Liberty All-Star® Growth Fund

Periods Ended

September 30, 2024 (Unaudited)

| Fund Statistics |

|

| Net Asset Value (NAV) |

$6.03 |

| Market Price |

$5.61 |

| Discount |

-7.0% |

| |

Quarter |

Year-to-Date |

| Distributions* |

$0.12 |

$0.35 |

| Market Price Trading Range |

$4.98 to $5.69 |

$4.97 to $5.69 |

| Discount Range |

-6.2% to -9.3% |

-6.2% to -10.2% |

| |

|

|

| Performance |

|

|

| Shares Valued at NAV with Dividends Reinvested |

5.75% |

11.90% |

| Shares Valued at Market Price with Dividends Reinvested |

7.41% |

13.37% |

| Dow Jones Industrial Average |

8.72% |

13.93% |

| Lipper Multi-Cap Growth Mutual Fund Average |

5.07% |

19.34% |

| NASDAQ Composite Index |

2.76% |

21.84% |

| Russell Growth Average |

5.92% |

17.50% |

| S&P 500®

Index |

5.89% |

22.08% |

| * |

Sources of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The final determination of the source of all distributions in 2024 for tax reporting purposes will be made after year end. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Based on current estimates a portion of the distributions consist of a return of capital. Pursuant to Section 852 of the Internal Revenue Code, the taxability of these distributions will be reported on Form 1099-DIV for 2024. |

Performance returns for the Fund are total returns,

which include dividends. Returns are net of management fees and other Fund expenses. The returns shown for the Lipper Multi-Cap Growth

Mutual Fund Average are based on open-end mutual funds’ total returns, which include dividends, and are net of fund expenses. Returns

for the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index, the Russell Growth Average and the S&P 500®

Index are total returns, including dividends. A description of the Lipper benchmark and the market indices can be found on page 17.

Past performance cannot predict future results.

Performance will fluctuate with market conditions. Current performance may be lower or higher than the performance data shown. Performance

information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment

in the Fund involves risk, including loss of principal. Closed-end funds raise money in an initial public offering and shares are listed

and traded on an exchange. Open-end mutual funds continuously issue and redeem shares at net asset value. Shares of closed-end funds frequently

trade at a discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are

beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

The views expressed in the President’s letter

reflect the views of the President as of October 2024 and may not reflect his views on the date this report is first published or anytime

thereafter. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult

to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any

time based upon economic, market or other conditions and the Fund disclaims any responsibility to update such views. These views may not

be relied on as investment advice and, because investment decisions for the Fund are based on numerous factors, may not be relied on as

an indication of trading intent.

| Liberty All-Star® Growth Fund |

President’s Letter |

| |

(Unaudited) |

| Fellow Shareholders: |

October

2024 |

With signs indicating that the tide had turned

in the battle against inflation—and that interest rate reductions were imminent—stocks overcame occasional choppiness to

post gains in the third quarter, with the S&P 500® Index and the Dow Jones Industrial Average notching record highs

along the way. The S&P 500® is off to its best start to a year since 1997 when the dotcom bubble was in full swing.

Growing belief the economy is in for a soft landing has resulted in the index posting 43 record highs through nine months of the year.

In addition, a range of data consistently indicated that economic activity was both strong and sustainable. The highlight of the quarter

came on September 18 when the Federal Reserve lowered the fed funds rate by half a percentage point (50 basis points) and hinted that

further reductions could be in store by year-end. What was perhaps the key data point surfaced in late July when the Commerce Department

reported that GDP advanced a strong 2.8 percent in the second quarter (later revised upward to 3.0 percent). This was well ahead of the

first quarter’s rate of 1.4 percent and gave credence to the soft-landing narrative, in which inflation eases without spawning

a recession.

The S&P 500® returned 5.89

percent for the quarter, building on previous quarterly advances that carried the large-cap benchmark to a gain of 22.08 percent through

nine months. The Dow Jones Industrial Average (DJIA) returned 8.72 percent for the quarter, led by strong returns from names like 3M,

IBM and McDonald’s; the index returned 13.93 percent through nine months. The NASDAQ Composite returned 2.76 percent for the quarter;

the index’s return of 21.84 percent through nine months narrowly trailed the S&P 500® after leading through

the first six months. Driven by technology stocks through the first half, the market broadened out during the quarter—especially

in July—as a diverse range of industries and companies benefited from a stable economic environment.

The catalyst for the broader market was a Consumer

Price Index report in early July showing that prices fell 0.1 percent in June, lowering the annual inflation rate to 3.0 percent. That

triggered a sell-off in technology stocks, while the real estate, utilities, financials and industrials sectors rallied. Indicative of

the broadening, for July the NASDAQ Composite returned -0.73 percent while the S&P 500® gained 1.22 percent; the DJIA,

which has the greatest value orientation of the three, made a strong move, returning 4.51 percent for the month.

In early August, the unemployment rate rose from

4.1 percent to 4.3 percent, triggering a brief sell-off. Meanwhile the shift remained in place, but moderated during August when the

NASDAQ, S&P 500® and DJIA, respectively, returned 0.74 percent, 2.43 percent and 2.03 percent. September saw technology

stocks resume market leadership, exemplified by the NASDAQ returning 2.76 percent, followed by 2.14 percent for the S&P 500®

and 1.96 percent for the DJIA.

Predictions of an imminent recession have been

rebuffed to date. Geopolitical tensions, an imminent U.S. election and countervailing economic reports—regarding employment, wages,

prices, consumer confidence, manufacturing activity and other factors—meant that more than many quarters 3Q24 experienced bouts

of trading extremes. The DJIA rallied over six straight trading sessions in early July only to lose over 900 points the next two days.

What is perhaps the most magnificent of the so-called “Magnificent Seven1” stocks, NVIDIA, fell nearly 6.8 percent

on July 24 only to gain 12.8 percent on July 31. In the span of one week (beginning August 5), the S&P 500® had its

best and worst trading days in nearly two years. Beginning on September 9, the S&P 500®, DJIA and NASDAQ enjoyed their

best week of the year. And the DJIA surged past the 42000 level on September 19.

