Ranked top restructuring advisor by volume

globally for first half of year

Assets under management increased 11% from

first to second quarter

Returned $264 million of capital to

shareholders in first half of year

Lazard Ltd (NYSE: LAZ) today reported operating revenue1 of $543

million for the quarter ended June 30, 2020. Net income, as

adjusted2, was $75 million, or $0.67 per share (diluted) for the

quarter. On a U.S. GAAP basis, second-quarter 2020 net income was

$73 million, or $0.66 per share (diluted).

First-half 2020 net income, as adjusted, was $142 million, or

$1.25 per share (diluted). On a U.S. GAAP basis, first-half 2020

net income was $137 million, or $1.22 per share (diluted).

“Lazard continues to perform well in a period of unprecedented

uncertainty, reflecting the strength and resilience of our business

model and the dedication of our people,” said Kenneth M. Jacobs,

Chairman and Chief Executive Officer of Lazard. “Our broad array of

Financial Advisory services, including our preeminent Restructuring

franchise, mitigates the impact of a slowdown in global M&A

markets. In Asset Management, the diversification of our investment

platforms and global client base continue to be a solid foundation

for long-term growth.”

($ in millions, except per share data and

AUM)

Quarter Ended June 30,

Six Months Ended June

30,

2020

2019

%’20-’19

2020

2019

%’20-’19

Net

Income

U.S. GAAP

$73

$66

12%

$137

$163

(16)%

Per share, diluted

$0.66

$0.55

20%

$1.22

$1.36

(10)%

Adjusted2

$75

$86

(12)%

$142

$191

(26)%

Per share, diluted

$0.67

$0.73

(8)%

$1.25

$1.61

(22)%

Operating

Revenue1

Total operating revenue

$543

$630

(14)%

$1,106

$1,250

(12)%

Financial Advisory

$293

$329

(11)%

$588

$659

(11)%

Asset Management

$245

$291

(16)%

$514

$575

(11)%

AUM ($ in

billions)

Period End

$215

$237

(10)%

Average

$208

$237

(12)%

$215

$233

(8)%

Note: Endnotes are on page 6 of this release. A reconciliation

of adjusted GAAP to U.S. GAAP begins on page 13.

COVID-19 ENVIRONMENT UPDATE

During the second quarter of 2020, the COVID-19 pandemic

continued to have a negative impact on economic activity around the

world. Governments and central banks have taken extraordinary

measures to support local economies and capital markets, but the

macroeconomic outlook remains uncertain while significant health

risks persist.

Lazard’s offices around the world have continued to operate in

the context of applicable local regulations and guidelines

regarding business activity, and in the second quarter, the

majority of our people worked from home, employing virtual and

secure cloud-based systems to continue communicating, collaborating

and conducting client business.

We continue to expect a challenging environment in the near-term

due to elevated uncertainty, capital markets volatility and a

downturn in global M&A activity. We believe that our strong

financial position, the diversity of our business, and our

consistent focus on cost discipline will enable us to weather the

economic downturn.

OPERATING REVENUE

Operating revenue1 was $543 million for the second quarter of

2020, and $1,106 million for the first half of 2020, down 14% and

12% for both periods from the respective 2019 periods.

Financial Advisory

Our Financial Advisory results include M&A Advisory, Capital

Advisory, Capital Raising, Restructuring, Shareholder Advisory,

Sovereign Advisory, and other strategic advisory work for

clients.

For the second quarter of 2020, Financial Advisory operating

revenue was $293 million, 11% lower than the second quarter of

2019. The decrease reflected lower M&A completions offset by

higher Restructuring advisory fees.

For the first half of 2020, Financial Advisory operating revenue

was $588 million, 11% lower than the first half of 2019.

During and since the second quarter of 2020, Lazard has been

engaged in significant and complex M&A transactions and other

advisory assignments globally, including the following (clients are

in italics): Alfried Krupp von Bohlen und Halbach-Foundation in

thyssenkrupp’s €17.2 billion sale of its Elevator Technology

business to a consortium led by Advent, Cinven and RAG foundation;

Anheuser-Busch InBev’s AUD 16.0 billion sale of Carlton &

United Breweries to Asahi Group Holdings; Apergy in its combination

with ChampionX, valuing the combined entity at $7.4 billion; Sempra

Energy on its $3.6 billion sale of its equity interests in its

Peruvian businesses to China Yangtze Power, and its $2.2 billion

sale of its equity interests in its Chilean businesses to State

Grid International Development; Visa’s $5.3 billion acquisition of

Plaid; Arqiva’s £2.0 billion sale of its Telecoms division to

Cellnex; and Teladoc Health’s $600 million acquisition of InTouch

Health.

Lazard has one of the world’s preeminent restructuring

practices, with a long track record of successfully advising

businesses and governments. During and since the second quarter of

2020, we have been engaged in a broad range of highly visible and

complex restructuring and debt advisory assignments for debtors or

creditors, including roles involving: 24 Hour Fitness; CSM Bakery

Solutions; Diamond Offshore Drilling; Foresight Energy; Gavilan

Resources; Global Cloud Xchange; Hi-Crush; J.C. Penney; J.Crew;

Libbey; Macy’s; Neiman Marcus; PG&E; Pioneer Energy Services;

Premier Oil; Pyxus International; Technicolor; Trevi Finanziaria

Industriale; and Valaris. Lazard was the global leader in announced

restructurings by volume for the first half of 2020 (Source:

Refinitiv).

