Lazard Sustainable Private Infrastructure Team Completes Inaugural Investment in DBE Energy

December 19 2022 - 3:00AM

Business Wire

Lazard Asset Management (LAM) today announced that the Lazard

Sustainable Private Infrastructure team completed its inaugural

investment in DBE Energy, owner, and operator of an anaerobic

digestion (AD) plant in Surrey, England.

The investment has been made in partnership with DBE’s

experienced management team who will continue operating the plant

with LAM as a majority shareholder. The DBE Energy plant

contributes to both the decarbonization and circular economy

ambitions of the U.K. by producing green, renewable gas from

organic waste and supplying it to the National Grid for commercial

and domestic use as a carbon neutral alternative to fossil gas.

“The Lazard Global Sustainable Private Infrastructure strategy

focuses on making investments in infrastructure companies that we

believe are well-positioned to achieve strong investment

performance while delivering positive and measurable improvements

in ESG and sustainability outcomes,” said Robert Wall, Head of

Sustainable Private Infrastructure at LAM. “The AD market in the

U.K., despite being one of the most advanced in Europe, is

fragmented and thus creates significant potential for consolidation

and growth. We are delighted to have completed this investment in

DBE Energy, and together with its management team are looking

forward to growing this partnership further.”

DBE Energy’s state-of-the-art AD plant began receiving local

food waste in January 2020 and has the capacity to process 25,000

tons of waste each year to produce up to 2.3 million cubic meters

of clean, green, renewable biomethane, providing energy for around

700 average sized family homes per year.

The Sustainable Private Infrastructure team, led by Robert Wall

and based in London, comprises John Cresswell as Operating Advisor

alongside Vitaly Filipskiy, Xenia Bredima and Alexis Agabriel. The

team has extensive experience in private investment and asset

ownership.

AM - LAZ

Lazard Asset Management

A subsidiary of Lazard Ltd (NYSE: LAZ), Lazard Asset Management

offers a range of equity, fixed-income, and alternative investment

products worldwide. As of November 30, 2022, Lazard’s asset

management businesses managed approximately $221 billion of client

assets. For more information about LAM, please visit

www.LazardAssetManagement.com. Follow LAM at @LazardAsset.

This document reflects the views of Lazard Asset Management LLC,

or its affiliates (“Lazard”) based upon information believed to be

reliable as of the publication date. There is no guarantee that any

forecast or opinion will be realized. This document is provided by

Lazard Asset Management LLC or its affiliates (“Lazard”) for

informational purposes only. Nothing herein constitutes investment

advice or a recommendation relating to any security, commodity,

derivative, investment management service or investment product.

Investments in securities, derivatives and commodities involve

risk, will fluctuate in price, and may result in losses. This

document is intended only for persons residing in jurisdictions

where its distribution or availability is consistent with local

laws and Lazard’s local regulatory authorizations. Please visit

www.lazardassetmanagement.com/globaldisclosure for the specific

Lazard entities that have issued this document and the scope of

their authorized activities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221219005207/en/

Media: Zoe Butt, +44 7463 978 444 zoe.butt@lazard.com

Julia Wright, Edelman Smithfield, + 44 7900 227 672

julia.wright@Edelmansmithfield.com

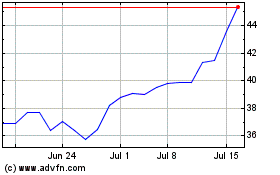

Lazard (NYSE:LAZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

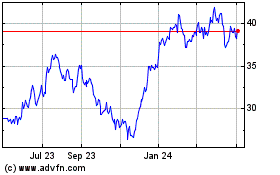

Lazard (NYSE:LAZ)

Historical Stock Chart

From Apr 2023 to Apr 2024