In contrast to recent quarters, large-cap growth

stocks did not deliver the highest returns among the capitalization ranges. The large-cap Russell 1000® Growth Index returned

3.19 percent in the third quarter, which was topped by the 6.54 percent return of the Russell Midcap® Growth Index and

the even higher 8.41 percent return of the small-cap Russell 2000® Growth Index. Through nine months of the year, however,

the large-cap Russell index remained well ahead; returns for the midcap and small-cap indices were within a half percentage point of

each other at a level about half that of the large-cap index.

| 1 |

Those stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla. |

| Third Quarter Report (Unaudited) | September 30, 2024 |

1 |

| Liberty

All-Star® Growth Fund |

President’s Letter |

| |

(Unaudited) |

Liberty All-Star® Growth Fund

Liberty All-Star Growth Fund posted solid absolute

and relative returns for the quarter. The Fund returned 5.75 percent when shares are valued at net asset value (NAV) with dividends reinvested

and 7.41 percent when shares are valued at market price with dividends reinvested. (Fund returns are net of expenses.) The Fund’s

market price return was ahead of the S&P 500® and the NASDAQ Composite; it trailed only the strong 8.72 percent return

of the DJIA. The Fund’s NAV return was not as strong but outperformed the NASDAQ Composite and the 5.07 percent return of the Fund’s

primary benchmark, the Lipper Multi-Cap Growth Mutual Fund Average.

Fund returns were helped by small- and mid-cap

strength in July but hindered when small-cap issues lost some of their momentum in August. Overall for the quarter, stock selection and

an overweight to financials/underweight to information technology contributed to return while stock selection in the industrials sector

detracted from return.

Through the first nine months of the year, both

measures of Fund performance delivered double-digit gains: 11.90 percent when shares are valued at NAV with dividends reinvested and 13.37

percent when shares are valued at market price with dividends reinvested. Nevertheless, Fund returns lagged through three quarters owing

to extreme concentration in the first half, when a handful of mega-cap technology stocks that rallied around the potential of artificial

intelligence (AI) distorted returns.

The discount at which Fund shares traded relative

to their underlying NAV declined during the third quarter. Fund shares traded at discounts to NAV ranging from -6.2 percent to -9.3 percent.

Year to date, the discount extended from -6.2 percent to -10.2 percent.

In accordance with the Fund’s distribution

policy, the Fund paid a distribution of $0.12 per share in the third quarter, bringing the total distributed to shareholders since 1997,

when the distribution policy commenced, to $17.28 per share for a total of more than $460 million. The Fund’s distribution policy

is a major component of the Fund’s total return, and we continue to emphasize that shareholders should include these distributions

when determining the total return on their investment in the Fund.

Turning to Fund news, shareholders overwhelmingly

approved Westfield Capital Management to replace Sustainable Growth Advisers as the Fund’s large-cap growth manager. The change,

effective September 3, was implemented smoothly. We look forward to sharing more in-depth information about the new manager in the 2024

Annual Report.

The third quarter’s greater market breadth

was a hopeful sign. While not perhaps signaling a regime reversal in which mega-cap technology stocks surrender market leadership, the

greater participation by diverse large-cap stocks and, especially, mid- and small-cap stocks, was especially welcome. Such a broadening,

if it can endure, is healthy for stocks, the economy and, obviously, for long-term investors. Liberty All-Star Growth Fund represents

those attributes: not only a long-term view and diversification but also quality and a focus on investors’ best interests. We remain

resolute in our belief in these attributes.

Sincerely,

Mark T. Haley, CFA

President

Liberty All-Star® Growth Fund,

Inc.

| |

Table

of Distributions, |

| Liberty

All-Star® Growth Fund |

Rights

Offerings and Distribution Policy |

| |

(Unaudited) |

| |

|

Rights Offerings |

| Year |

Per Share

Distributions |

Month

Completed |

Shares Needed to Purchase

One Additional Share |

Subscription

Price |

| 1997 |

$1.24 |

|

|

|

| 1998 |

1.35 |

July |

10 |

$12.41 |

| 1999 |

1.23 |

|

|

|

| 2000 |

1.34 |

|

|

|

| 2001 |

0.92 |

September |

8 |

6.64 |

| 2002 |

0.67 |

|

|

|

| 2003 |

0.58 |

September |

81 |

5.72 |

| 2004 |

0.63 |

|

|

|

| 2005 |

0.58 |

|

|

|

| 2006 |

0.59 |

|

|

|

| 2007 |

0.61 |

|

|

|

| 2008 |

0.47 |

|

|

|

| 20092 |

0.24 |

|

|

|

| 2010 |

0.25 |

|

|

|

| 2011 |

0.27 |

|

|

|

| 2012 |

0.27 |

|

|

|

| 2013 |

0.31 |

|

|

|

| 2014 |

0.33 |

|

|

|

| 20153 |

0.77 |

|

|

|

| 2016 |

0.36 |

|

|

|

| 2017 |

0.42 |

|

|

|

| 2018 |

0.46 |

November |

3 |

4.81 |

| 2019 |

0.46 |

|

|

|

| 2020 |

0.63 |

March |

5 |

4.34 |

| 2021 |

1.02 |

June |

51 |

8.21 |

| 2022 |

0.50 |

|

|

|

| 2023 |

0.43 |

|

|

|

| 2024 |

|

|

|

|

| 1st Quarter |

0.11 |

|

|

|

| 2nd Quarter |

0.12 |

|

|

|

| 3rd Quarter |

0.12 |

|

|

|

| Total |

$17.28 |

|

|

|

| 1 |

The number of shares offered was increased by an additional 25 percent to cover a portion of the over-subscription requests. |

| 2 |

Effective with the second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent. |

| 3 |

Effective with the second quarter distribution, the annual distribution rate was changed from 6 percent to 8 percent. |

DISTRIBUTION POLICY

The current policy is to pay distributions on

its shares totaling approximately 8 percent of its net asset value per year, payable in four quarterly installments of 2 percent of the

Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Sources

of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The final determination

of the source of all distributions in 2024 for tax reporting purposes will be made after year end. The actual amounts and sources of the

amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and

may be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Fund provides

a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization

(for the full year’s distributions) contained in shareholder 1099-DIV forms after the end of the year. If the Fund’s ordinary

dividends and long-term capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion,

retain and not distribute capital gains and pay income tax thereon to the extent of such excess.

| Third Quarter Report (Unaudited) | September 30, 2024 |

3 |

| Liberty All-Star® Growth Fund |

Stock Changes in the Quarter |

| |

(Unaudited) |

The following are the largest ($2 million or more)

stock changes - both purchases and sales - that were made in the Fund’s portfolio during the third quarter of 2024, excluding transactions

from the transition to Westfield Capital Management Company, L.P.

| |

Shares |

| Security Name |

Purchases (Sales) |

Held as of 9/30/24 |

| Purchases |

|

|

| American Eagle Outfitters, Inc. |

127,952 |

127,952 |

| AptarGroup, Inc. |

16,184 |

16,184 |

| Curtiss-Wright Corp. |

10,000 |

10,000 |

| Halozyme Therapeutics, Inc. |

50,000 |

50,000 |

| Onto Innovation, Inc. |

14,500 |

14,500 |

| PTC, Inc. |

15,000 |

15,000 |

| US Foods Holding Corp. |

50,000 |

50,000 |

| |

|

|

| Sales |

|

|

| Avery Dennison Corp. |

(12,893) |

1,107 |

| Darden Restaurants, Inc. |

(19,500) |

0 |

| Entegris, Inc. |

(20,000) |

0 |

| Keysight Technologies, Inc. |

(15,000) |

0 |

| STERIS PLC |

(12,500) |

0 |

| Transcat, Inc. |

(15,905) |

20,798 |

| Vertex, Inc. |

(88,739) |

86,914 |

| WillScot Mobile Mini Holdings Corp. |

(55,000) |

0 |

| Liberty All-Star® Growth Fund |

Top 20 Holdings & Economic Sectors |

| |

September 30, 2024 (Unaudited) |

| Top 20 Holdings* |

Percent of Net Assets |

| NVIDIA Corp. |

3.56% |

| Apple, Inc. |

3.15 |

| Microsoft Corp. |

2.94 |

| Amazon.com, Inc. |

2.70 |

| Alphabet, Inc. |

2.05 |

| Meta Platforms, Inc. |

2.02 |

| SPS Commerce, Inc. |

1.96 |

| Natera, Inc. |

1.96 |

| FirstService Corp. |

1.95 |

| Casella Waste Systems, Inc. |

1.73 |

| Hamilton Lane, Inc. |

1.62 |

| StepStone Group, Inc. |

1.62 |

| Glaukos Corp. |

1.57 |

| Tandem Diabetes Care, Inc. |

1.33 |

| Visa, Inc. |

1.30 |

| TransDigm Group, Inc. |

1.27 |

| Ollie's Bargain Outlet Holdings, Inc. |

1.23 |

| Booz Allen Hamilton Holding Corp. |

1.05 |

| Casey's General Stores, Inc. |

1.03 |

| Brown & Brown, Inc. |

1.02 |

| |

37.06% |

| Economic Sectors* |

Percent of Net Assets |

| Information Technology |

29.14% |

| Health Care |

18.05 |

| Industrials |

16.81 |

| Financials |

11.01 |

| Consumer Discretionary |

9.45 |

| Communication Services |

5.53 |

| Consumer Staples |

3.86 |

| Real Estate |

2.33 |

| Materials |

0.78 |

| Energy |

0.76 |

| Other Net Assets |

2.28 |

| |

100.00% |

| * |

Because the Fund is actively managed, there can be no guarantee that the Fund will continue to hold securities of the indicated issuers and sectors in the future. |

| Third Quarter Report (Unaudited) | September 30, 2024 |

5 |

| |

Investment Managers/ |

| Liberty All-Star® Growth Fund |

Portfolio Characteristics |

| |

(Unaudited) |

THE FUND’S THREE GROWTH INVESTMENT MANAGERS

AND THE MARKET CAPITALIZATION ON WHICH EACH

FOCUSES:

ALPS Advisors, Inc., the investment advisor to

the Fund, has the ultimate authority (subject to oversight by the Board of Directors) to oversee the investment managers and recommend

their hiring, termination and replacement.

MANAGERS’ DIFFERING INVESTMENT STRATEGIES

ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The portfolio characteristics table below is a

regular feature of the Fund’s shareholder reports. It serves as a useful tool for understanding the value of the Fund’s multi-managed

portfolio. The characteristics are different for each of the Fund’s three investment managers. These differences are a reflection

of the fact that each has a different capitalization focus and investment strategy. The shaded column highlights the characteristics of

the Fund as a whole, while the first three columns show portfolio characteristics for the Russell Smallcap, Midcap and Largecap Growth

indices. See page 17 for a description of these indices.

PORTFOLIO CHARACTERISTICS As

of September 30, 2024 (Unaudited)