Our Capital and Shareholder Advisory practices remain active

globally, advising on a broad range of public and private

assignments. Our Sovereign Advisory practice continues to be active

advising governments, sovereign and sub-sovereign entities across

developed and emerging markets.

For a list of publicly announced Financial Advisory transactions

on which Lazard advised in the second quarter of 2020, or continued

to advise or completed since June 30, 2020, please visit our

website at www.lazard.com/businesses/transactions.

Asset Management

In the text portion of this press release, we present our Asset

Management results as 1) Management fees and other revenue, and 2)

Incentive fees.

For the second quarter of 2020, Asset Management operating

revenue was $245 million, 16% lower than the second quarter of

2019. For the first half of 2020, Asset Management operating

revenue was $514 million, 11% lower than the first half of

2019.

For the second quarter of 2020, management fees and other

revenue was $245 million, 14% lower than the second quarter of

2019, and 9% lower than the first quarter of 2020. For the first

half of 2020, management fees and other revenue was $512 million,

10% lower than the first half of 2019.

Average assets under management (AUM) for the second quarter of

2020 was $208 billion, 12% lower than the second quarter of 2019,

and 6% lower than the first quarter of 2020. Average AUM for the

first half of 2020 was $215 billion, 8% lower than the first half

of 2019.

AUM as of June 30, 2020, was $215 billion, down 10% from June

30, 2019, and up 11% from March 31, 2020. The sequential increase

was primarily driven by market appreciation of $25 billion and

foreign exchange appreciation of $2.4 billion, partially offset by

$6 billion in net outflows.

For the second quarter of 2020, incentive fees were $1 million,

compared to $5 million for the second quarter of 2019. For the

first half of 2020, incentive fees were $2 million, compared to $6

million for the first half of 2019.

OPERATING EXPENSES

Compensation and

Benefits

In managing compensation and benefits expense, we focus on

annual awarded compensation (cash compensation and benefits plus

deferred incentive compensation with respect to the applicable

year, net of estimated future forfeitures and excluding charges), a

non-GAAP measure. We believe annual awarded compensation is an

appropriate measure to assess actual annual compensation cost when

also presented with the GAAP measure of compensation cost, which

includes applicable-year cash compensation and the amortization of

deferred incentive compensation principally attributable to

previous years’ deferred compensation. We believe that by managing

our business using awarded compensation with a consistent deferral

policy, we can better manage our compensation costs, increase our

flexibility in the future and build shareholder value over

time.

For the second quarter of 2020, we accrued compensation and

benefits expense1 at an adjusted compensation1 ratio of 60%. This

resulted in $326 million of adjusted compensation and benefits

expense, compared to $362 million for the second quarter of

2019.

For the first half of 2020, adjusted compensation and benefits

expense1 was $663 million, compared to $719 million for the first

half of 2019.

We manage our compensation and benefits expense based on awarded

compensation with a consistent deferral policy. We take a

disciplined approach to compensation, and our goal is to maintain a

compensation-to-operating revenue ratio over the cycle in the mid-

to high-50s percentage range on both an awarded and adjusted basis,

with consistent deferral policies.

Non-Compensation Expense

Adjusted non-compensation expense1 for the second quarter of

2020 was $100 million, 22% lower than the second quarter of 2019.

The decrease primarily reflects lower marketing and business

development expenses, including travel. The ratio of adjusted

non-compensation expense to operating revenue for the second

quarter of 2020 was 18.3%, compared to 20.3% for the second quarter

of 2019.

Adjusted non-compensation expense1 for the first half of 2020

was $212 million, 13% lower than the first half of 2019. The ratio

of adjusted non-compensation expense to operating revenue for the

first half of 2020 was 19.2%, compared to 19.5% for the first half

of 2019.

Our goal remains to achieve an adjusted non-compensation

expense-to-operating revenue ratio over the cycle of 16% to

20%.

TAXES

The provision for taxes, on an adjusted basis1, was $24 million

for the second quarter of 2020 and $50 million for the first half

of 2020. The effective tax rate on the same basis was 23.9% for the

second quarter and 26.3% for the first half of 2020, compared to

28.8% and 23.9% for the respective 2019 periods.

CAPITAL MANAGEMENT AND BALANCE SHEET

Our primary capital management goals include managing debt and

returning capital to shareholders through dividends and share

repurchases.

For the second quarter of 2020, Lazard returned $53 million to

shareholders, which included: $49 million in dividends and $4

million in satisfaction of employee tax obligations in lieu of

share issuances upon vesting of equity grants.

For the first half of 2020, Lazard returned $264 million to

shareholders, which included: $98 million in dividends; $95 million

in share repurchases of our Class A common stock; and $71 million

in satisfaction of employee tax obligations in lieu of share

issuances upon vesting of equity grants.

