SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

28

November 2018

LLOYDS BANKING GROUP

plc

(Translation of registrant's name into

English)

5th Floor

25 Gresham Street

London

EC2V 7HN

United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule

12g3-2(b):

82- ________

Index

to Exhibits

Item

No.

1 Regulatory News Service Announcement, dated 28 November

2018

re: Bank

of England 2018 Stress Test Passed

28 November 2018

LLOYDS BANKING GROUP PASSES THE BANK OF ENGLAND 2018 STRESS

TEST

Lloyds Banking Group plc (the Group), together with six other

financial institutions in the UK, has been subject to the 2018

stress test conducted by the Bank of England (BoE).

This year's stress test scenario is broadly the same as in 2017 and

thus remains the most severe test that the Group has faced, and

more severe than the last global financial crisis. The scenario

combines rapidly rising interest rates and unemployment, in

conjunction with significant falls in property prices and GDP. In

particular, base rates rise to 4 per cent in the first year and

remain at this level for a further three years, GDP reduces by 4.7

per cent in the first year, unemployment increases to a peak of 9.5

per cent in the second year, and UK house and commercial property

prices fall 33 per cent and 40 per cent, respectively over the

first three years.

This year's stress test runs under the IFRS 9 accounting standard

(rather than IAS 39) for the first time, which requires the

immediate recognition of expected lifetime losses rather than

reflecting incurred losses. The BoE assesses the stress test

results on an IFRS 9 transitional basis, in line with the phased

implementation approach. Results are also shown on an IFRS 9

fully-loaded basis.

Result of the stress test

The Group has passed the stress test on a transitional basis with

the BoE calculating the Group's transitional CET1 ratio after the

application of management actions as 9.3 per cent and its leverage

ratio as 4.5 per cent against the increased hurdle rates of 8.5 per

cent and 3.8 per cent, respectively.

Despite the severity of the stress test scenario, the Group exceeds

the capital and leverage hurdles after the application of

management actions. At the low point, the total CET1 drawdown on a

transitional basis is 20 basis points less than in the 2017 stress

test and the headroom between the CET1 ratio low point and the

hurdle rate has widened by 40 basis points to 80 basis

points.

Given this performance, the Group is not required to take any

capital actions and all capital guidance is reaffirmed, including

the Board's view of the level of CET1 required, which remains circa

13 per cent, plus a management buffer of around 1 per

cent.

The Group's capital position remains strong having reported a CET1

ratio of 14.6 per cent and a leverage ratio of 5.3 per cent, post

dividend accrual, at 30 September 2018. The Group also continues to

be strongly capital generative, having built 162 basis points of

CET1 in the first nine months of 2018, and continues to expect to

deliver circa 200 basis points for the full year which will support

an increased capital start point for the 2019 stress test (2018

start point: 14.0 per cent on a transitional basis and 13.8 per

cent on a fully loaded basis).

As stated by the BoE, there is no automatic link between the stress

test results and the setting of capital buffers. The PRA buffer is

expected to be communicated to the Group before the publication of

the Group's 2018 results.

Further details

Details of the BoE's approach to the stress test and the detailed

results in relation to all participating financial institutions are

available from the BoE website.

- END -

For further information:

Investor Relations

Douglas

Radcliffe +44

(0) 20 7356 1571

Group Investor Relations Director

douglas.radcliffe@lloydsbanking.com

Corporate Affairs

Matt

Smith

+44 (0) 20 7356

3522

Head of Media Relations

matt.smith@lloydsbanking.com

FORWARD LOOKING STATEMENTS

This document contains certain forward looking statements with

respect to the business, strategy, plans and /or results of the

Group and its current goals and expectations relating to its future

financial condition and performance. Statements that are not

historical facts, including statements about the Group's or its

directors' and/or management's beliefs and expectations, are

forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to

events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy,

plans and/or results (including but not limited to the payment of

dividends) to differ materially from forward looking statements

made by the Group or on its behalf include, but are not limited to:

general economic and business conditions in the UK and

internationally; market related trends and developments;

fluctuations in interest rates, inflation, exchange rates, stock

markets and currencies; the ability to access sufficient sources of

capital, liquidity and funding when required; changes to the

Group's credit ratings; the ability to derive cost savings and

other benefits including, but without limitation as a result of any

acquisitions, disposals and other strategic transactions; changing

customer behaviour including consumer spending, saving and

borrowing habits; changes to borrower or counterparty credit

quality; instability in the global financial markets, including

Eurozone instability, instability as a result of the exit by the UK

from the European Union (EU) and the potential for other countries

to exit the EU or the Eurozone and the impact of any

sovereign credit rating downgrade or other sovereign financial

issues; technological changes and risks to the security of IT and

operational infrastructure, systems, data and information

resulting from increased threat of cyber and other

attacks; natural, pandemic and other disasters, adverse weather and

similar contingencies outside the Group's control; inadequate or

failed internal or external processes or systems; acts of war,

other acts of hostility, terrorist acts and responses to those

acts, geopolitical, pandemic or other such events; changes in laws,

regulations, practices and accounting standards or taxation,

including as a result of the exit by the UK from the EU, or a

further possible referendum on Scottish independence; changes to

regulatory capital or liquidity requirements and similar

contingencies outside the Group's control; the policies, decisions

and actions of governmental or regulatory authorities or courts in

the UK, the EU, the US or elsewhere including the implementation

and interpretation of key legislation and regulation together with

any resulting impact on the future structure of the Group; the

ability to attract and retain senior management and other employees

and meet its diversity objectives; actions or omissions by the

Group's directors, management or employees including industrial

action; changes to the Group's post-retirement defined benefit

scheme obligations; the extent of any future impairment charges or

write-downs caused by, but not limited to, depressed asset

valuations, market disruptions and illiquid markets; the value and

effectiveness of any credit protection purchased by the Group; the

inability to hedge certain risks economically; the adequacy of loss

reserves; the actions of competitors, including non-bank financial

services, lending companies and digital innovators and disruptive

technologies; and exposure to regulatory or competition scrutiny,

legal, regulatory or competition proceedings, investigations or

complaints. Please refer to the latest Annual Report on Form 20-F

filed with the US Securities and Exchange Commission for a

discussion of certain factors and risks together with examples of

forward looking statements. Except as required by any applicable

law or regulation, the forward looking statements contained in this

document are made as of today's date, and the Group expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward looking statements contained in

this document to reflect any change in the Group's expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statement is based. The

information, statements and opinions contained in this document do

not constitute a public offer under any applicable law or an offer

to sell any securities or financial instruments or any advice or

recommendation with respect to such securities or financial

instruments.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

LLOYDS

BANKING GROUP plc

(Registrant)

By: Douglas

Radcliffe

Name: Douglas

Radcliffe

Title: Group

Investor Relations Director

Date:

28 November 2018

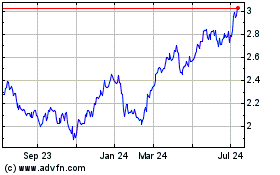

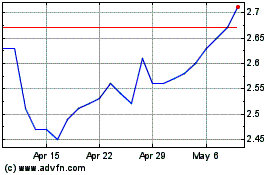

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024