| |

|

|

|

Market Capitalization Spectrum |

|

| |

Russell Growth |

Small |

|

Large |

|

| |

Smallcap |

Midcap |

Largecap |

|

Total |

| |

Index |

Index |

Index |

Weatherbie |

Congress |

Westfield |

Fund |

| Number of Holdings |

1,120 |

288 |

440 |

49 |

40 |

37 |

125* |

| Percent of Holdings in Top 10 |

7% |

16% |

57% |

48% |

30% |

61% |

25% |

| Weighted Average Market Capitalization (billions) |

$4.2 |

$30.5 |

$1,528.5 |

$5.6 |

$17.4 |

$1,404.0 |

$504.0 |

| Average Five-Year Earnings Per Share Growth |

18% |

18% |

21% |

11% |

16% |

22% |

18% |

| Average Five-Year Sales Per Share Growth |

11% |

16% |

18% |

13% |

12% |

16% |

14% |

| Price/Sales Ratio |

2.1x |

3.5x |

5.4x |

3.3x |

2.8x |

5.6x |

3.6x |

| Price/Book Value Ratio |

4.6x |

10.5x |

9.9x |

5.4x |

5.5x |

10.1x |

6.5x |

| * |

Certain holdings are held by more than one manager. |

| Liberty All-Star® Growth Fund |

Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (97.72%) | |

| | | |

| | |

| COMMUNICATION SERVICES (5.53%) | |

| | | |

| | |

| Entertainment (1.46%) | |

| | | |

| | |

| Netflix, Inc.(a) | |

| 3,757 | | |

$ | 2,664,727 | |

| Take-Two Interactive Software, Inc.(a) | |

| 17,500 | | |

| 2,689,925 | |

| | |

| | | |

| 5,354,652 | |

| Interactive Media & Services (4.07%) | |

| | | |

| | |

| Alphabet, Inc., Class A | |

| 45,150 | | |

| 7,488,128 | |

| Meta Platforms, Inc., Class A | |

| 12,918 | | |

| 7,394,780 | |

| | |

| | | |

| 14,882,908 | |

| CONSUMER DISCRETIONARY (9.45%) | |

| | | |

| | |

| Automobiles (0.44%) | |

| | | |

| | |

| Tesla, Inc.(a) | |

| 6,150 | | |

| 1,609,025 | |

| | |

| | | |

| | |

| Broadline Retail (3.99%) | |

| | | |

| | |

| Amazon.com, Inc.(a) | |

| 52,989 | | |

| 9,873,440 | |

| Ollie's Bargain Outlet Holdings, Inc.(a) | |

| 46,197 | | |

| 4,490,348 | |

| Savers Value Village, Inc.(a)(b) | |

| 21,730 | | |

| 228,600 | |

| | |

| | | |

| 14,592,388 | |

| Distributors (0.72%) | |

| | | |

| | |

| Pool Corp. | |

| 7,000 | | |

| 2,637,600 | |

| | |

| | | |

| | |

| Hotels, Restaurants & Leisure (1.17%) | |

| | | |

| | |

| Chipotle Mexican Grill, Inc.(a) | |

| 23,290 | | |

| 1,341,970 | |

| Planet Fitness, Inc., Class A(a) | |

| 17,484 | | |

| 1,420,050 | |

| Wingstop, Inc. | |

| 3,634 | | |

| 1,512,035 | |

| | |

| | | |

| 4,274,055 | |

| Specialty Retail (2.21%) | |

| | | |

| | |

| American Eagle Outfitters, Inc. | |

| 127,952 | | |

| 2,864,845 | |

| Ulta Beauty, Inc.(a) | |

| 6,250 | | |

| 2,432,000 | |

| Valvoline, Inc.(a) | |

| 67,000 | | |

| 2,803,950 | |

| | |

| | | |

| 8,100,795 | |

| Textiles, Apparel & Luxury Goods (0.92%) | |

| | | |

| | |

| Deckers Outdoor Corp.(a) | |

| 21,000 | | |

| 3,348,450 | |

| | |

| | | |

| | |

| CONSUMER STAPLES (3.86%) | |

| | | |

| | |

| Consumer Staples Distribution & Retail (3.07%) | |

| | | |

| | |

| Casey's General Stores, Inc. | |

| 10,000 | | |

| 3,757,100 | |

| Costco Wholesale Corp. | |

| 2,810 | | |

| 2,491,121 | |

| Target Corp. | |

| 12,210 | | |

| 1,903,051 | |

| US Foods Holding Corp.(a) | |

| 50,000 | | |

| 3,075,000 | |

| | |

| | | |

| 11,226,272 | |

See Notes to Schedule of Investments.

| Third Quarter Report (Unaudited) | September 30, 2024 |

7 |

| Liberty All-Star® Growth Fund |

Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Household Products (0.79%) | |