During the first half of 2020, we repurchased 2.9 million shares

at an average price of $32.70 per share. As of June 30, 2020, our

remaining share repurchase authorization was $306 million.

On July 29, 2020, Lazard declared a quarterly dividend of $0.47

per share on its outstanding common stock. The dividend is payable

on August 21, 2020, to stockholders of record on August 10,

2020.

Lazard’s financial position remains strong. As of June 30, 2020,

our cash and cash equivalents were $897 million, and stockholders’

equity related to Lazard’s interests was $601 million.

CONFERENCE CALL

Lazard will host a conference call at 8:00 a.m. EDT on July 31,

2020, to discuss the company’s financial results for the second

quarter and first half of 2020. The conference call can be accessed

via a live audio webcast available through Lazard’s Investor

Relations website at www.lazard.com, or by dialing 1 (800) 458-4148

(U.S. and Canada) or +1 (323) 794-2093 (outside of the U.S. and

Canada), 15 minutes prior to the start of the call.

A replay of the conference call will be available by 10:00 a.m.

EDT on July 31, 2020, via the Lazard Investor Relations website, or

by dialing 1 (888) 203-1112 (U.S. and Canada) or +1 (719) 457-0820

(outside of the U.S. and Canada). The replay access code is

1611226.

ABOUT LAZARD

Lazard, one of the world's preeminent financial advisory and

asset management firms, operates from more than 40 cities across 25

countries in North America, Europe, Asia, Australia, Central and

South America. With origins dating to 1848, the firm provides

advice on mergers and acquisitions, strategic matters,

restructuring and capital structure, capital raising and corporate

finance, as well as asset management services to corporations,

partnerships, institutions, governments and individuals. For more

information on Lazard, please visit www.lazard.com. Follow Lazard

at @Lazard.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements. In some

cases, you can identify these statements by forward-looking words

such as “may”, “might”, “will”, “should”, “could”, “would”,

“expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”,

“potential”, “target,” “goal”, or “continue”, and the negative of

these terms and other comparable terminology. These forward-looking

statements, which are subject to known and unknown risks,

uncertainties and assumptions about us, may include projections of

our future financial performance based on our growth strategies,

business plans and initiatives and anticipated trends in our

business. These statements are only predictions based on our

current expectations and projections about future events. There are

important factors that could cause our actual results, level of

activity, performance or achievements to differ materially from the

results, level of activity, performance or achievements expressed

or implied by these forward-looking statements.

These factors include, but are not limited to, those discussed

in our Annual Report on Form 10-K under Item 1A “Risk Factors,” and

also discussed from time to time in our reports on Forms 10-Q and

8-K, including the following:

- A decline in general economic conditions or the global or

regional financial markets;

- A decline in our revenues, for example due to a decline in

overall mergers and acquisitions (M&A) activity, our share of

the M&A market or our assets under management (AUM);

- Losses caused by financial or other problems experienced by

third parties;

- Losses due to unidentified or unanticipated risks;

- A lack of liquidity, i.e., ready access to funds, for use in

our businesses; and

- Competitive pressure on our businesses and on our ability to

retain and attract employees at current compensation levels.

Although we believe the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, level of activity, performance or achievements.

Neither we nor any other person assumes responsibility for the

accuracy or completeness of any of these forward-looking

statements. You should not rely upon forward-looking statements as

predictions of future events. We are under no duty to update any of

these forward-looking statements after the date of this release to

conform our prior statements to actual results or revised

expectations and we do not intend to do so.

Lazard Ltd is committed to providing timely and accurate

information to the investing public, consistent with our legal and

regulatory obligations. To that end, Lazard and its operating

companies use their websites to convey information about their

businesses, including the anticipated release of quarterly

financial results, quarterly financial, statistical and

business-related information, and the posting of updates of assets

under management in various mutual funds, hedge funds and other

investment products managed by Lazard Asset Management LLC and

Lazard Frères Gestion SAS. Investors can link to Lazard and its

operating company websites through www.lazard.com.

ENDNOTES

1 A non-U.S. GAAP measure. See attached financial schedules and

related notes for a detailed explanation of adjustments to

corresponding U.S. GAAP results. We believe that presenting our

results on an adjusted basis in addition to the U.S. GAAP results

is a meaningful and useful basis to compare our operating results

across periods.

2 Second-quarter and first-half 2020 adjusted results1 exclude

pre-tax charges of $2.5 million and $6.2 million, respectively, of

costs relating to an office space reorganization. On a U.S. GAAP

basis, these resulted in a net charge of $1.7 million, or $0.02

(diluted) per share, for the second quarter, and a net charge of

$4.2 million, or $0.04 (diluted) per share, for the first half of

2020.

