|

Item 1.01

|

Entry into a Material Definitive Agreement

|

Merger Agreement

On February 18, 2020, LendingClub Corporation, a Delaware corporation (“LendingClub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with privately-owned Radius Bancorp, Inc., a savings and loan holding company and a Delaware corporation (“Radius”) and SC Sub I, Inc., a Delaware corporation and a direct, wholly owned subsidiary of LendingClub (“Merger Sub”). The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, Merger Sub will merge with and into Radius (the “Merger”), with Radius as the surviving corporation in the Merger. Immediately thereafter, at LendingClub’s option Radius will merge with and into LendingClub (the “Subsequent Merger” and, together with the Merger, the “Mergers”). As part of the transaction, LendingClub will acquire Radius’ wholly-owned subsidiary, Radius Bank, a federal savings association, which will convert to a national bank simultaneously with the Merger. The Merger Agreement was approved by the Boards of Directors of each of LendingClub and Radius.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), holders of Radius voting common stock and non-voting common stock will have the right to receive in the aggregate 3,761,141 shares of LendingClub common stock and cash consideration of $138,750,000 with the amount of cash being subject to adjustment based on a variety of factors as set forth in the Merger Agreement.

The Merger Agreement contains customary representations, warranties and covenants and completion of the Merger is subject to receipt of required bank regulatory approvals, along with the satisfaction or waiver of customary closing conditions, including the expiration or early termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

Radius stockholders holding over 90% of its Class A voting common stock and 100% of its Class B non-voting common stock have agreed to support the Merger and vote in favor of the Merger Agreement and the transactions contemplated thereby. In addition, such stockholders have agreed not to transfer their LendingClub common stock received pursuant to the Merger for a 60 day period after the Effective Time.

The Merger Agreement provides certain termination rights for both LendingClub and Radius and further provides that a termination fee of $5 million will be payable to Radius by LendingClub (or, in certain circumstances, payable to LendingClub by Radius) in connection with the termination of the Merger Agreement under certain circumstances. The Merger Agreement also provides that either party can terminate the Merger Agreement at the one year anniversary of the execution thereof unless LendingClub pays Radius $5 million to extend the time at which either party can terminate the Merger Agreement to the fifteen-month anniversary of the execution thereof.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding LendingClub or Radius, their respective affiliates or their respective businesses. In particular, the Merger Agreement and related description are not intended to be, and should not be relied upon as, disclosures regarding any facts and circumstances

relating to LendingClub or Radius. The representations and warranties have been negotiated with the principal purpose of not establishing matters of fact, but rather as a risk allocation method establishing the circumstances under which a party may have the right not to consummate the Merger if the representations and warranties of the other party prove to be untrue due to a change in circumstance or otherwise. As is customary, the assertions embodied in the representations and warranties made by Radius in the Merger Agreement are qualified by information contained in confidential disclosure schedules that Radius has delivered to LendingClub in connection with the signing of the Merger Agreement. The representations and warranties also may be subject to a contractual standard of materiality different from those generally applicable under the securities laws. Shareholders of LendingClub are not third-party beneficiaries under the Merger Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of LendingClub or Radius. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement.

Exchange Agreement

In connection with the execution of the Merger Agreement and in order to facilitate the regulatory approvals of the Merger, on February 18, 2020, LendingClub entered into an exchange agreement (the “Exchange Agreement”) with its largest stockholder, Shanda Asset Management Holdings Limited and its affiliates (collectively, “Shanda”), pursuant to which Shanda will exchange all of the 19,562,881 shares beneficially owned by it of LendingClub common stock, par value $0.01 per share for (i) 195,628 newly issued shares of LendingClub Mandatorily Convertible Non-Voting Preferred Stock, Series A (“Series A Preferred Stock”), par value $0.01 per share, having the designations, relative rights, other preferences and limitations set forth in a certificate of designations attached to the Exchange Agreement and that are mandatorily convertible in certain circumstances when owned by a person other than Shanda or any affiliate of Shanda into 19,562,800 shares of LendingClub common stock and (ii) a one-time cash payment of $50,203,332.77. Series A Preferred Stock is substantially the same as LendingClub common stock except as to voting rights and constitutes non-voting securities of LendingClub for bank regulatory purposes.

