LEIDOS, INC. RETIREMENT PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

AS OF DECEMBER 31, 2021 AND 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2021 | | 2020 |

| | | | | (in thousands) |

| ASSETS: | | | | | |

| Investments: | | | |

| | | Investment in Leidos, Inc. Master Trust at fair value | $ | 9,452,822 | | | $ | 8,558,483 | |

| | | Investment in Leidos, Inc. Master Trust at contract value | | 513,617 | | | 547,644 | |

| | | | | Total investments | 9,966,439 | | | 9,106,127 | |

| Receivables: | | | |

| | | | Notes receivable from participants | 62,321 | | | 58,942 | |

| | | Interest and dividends receivable | | 268 | | | | — | |

| | | | Total receivables | 62,589 | | | 58,942 | |

| NET ASSETS AVAILABLE FOR BENEFITS | $ | 10,029,028 | | | $ | 9,165,069 | |

See notes to financial statements.

LEIDOS, INC. RETIREMENT PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2021 | | 2020 |

| | | | (in thousands) |

| ADDITIONS: | |

| Investment income: | | | |

| | | Plan interest in Leidos, Inc. Master Trust | $ | 1,003,906 | | | $ | 1,195,411 | |

| | | | | | | | |

| Interest income on notes receivable from participants | 2,973 | | | 3,226 | |

| | Contributions: | | | |

| | Participants | 288,738 | | | 265,588 | |

| | | Employer | 119,520 | | | 112,884 | |

| | Employee rollovers | 111,348 | | | 50,088 | |

| | | | Total contributions | 519,606 | | | 428,560 | |

| | | Total additions | 1,526,485 | | | 1,627,197 | |

| | | |

| DEDUCTIONS: | | | |

| Distributions paid to participants | 659,503 | | | 556,442 | |

| | Administrative expenses | 3,023 | | | 3,599 | |

| | | Total deductions | 662,526 | | | 560,041 | |

| INCREASE IN NET ASSETS AVAILABLE FOR BENEFITS | 863,959 | | | 1,067,156 | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS: | | | |

| Beginning of year | 9,165,069 | | | 8,097,913 | |

| | End of year | $ | 10,029,028 | | | $ | 9,165,069 | |

See notes to financial statements.

LEIDOS, INC. RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

1.DESCRIPTION OF THE PLAN

The following brief description of the Leidos, Inc. Retirement Plan (the “Plan”) is for general information purposes only. Participants should refer to the Plan document, Summary Plan Description and Prospectus Supplement all most recently amended and restated as of January 1, 2021 for more complete information regarding the Plan. Within these financial statements, Leidos, Inc. (the “Company”) refers to the sponsoring employer, and Leidos Holdings, Inc. (“Leidos”) refers to the publicly-traded parent of the sponsoring employer.

General—The Plan is a defined contribution plan sponsored by the Company and is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended. The Plan is a defined contribution 401(k) plan with profit-sharing and employee stock ownership plan (“ESOP”) features. Contributions to the Plan from participants and the Company are held in a qualified retirement trust fund. The Leidos, Inc. Retirement Plans Committee is the Plan’s named fiduciary for purposes of Section 402(a) of ERISA.

Investment Funds—As of December 31, 2021 and 2020, the Plan held an interest in the Leidos, Inc. Master Trust (“Master Trust”).

Eligibility—Employees of the Company and its subsidiaries that have adopted the Plan are eligible to participate in the Plan. Employees must be in an eligible fringe benefit package to be eligible to receive Company matching 401(k) contributions, profit sharing contributions, and ESOP contributions. Employees may make elective contributions and receive Company matching 401(k) contributions upon commencing employment.

Participant Contributions—The Plan permits participants to contribute up to 90% of their eligible compensation, as defined, to the Plan, subject to statutory limitations. Participants who have attained the age of 50 before the end of the plan year are eligible to make catch-up contributions. Certain participants within their collective bargaining agreement with the Company may make an additional elective contribution that is deducted from their Cash or Deferral Agreement. Participants may also contribute amounts representing rollovers from other qualified plans. Participant contributions are invested according to participant direction into any of the available investment funds of the Plan. Participant contributions and rollovers to the Leidos Common Stock Fund are limited to a maximum 50% of the employee deferral or rollover, as applicable.