LAZ-EPE

LAZARD LTD UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS (U.S. GAAP)

Three Months Ended

% Change From

June 30,

March 31,

June 30,

March 31,

June 30,

($ in thousands, except per share data)

2020

2020

2019

2020

2019

Total revenue

$592,264

$558,157

$650,801

6

%

(9

%)

Interest expense

(19,972

)

(20,143

)

(20,111

)

Net revenue

572,292

538,014

630,690

6

%

(9

%)

Operating expenses: Compensation and benefits

351,568

319,755

372,470

10

%

(6

%)

Occupancy and equipment

30,574

32,198

30,953

Marketing and business development

6,517

20,186

28,784

Technology and information services

32,629

31,358

38,825

Professional services

16,728

14,545

19,144

Fund administration and outsourced services

24,053

26,390

28,493

Amortization and other acquisition-related costs

455

446

5,042

Other

13,903

9,039

5,294

Subtotal

124,859

134,162

156,535

(7

%)

(20

%)

Operating expenses

476,427

453,917

529,005

5

%

(10

%)

Operating income

95,865

84,097

101,685

14

%

(6

%)

Provision for income taxes

22,789

25,766

28,172

(12

%)

(19

%)

Net income

73,076

58,331

73,513

25

%

(1

%)

Net income (loss) attributable to noncontrolling interests

(382

)

(5,691

)

7,736

Net income attributable to Lazard Ltd

$73,458

$64,022

$65,777

15

%

12

%

Attributable to Lazard Ltd Common Stockholders:

Weighted average shares outstanding: Basic

106,662,064

106,303,962

111,981,204

0

%

(5

%)

Diluted

111,487,749

114,120,179

116,175,349

(2

%)

(4

%)

Net income per share: Basic

$0.68

$0.59

$0.57

15

%

19

%

Diluted

$0.66

$0.56

$0.55

18

%

20

%

LAZARD LTD UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS (U.S. GAAP)

Six Months Ended

June 30,

June 30,

($ in thousands, except per share data)

2020

2019

% Change

Total revenue

$1,150,421

$1,312,479

(12%)

Interest expense

(40,115

)

(38,115

)

Net revenue

1,110,306

1,274,364

(13%)

Operating expenses:

Compensation and benefits

671,323

744,724

(10%)

Occupancy and equipment

62,772

59,248

Marketing and business development

26,703

56,768

Technology and information services

63,987

70,880

Professional services

31,273

33,361

Fund administration and outsourced services

50,443

57,423

Amortization and other acquisition-related costs

901

8,512

Other

22,942

22,100

Subtotal

259,021

308,292

(16%)

Operating expenses

930,344

1,053,016

(12%)

Operating income

179,962

221,348

(19%)

Provision for income taxes

48,555

51,359

(5%)

Net income

131,407

169,989

(23%)

Net income (loss) attributable to noncontrolling interests

(6,073

)

7,170

Net income attributable to Lazard Ltd

$137,480

$162,819

(16%)

Attributable to Lazard Ltd Common Stockholders:

Weighted average shares outstanding:

Basic

106,483,013

111,962,729

(5%)

Diluted

112,803,964

118,497,717

(5%)

Net income per share:

Basic

$1.27

$1.44

(12%)

Diluted

$1.22

$1.36

(10%)

LAZARD LTD UNAUDITED CONDENSED CONSOLIDATED

STATEMENT OF FINANCIAL CONDITION (U.S. GAAP)

June 30,

December 31,

($ in thousands)

2020

2019

ASSETS Cash and

cash equivalents

$896,843

$1,231,593

Deposits with banks and short-term investments

1,155,539

1,180,686

Cash deposited with clearing organizations and other segregated

cash

40,283

43,280

Receivables

652,112

663,138

Investments

523,366

531,995

Goodwill and other intangible assets

369,159

373,594

Operating lease right-of-use assets

525,193

551,504

Deferred tax assets

563,243

586,750

Other assets

586,380

477,041

Total Assets

$5,312,118

$5,639,581

LIABILITIES & STOCKHOLDERS'

EQUITY Liabilities Deposits and other

customer payables

$1,230,920

$1,246,200

Accrued compensation and benefits

365,989

602,777

Operating lease liabilities

618,362

644,345

Tax receivable agreement obligation

221,890

247,344

Senior debt

1,680,845

1,679,562

Other liabilities

510,144

537,779

Total liabilities

4,628,150

4,958,007

Commitments and contingencies Stockholders'

equity Preferred stock, par value $.01 per share

-

-

Common stock, par value $.01 per share

1,128

1,128

Additional paid-in capital

52,274

41,020

Retained earnings

1,140,015

1,193,570

Accumulated other comprehensive loss, net of tax

(308,921

)

(293,648

)

Subtotal

884,496

942,070

Class A common stock held by subsidiaries, at cost

(283,899

)

(332,079

)

Total Lazard Ltd stockholders' equity

600,597

609,991

Noncontrolling interests

83,371

71,583

Total stockholders' equity

683,968

681,574

Total liabilities and stockholders' equity

$5,312,118

$5,639,581

LAZARD LTD SELECTED SUMMARY FINANCIAL INFORMATION (a)

(Non-GAAP - unaudited)

Three Months Ended

% Change From

June 30,

March 31,

June 30,

March 31,

June 30,

($ in thousands, except per share data)