The Exchange Agreement imposes certain restrictions and obligations on Shanda so as to ensure that its ownership of LendingClub securities and activities will not impede LendingClub’s ability to obtain the necessary bank regulatory approvals to effect the Merger.

The foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Exchange Agreement, which is attached to this report as Exhibit 10.1.

Registration Rights Agreement

LendingClub and Shanda also entered into a Registration Rights Agreement (“Registration Rights Agreement”) on February 18, 2020. The Registration Rights Agreement provides, among other things, that LendingClub will prepare and file with the Securities and Exchange Commission a registration statement covering the resale by Shanda of the LendingClub common stock that the Series A Preferred Stock is convertible into, along with other shares of LendingClub common stock subsequently acquired and held by Shanda.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Registration Rights Agreement, which is attached to this report as Exhibit 10.2.

Protection Agreement

In connection with the Merger Agreement and in an effort to facilitate compliance with federal banking regulations and prevent closing of the Merger from being delayed or disrupted, on February 18, 2020, LendingClub also entered into a Temporary Bank Charter Protection Agreement (the “Protection Agreement”) with American Stock Transfer & Trust Company, LLC as Rights Agent (as such term is defined in the Protection Agreement). A brief summary of the Protection Agreement is set forth under “Item 3.03 Material Modification to Rights of Security Holders” below and is incorporated herein by reference.

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The information set forth in the second and seventh paragraphs of Item 1.01 of hereby incorporated by reference. No underwriting discounts or commissions are being paid in connection with the Merger or the issuance of Series A Preferred Stock.

Shares offered pursuant to the Merger and shares of Series A Preferred Stock will be offered pursuant to exemptions from registration under the Securities Act of 1933. LendingClub has not engaged in general solicitation or advertising relating to the offering of Series A Preferred Stock or common stock in connection with the Merger and is not offering any securities to the public in connection with the Merger Agreement or the Exchange Agreement.

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

Protection Agreement

Unless otherwise defined herein, the capitalized terms used in this Item 3.03 shall have the meanings ascribed to them in the Protection Agreement.

Effective February 18, 2020, the board of directors of LendingClub (the “Board”) authorized and declared a dividend of one right for each outstanding share of LendingClub common stock (each such right, a “Common Right”) and one right for each outstanding share of Series A Preferred Stock (each such right, a “Series A Preferred Right” and, together with the Common Rights, the “Rights”) in each case to stockholders of record at the Close of Business on March 19, 2020 (the “Record Date”), and authorized the issuance of one Common Right or one Series A Preferred Right (as such number may be adjusted pursuant to the Protection Agreement) for each share of LendingClub common stock or Series A Preferred Stock, respectively, issued between the Record Date and the earlier of the Distribution Date (as defined below) and the Expiration Date (as defined below) and, in some cases, through the Expiration Date.

Each Common Right entitles the registered holder, subject to the terms of the Protection Agreement, to purchase from LendingClub one one-thousandth of a share (a “Unit”) of the LendingClub Preferred Stock, Series B (“Series B Preferred Stock”), at a purchase price of $48.00 per Unit, subject to adjustment. Each Series A Preferred Right entitles the registered holder, subject to the terms of the Protection Agreement, to purchase from LendingClub one share of LendingClub Series A Preferred Stock, at a purchase price of $4,800.00 per share, subject to adjustment. The purchase price is payable in cash or by certified or bank check or money order payable to the order of LendingClub.

