UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Month of August 2024

Commission File Number: 001-41569

LANVIN GROUP HOLDINGS LIMITED

4F, 168 Jiujiang Road,

Carlowitz & Co, Huangpu District

Shanghai, 200001, China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

INCORPORATION

BY REFERENCE

Exhibits 99.1 and 99.2 to

this Form 6-K are incorporated by reference into the registration statement on Form F-3 (No. 333-276476), the post-effective amendment

No. 4 to Form F-1 on Form F-3 (No. 333-269150) and the registration statement on Form F-3 (No. 333-280891) of Lanvin Group Holdings Limited

and shall be a part thereof from the date on which this Report is furnished, to the extent not superseded by documents or reports subsequently

filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | LANVIN GROUP HOLDINGS LIMITED |

| | |

| By: | /s/ Zhen Huang |

| | | Name: |

Zhen Huang |

| | | Title: |

Chairman |

Date: August 26, 2024

Exhibit 99.1

Lanvin Group

Posts Revenue of €171 million in H1 2024

Global Challenges

Impact First-Half Results

| · | Group

Revenue was €171 million for H1 2024, a 20% decrease over H1 2023 |

| · | Group

Gross profit margin remained steady, declining just 1% to 57.5%, and Lanvin, St. John and

Caruso all showed marked gross profit margin improvement from better full-price sell-through

and strategic inventory management |

| · | Global

luxury market softness particularly impacted revenue in EMEA and Greater China; as did the

Wholesale Channel; Lanvin brand showed strong growth in APAC, outside of Greater China, with

9% growth |

| · | Wolford

revenue and margin was impacted by a significant shipping delay due to integration issues

with a new logistics provider; and Sergio Rossi saw a planned rationalization of third-party

production resulting in lower revenue |

| · | Strategic

actions were taking in H1 2024 to ensure our brands’ long-term competitiveness globally,

including the appointment of Peter Copping as Lanvin’s new Artistic Director; appointment

of Regis Rimbert as Wolford’s CEO; and the optimization of production and supply chain

management for Sergio Rossi |

| · | Adjusted

EBITDA held steady, decreasing only €1 million, period-over-period due to proactive

cost management initiatives |

| · | All

brands remained committed to improving cost structure while continuing to tactically invest

in marketing for upcoming campaigns |

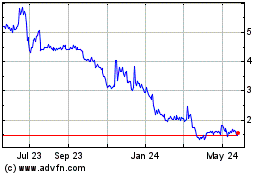

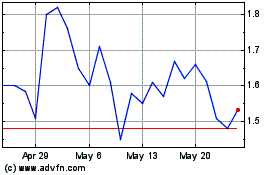

August 26, 2024 - Lanvin Group (NYSE:

LANV, the “Group”), a global luxury fashion group with Lanvin, Wolford, Sergio Rossi, St. John and Caruso in its portfolio

of brands, today announced its results for the first half of 2024. Despite facing macroeconomic pressures in the global luxury market,

the Group continued to drive its innovative strategies and remained focused on the long-term development of its brands.

The Group achieved revenue of €171 million,

a 20% decrease period-over-period versus 2023. Nonetheless, the Group continued to demonstrate operational stability and strong cost

control through proactive strategic adjustments. With effective measures to improve cost efficiency across brands, Gross profit was at

€98 million, maintaining a 57.5% gross profit margin, reflecting Lanvin Group’s resilience and its potential for sustainable

growth in a challenging environment.

Zhen Huang, Chairman of Lanvin Group,

said: “We faced a tumultuous market in the first half of 2024. While we anticipate this will continue for the near-term, we remain

committed to the long-term growth of our Group and our path to profitability.”

Eric Chan, CEO of Lanvin Group, said:

“Struggles in the wholesale channel compounded the issues of a softening global luxury market, in the first half of 2024. We spent

much of the first half committed to our marketing plan, but also prioritized rationalizing our cost base to fit the current market environment.

Furthermore, we are committed to our product strategy and investing in product development, which is why we are excited to have the new

creative leaders who have joined our family. While we will be proactive in our approach to the near-term slowdown, we remain resolute

in investing in our brands to forge our path forward, and to capitalize on our momentum as the markets improve.”