2020

2020

2019

2020

2019

Revenues: Financial Advisory

$292,906

$294,773

$328,814

(1%)

(11%)

Asset Management

245,346

268,953

291,269

(9%)

(16%)

Corporate

4,662

(915)

9,617

NM

(52%)

Operating revenue (b)

$542,914

$562,811

$629,700

(4%)

(14%)

Expenses:

Adjusted compensation and benefits expense (c)

$325,749

$337,686

$362,078

(4%)

(10%)

Ratio of adjusted compensation to operating revenue

60.0%

60.0%

57.5%

Non-compensation expense (d)

$99,617

$112,632

$128,014

(12%)

(22%)

Ratio of non-compensation to operating revenue

18.3%

20.0%

20.3%

Earnings:

Earnings from operations (e)

$117,548

$112,493

$139,608

4%

(16%)

Operating margin (f)

21.7%

20.0%

22.2%

Adjusted net income (g)

$75,151

$66,552

$85,746

13%

(12%)

Diluted adjusted net income per share

$0.67

$0.58

$0.73

16%

(8%)

Diluted weighted average shares (h)

111,845,101

114,160,044

117,422,884

(2%)

(5%)

Effective tax rate (i)

23.9%

28.8%

28.8%

This presentation includes non-U.S. GAAP ("non-GAAP") measures. Our

non-GAAP measures are not meant to be considered in isolation or as

a substitute for the corresponding U.S. GAAP measures, and should

be read only in conjunction with our consolidated financial

statements prepared in accordance with U.S. GAAP. For a detailed

explanation of the adjustments made to the corresponding U.S. GAAP

measures, see Reconciliation of U.S. GAAP to Selected Summary

Financial Information and Notes to Financial Schedules.

LAZARD

LTD SELECTED SUMMARY FINANCIAL INFORMATION (a)

(Non-GAAP - unaudited)

Six Months Ended

June 30,

June 30,

($ in thousands, except per share data)

2020

2019

% Change

Revenues: Financial Advisory

$587,679

$658,808

(11%)

Asset Management

514,299

575,003

(11%)

Corporate

3,747

15,879

(76%)

Operating revenue (b)

$1,105,725

$1,249,690

(12%)

Expenses:

Adjusted compensation and benefits expense (c)

$663,435

$718,572

(8%)

Ratio of adjusted compensation to operating revenue

60.0%

57.5%

Non-compensation expense (d)

$212,249

$243,751

(13%)

Ratio of non-compensation to operating revenue

19.2%

19.5%

Earnings:

Earnings from operations (e)

$230,041

$287,367

(20%)

Operating margin (f)

20.8%

23.0%

Adjusted net income (g)

$141,703

$191,283

(26%)

Diluted adjusted net income per share

$1.25

$1.61

(22%)

Diluted weighted average shares (h)

113,002,572

119,178,774

(5%)

Effective tax rate (i)

26.3%

23.9%

This presentation includes non-GAAP measures. Our non-GAAP measures

are not meant to be considered in isolation or as a substitute for

the corresponding U.S. GAAP measures, and should be read only in

conjunction with our consolidated financial statements prepared in

accordance with U.S. GAAP. For a detailed explanation of the

adjustments made to the corresponding U.S. GAAP measures, see

Reconciliation of U.S. GAAP to Selected Summary Financial

Information and Notes to Financial Schedules.

LAZARD LTD

ASSETS UNDER MANAGEMENT ("AUM") (unaudited) ($ in

millions)

As of

Variance

June 30,

March 31,

December 31,

2020

2020

2019

Qtr to Qtr

YTD

Equity: Emerging Markets

$28,937

$27,716

$40,612

4.4%

(28.7%)

Global

45,178

39,094

49,759

15.6%

(9.2%)

Local

43,477

37,496

48,985

16.0%

(11.2%)

Multi-Regional

55,923

50,335

66,185

11.1%

(15.5%)

Total Equity

173,515

154,641

205,541

12.2%

(15.6%)

Fixed Income:

Emerging Markets

12,412

11,424

14,387

8.6%

(13.7%)

Global

9,883

9,100

9,233

8.6%

7.0%

Local

5,436

5,421

5,450

0.3%

(0.3%)

Multi-Regional

9,153

8,376

9,193

9.3%

(0.4%)

Total Fixed Income

36,884

34,321

38,263

7.5%

(3.6%)

Alternative Investments

2,028

1,902

2,149

6.6%

(5.6%)

Private Equity

1,412

1,406

1,385

0.4%

1.9%

Cash Management

865

778

901

11.2%

(4.0%)

Total AUM

$214,704

$193,048

$248,239

11.2%

(13.5%)

Three Months Ended June 30,

Six Months Ended June 30,

2020

2019

2020

2019

AUM - Beginning of Period

$193,048

$234,979

$248,239

$214,734

Net Flows

(5,968

)

(5,246

)

(10,881)

(5,208)

Market and foreign exchange appreciation (depreciation)

27,624

7,733

(22,654)

27,940

AUM - End of Period

$214,704

$237,466

$214,704

$237,466

Average AUM

$208,454

$236,978

$215,008

$232,740

% Change in average AUM

(12.0

%)

(7.6%)

Note: Average AUM generally represents the average of the

monthly ending AUM balances for the period.

