Lincoln Financial Group Offers Faster Route From Planning to Protection With New, Fully Automated Life Product

January 24 2023 - 10:00AM

Business Wire

Lincoln WealthAccelerate SM is an indexed

universal life product with a streamlined, electronic process from

application to policy management.

Lincoln Financial Group (NYSE: LNC) continues to advance the

life insurance business model while improving the customer

experience with the introduction of Lincoln WealthAccelerateSM, an

indexed universal life (IUL) product offering a fully digital and

automated experience to consumers.

As the world becomes more digitally focused, consumers expect

ease and accessibility from their financial products. Lincoln

WealthAccelerateSM meets those changing consumer expectations

through a streamlined product with the advantages of indexed

universal life insurance – access to a cash value component in

addition to a death benefit – and the ease of a fully electronic

process guided by an experienced financial professional.

“Today’s life insurance customer is changing – they’re digitally

savvy, expect faster and simpler processes and want flexibility,”

said Matt Grove, executive vice president and president, Retail

Solutions, Lincoln Financial Group. “WealthAccelerateSM meets their

expectations by offering a more streamlined and convenient

experience and helping them and their families feel more confident

through all of life’s changes.”

WealthAccelerateSM is available to customers ages 20 to 55 with

protection needs from $100,000 to $1.5 million. The product offers

protections for every phase of life, including a permanent life

insurance death benefit and options that cover critical and chronic

illness expenses to meet a policyholder’s long-term care

needs1.

WealthAccelerateSM features a simplified product design that

gives consumers access to a policy’s cash value2 and a fully

electronic underwriting process, including:

- Paperless, electronic submission with automated

underwriting

- Online or phone client interview for application

completion

- Lab-free opportunity for qualifying clients with speedy

underwriting from Lincoln’s dedicated, in-house team

- No Attending Physician Statement (APS) requirement for

submissions

- Electronic policy delivery on all cases

With access to a policy’s cash value, along with a personalized

customer portal, WealthAccelerateSM policyholders get the

protections they need and the convenience they want. For more

information, visit the Lincoln Financial Group Life Insurance

product page here.

About Lincoln Financial Group

Lincoln Financial Group provides advice and solutions that help

people take charge of their financial lives with confidence and

optimism. Today, approximately 16 million customers trust our

retirement, insurance and wealth protection expertise to help

address their lifestyle, savings and income goals, and guard

against long-term care expenses. Headquartered in Radnor,

Pennsylvania, Lincoln Financial Group is the marketing name for

Lincoln National Corporation (NYSE: LNC) and its affiliates. The

company had $279 billion in end-of-period account values as of

December 31, 2022. Lincoln Financial Group is a committed corporate

citizen included on major sustainability indices including the Dow

Jones Sustainability Index North America and FTSE4Good and ranks

among Newsweek’s Most Responsible Companies. Dedicated to

diversity, equity and inclusion, we are included on transparency

benchmarking tools such as the Corporate Equality Index, the

Disability Equality Index and the Bloomberg Gender-Equality Index.

Committed to providing our employees with flexible work

arrangements, we were named to FlexJobs’ list of the Top 100

Companies to Watch for Remote Jobs in 2022. With a long and rich

legacy of acting ethically, telling the truth and speaking up for

what is right, Lincoln was recognized as one of Ethisphere’s 2022

World’s Most Ethical Companies®. Learn more at:

www.LincolnFinancial.com. Follow us on Facebook, Twitter, LinkedIn,

and Instagram. Sign up for email alerts at

http://newsroom.lfg.com.

Lincoln Financial Group® affiliates, their distributors, and

their respective employees, representatives, and/or insurance

agents do not provide tax, accounting, or legal advice. Please

consult an independent professional as to any tax, accounting, or

legal statements made herein.

Lincoln WealthAccelerateSM IUL is issued on policy form

ICC22-UL6093/UL6093 and state variations by The Lincoln National

Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln

Financial Distributors, Inc., a broker-dealer. The Lincoln National

Life Insurance Company does not solicit business in the state of

New York, nor is it authorized to do so.

All guarantees and benefits of the insurance policy are subject

to the claims-paying ability of the issuing insurance company. They

are not backed by the broker-dealer and/or insurance agency selling

the policy, or any affiliates of those entities other than the

issuing company affiliates, and none makes any representations or

guarantees regarding the claims-paying ability of the issuer.

Products, riders and features are subject to state availability.

Limitations and exclusions may apply. Not available in New York.

Check state availability.

It is possible coverage will expire when either no premiums are

paid following the initial premium, or subsequent premiums are

insufficient to continue coverage.

______________________________ 1 Additional costs may apply. 2

Access to cash values is through loans and withdrawals, which will

reduce cash value and death benefit amounts, may cause the policy

to lapse and may have tax consequences.

LCN-5398851-010623

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230123005131/en/

Media: Patrick Wright 980-322-4527

patrick.wright@lfg.com

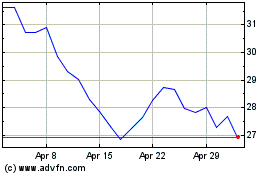

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Apr 2023 to Apr 2024