The Company completed the acquisition of Gibbs & Cox, Inc. on May 7, 2021. The acquisition required the termination of the Gibbs & Cox, Inc. 401(k) Plan. Participants were given the option to rollover their account balances into the Plan or liquidate their account balances and receive cash or rollover distributions to other qualified plans by July 30, 2021, or as soon as administratively feasible. All transferred amounts are included in employee rollovers on the statement of changes in net assets available for benefits for the year ended December 31, 2021.

Employer Contributions—The Company may make discretionary contributions, which include matching 401(k) contributions, non-elective contributions, and ESOP contributions. Eligible participants may receive Company matching 401(k) contributions based on a maximum match percentage of 100%, depending on fringe level, of the first 5% of eligible compensation contributed to the Plan (up to a maximum match percentage of 5%), which are invested per participant direction. The Company, at its discretion, may also make additional contributions to the Plan for the benefit of non-highly compensated participants in order to comply with Section 401(k) (3) of the Internal Revenue Code. The Company made no additional contributions for the benefit of non-highly compensated participants for the years ended December 31, 2021 and 2020. Company contributions to the Plan for the years ended December 31, 2021 and 2020 were made in cash and transfers from the forfeiture account.

Participant Accounts—In accordance with Plan provisions, individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contributions, and if eligible, allocations of Company discretionary contributions. Allocations are based on participant eligible compensation, as defined in the Plan document. Participant accounts also reflect changes from investment income and losses and from distributions. The benefit to which a participant is entitled is the vested balance of his or her account.

LEIDOS, INC. RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

Vesting and Forfeitures—Participant’s elective deferrals and rollover contributions together with associated earnings vest immediately. Company contributions vest 25% for each of the first two calendar years during which the participant works at least 850 hours and become fully vested after the participant completes three years of vesting service, as defined by the Plan. In addition, participants become fully vested in Company contributions while employed with the Company upon reaching age 59-1/2, permanent disability, or death. Upon termination of employment with the Company, participants forfeit any portion of Company contributions that have not yet vested when they take a full distribution or after five one-year breaks in service. Forfeitures may be applied to future Company matching 401(k) contributions, to provide reinstatement due to military leave, to increase profit sharing contributions, or to pay Plan expenses. During the years ended December 31, 2021 and 2020, the Company applied forfeited non-vested amounts of approximately $3,997,000 and $4,557,000, respectively, primarily toward Company matching 401(k) contributions. As of December 31, 2021 and 2020, forfeited non-vested accounts available for application by the Company totaled approximately $463,000 and $440,000, respectively.

Notes Receivable from Participants—Participants may borrow up to 50% of their vested account balance, up to a maximum of

$50,000. Loan repayment periods may not exceed 60 months except for loans used to acquire a principal residence, in which case the repayment period may not exceed 30 years. The loans are secured by the vested account balance in the participant’s account and bear interest at a rate commensurate with local prevailing rates as determined monthly by the Plan administrator. The loans are recorded at amortized cost, which is the remaining unpaid principal balance plus any accrued but unpaid interest. Principal and interest are collected ratably through payroll deductions or through direct payments from terminated employees who have loans. Delinquent loans are reclassified as distributions based upon the terms of the Plan. As of December 31, 2021, outstanding loans bear interest at rates ranging from 4.25% to 9.25%, and have maturities from January 2022 through December 2051.

Distributions to Participants—For vested account balances less than or equal to $1,000, participants receive their vested account balance in a single lump sum within 12 calendar months following termination of employment with the Company. For balances over $1,000 and less than or equal to $5,000, participants have an opportunity to elect a cash distribution or a rollover to another eligible plan within 12 calendar months following termination. Otherwise, the balance will automatically be rolled over to a Vanguard IRA. For vested account balances that exceed $5,000, a participant’s vested account balance is not distributed unless the participant elects to take a distribution following the participant’s termination of employment with the Company. Regardless of the existing account balance, distributions are made to participants who die or become permanently disabled while employed by the Company. After attaining age 59-1/2, a participant may make withdrawals even if still employed by the Company. A participant may make withdrawals from the Plan prior to attaining age 59-1/2 of their rollover account, after-tax account or if the participant incurs a financial hardship, as specified by the Plan. Former employees, regardless of their age, may elect to receive unlimited distributions in any given plan year, of all or a portion of their account balance.

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security (“CARES”) Act was signed into law. Qualified individuals are those diagnosed with coronavirus ("COVID-19") or have a spouse or dependent who have been diagnosed, or who experience “adverse financial consequences” as a result of a quarantine, furlough, lay-off, reduction in work hours, business closure, the lack of child care, or other factors due to the COVID-19 pandemic.