| | | |

| | |

| Church & Dwight Co., Inc. | |

| 27,500 | | |

$ | 2,879,800 | |

| | |

| | | |

| | |

| ENERGY (0.76%) | |

| | | |

| | |

| Energy Equipment & Services (0.76%) | |

| | | |

| | |

| Core Laboratories, Inc. | |

| 31,812 | | |

| 589,476 | |

| Weatherford International PLC | |

| 26,000 | | |

| 2,207,920 | |

| | |

| | | |

| 2,797,396 | |

| FINANCIALS (11.01%) | |

| | | |

| | |

| Banks (0.32%) | |

| | | |

| | |

| Bank of America Corp. | |

| 30,040 | | |

| 1,191,987 | |

| | |

| | | |

| | |

| Capital Markets (5.41%) | |

| | | |

| | |

| FactSet Research Systems, Inc. | |

| 7,000 | | |

| 3,218,950 | |

| Hamilton Lane, Inc., Class A | |

| 35,178 | | |

| 5,923,623 | |

| Raymond James Financial, Inc. | |

| 25,000 | | |

| 3,061,500 | |

| S&P Global, Inc. | |

| 3,211 | | |

| 1,658,867 | |

| StepStone Group, Inc., Class A | |

| 104,220 | | |

| 5,922,823 | |

| | |

| | | |

| 19,785,763 | |

| Consumer Finance (0.84%) | |

| | | |

| | |

| Upstart Holdings, Inc.(a) | |

| 77,097 | | |

| 3,084,651 | |

| | |

| | | |

| | |

| Financial Services (2.11%) | |

| | | |

| | |

| Apollo Global Management, Inc. | |

| 15,270 | | |

| 1,907,376 | |

| Flywire Corp.(a) | |

| 63,446 | | |

| 1,039,880 | |

| Visa, Inc., Class A | |

| 17,340 | | |

| 4,767,633 | |

| | |

| | | |

| 7,714,889 | |

| Insurance (2.33%) | |

| | | |

| | |

| Brown & Brown, Inc. | |

| 36,000 | | |

| 3,729,600 | |

| Palomar Holdings, Inc.(a) | |

| 17,990 | | |

| 1,703,113 | |

| Progressive Corp. | |

| 12,120 | | |

| 3,075,571 | |

| | |

| | | |

| 8,508,284 | |

| HEALTH CARE (18.05%) | |

| | | |

| | |

| Biotechnology (6.03%) | |

| | | |

| | |

| AbbVie, Inc. | |

| 11,170 | | |

| 2,205,852 | |

| ACADIA Pharmaceuticals, Inc.(a) | |

| 199,856 | | |

| 3,073,785 | |

| Ascendis Pharma A/S(a)(c) | |

| 22,550 | | |

| 3,366,940 | |

| Halozyme Therapeutics, Inc.(a) | |

| 50,000 | | |

| 2,862,000 | |

| Legend Biotech Corp.(a)(c) | |

| 29,020 | | |

| 1,414,145 | |

| Natera, Inc.(a) | |

| 56,420 | | |

| 7,162,519 | |

| Ultragenyx Pharmaceutical, Inc.(a) | |

| 35,660 | | |

| 1,980,913 | |

| | |

| | | |

| 22,066,154 | |

| See Notes to Schedule of Investments. |

|

| 8 |

www.all-starfunds.com |

| Liberty All-Star® Growth Fund |

Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Health Care Equipment & Supplies (8.56%) | |

| | | |

| | |

| Cooper Cos., Inc. | |

| 30,000 | | |

$ | 3,310,200 | |

| Dexcom, Inc.(a) | |

| 22,340 | | |

| 1,497,674 | |

| Glaukos Corp.(a) | |

| 44,144 | | |

| 5,751,080 | |

| Hologic, Inc.(a) | |

| 35,000 | | |

| 2,851,100 | |

| Inmode, Ltd.(a) | |

| 21,533 | | |

| 364,984 | |

| Inogen, Inc.(a) | |

| 41,696 | | |

| 404,451 | |

| Inspire Medical Systems, Inc.(a) | |

| 3,615 | | |

| 762,946 | |

| iRhythm Technologies, Inc.(a) | |

| 19,811 | | |

| 1,470,769 | |

| Neogen Corp.(a) | |

| 213,383 | | |

| 3,586,968 | |

| Penumbra, Inc.(a) | |

| 15,500 | | |

| 3,011,805 | |

| ResMed, Inc. | |

| 14,000 | | |

| 3,417,680 | |

| Tandem Diabetes Care, Inc.(a) | |

| 115,098 | | |

| 4,881,306 | |

| | |

| | | |

| 31,310,963 | |

| Health Care Providers & Services (1.81%) | |

| | | |

| | |

| NeoGenomics, Inc.(a) | |

| 110,945 | | |

| 1,636,439 | |

| Progyny, Inc.(a) | |

| 126,378 | | |

| 2,118,095 | |

| UnitedHealth Group, Inc. | |

| 3,152 | | |

| 1,842,912 | |

| US Physical Therapy, Inc. | |

| 12,148 | | |

| 1,028,085 | |

| | |

| | | |

| 6,625,531 | |

| Life Sciences Tools & Services (1.65%) | |

| | | |

| | |

| Charles River Laboratories International, Inc.(a) | |

| 10,500 | | |

| 2,068,185 | |

| ICON PLC(a) | |

| 5,970 | | |

| 1,715,241 | |

| West Pharmaceutical Services, Inc. | |

| 7,500 | | |

| 2,251,200 | |

| | |

| | | |

| 6,034,626 | |

| INDUSTRIALS (16.81%) | |

| | | |

| | |

| Aerospace & Defense (3.94%) | |

| | | |

| | |

| AAR Corp.(a) | |

| 31,952 | | |

| 2,088,383 | |

| Cadre Holdings, Inc. | |

| 47,302 | | |

| 1,795,111 | |

| Curtiss-Wright Corp. | |

| 10,000 | | |

| 3,286,900 | |

| Kratos Defense & Security Solutions, Inc.(a) | |

| 73,621 | | |

| 1,715,369 | |

| Loar Holdings, Inc.(a)(b) | |

| 11,508 | | |

| 858,382 | |

| TransDigm Group, Inc. | |

| 3,260 | | |

| 4,652,444 | |

| | |

| | | |

| 14,396,589 | |

| Commercial Services & Supplies (3.54%) | |

| | | |

| | |

| Casella Waste Systems, Inc., Class A(a) | |

| 63,768 | | |

| 6,344,278 | |

| CECO Environmental Corp.(a) | |

| 16,167 | | |

| 455,910 | |

| Copart, Inc.(a) | |

| 60,000 | | |

| 3,144,000 | |

| Montrose Environmental Group, Inc.(a) | |

| 114,370 | | |

| 3,007,931 | |

| | |

| | | |

| 12,952,119 | |

| Construction & Engineering (0.92%) | |

| | | |

| | |

| EMCOR Group, Inc. | |

| 7,500 | | |

| 3,228,975 | |

| See Notes to Schedule of Investments. |

|

| Third Quarter Report (Unaudited) | September 30, 2024 |

9 |

| Liberty All-Star® Growth Fund |

Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Construction & Engineering (continued) | |

