UK Financial Watchdog Fines Bank of Scotland For Fraud Failures

June 21 2019 - 5:15AM

Dow Jones News

By Adam Clark

Lloyds Banking Group PLC's (LLOY.LN) Bank of Scotland arm has

been fined 45.5 million pounds ($57.3 million) for failing to

disclose information about suspicions of fraud at one of its

branches.

The U.K.'s Financial Conduct Authority said Friday that Bank of

Scotland failed to alert regulators and the police about suspicions

of fraud at its Reading branch, delaying the subsequent

investigations.

"There is no evidence anyone properly addressed their mind to

this matter or its consequences. The result risked substantial

prejudice to the interests of justice, delaying scrutiny of the

fraud by regulators, the start of criminal proceedings as well as

the payment of compensation to customers," the FCA said.

Lloyds has already paid out more than GBP96 million pounds in

compensation to customers who were victims of fraud by staff at

HBOS Reading between 2003 and 2007. Lloyds acquired HBOS in early

2009 and the FCA said its investigation focused on actions prior to

the deal.

The regulator said HBOS first identified suspicious conduct in

early 2007 but failed to understand the significance of the

situation and only provided full disclosure in July 2009, which

subsequently led to a criminal investigation. Six individuals were

convicted in 2017.

Bank of Scotland received a 30% discount on its fine in exchange

for early settlement, which would otherwise have led to a GBP65

million penalty.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

June 21, 2019 05:00 ET (09:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

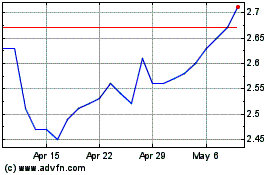

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

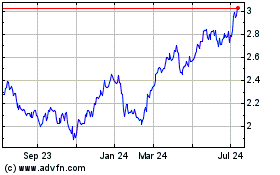

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024