The Plan elected to adopt the provisions of the CARES Act. Section 2202(a) of the CARES Act allows for qualified individuals to take up to $100,000 in coronavirus-related distributions with repayment terms of up to three years. Participants were able to request coronavirus-related distributions under the CARES Act from May 12, 2020 to December 31, 2020. The distributions without tax withholding made during 2020 may be returned to the Plan within three years, or if not returned, will be subject to ordinary taxation. Qualified individuals could also request a delay of note receivable repayments for repayments that occurred between May 12, 2020 and December 31, 2020. If a delay was granted, the participant’s note was reamortized and included any interest accrued during the period of delay. In addition, pursuant to the CARES Act, qualified individuals who were currently receiving required minimum distributions had their 2020 payment automatically waived and participants who were due to receive the first required distribution in 2020 had their distribution automatically waived. The ability to waive a required minimum distribution and delay in note repayments and take a coronavirus-related distribution under the CARES Act ceased as of December 31, 2020.

Tax Status—The Internal Revenue Service (“IRS”) has determined and informed the Company by a letter dated March 10, 2015, that the Plan was designed in accordance with the applicable requirements of the Internal Revenue Code. Accordingly, no provision for income taxes has been included in the Plan’s financial statements. Although the Plan has been amended since receiving the March 10, 2015 letter, the Plan administrator and the Plan’s tax counsel believe that the Plan is designed, and is currently being operated, in compliance with the applicable requirements of the Internal Revenue Code and, therefore, believe that the Plan is qualified, and the related trust is tax-exempt.

LEIDOS, INC. RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the organization has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service and other taxing authorities. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Related-Party Transactions—Certain Plan investments are managed by The Vanguard Group, the Plan’s record-keeper; therefore, transactions with these investments qualify as party-in-interest transactions. Fees paid to the record-keeper were approximately $3,023,000 and $3,599,000 for the years ended December 31, 2021 and 2020, respectively. There were no amounts payable to the Plan’s record-keeper as of December 31, 2021 and December 31, 2020. Members of the Company’s Retirement Plans Committee also participate in the Plan. The Company pays directly any other fees related to the Plan’s operation.

At December 31, 2021 and 2020, Leidos Holdings, Inc. common stock held by the Master Trust were:

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| | (in thousands) |

| Number of Shares | | 6,804 | | | 7,064 | |

| Cost Basis | | $ | 290,635 | | | $ | 288,349 | |

| Fair Value | | $ | 602,338 | | | $ | 742,592 | |

Termination of the Plan—Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions and to terminate the Plan at any time subject to the provisions of ERISA. Upon termination of the Plan, the participants become 100% vested in any unvested portion of their accounts.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting—The Plan’s financial statements are prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America. Investment transactions are accounted for on their trade dates.

Accounting Estimates—The preparation of financial statements in conformity with generally accepted accounting principles requires Plan management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of additions and deductions during the reporting periods. Actual results may differ from those estimates.

Investment Valuation and Income Recognition—Investments are held by the Leidos, Inc. Master Trust as of December 31, 2021 and 2020 as follows:

Investment in Master Trust—Primarily reported at fair value. Fair value is the price that would have been received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Master Trust invests in a Stable Value Fund which holds synthetic guaranteed investment contracts ("GICs") that are reported at contract value. The synthetic GICs simulate the performance of guaranteed investment contracts through an issuer’s guarantee of a specific interest rate (the wrapper contract) and a portfolio of financial instruments which include intermediate bond funds and money market funds. Contract value is the relevant measurement attributable to a GIC because it is the amount participants would receive if they were to initiate permitted transactions under the terms of the plan. The Master Trust invests in Mutual Funds, Common Collective Trusts, Leidos Stock and the Stable Value Fund mentioned above.

Investment in Common Stock—Investments in shares of Leidos Holdings, Inc. common stock, which is publicly traded on the New York Stock Exchange, is recorded at its publicly-traded quoted market price as of December 31, 2021 and 2020.

Investment Gains and Losses—Realized gains and losses on sales of investments are calculated as the difference between the fair value of the investments upon sale and the fair value of the investments at purchase. Unrealized appreciation or depreciation is calculated as the difference between the fair value of the investments at the end of the year and the fair value of the investments at the beginning of the year or at purchase if purchased during the year.

Interest income is recorded on the accrual basis of accounting. Dividends are recorded on the ex-dividend date.