Distribution Date. Initially, the Rights will attach to all certificates representing shares of outstanding LendingClub common stock and Series A Preferred Stock, and no separate Rights Certificates will be distributed. Subject to the provisions of the Protection Agreement, the Common Rights may separate from the LendingClub common stock (though the Series A Preferred Rights shall not separate from the Series A Preferred Stock) and the “Distribution Date” will occur upon the earlier of (i) ten business days following a public announcement (the date of such announcement being the “Stock Acquisition Date”) (or, if the tenth business day after the Stock Acquisition Date occurs before the Record Date, the Close of Business on the Record Date) that a Person, acting directly or indirectly or through or in concert with one or more Persons, has acquired control over securities representing either (x) either (1) from and after the first public announcement by LendingClub of the closing of the Exchange, 10% or more, or (2) until such announcement, 7.5% or more (or more than 15% in some cases specified in the Protection Agreement) of any class of the then-outstanding Voting Securities of LendingClub or (y) 25% or more of the total equity of LendingClub (such Person an “Acquiring Person”), and (ii) ten business days (or such later date as may be determined by the Board) following the commencement of a tender offer or exchange offer that would result in a Person becoming an Acquiring Person. Any determinations under the definition of Acquiring Person shall be made by the Board and in a manner consistent with the provisions of Regulation Y and the published interpretations of the Board of Governors of the Federal Reserve System and the published rulings and opinions of the staff of the Board of Governors of the Federal Reserve System thereunder.

Until the Distribution Date, the Rights will be evidenced by LendingClub common stock and Series A Preferred Stock certificates and will be transferred with and only with such LendingClub common stock and Series A Preferred Stock certificates. Until the Distribution Date or, in the case of Series A Preferred Stock, the Expiration Date, the surrender for transfer of any certificates representing outstanding LendingClub common stock or outstanding Series A Preferred Stock will also constitute the transfer of the Rights associated with LendingClub common stock or Series A Preferred Stock represented by such certificates.

An “Acquiring Person” does not include certain Persons specified in the Protection Agreement.

The Rights are not exercisable until the Distribution Date and will expire at the Close of Business on the eighteen-month anniversary of the Protection Agreement or if earlier at the time of consummation of the Relevant Transaction or under certain circumstances in connection with a transaction pursuant to a Qualified Offer (the “Expiration Date”), unless earlier redeemed or exchanged by LendingClub as described below. Under certain circumstances, as provided in the Protection Agreement, the exercisability of the Rights may be suspended.

As soon as practicable after the Distribution Date, Rights Certificates will be mailed to holders of record of LendingClub common stock and Series A Preferred Stock as of the Close of Business on the Distribution Date (and to each initial holder of certain shares of LendingClub common stock and Series A Preferred Stock issued after the Distribution Date) and, thereafter, the separate Rights Certificates alone will represent the Rights, provided, that the Company may choose to issue Rights in book-entry form.

Flip-In. If a Person becomes an Acquiring Person, then each holder of a Right will thereafter have the right to buy either Series A Preferred Stock, in the case of Series A Preferred Rights, or common stock, in the case of Common Rights, at one-half of market price (determined as provided in the Protection Agreement), for the exercise price of a Right. Notwithstanding any of the foregoing, following the occurrence of the event set forth in this paragraph, all Rights that are, or (under certain circumstances specified in the Protection Agreement) were, beneficially owned by any Acquiring Person or any affiliate or associate thereof (or certain transferees of any thereof) will be null and void.

Flip-Over. If, at any time following the date that any Person becomes an Acquiring Person, (i) LendingClub is acquired in a merger or other business combination transaction and LendingClub is not the surviving corporation, (ii) any Person merges with LendingClub and all or part of LendingClub common stock is converted or exchanged for securities, cash or property of LendingClub or any other Person or (iii) one-half or more of LendingClub’s assets, cash flow or earning power is sold or transferred, each holder of a Right (except Rights which previously have been voided as described above) shall thereafter have the right to receive, upon exercise, common stock of the acquiring company having a value equal to two times the exercise price of the Right.