| | | |

| | |

| MYR Group, Inc.(a) | |

| 1,132 | | |

$ | 115,724 | |

| | |

| | | |

| 3,344,699 | |

| Electrical Equipment (1.16%) | |

| | | |

| | |

| nVent Electric PLC | |

| 37,500 | | |

| 2,634,750 | |

| Vertiv Holdings Co. | |

| 16,160 | | |

| 1,607,758 | |

| | |

| | | |

| 4,242,508 | |

| Ground Transportation (2.18%) | |

| | | |

| | |

| RXO, Inc.(a) | |

| 107,551 | | |

| 3,011,428 | |

| Saia, Inc.(a) | |

| 7,000 | | |

| 3,060,820 | |

| Union Pacific Corp. | |

| 7,760 | | |

| 1,912,685 | |

| | |

| | | |

| 7,984,933 | |

| Machinery (2.00%) | |

| | | |

| | |

| Crane Co. | |

| 20,000 | | |

| 3,165,600 | |

| Regal Rexnord Corp.(a) | |

| 6,240 | | |

| 1,035,091 | |

| Watts Water Technologies, Inc., Class A | |

| 15,000 | | |

| 3,107,850 | |

| | |

| | | |

| 7,308,541 | |

| Professional Services (1.36%) | |

| | | |

| | |

| Booz Allen Hamilton Holding Corp. | |

| 23,500 | | |

| 3,824,860 | |

| First Advantage Corp.(a) | |

| 58,736 | | |

| 1,165,910 | |

| | |

| | | |

| 4,990,770 | |

| Trading Companies & Distributors (1.71%) | |

| | | |

| | |

| SiteOne Landscape Supply, Inc.(a) | |

| 23,050 | | |

| 3,478,476 | |

| Transcat, Inc.(a) | |

| 20,798 | | |

| 2,511,774 | |

| Xometry, Inc., Class A(a) | |

| 14,974 | | |

| 275,072 | |

| | |

| | | |

| 6,265,322 | |

| INFORMATION TECHNOLOGY (29.14%) | |

| | | |

| | |

| Electronic Equipment, Instruments & Components (2.29%) | |

| | | |

| | |

| Fabrinet(a) | |

| 13,000 | | |

| 3,073,720 | |

| Novanta, Inc.(a) | |

| 11,517 | | |

| 2,060,622 | |

| PAR Technology Corp.(a) | |

| 7,464 | | |

| 388,725 | |

| Teledyne Technologies, Inc.(a) | |

| 6,500 | | |

| 2,844,790 | |

| | |

| | | |

| 8,367,857 | |

| Semiconductors & Semiconductor Equipment (8.93%) | |

| | | |

| | |

| Advanced Micro Devices, Inc.(a) | |

| 8,740 | | |

| 1,434,059 | |

| ASML Holding N.V. | |

| 2,030 | | |

| 1,691,498 | |

| Broadcom Ltd. | |

| 11,580 | | |

| 1,997,550 | |

| Impinj, Inc.(a) | |

| 8,087 | | |

| 1,750,997 | |

| Monolithic Power Systems, Inc. | |

| 3,350 | | |

| 3,097,075 | |

| NVIDIA Corp. | |

| 107,190 | | |

| 13,017,154 | |

| NXP Semiconductors NV | |

| 5,930 | | |

| 1,423,259 | |

| Onto Innovation, Inc.(a) | |

| 14,500 | | |

| 3,009,620 | |

| See Notes to Schedule of Investments. |

|

| 10 |

www.all-starfunds.com |

| Liberty All-Star® Growth Fund |

Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Semiconductors & Semiconductor Equipment (continued) | |

| | | |

| | |

| Semtech Corp.(a) | |

| 40,759 | | |

$ | 1,861,056 | |

| SiTime Corp.(a) | |

| 7,037 | | |

| 1,206,916 | |

| Taiwan Semiconductor Manufacturing Co. Ltd.(c) | |

| 12,400 | | |

| 2,153,508 | |

| | |

| | | |

| 32,642,692 | |

| Software (14.02%) | |

| | | |

| | |

| Agilysys, Inc.(a) | |

| 24,818 | | |

| 2,704,417 | |

| Cadence Design Systems, Inc.(a) | |

| 7,820 | | |

| 2,119,455 | |

| Descartes Systems Group, Inc.(a) | |

| 30,000 | | |

| 3,088,800 | |

| Dynatrace, Inc.(a) | |

| 60,000 | | |

| 3,208,200 | |

| Intapp, Inc.(a) | |

| 5,439 | | |

| 260,147 | |

| Microsoft Corp. | |

| 24,960 | | |

| 10,740,288 | |

| nCino, Inc.(a) | |

| 47,023 | | |

| 1,485,457 | |

| Oracle Corp. | |

| 11,610 | | |

| 1,978,344 | |

| PROS Holdings, Inc.(a) | |

| 55,419 | | |

| 1,026,360 | |

| PTC, Inc.(a) | |

| 15,000 | | |

| 2,709,900 | |

| Qualys, Inc.(a) | |

| 18,000 | | |

| 2,312,280 | |

| Salesforce, Inc. | |

| 8,093 | | |

| 2,215,135 | |

| SAP SE(c) | |

| 10,820 | | |

| 2,478,862 | |

| ServiceNow, Inc.(a) | |

| 4,086 | | |

| 3,654,478 | |

| Sprout Social, Inc.(a) | |

| 27,416 | | |

| 796,983 | |

| SPS Commerce, Inc.(a) | |

| 36,938 | | |

| 7,172,251 | |

| Vertex, Inc., Class A(a) | |

| 86,914 | | |

| 3,347,058 | |

| | |

| | | |

| 51,298,415 | |

| Technology Hardware, Storage & Peripherals (3.90%) | |

| | | |

| | |

| Apple, Inc. | |

| 49,392 | | |

| 11,508,336 | |

| Pure Storage, Inc.(a) | |

| 55,000 | | |

| 2,763,200 | |

| | |

| | | |

| 14,271,536 | |

| MATERIALS (0.78%) | |

| | | |

| | |

| Containers & Packaging (0.78%) | |

| | | |

| | |

| AptarGroup, Inc. | |

| 16,184 | | |

| 2,592,515 | |

| Avery Dennison Corp. | |

| 1,107 | | |

| 244,381 | |

| | |

| | | |

| 2,836,896 | |

| REAL ESTATE (2.33%) | |

| | | |

| | |

| Real Estate Management & Development (2.33%) | |

| | | |

| | |

| CoStar Group, Inc.(a) | |

| 18,540 | | |

| 1,398,657 | |

| FirstService Corp. | |

| 39,143 | | |

| 7,142,032 | |

| | |

| | | |

| 8,540,689 | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (COST OF $260,595,398) | |

| | | |

| 357,469,755 | |

| See Notes to Schedule of Investments. |

|

| Third Quarter Report (Unaudited) | September 30, 2024 |

11 |

| Liberty All-Star® Growth Fund |

Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

| | |

SHARES | | |

VALUE | |

| SHORT TERM INVESTMENTS (2.34%) | |

| | | |

| | |

| MONEY MARKET FUND (2.10%) | |

| | | |

| | |

| State Street Institutional US Government Money Market Fund, Premier Class, 4.94%(d) | |