LEIDOS, INC. RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

Notes Receivable from Participants—Notes receivable from participants are carried at the aggregate unpaid principal balance of loans outstanding. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when incurred. No allowance for credit losses has been recorded as of December 31, 2021 and 2020. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Benefits Payable—Benefit payments to participants are recorded upon distribution. There were no benefits payable to participants who had elected to withdraw from the Plan, but had not yet been paid as of December 31, 2021 and 2020.

Administrative Expenses—Administrative expenses of the Plan are paid by the Plan sponsor or Plan participants as provided in the Plan document.

Subsequent Events—The Plan has evaluated subsequent events through the date of this filing. Other than the event mentioned below, no other significant events were identified during the period.

On January 14, 2021, the Company acquired 1901 Group, LLC ("1901 Group"). As a result of the merger, all assets of the 1901 Group, LLC 401(k) Plan ("1901 Group Plan"), totaling approximately $13,425,000, were transferred into the Plan on January 3, 2022. Participants of the 1901 Group Plan who were employed with 1901 Group as of December 31, 2021 were immediately eligible to participate in the Plan on or after January 1, 2022.

3. FAIR VALUE MEASUREMENTS

Accounting guidance has been issued that establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The three levels of the fair value hierarchy are described below:

Level 1 Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2 Inputs to the valuation methodology include: quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; inputs other than quoted prices that are observable for the asset or liability; and inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3 Inputs to the valuation methodology are unobservable to the fair value measurement of assets or liabilities and are used to the extent that observable inputs are not available.

The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at the end of the reporting period.

LEIDOS, INC. RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

The following table sets forth by level, within the fair value hierarchy, the assets at fair value of the Master Trust as of December 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (Level 1) | | Total |

| | 2021 | | 2020 | | 2021 | | 2020 |

| (in thousands) |

| Mutual funds | $ | 947,140 | | | $ | 841,035 | | | $ | 947,140 | | | $ | 841,035 | |

| Common stock | 602,338 | | | 742,592 | | | 602,338 | | | 742,592 | |

| Total assets in the fair value hierarchy | $ | 1,549,478 | | | $ | 1,583,627 | | | 1,549,478 | | | 1,583,627 | |

Investments measured at NAV(1) | | | | | 8,475,182 | | | 7,440,622 | |

| Investments at fair value | | $ | 10,024,660 | | | $ | 9,024,249 | |

(1)Investments measured at NAV per share or its equivalent are not classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the statements of net assets available for benefits. These investments, which represent the Plan’s investments in common collective trusts, have no unfunded commitments, have a daily redemption frequency and do not have a redemption notice period.

The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at the beginning of the reporting period.

We evaluate the significance of transfers between levels based upon the nature of the financial instrument and size of the transfer relative to total net assets available for benefits. For the years ended December 31, 2021 and 2020, there were no significant transfers in or out of levels 1, 2, or 3. The Plan did not have any Level 2 or Level 3 investments for the years ended December 31, 2021 and 2020.

4. PLAN INTEREST IN MASTER TRUST

The Plan’s investments are included in the investments of the Leidos, Inc. Master Trust. Each participant in the retirement plan directs their investments into the funds within the Master Trust. The Plan’s record keeper maintains supporting records for the purpose of allocating net assets and net gains and losses of each of the investments of the Plans and to each participant’s account based on participant direction. The Master Trust also includes investment assets of the QTC Management, Inc. Retirement Savings Plan, Leidos BioMedical Research Capital Accumulation Plan and the Leidos BioMedical Research Employee Savings Plan.

The following table presents the investments of the Master Trust and the Plan's interest in the Master Trust, as of December 31, 2021 and 2020:

| | | | | | | | | | | | | | | | | | | | | | | |

| Master Trust Balances | | Plan’s Interest in Master Trust Balances |

| 2021 | | 2020 | | 2021 | | 2020 |

| (in thousands) |

| Mutual funds | $ | 947,140 | | | $ | 841,035 | | | $ | 918,185 | | | $ | 814,051 | |

| Leidos Holdings, Inc. common stock | 602,338 | | | 742,592 | | | 602,338 | | | 742,592 | |

| Common collective trusts | 8,475,182 | | | 7,440,622 | | | 7,932,299 | | | 7,001,840 | |

| Total investments at fair value | 10,024,660 | | | 9,024,249 | | | 9,452,822 | | | 8,558,483 | |

| Stable value fund at contract value | 559,710 | | | 594,550 | | | 513,617 | | | 547,644 | |

| Other receivables | 282 | | | — | | | — | | | — | |

| Total investments | $ | 10,584,652 | | | $ | 9,618,799 | | | $ | 9,966,439 | | | $ | 9,106,127 | |