LAZARD LTD

RECONCILIATION OF U.S. GAAP TO SELECTED SUMMARY FINANCIAL

INFORMATION (a) (unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

($ in thousands, except per share data)

2020

2020

2019

2020

2019

Operating Revenue Net revenue - U.S. GAAP Basis

$572,292

$538,014

$630,690

$1,110,306

$1,274,364

Adjustments: (Revenue) loss related to noncontrolling

interests (j)

(2,173

)

2,772

(11,819

)

599

(14,090

)

(Gains) losses related to Lazard Fund Interests ("LFI") and other

similar arrangements

(23,803

)

19,637

(6,484

)

(4,166

)

(20,354

)

Distribution fees, reimbursable deal costs and bad debt expense (k)

(21,936

)

(16,384

)

(13,357

)

(38,320

)

(37,689

)

Private Equity investment adjustment (l)

-

-

11,948

-

11,948

Interest expense

18,534

18,772

18,722

37,306

35,511

Operating revenue, as adjusted (b)

$542,914

$562,811

$629,700

$1,105,725

$1,249,690

Compensation and Benefits Expense Compensation and

benefits expense - U.S. GAAP Basis

$351,568

$319,755

$372,470

$671,323

$744,724

Adjustments: (Charges) credits pertaining to LFI and other

similar arrangements

(23,803

)

19,637

(6,484

)

(4,166

)

(20,354

)

Compensation related to noncontrolling interests (j)

(2,016

)

(1,706

)

(3,908

)

(3,722

)

(5,798

)

Compensation and benefits expense, as adjusted (c)

$325,749

$337,686

$362,078

$663,435

$718,572

Non-Compensation Expense Non-compensation expense -

Subtotal - U.S. GAAP Basis

$124,859

$134,162

$156,535

$259,021

$308,292

Adjustments: Expenses associated with ERP system

implementation (m)

-

-

(7,626

)

-

(10,831

)

Expenses related to office space reorganization (n)

(2,487

)

(3,664

)

-

(6,151

)

-

Distribution fees, reimbursable deal costs and bad debt expense (k)

(21,936

)

(16,384

)

(13,357

)

(38,320

)

(37,689

)

Amortization and other acquisition-related costs (o)

(455

)

(446

)

(5,042

)

(901

)

(8,512

)

Charges pertaining to Senior Debt refinancing (p)

-

-

(2,262

)

-

(6,505

)

Non-compensation expense related to noncontrolling interests (j)

(364

)

(1,036

)

(234

)

(1,400

)

(1,004

)

Non-compensation expense, as adjusted (d)

$99,617

$112,632

$128,014

$212,249

$243,751

Pre-Tax Income and Earnings From Operations Operating

Income - U.S. GAAP Basis

$95,865

$84,097

$101,685

$179,962

$221,348

Adjustments: Expenses associated with ERP system

implementation (m)

-

-

7,626

-

10,831

Expenses related to office space reorganization (n)

2,487

3,664

-

6,151

-

Acquisition-related costs (o)

-

-

4,612

-

7,651

Private Equity investment adjustment (l)

-

-

11,948

-

11,948

Charges pertaining to Senior Debt refinancing (p)

-

-

2,348

-

6,805

Net (income) loss related to noncontrolling interests (j)

382

5,691

(7,736

)

6,073

(7,170

)

Pre-tax income, as adjusted

98,734

93,452

120,483

192,186

251,413

Interest expense

18,534

18,772

18,636

37,306

35,211

Amortization (LAZ only)

280

269

489

549

743

Earnings from operations, as adjusted (e)

$117,548

$112,493

$139,608

$230,041

$287,367

Net Income attributable to Lazard Ltd Net

income attributable to Lazard Ltd - U.S. GAAP Basis

$73,458

$64,022

$65,777

$137,480

$162,819

Adjustments: Expenses associated with ERP system implementation (m)

-

-

7,626

-

10,831

Expenses related to office space reorganization (n)

2,487

3,664

-

6,151

-

Acquisition-related costs (o)

-

-

4,612

-

7,651

Private Equity investment adjustment (l)

-

-

11,948

-

11,948

Charges pertaining to Senior Debt refinancing (p)

-

-

2,348

-

6,805

Tax benefit allocated to adjustments

(794

)

(1,134

)

(6,565

)

(1,928

)

(8,771

)

Net income, as adjusted (g)

$75,151

$66,552

$85,746

$141,703

$191,283

Diluted Weighted Average Shares Outstanding Diluted

Weighted Average Shares Outstanding - U.S. GAAP Basis

111,487,749

114,120,179

116,175,349

112,803,964

118,497,717

Adjustment: participating securities including profits interest

participation rights

357,352

39,865

1,247,535

198,609

681,057

Diluted Weighted Average Shares Outstanding, as adjusted (h)

111,845,101

114,160,044

117,422,884

113,002,572

119,178,774

Diluted net income per share: U.S. GAAP Basis

$0.66

$0.56

$0.55

$1.22

$1.36

Non-GAAP Basis, as adjusted

$0.67

$0.58

$0.73

$1.25

$1.61

This presentation includes non-GAAP measures. Our non-GAAP measures

are not meant to be considered in isolation or as a substitute for

comparable U.S. GAAP measures, and should be read only in

conjunction with our consolidated financial statements prepared in

accordance with U.S. GAAP. For a detailed explanation of the

adjustments made to comparable U.S. GAAP measures, see Notes to

Financial Schedules.

