Available through Lincoln’s proprietary

WellnessPATH® solution, the marketplace will connect employees with

financial wellness resources, starting with student debt solutions

in 2023.

Lincoln Financial Group’s (NYSE: LNC) Workplace Solutions

business announced today an expansion of its financial wellness

program with the launch of a new marketplace that connects

individuals with partner companies that offer solutions to help

improve financial wellness. Lincoln Financial’s propriety financial

wellness tool, WellnessPATH®, already offers users a holistic

financial picture along with a personalized plan of action. With

the integration of the marketplace in 2023, users will now be able

to access third-party solutions and resources that can help them on

their financial wellness journey in one, easy-to-navigate,

aggregated experience.

Lincoln will launch its financial wellness marketplace with a

new partnership that will help employees and their families tackle

student loan debt and savings. Candidly, a leading student

debt management platform, offers users options to plan, borrow,

repay and reassess their debt, and provides support and assistance

with federal student loan forgiveness programs and

applications.

Currently, student loan debt in America exceeds $1.77 trillion1,

and research from Lincoln Financial shows eight in 10 workers hold

some form of debt, including credit card, mortgage and student

loans2. By offering support and financial wellness resources,

employers can help ease some of the burden this debt may be

causing. In fact, nearly all employees surveyed who have used

financial wellness resources report a positive impact – and 42% say

the impact has been significant3.

“Lincoln is committed to helping drive positive outcomes and

make benefits more beneficial for employers, employees and their

families,” said James Reid, executive vice president, president,

Workplace Solutions, Lincoln Financial Group. “The resources and

solutions that will be available through our new financial wellness

marketplace, beginning with our newest partnership with Candidly,

will offer employers a significant opportunity to improve

employees’ financial health through every life stage, while also

strengthening their business by helping them attract, retain and

engage top talent.”

Candidly’s student debt platform helps users make progress on

paying down student debt and also helps families plan for future

expenses. Candidly’s suite of services includes:

- Public Service Loan Forgiveness (PSLF): Enables

borrowers to determine eligibility status and tracking for PSLF

applications. The platform allows users to quickly and easily

request employment certification and set up recertification

reminders.

- Student loan dashboard: Users can manage and keep track

of multiple loans through Candidly’s student loan dashboard. The

dashboard offers a custom view of loan status, balance and monthly

payments and access to tools and resources for borrowers.

- College planning: Explore strategies for college

savings, finding scholarships and navigating financial aid. Users

can also compare and apply for funds and access informative

articles and how-to guides.

Saving, spending, debt and protection: How Lincoln

WellnessPATH® can help

Lincoln continues to expand its financial wellness program

through its proprietary financial wellness tool, Lincoln

WellnessPATH®, available to all Workplace Solutions customers.

Designed to improve financial health and management skills, the

easy-to-use tool helps employees learn about investing, saving and

budgeting with the ability to set goals and track their financial

status. After completing a simple quiz, employees are given a

personalized financial wellness score that is divided into four

categories: spending, protection, debt and saving. WellnessPATH®

features include:

- Actionable web content: Always-available web-based

self-serve content, including articles, videos, calculators,

gamified tools, worksheets and checklists.

- One-on-one support: Personalized education and support

offered wherever and whenever users need it — in person, over the

phone or via video chat.

- Personalized access: The interactive tool allows users

to access aggregated accounts, in addition to goal setting and

budget features that help users set and track progress toward

personalized goals.

- NEW financial wellness marketplace: Beginning with

Candidly in 2023, Lincoln will continue to add new partnership to

its marketplace, helping connect employees with financial wellness

resources and solutions to help them work toward their goals.

“We know employees are interested in improving their finances,

but they need help navigating the competing financial priorities of

today,” said Sharon Scanlon, senior vice president, Customer

Experience and Transformation, Lincoln Financial Group. “Our newly

expanded tools, solutions available through our marketplace and

continued investments in financial wellness resources allow us to

partner with employers to help more Americans take charge of their

financial futures.”

Lincoln WellnessPATH® and the marketplace it will offer,

starting with the partnership with Candidly, are just one part of

the company’s robust benefit and protection offering to customers.

Lincoln Financial is committed to offering new and innovative

products and solutions, and continues to expand and enhance its

workplace benefits and retirement savings offerings, helping more

and more Americans plan for and achieve the financial future they

envision.

About Lincoln Financial Group

Lincoln Financial Group provides advice and solutions that help

people take charge of their financial lives with confidence and

optimism. Today, approximately 16 million customers trust our

retirement, insurance and wealth protection expertise to help

address their lifestyle, savings and income goals, and guard

against long-term care expenses. Headquartered in Radnor,

Pennsylvania, Lincoln Financial Group is the marketing name for

Lincoln National Corporation (NYSE:LNC) and its affiliates. The

company had $270 billion in end-of-period account values as of

September 30, 2022. Lincoln Financial Group is a committed

corporate citizen included on major sustainability indices

including the Dow Jones Sustainability Index North America and

FTSE4Good and ranks among Newsweek’s Most Responsible Companies.

Dedicated to diversity, equity and inclusion, we are included on

transparency benchmarking tools such as the Corporate Equality

Index, the Disability Equality Index and the Bloomberg

Gender-Equality Index. Committed to providing our employees with

flexible work arrangements, we were named to FlexJobs’ list of the

Top 100 Companies to Watch for Remote Jobs in 2022. With a long and

rich legacy of acting ethically, telling the truth and speaking up

for what is right, Lincoln was recognized as one of Ethisphere’s

2022 World’s Most Ethical Companies®. We create opportunities for

early career talent through our intern development program, which

ranks among WayUp and Yello’s annual list of Top 100 Internship

Programs. Learn more at: www.LincolnFinancial.com. Follow us on

Facebook, Twitter, LinkedIn, and Instagram. Sign up for email

alerts at http://newsroom.lfg.com.

Candidly is not an affiliate of Lincoln Financial Group. Lincoln

Financial Group and its financial professionals do not provide

banking or lending services or advice related to such and are not

responsible for, and make no representations or endorsements

regarding, the quality, accuracy, or reliability of information

provided by Candidly, its representatives, or its websites.

Lincoln Financial Group will receive a marketing distribution

fee from Candidly if you choose to enroll in its services or apply

for a student loan.

LCN-5346919-121222

_______________________

1 Federal Reserve, as of 9/30/22:

https://www.federalreserve.gov/releases/g19/current

2 2021 Lincoln Retirement Power® Study

3 Lincoln Financial, Wellness at Work Study 2022

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221215005888/en/

Media: Anastasia Barbalios anastasia.barbalios@lfg.com

215-201-9012

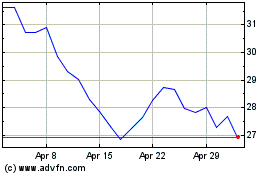

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Apr 2023 to Apr 2024