LEIDOS, INC. RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020

The following table represents the changes in net assets in the Master Trust for the year ended December 31, 2021 and 2020:

| | | | | | | | | | | |

| 2021 | | 2020 |

| (in thousands) |

| Net appreciation in fair value of investments | $ | 1,055,713 | | | $ | 1,225,331 | |

| Interest and dividend income | 18,999 | | | 20,269 | |

| Total investment income | 1,074,712 | | | 1,245,600 | |

| | | |

| Net transfers (out of) into Master Trust | (108,859) | | | 129,229 | |

| | | |

| Master Trust Net Assets: | | | |

| Beginning | 9,618,799 | | | 8,243,970 | |

| Ending | $ | 10,584,652 | | | $ | 9,618,799 | |

During 2021 and 2020, the Plan received an allocation of 93.4% and 96.0%, respectively, on the net investment income in the Master Trust. Investment income is allocated to each plan based on the plan’s specific interest attributed to the underlying assets of the Master Trust.

5. RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of net assets available for benefits as reported in the financial statements to Schedule H on Form 5500:

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| | (in thousands) |

| Net assets available for benefits as reported in financial statements | $ | 10,029,028 | | | $ | 9,165,069 | |

| Participant loans deemed distributed | | (996) | | | (986) | |

| Deemed loans repaid | | 116 | | | 60 | |

| Net assets available for benefits reported on Schedule H on Form 5500 | $ | 10,028,148 | | | $ | 9,164,143 | |

The following is a reconciliation of changes in net assets available for benefits as reported in the financial statements to Schedule H on Form 5500:

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| | (in thousands) |

| Increase in net assets available for benefits per the financial statements | $ | 863,959 | | | $ | 1,067,156 | |

| Net change in participant loans deemed distributed | | (10) | | | 195 | |

| Net change in deemed loans repaid | | 56 | | | (220) | |

| Net income per Schedule H on Form 5500 | $ | 864,005 | | | $ | 1,067,131 | |

6. RISKS AND UNCERTAINTIES

The Plan invests in various securities. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, and overall market volatility. Due to the level of risk associated with investment securities, it is reasonably possible that changes in the values of certain investment securities will occur in the near term and that such change could materially affect the amounts reported in the statements of net assets available for benefits. See Note 2 – Significant Accounting Policies.

*****

SUPPLEMENTAL SCHEDULE

LEIDOS, INC. RETIREMENT PLAN

FORM 5500, SCHEDULE H, PART IV, LINE 4i—SCHEDULE OF ASSETS (HELD AT END OF YEAR) AS OF DECEMBER 31, 2021 (in thousands)

EIN: 95-3630868 Plan #004

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | | (b) Identity of Issue, Borrower, Lessor or Similar Party | | (c) Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value | | (d) Cost | | (e) Current Value |

| * | | Notes Receivable from Participants | | Loans/Interest rates from 4.25% to 9.25%; maturities from January 2022 to December 2051 | | ** | | 62,321 | |

| | | | | | | | $ | 62,321 | |

* Indicates party-in-interest to the Plan.

** Not applicable—participant-directed investment.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Leidos, Inc. Retirement Plans Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| LEIDOS, INC. RETIREMENT PLAN |

| |

| Date: June 13, 2022 | /s/ J. Councill Leak |

| J. Councill Leak |

| Treasurer |

Exhibit Index

Exhibit No.

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement Nos. 333-138095, 333-153360, 333-169693, No. 333-218435, and Post-Effective Amendment No. 1 to Registration Statement No. 333-138095 on Forms S-8 of Leidos Holdings, Inc. of our report dated June 13, 2022, relating to the financial statements and supplemental schedule appearing in this Annual Report on Form 11-K of Leidos, Inc. Retirement Plan for the year ended December 31, 2021.

/s/ Elliott Davis, LLC

Augusta, Georgia

June 13, 2022

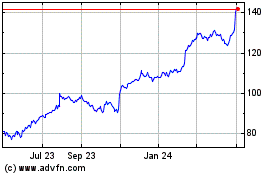

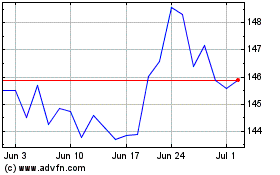

Leidos (NYSE:LDOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Leidos (NYSE:LDOS)

Historical Stock Chart

From Apr 2023 to Apr 2024