See Notes to Financial Schedules

LAZARD LTD RECONCILIATION OF NON-COMPENSATION U.S. GAAP

TO ADJUSTED (a) (unaudited)

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

($ in thousands)

2020

2020

2019

2020

2019

Non-compensation expense

- U.S. GAAP Basis: Occupancy and

equipment

$30,574

$32,198

$30,953

$62,772

$59,248

Marketing and business development

6,517

20,186

28,784

26,703

56,768

Technology and information services

32,629

31,358

38,825

63,987

70,880

Professional services

16,728

14,545

19,144

31,273

33,361

Fund administration and outsourced services

24,053

26,390

28,493

50,443

57,423

Amortization and other acquisition-related costs

455

446

5,042

901

8,512

Other

13,903

9,039

5,294

22,942

22,100

Non-compensation expense - Subtotal - U.S. GAAP Basis

$124,859

$134,162

$156,535

$259,021

$308,292

Non-compensation expense

- Adjustments: Occupancy and

equipment (j) (n)

($2,448

)

($3,733

)

($25

)

($6,181

)

($58

)

Marketing and business development (j) (k) (m)

(755

)

(2,691

)

(6,493

)

(3,446

)

(9,897

)

Technology and information services (j) (k) (m)

(167

)

(435

)

(7,427

)

(602

)

(10,703

)

Professional services (j) (k) (m) (n)

(1,658

)

(1,778

)

(2,091

)

(3,436

)

(3,455

)

Fund administration and outsourced services (j) (k)

(10,129

)

(12,120

)

(12,549

)

(22,249

)

(28,458

)

Amortization and other acquisition-related costs (o)

(455

)

(446

)

(5,042

)

(901

)

(8,512

)

Other (j) (k) (m) (p)

(9,630

)

(327

)

5,106

(9,957

)

(3,458

)

Subtotal Non-compensation adjustments

($25,242

)

($21,530

)

($28,521

)

($46,772

)

($64,541

)

Non-compensation expense,

as adjusted: Occupancy and

equipment

$28,126

$28,465

$30,928

$56,591

$59,190

Marketing and business development

5,762

17,495

22,291

23,257

46,871

Technology and information services

32,462

30,923

31,398

63,385

60,177

Professional services

15,070

12,767

17,053

27,837

29,906

Fund administration and outsourced services

13,924

14,270

15,944

28,194

28,965

Amortization and other acquisition-related costs

-

-

-

-

-

Other

4,273

8,712

10,400

12,985

18,642

Non-compensation expense, as adjusted (d)

$99,617

$112,632

$128,014

$212,249

$243,751

This presentation includes non-GAAP measures. Our non-GAAP measures

are not meant to be considered in isolation or as a substitute for

comparable U.S. GAAP measures, and should be read only in

conjunction with our consolidated financial statements prepared in

accordance with U.S. GAAP. For a detailed explanation of the

adjustments made to comparable U.S. GAAP measures, see Notes to

Financial Schedules.

See Notes to Financial Schedules

LAZARD LTD Notes to Financial Schedules

(a)

Selected Summary Financial

Information are non-GAAP measures. Lazard believes that presenting

results and measures on an adjusted basis in conjunction with U.S.

GAAP measures provides a meaningful and useful basis for comparison

of its operating results across periods.

(b)

A non-GAAP measure which excludes

(i) (revenue)/loss related to noncontrolling interests (see (j)

below), (ii) (gains)/losses related to the changes in the fair

value of investments held in connection with Lazard Fund Interests

and other similar deferred compensation arrangements for which a

corresponding equal amount is excluded from compensation &

benefits expense, (iii) revenue related to distribution fees and

reimbursable deal costs in accordance with the revenue recognition

guidance and bad debt expense (see (k) below), (iv) for the three

and six month periods ended June 30, 2019, private equity

investment adjustment (see (l) below), (v) interest expense

primarily related to corporate financing activities, and (vi) for

the three and six month periods ended June 30, 2019, excess

interest expense pertaining to Senior Debt refinancing (see (p)

below).

(c)

A non-GAAP measure which excludes

(i) (charges)/credits related to the changes in the fair value of

the compensation liability recorded in connection with Lazard Fund

Interests and other similar deferred compensation arrangements, and

(ii) compensation and benefits related to noncontrolling interests

(see (j) below).

