Current Report Filing (8-k)

September 03 2021 - 4:08PM

Edgar (US Regulatory)

0001300514false00013005142021-09-032021-09-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) September 3, 2021

|

|

|

|

|

|

|

|

|

|

|

LAS VEGAS SANDS CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

(State or other jurisdiction of incorporation)

|

|

001-32373

|

27-0099920

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

3355 Las Vegas Boulevard South

|

|

|

Las Vegas,

|

Nevada

|

89109

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(702) 414-1000

(Registrant's Telephone Number, Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

Common Stock ($0.001 par value)

|

|

LVS

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

|

|

|

|

|

|

|

|

ITEM 1.01.

|

Entry into a Material Definitive Agreement.

|

On September 3, 2021 (the “Closing Date”), Las Vegas Sands Corp. (the “Borrower”) entered into Amendment No. 2 to Revolving Credit Agreement (the “Amendment”) with the lenders party thereto and The Bank of Nova Scotia, as administrative agent (in such capacity, the “Administrative Agent”) with respect to the Revolving Credit Agreement, dated as of August 9, 2019 (as amended by that certain Amendment No. 1 to Revolving Credit Agreement, dated as of September 23, 2020 and otherwise in effect prior to the effectiveness of the Amendment, the “Existing Revolving Credit Agreement”), by and among the Borrower, the Administrative Agent and the lenders and issuing banks from time to time party thereto.

Pursuant to the Amendment, the Existing Revolving Credit Agreement was amended to (a) extend the period during which the Borrower is not required to maintain a maximum consolidated leverage ratio of 4.00:1.00 as of the last day of any fiscal quarter of the Borrower to December 31, 2022; (b) extend the period during which the Borrower is required to maintain a specified amount of minimum liquidity as of the last day of each month to December 31, 2022; (c) increase the minimum liquidity amount that the Borrower is required to maintain until December 31, 2022 to $700 million; and (d) extend the period during which the Borrower is unable to declare or pay any dividend or other distribution, unless liquidity is greater than $1.0 billion on a pro forma basis after giving effect to such dividend or distribution, to December 31, 2022. In addition, pursuant to the Amendment and subject to the satisfaction of the certain conditions specified therein, the requisite lenders under the Existing Revolving Credit Agreement consented to, and waived any applicable restrictions in the Existing Revolving Credit Agreement prohibiting, the consummation of the transactions contemplated by the definitive agreements entered into on March 2, 2021 (the “Signing Date”) by the Borrower to sell its Las Vegas real property and operations, including The Venetian Resort Las Vegas and the Sands Expo and Convention Center, as previously disclosed in the Borrower’s Current Report on Form 8-K filed with the Securities and Exchange Commission on the Signing Date, which is incorporated in this Item 1.01 by reference.

The foregoing summary of the Amendment is not complete and is qualified in its entirety by reference to the full and complete text of the Amendment, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

|

|

|

|

|

|

|

|

ITEM 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

(d)

|

Exhibits

|

|

10.1†

|

|

|

104

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

† Certain identified information has been excluded from the exhibit because such information both (i) is not material and (ii) would be competitively harmful if publicly disclosed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 3, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAS VEGAS SANDS CORP.

|

|

|

By:

|

/S/ D. ZACHARY HUDSON

|

|

|

|

Name: D. Zachary Hudson

Title: Executive Vice President, Global General Counsel and Secretary

|

|

|

|

|

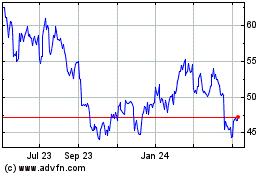

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

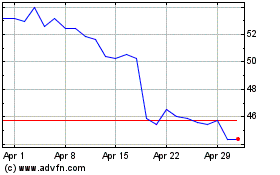

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024