| | | |

| | |

| (COST OF $7,671,259) | |

| 7,671,259 | | |

$ | 7,671,259 | |

| | |

| | | |

| | |

| INVESTMENTS PURCHASED WITH COLLATERAL FROM SECURITIES LOANED (0.24%) | |

| | | |

| | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 5.02% | |

| | | |

| | |

| (COST OF $888,908) | |

| 888,908 | | |

| 888,908 | |

| | |

| | | |

| | |

| TOTAL SHORT TERM INVESTMENTS | |

| | | |

| | |

| (COST OF $8,560,167) | |

| | | |

| 8,560,167 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS (100.06%) | |

| | | |

| | |

| (COST OF $269,155,565) | |

| | | |

| 366,029,922 | |

| | |

| | | |

| | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-0.06%) | |

| | | |

| (228,966 | ) |

| | |

| | | |

| | |

| NET ASSETS (100.00%) | |

| | | |

$ | 365,800,956 | |

| | |

| | | |

| | |

| NET ASSET VALUE PER SHARE | |

| | | |

| | |

| (60,630,031 SHARES OUTSTANDING) | |

| | | |

$ | 6.03 | |

| (a) |

Non-income producing security. |

| (b) |

Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $1,086,981. |

| (c) |

American Depositary Receipt. |

| (d) |

Rate reflects seven-day effective yield on September 30, 2024. |

| See Notes to Schedule of Investments. |

|

| 12 |

www.all-starfunds.com |

| Liberty All-Star® Growth Fund |

Notes to Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

Security Valuation

Equity securities are valued at the last sale

price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market LLC (“NASDAQ”),

which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the

day are valued at the closing bid price on such exchanges or over-the-counter markets.

Cash collateral from securities lending activity

is reinvested in the State Street Navigator Securities Lending Government Money Market Portfolio (“State Street Navigator”),

a registered investment company under the Investment Company Act of 1940 (the “1940 Act”), which operates as a money market

fund in compliance with Rule 2a-7 under the 1940 Act. Shares of registered investment companies are valued daily at that investment company’s

net asset value (“NAV”) per share.

The Fund’s investments are valued at market

value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the

Fund's Board of Directors (the "Board"). The Board has designated ALPS Advisors, Inc. (the “Advisor”) as the Fund’s

Valuation Designee. The Valuation Designee is responsible for determining fair value in good faith for all Fund investments, subject to

oversight by the Board. When market quotations are not readily available, or in management’s judgment they do not accurately reflect

fair value of a security, or an event occurs after the market close but before the Fund is priced that materially affects the value of

a security, the security will be valued by the Fund’s Valuation Committee using fair valuation procedures established by the Valuation

Designee. Examples of potentially significant events that could materially impact a Fund’s NAV include, but are not limited to:

single issuer events such as corporate actions, reorganizations, mergers, spin-offs, liquidations, acquisitions and buyouts; corporate

announcements on earnings or product offerings; regulatory news; and litigation and multiple issuer events such as governmental actions;

natural disasters or armed conflicts that affect a country or a region; or significant market fluctuations. Potential significant events

are monitored by the Advisor, Sub-Advisers and/or the Valuation Committee through independent reviews of market indicators, general news

sources and communications from the Fund’s custodian. As of September 30, 2024, the Fund held no securities that were fair valued.

Security Transactions

Security transactions are recorded on trade date.

Cost is determined and gains/(losses) are based upon the specific identification method for both financial statement and federal income

tax purposes.

Income Recognition

Interest income is recorded on the accrual basis.

Corporate actions and dividend income are recorded on the ex-date.

The Fund estimates components of distributions

from real estate investment trusts (“REITs”). Distributions received in excess of income are recorded as a reduction of the

cost of the related investments. Once the REIT reports annually the tax character of its distributions, the Fund revises its estimates.

If the Fund no longer owns the applicable securities, any distributions received in excess of income are recorded as realized gains.

| Third Quarter Report (Unaudited) | September 30, 2024 |

13 |

| Liberty All-Star® Growth Fund |

Notes to Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

Lending of Portfolio Securities

The Fund may lend its portfolio securities only

to borrowers that are approved by the Fund’s securities lending agent, State Street Bank & Trust Co. (“SSB”). The

Fund will limit such lending to not more than 20% of the value of its total assets. The borrower pledges and maintains with the Fund collateral

consisting of cash (U.S. Dollar only), securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, or

by irrevocable bank letters of credit issued by a person other than the borrower or an affiliate of the borrower. The initial collateral

received by the Fund is required to have a value of no less than 102% of the market value of the loaned securities for securities traded

on U.S. exchanges and a value of no less than 105% of the market value for all other securities. The collateral is maintained thereafter,

at a market value equal to no less than 100% of the current value of the securities on loan. The market value of the loaned securities

is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day.

During the term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities

are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for

settlement of securities transactions.

Any cash collateral received is reinvested in

State Street Navigator. Non-cash collateral, in the form of securities issued or guaranteed by the U.S. government or its agencies or

instrumentalities, is not disclosed in the Fund’s Schedule of Investments as it is held by the lending agent on behalf of the Fund,

and the Fund does not have the ability to re-hypothecate these securities.

The following is a summary of the Fund’s

securities lending positions and related cash and non-cash collateral received as of September 30, 2024:

Market

Value of

Securities

on Loan |

Cash

Collateral

Received |

Non-Cash

Collateral

Received |

Total

Collateral

Received |

| $1,086,981 |

$888,908 |

$223,997 |

$1,112,905 |

The risks of securities lending include the risk

that the borrower may not provide additional collateral when required or may not return the securities when due. To mitigate these risks,

the Fund benefits from a borrower default indemnity provided by SSB. SSB’s indemnity allows for full replacement of securities lent

wherein SSB will purchase the unreturned loaned securities on the open market by applying the proceeds of the collateral or to the extent

such proceeds are insufficient or the collateral is unavailable, SSB will purchase the unreturned loan securities at SSB’s expense.

However, the Fund could suffer a loss if the value of the investments purchased with cash collateral falls below the value of the cash

collateral received.

Fair Value Measurements

The Fund discloses the classification of its fair

value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions

that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable.

Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on

market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions

about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information

available.

| Liberty All-Star® Growth Fund |

Notes to Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

Valuation techniques used to value the Fund’s

investments by major category are as follows:

Equity securities that are valued based on unadjusted

quoted prices in active markets are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing

prices are not available, securities are valued at the mean of the most recent quoted bid and ask prices on such day and are generally

categorized as Level 2 in the hierarchy. Investments in open-end mutual funds are valued at their closing NAV each business day and are

categorized as Level 1 in the hierarchy.

Various inputs are used in determining the value

of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy,

the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant

to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity

associated with these investments.

These inputs are categorized in the following

hierarchy under applicable financial accounting standards:

| Level 1 – |

Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| |

|

| Level 2 – |

Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| |

|

| Level 3 – |

Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used

to value the Fund’s investments as of September 30, 2024:

| | |

Valuation Inputs | | |

| |

| Investments in Securities at Value | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks* | |

$ | 357,469,755 | | |

$ | – | | |

$ | – | | |

$ | 357,469,755 | |

| Short Term Investments | |

| 8,560,167 | | |

| – | | |

| – | | |

| 8,560,167 | |

| Total | |

$ | 366,029,922 | | |

$ | – | | |

$ | – | | |

$ | 366,029,922 | |

| * |

See Schedule of Investments for industry classifications. |

The Fund did not have any securities that used

significant unobservable inputs (Level 3) in determining fair value during the period.

Indemnification

In the normal course of business, the Fund enters

into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum

exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also, under the Fund’s organizational

documents and by contract, the Directors and Officers of the Fund are indemnified against certain liabilities that may arise out of their

duties to the Fund. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be minimal.

| Third Quarter Report (Unaudited) | September 30, 2024 |

15 |

| Liberty All-Star® Growth Fund |

Notes to Schedule of Investments |

| |

September 30, 2024 (Unaudited) |

Maryland Statutes

By resolution of the Board of Directors, the Fund

has opted into the Maryland Control Share Acquisition Act and the Maryland Business Combination Act. In general, the Maryland Control

Share Acquisition Act provides that “control shares” of a Maryland corporation acquired in a control share acquisition may

not be voted except to the extent approved by shareholders at a meeting by a vote of two-thirds of the votes entitled to be cast on the

matter (excluding shares owned by the acquirer and by officers or directors who are employees of the corporation). “Control shares”

are voting shares of stock which, if aggregated with all other shares of stock owned by the acquirer or in respect of which the acquirer

is able to exercise or direct the exercise of voting power (except solely by virtue of a revocable proxy), would entitle the acquirer

to exercise voting power in electing directors within certain statutorily defined ranges (one-tenth but less than one-third, one-third

but less than a majority, and more than a majority of the voting power). In general, the Maryland Business Combination Act prohibits an

interested shareholder (a shareholder that holds 10% or more of the voting power of the outstanding stock of the corporation) of a Maryland

corporation from engaging in a business combination (generally defined to include a merger, consolidation, share exchange, sale of a substantial

amount of assets, a transfer of the corporation’s securities and similar transactions to or with the interested shareholder or an

entity affiliated with the interested shareholder) with the corporation for a period of five years after the most recent date on which

the interested shareholder became an interested shareholder. At the time of adoption, March 19, 2009, the Board and the Fund were not

aware of any shareholder that held control shares or that was an interested shareholder under the statutes. A January 2023 Memorandum

of Decision and Order issued by a Massachusetts Superior Court judge has held that a by-laws provision limiting the ability of shareholders

to vote shares in excess of a specified amount is not permissible under the Investment Company Act of 1940. As a result of this decision,

there is some uncertainty whether a registered investment company such as the Fund may rely on the Maryland Business Control Share Acquisition

Act.

| |

Description of Lipper Benchmark |

| Liberty All-Star® Growth Fund |

and Market Indices |

| |

September 30, 2024 (Unaudited) |

Dow Jones Industrial Average

A price-weighted measure of 30 U.S. blue-chip companies.

Lipper Multi-Cap Growth Mutual Fund Average

The average of funds that, by portfolio practice,

invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization

range over an extended period of time. Multi-Cap growth funds typically have above-average characteristics compared to the S&P SuperComposite

1500® Index.

NASDAQ Composite Index

Measures all NASDAQ domestic and international

based common type stocks listed on the NASDAQ Stock Market.

Russell Top 200® Growth Index

Measures the performance of those Russell Top

200® companies with lower book-to-price-ratios and higher growth values. The Russell Top 200® Index measures

the performance of the 200 largest companies in the Russell 3000® Index.

Russell 1000® Growth Index

(Largecap)

Measures the performance of those Russell 1000®

companies with lower book-to-price-ratios and higher growth values. The Russell 1000® Index measures the performance

of the 1,000 largest companies in the Russell 3000® Index.

Russell Midcap® Growth Index

Measures the performance of those Russell Midcap®

companies with lower book-to-price-ratios and higher growth values. The Russell Midcap® Index measures the performance

of the 800 smallest companies in the Russell 1000® Index.

Russell 2000® Growth Index

(Smallcap)

Measures the performance of those Russell 2000®

companies with lower book-to-price-ratios and higher growth values. The Russell 2000® Index measures the performance

of the 2,000 smallest companies in the Russell 3000® Index.

Russell Growth Average

The average of the Russell Top 200®,

Midcap® and 2000® Growth Indices.

S&P 500® Index

A large cap U.S. equities index that includes

500 leading companies and represents approximately 80% of the total domestic U.S. equity market capitalization.

An investor cannot invest directly in an index.

| Third Quarter Report (Unaudited) | September 30, 2024 |

17 |

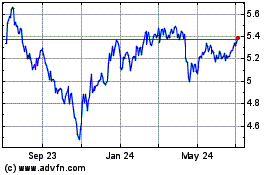

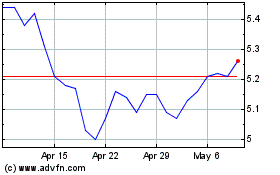

Liberty All Star Growth (NYSE:ASG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Liberty All Star Growth (NYSE:ASG)

Historical Stock Chart

From Nov 2023 to Nov 2024