(d)

A non-GAAP measure which excludes

(i) for the three and six month periods ended June 30, 2019,

expenses associated with ERP system implementation (see (m) below),

(ii) for the three and six month periods ended June 30, 2020 and

for the three month period ended March 31, 2020, expenses related

to office space reorganization (see (n) below), (iii) expenses

related to distribution fees and reimbursable deal costs in

accordance with the revenue recognition guidance and bad debt

expense (see (k) below), (iv) amortization and other

acquisition-related costs (see (o) below), (v) for the three and

six month periods ended June 30, 2019, charges pertaining to Senior

Debt refinancing (see (p) below), and (vi) expenses related to

noncontrolling interests (see (j) below).

(e)

A non-GAAP measure which excludes

(i) for the three and six month periods ended June 30, 2019,

expenses associated with ERP system implementation (see (m) below),

(ii) for the three and six month periods ended June 30, 2020 and

for the three month period ended March 31, 2020, expenses related

to office space reorganization (see (n) below), (iii) amortization

and for the three and six month periods ended June 30, 2019, other

acquisition-related costs (see (o) below), (iv) for the three and

six month periods ended June 30, 2019, private equity investment

adjustment (see (l) below), (v) for the three and six month periods

ended June 30, 2019, charges pertaining to Senior Debt refinancing

(see (p) below), (vi) net revenue and expenses related to

noncontrolling interests (see (j) below), and (vii) interest

expense primarily related to corporate financing activities.

(f)

Represents earnings from

operations as a percentage of operating revenue, and is a non-GAAP

measure.

(g)

A non-GAAP measure which excludes

(i) for the three and six month periods ended June 30, 2019,

expenses associated with ERP system implementation (see (m) below),

(ii) for the three and six month periods ended June 30, 2020 and

for the three month period ended March 31, 2020, expenses related

to office space reorganization (see (n) below), (iii) for the three

and six month periods ended June 30, 2019, acquisition-related

costs (see (o) below), (iv) for the three and six month periods

ended June 30, 2019, private equity investment adjustment, (see (l)

below), and (v) for the three and six month periods ended June 30,

2019, charges pertaining to Senior Debt refinancing (see (p)

below), net of tax benefits.

(h)

A non-GAAP measure which includes

units of the long-term incentive compensation program consisting of

profits interest participation rights, which are equity incentive

awards that, subject to certain conditions, may be exchanged for

shares of our common stock. Certain profits interest participation

rights and other participating securities may be excluded from the

computation of outstanding stock equivalents for U.S. GAAP net

income per share.

(i)

Effective tax rate is a non-GAAP

measure based upon the U.S. GAAP rate with adjustments for the tax

applicable to the non-GAAP adjustments to operating income,

generally based upon the effective marginal tax rate in the

applicable jurisdiction of the adjustments. The computation is

based on a quotient, the numerator of which is the provision for

income taxes of $23,583, $26,900, and $34,737 for the three month

periods ended June 30, 2020, March 31, 2020, and June 30, 2019,

respectively, $50,483 and $60,130 for the six month periods ended

June 30, 2020 and 2019 and the denominator of which is pre-tax

income of $98,734, $93,452, and $120,483 for the three month

periods ended June 30, 2020, March 31, 2020, and June 30, 2019,

respectively, $192,186 and $251,413 for the six month periods ended

June 30, 2020 and 2019.

(j)

Noncontrolling interests include

revenue and expenses related to Edgewater and ESC funds.

(k)

Represents certain distribution

fees and reimbursable deal costs paid to third parties for which an

equal amount is excluded from both non-GAAP operating revenue and

non-compensation expense, respectively, and excludes bad debt

expense, which represents fees that are deemed uncollectible.

(l)

Represents write-down of private

equity investment to potential transaction value.

(m)

Represents expenses associated

with Enterprise Resource Planning (ERP) system implementation.

(n)

Represents incremental rent

expense related to office space reorganization.

(o)

Primarily represents the change

in fair value of the contingent consideration associated with

certain business acquisitions.

(p)

The company incurred charges

related to the extinguishment of the remaining 4.25% Senior Notes

maturing in November 2020. $168 million of the 2020 Notes were

redeemed in March 2019 and the remaining $82 million have been

redeemed in April 2019. The charges include a pre-tax loss on the

extinguishment of $6.5 million and excess interest expense of $0.3

million (due to the period of time between the issuance of the 2029

notes and the settlement of the 2020 notes).

NM

Not meaningful

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200731005098/en/

Media Contact: Judi Frost Mackey +1 212 632 1428

judi.mackey@lazard.com Investor Contact: Alexandra Deignan +1 212

632 6886 alexandra.deignan@lazard.com

Lazard (NYSE:LAZ)

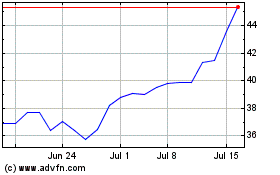

Historical Stock Chart

From Mar 2024 to Apr 2024

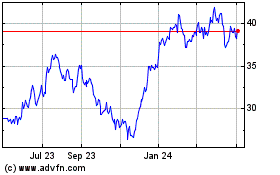

Lazard (NYSE:LAZ)

Historical Stock Chart

From Apr 2023 to Apr 2024