Most Americans See Room to Improve Their Overall Financial Wellness in 2023, Says New Lincoln Financial Group Study

December 19 2022 - 11:02AM

Business Wire

Company encourages consumers to resolve to

protect their family and their finances this New Year by adding a

little TLC using three simple tips

After a holiday season racking up credit card bills, Americans

considering financial resolutions in the New Year are in good

company. When looking back on 2022, 88% of Americans see room for

improvement in their overall financial wellness and 71% say they

are likely to set financial goals in 2023, according to new data

from Lincoln Financial Group’s Consumer Sentiment Tracker. Now is

the perfect time for consumers to not only re-evaluate their saving

and spending, but also resolve to create a more holistic financial

plan that protects their finances and their family by adding a

little TLC using three simple tips.

Lincoln Financial’s study also found consumers are seeking

stability and preparedness in today’s uncertain economic

environment. With ongoing inflation and market volatility, 56% of

respondents cited protection from risk as being most important to

them. When it comes to thinking about their finances, people said

they have the greatest interest in protecting their family (39%)

followed by their income (26%).

“Our research reinforced the importance of financial solutions

that can help consumers navigate through market cycles and protect

their loved ones,” said David Berkowitz, president, Lincoln

Financial Network, Lincoln Financial’s wealth management business.

“People are not only concerned about having enough to pay their

bills, but also saving for retirement and preparing for the

unexpected. It’s important to have a well-rounded financial plan

that can address those risks, protect assets and create positive

outcomes for today’s families.”

To achieve a stronger financial future, consumers interested in

setting financial goals can start by adding a little TLC (Talk,

Learn, Commit). Resolve to create a robust financial plan using

these three tips from Lincoln Financial:

- Talk about it. Financial conversations play a crucial

role. Be transparent with loved ones about financial priorities to

set expectations and work toward shared financial goals. Initiate

ongoing discussions to stay on track with everything from saving

for retirement to paying for a long-term healthcare event, which

can happen suddenly and be very costly. Also, consider talking to a

financial professional who can help identify solutions that best

meet individual needs, as well as drive better outcomes. Lincoln’s

research found those who work with financial professionals are more

likely to prioritize retirement savings (26% vs. 10%).

- Learn more about tax-deferred investments. Life

insurance can be more than just a death benefit, with some types of

policies offering income replacement for unforeseen events. It can

also protect financial security from the impact of taxes, market

volatility and longevity. It’s not just for individuals and

families, but businesses too. Also, consider diversifying your

portfolio with an annuity, which can provide protected growth and

monthly lifetime income to help cover expenses in retirement and

ensure a stream of income.

- Commit to maximizing your workplace benefits. Look into

supplemental coverages like disability, accident and life insurance

that may be available through one’s employer. Solutions like these

protect against unexpected events that can disrupt the ability to

provide for family or create additional debt. For those with an

employer-sponsored retirement plan, contribute and get the match,

if offered. Tap into any financial wellness tools offered at work

to help provide an accurate picture of your holistic financial

situation and lower stress.

Visit www.lfg.com for more tools and resources.

Consumer Sentiment Tracker 2022 Methodology The goal of

this research is to gauge consumer sentiment on a variety of

financial topics. Data was collected in March, April, May, June,

July, September, October, and November 2022 using the Qualtrics

survey platform. Responses were collected from a total of 1000+

U.S. adults each month. The sample included quotas to be

representative of the total U.S. adult population.

About Lincoln Financial Group Lincoln Financial Group

provides advice and solutions that help people take charge of their

financial lives with confidence and optimism. Today, approximately

16 million customers trust our retirement, insurance and wealth

protection expertise to help address their lifestyle, savings and

income goals, and guard against long-term care expenses.

Headquartered in Radnor, Pennsylvania, Lincoln Financial Group is

the marketing name for Lincoln National Corporation (NYSE:LNC) and

its affiliates. The company had $270 billion in end-of-period

account values as of September 30, 2022. Lincoln Financial Group is

a committed corporate citizen included on major sustainability

indices including the Dow Jones Sustainability Index North America

and FTSE4Good and ranks among Newsweek’s Most Responsible

Companies. Dedicated to diversity, equity and inclusion, we are

included on transparency benchmarking tools such as the Corporate

Equality Index, the Disability Equality Index and the Bloomberg

Gender-Equality Index. Committed to providing our employees with

flexible work arrangements, we were named to FlexJobs’ list of the

Top 100 Companies to Watch for Remote Jobs in 2022. With a long and

rich legacy of acting ethically, telling the truth and speaking up

for what is right, Lincoln was recognized as one of Ethisphere’s

2022 World’s Most Ethical Companies®. We create opportunities for

early career talent through our intern development program, which

ranks among WayUp and Yello’s annual list of Top 100 Internship

Programs. Learn more at: www.LincolnFinancial.com. Follow us on

Facebook, Twitter, LinkedIn, and Instagram. Sign up for email

alerts at http://newsroom.lfg.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221219005573/en/

Media: Holly Fair Lincoln

Financial Group 484-583-1632 Holly.fair@lfg.com

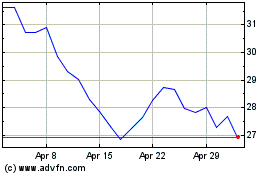

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Apr 2023 to Apr 2024