Redemption. At any time until ten business days following the Stock Acquisition Date (or, if the Stock Acquisition Date shall have occurred prior to the Record Date, until ten business days following the Record Date), the Board may redeem the Rights in whole, but not in part, at a price of $0.001 per Right (subject to adjustment in certain events) payable, at the election of the Board, in cash, shares of LendingClub common stock or other consideration deemed appropriate by the Board. Immediately upon the action of the Board ordering the redemption of the Rights, the Rights will terminate and the only right of the holders of Rights will be to receive the redemption price.

Exchange. LendingClub may, at any time after which a Person becomes an Acquiring Person, until the time specified in the Protection Agreement, exchange all or part of the then-outstanding and exercisable Rights (other than Rights that shall have become null and void) for Units or shares of Preferred Stock or shares of LendingClub common stock pursuant to a one-for-one exchange ratio, subject to adjustment.

No Stockholder Rights; Taxation. Until a Right is exercised, the holder thereof, as such, will have no rights as a stockholder of LendingClub, including the right to vote or to receive dividends. While the distribution of the Rights will not be taxable to stockholders or to LendingClub, stockholders may, depending upon the circumstances, recognize taxable income in the event that the Rights become exercisable or in the event of the redemption of Rights as set forth above.

Amendment. Any of the provisions of the Protection Agreement may be amended without the approval of the holders of the Rights or LendingClub common stock or Series A Preferred Stock at any time prior to the Distribution Date. After such date, the provisions of the Protection Agreement may be amended in order to cure any ambiguity, defect or inconsistency, to shorten or lengthen any time period under the Protection Agreement, or to make changes which do not adversely affect the interests of holders of Rights (excluding the interests of any Acquiring Person); provided, that no amendment shall be made to lengthen (i) the time period governing redemption at such time as the Rights are not redeemable or (ii) any other time period unless such lengthening is for the purpose of protecting, enhancing or clarifying the rights of, and/or the benefits to, the holders of Rights.

The foregoing description of the Protection Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Protection Agreement, which is attached to this report as Exhibit 4.1, and is incorporated herein by reference in its entirety.

Series A Preferred Stock

The Series A Preferred Stock is described herein under Item 1.01 “Exchange Agreement”.

Series B Preferred Stock

Each Unit of Series B Preferred Stock, if issued, will (a) be nonredeemable; (b) have a minimum preferential quarterly dividend of $0.001 per Unit or any higher per share dividend declared on LendingClub common stock; (c) in the event of a liquidation be entitled to receive a preferred liquidation payment equal to $0.001 per Unit plus the per share amount paid in respect of a share of LendingClub Common Stock; (d) will have one vote, voting together with LendingClub Common Stock; and in the event of any merger, consolidation or other transaction in which shares of LendingClub common stock are exchanged, will be entitled to receive the per share amount paid in respect of each share of LendingClub common stock.

The rights of holders of the Series B Preferred Stock with respect to dividends, liquidation and voting, and in the event of mergers and consolidations, are protected by customary antidilution provisions.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws.

|

On February 18, 2020, LendingClub filed a Certificate of Designations of the Series A Preferred Stock (the “Series A Certificate of Designations”) and a Certificate of Designations of the Series B Preferred Stock (the “Series B Certificate of Designations”) with the Secretary of State of Delaware. Pursuant to the Series A Certificate of Designations, the Board authorized 200,000 shares of Series A Preferred Stock, par value $0.01 per share. Pursuant to the Series B Certificate of Designations, the Board authorized 600,000 shares of Series B Preferred Stock, par value per share of $0.01.