Review of the First Half 2024 Results

| |

Revenue | | |

Growth

% | | |

CAGR

% | |

Lanvin

Group Revenue by Brand € in Thousands, unless otherwise | |

2022 | | |

2023 | | |

2024 | | |

2023H1

vs | | |

2024H1

vs | | |

’22 H1 – | |

| noted | |

H1 | | |

H1 | | |

H1 | | |

2022H1 | | |

2023H1 | | |

‘24 H1 | |

| Lanvin | |

| 63,949 | | |

| 57,052 | | |

| 48,272 | | |

| -10.8 | % | |

| -15.4 | % | |

| -13.1 | % |

| Wolford | |

| 54,261 | | |

| 58,802 | | |

| 42,594 | | |

| 8.4 | % | |

| -27.6 | % | |

| -11.4 | % |

| St. John | |

| 41,924 | | |

| 46,663 | | |

| 39,981 | | |

| 11.3 | % | |

| -14.3 | % | |

| -2.3 | % |

| Sergio Rossi | |

| 26,969 | | |

| 33,019 | | |

| 20,404 | | |

| 22.4 | % | |

| -38.2 | % | |

| -13.0 | % |

| Caruso | |

| 14,919 | | |

| 19,926 | | |

| 19,734 | | |

| 33.6 | % | |

| -1.0 | % | |

| 15.0 | % |

| Total Brand | |

| 202,022 | | |

| 215,462 | | |

| 170,985 | | |

| 6.7 | % | |

| -20.6 | % | |

| -8.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Eliminations | |

| -322 | | |

| -925 | | |

| -9 | | |

| 187.3 | % | |

| -99.0 | % | |

| -83.3 | % |

| Total Group | |

| 201,700 | | |

| 214,537 | | |

| 170,976 | | |

| 6.4 | % | |

| -20.3 | % | |

| -7.9 | % |

Lanvin Group Consolidated P&L

€ in Thousands,

unless | |

2022 | | |

2023 | | |

2024 | |

| otherwise noted | |

H1 | | |

% | | |

H1 | | |

% | | |

H1 | | |

% | |

| Revenue | |

| 201,700 | | |

| 100.0 | % | |

| 214,537 | | |

| 100.0 | % | |

| 170,976 | | |

| 100.0 | % |

| Gross profit | |

| 112,743 | | |

| 55.9 | % | |

| 125,454 | | |

| 58.5 | % | |

| 98,378 | | |

| 57.5 | % |

| Contribution profit | |

| 5,933 | | |

| 2.9 | % | |

| 14,854 | | |

| 6.9 | % | |

| -7,213 | | |

| -4.2 | % |

| Adjusted EBITDA | |

| -35,519 | | |

| -17.6 | % | |

| -40,916 | | |

| -19.1 | % | |

| -42,111 | | |

| -24.6 | % |

Selected Highlights

Continued cost efficiency initiatives effective

in maintaining Gross profit margin: Gross profit margin for the Group decreased by 1% due to effective efforts to improve cost efficiencies.

Better full-price sell-through, inventory management, and channel mix changes drove gross profit margin up 2% at Lanvin, up 7% at St.

John, and up nearly 3% at Caruso. Despite lower revenue, Sergio Rossi maintained relatively flat gross profit margin, and Wolford’s

gross profit margin was mainly impacted by delays from integration with a new logistics provider that resulted in an inability to absorb

fixed production costs.

Group Adjusted EBITDA declined only 3%, period-over-period:

In the face of strong topline challenges, the Group’s Adjusted EBITDA decreased from €41 million to a €42 million

loss due to effective and timely cost reduction initiatives at the brand level. The Group provided resources and coordinated with brand

executives in the first half to manage through the difficult market conditions.

Lanvin announces new Artistic Director: In

June 2024, Lanvin announced that Peter Copping will be joining the brand in the second half of the year as the new Artistic Director.

Mr. Copping brings to the brand and business a passion for and deep understanding of Lanvin’s heritage and a wealth of industry

experience. He will lead the creative direction of both women’s and menswear and introduce his vision for Lanvin in 2025.

New personnel announcement: Wolford appointed

Regis Rimbert as the new CEO of the brand in June 2024. Mr. Rimbert brings over 20 years of experience in the fashion industry,

where he has led transformative initiatives in retail, online, and international operations.

Lanvin Lab 2.0: Lanvin successfully launched

the second edition of Lanvin Lab with a collaboration with acclaimed contemporary artist, Erwin Wurm. Lanvin’s iconic Pencil Cat

Bag and Cash sneaker were incorporated into a monumental sculpture currently on a five-city tour throughout Greater China.

Review of First Half 2024 Financials

Revenue

For H1 2024, the Group generated revenue of €171

million, a 20% decrease period-over-period. DTC channel revenue decreased by 14% and Wholesale revenue by 30%. Other revenue growth comprised

of royalty and clearance income decreased 15% due to Lanvin’s reduction of clearance inventory. Regional revenue declined in EMEA

by 27% and Greater China at 24% (Asia excluding Greater China decreased by 7%), and North America by 11%.

The main drivers of the decline in revenue were

global market softness coupled with a struggling wholesale market. Additionally, Wolford had an integration issue with its new logistic

provider which significantly delayed shipments, and Sergio Rossi had a strategically planned reduction in third-party production, both

of which also contributed to the revenue decline.

Gross Profit

Gross profit was €98 million, representing

a 58% margin versus €125 million for H1 2023 at a margin of 59%. The Group continues to focus on scale, product mix improvements

and distribution management to drive the gross profit margin expansion.

Contribution Profit(1)

Contribution profit was -€7 million. While

cost reduction initiatives were undertaken, the Group was committed to investing in marketing spend with the long-term brand momentum

in mind, resulting in a lower contribution profit.

Adjusted EBITDA

Adjusted EBITDA for the Group declined to -€42

million versus -€41 million for H1 2023, resulting from lower revenue, but offset by a reduction of fixed general and administrative

expenses, decreasing from 36% to 34% of revenue. In the first half, the Group was able to effectively implement cost reductions to mitigate

the revenue impact.

