trentmann

at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

September 10, 2020 09:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

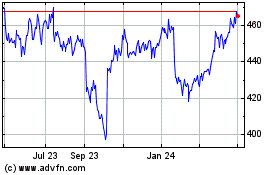

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

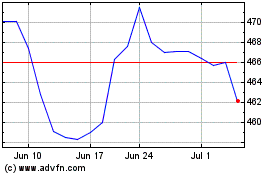

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024