The Series A Certificate of Designations and the Series B Certificate of Designations are attached hereto as Exhibits 3.1 and 3.2 and are incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits

|

Exhibits

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

Exhibit Title or Description

|

|

|

|

|

|

|

|

|

2.1*

|

|

|

Agreement and Plan of Merger, dated as of February 18, 2020, by and among LendingClub Corporation, Radius Bancorp, Inc. and SC Sub I, Inc.

|

|

|

|

|

|

|

|

|

3.1

|

|

|

Certificate of Designations of the Series A Preferred Stock, as filed with the Secretary of State of Delaware on February 18, 2020.

|

|

|

|

|

|

|

|

|

3.2

|

|

|

Certificate of Designations of the Series B Preferred Stock, as filed with the Secretary of State of Delaware on February 18, 2020.

|

|

|

|

|

|

|

|

|

4.1

|

|

|

Temporary Bank Charter Protection Agreement by and between LendingClub Corporation and American Stock Transfer & Trust Company dated February 18, 2020.

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Share Exchange Agreement, dated as of February 18, 2020, by and among LendingClub Corporation and Shanda Asset Management Holdings Limited.

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Registration Rights Agreement, dated as of February 18, 2020, by and among LendingClub Corporation and Shanda Asset Management Holdings, Limited.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release dated February 18, 2020.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (Cover page XBRL tags are embedded within the Inline XBRL document)

|

|

*

|

Certain schedules have been omitted and LendingClub agrees to furnish supplementally to the Securities and Exchange Commission a copy of any omitted exhibits and schedules upon request.

|

Forward-Looking Statements

This Current Report on Form 8-K may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by the use of words such as “may,” “might,” “will,” “would,” “should,” “could,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “probable,” “potential,” “possible,” “target,” “continue,” “look forward,” or “assume” and words of similar import. Forward-looking statements are not historical facts or guarantees of future performance or outcomes, but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and events may differ, possibly materially, from the anticipated results or events indicated in these forward-looking statements. We caution you not to place undue reliance on these statements. Forward-looking statements are made only as of the date of this report, and LendingClub undertakes no obligation to update any forward-looking statements to reflect new information or events or conditions after the date hereof.

Forward-looking statements are subject to certain risks, uncertainties and assumptions, including, but not limited to: expected synergies, cost savings and other financial or other benefits of the proposed transaction between LendingClub and Radius might not be realized within the expected timeframes or might be less than projected; the requisite regulatory approvals for the proposed transaction between LendingClub and Radius, including bank regulatory approvals, might not be obtained, or might not be obtained in a timely manner; credit and interest rate risks associated with LendingClub’s and Radius’s respective businesses; the exchange between LendingClub and Shanda is subject to closing conditions which might not be realized within the expected timeframes and the anticipated regulatory or other benefits of such exchange might be less than projected; customer borrowing, repayment, investment and deposit practices, and general economic conditions, either nationally or in the market areas in which LendingClub and Radius operate or anticipate doing business; and risks related to any required approvals for the consummation of such share exchange may be less favorable than expected, new regulatory or legal requirements or obligations, and other risks, uncertainties and assumptions identified under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in LendingClub’s Annual Report on Form 10-K for the year ended December 31, 2018, as well as LendingClub’s subsequent filings made with the Securities and Exchange Commission, including subsequent reports on Form 10-Q and 10-K. However, these risks and uncertainties are not exhaustive. Other sections of such filings describe additional factors that could impact LendingClub’s business, financial performance and pending or consummated acquisition transactions, including the proposed acquisition of Radius.

SIGNATURE(S)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

LendingClub Corporation

|

|

|

|

|

|

|

|

|

|

Date: February 19, 2020

|

|

|

|

By:

|

|

/s/ Brandon Pace

|

|

|

|

|

|

|

|

Brandon Pace

|

|

|

|

|

|

|

|

General Counsel & Secretary

|

|

|

|

|

|

|

|

(duly authorized officer)

|

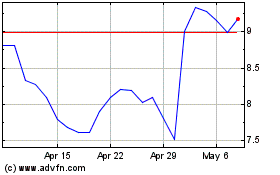

LendingClub (NYSE:LC)

Historical Stock Chart

From Mar 2024 to Apr 2024

LendingClub (NYSE:LC)

Historical Stock Chart

From Apr 2023 to Apr 2024