Results by Segment

Lanvin: Revenue decreased from €57

million in H1 2023 to €48 million in H1 2024, mainly due to a slowdown in global luxury consumption coupled with a challenging wholesale

market. Retail including boutique and outlet was down only 3%, while the overall DTC channel declined by 10%; and Wholesale by 23%.

Globally, EMEA saw the largest decrease at 21%,

driven by a decrease in European wholesale receipts. North America and APAC declined by 9% with Greater China at 14%; APAC excluding

Greater China generated positive 9% growth.

Gross profit decreased to €28 million from

€32 million. Gross profit margin increased from 56% to 58%, due to increased full-price sell-through and strategic inventory management.

Contribution profit declined from a contribution loss of €5 million in H1 2023 to a contribution loss of €9 million in H1 2024.

In June 2024, Lanvin announced the September arrival

of Peter Copping as Artistic Director. The house intends to propel the brand momentum from this significant appointment in the development

and marketing of Mr. Copping’s debut collection launch in 2025.

For the balance of 2024, Lanvin is aggressively

executing initiatives to increase retail and digital traffic and implement operational cost efficiencies to improve DTC profitability.

The brand will continue to emphasize its leather goods and accessories offer and will further build out its seasonless carryover product

offer across categories.

Wolford: Revenue declined by 28% from

€59 million in H1 2023 to €43 million in H1 2024. The decrease was mainly drive by integration issues with its new logistics

provider that resulted in significant delays in shipments. Additionally, the challenging wholesale market in Europe also impacted revenue.

On a channel-basis, DTC decreased by 14% and

Wholesale by 53%. Geographically, EMEA saw the largest decrease at 34%, North America by 10%, and APAC by 24% with Greater China seeing

a 20% decline.

Gross profit margin decreased to 63% from 72%

due to the logistics issues as well as a planned liquidation of excess inventory. Contribution loss was €8 million.

In the first half, Wolford made a number of personnel

changes, most notably, the appointment of Regis Rimbert as CEO. Mr. Rimbert’s experience operating in luxury fashion is extensive

and he will drive second half initiatives to implement a sustainable cost model by transforming supply chain and distribution, as well

as focus on brand positioning and marketing, and improve the client experience.

Sergio Rossi: Revenue declined from €33

million in H1 2023 to €20 million in H1 2024, or 38%. The brand had a 49% decline in its largest market, EMEA, and 22% in APAC with

Greater China decreasing by 34%. The revenue impact was due to continued softness in wholesale as well as a planned reduction of third-party

production. The DTC channel was down 17% overall and e-Commerce by 2%. Wholesale, which includes third-party production, decreased by

60%.

Gross profit margin landed at 50%, relatively

flat from H1 2023, due to the change in channel mix with the decline in wholesale revenue, including the reduction of third-party production.

Contribution profit declined from €6 million to €1 million. The revenue impact was mitigated by cost control initiatives to

maintain positive contribution profit.

For the second half of 2024, the brand will drive

cost efficiencies through planned initiatives and supply chain improvements. Sergio Rossi also plans to continue to right-size its retail

fleet and overhead.

The brand also plans to emphasize new marketing

initiatives celebrating its heritage and renowned shoe archive with the anticipated arrival of the new Creative Director, Paul Andrew.

The brand announced in July 2024, that Paul Andrew will join Sergio Rossi in the second half.

St. John: Revenue decreased from €47

million in H1 2023 to €40 million in H1 2024, a decline of 14%. The revenue impact was consistent across the distribution channels

with DTC, including e-Commerce declining by 15%; and Wholesale by 13%. North America, by far its largest market, decreased by 10%, while

APAC, which represents less than 10% of revenue, was down 46%, due to general market softness.

Gross profit margin was significantly higher

growing from 62% to 69% due to increased full-price sell-through and better channel mix. Contribution profit margin remained steady at

12% from improved marketing efficiency mitigating the decline in revenue.

For the second half of 2024, the brand will continue

to push its “basics” product lines and further refine its retail network and overhead.

Caruso: Despite a challenging global luxury

and wholesale environment, Caruso maintained flat revenue with a 1% decline. Caruso’s Maisons business, its third-party production

unit showed some softness, but it was offset by its propriety Caruso brand business which grew by 21% with strong sales of its ready-to-wear

and made-to-measure products.

Gross profit increased from €5 million to

€6 million, and gross profit margin increased from 26% to 29% from improved in-house production efficiencies and a reduction of

outsourcing. Contribution profit also increased from €4 million to €5 million, and contribution profit margin increased from

22% to 24%.

For the remainder of 2024, the brand will continue

to expand its B2B Maisons business with new client development programs.

2024 Full-Year Outlook

The Group expects a challenging second half of

2024, but will remain proactive in its cost-reduction and operating efficiency efforts. Lanvin and Sergio Rossi plan to further emphasize

marketing initiatives to forge their creative paths for 2025 with the additions of Peter Copping and Paul Andrew, respectively.

Lanvin Group will continue to focus on revenue

expansion opportunities through marketing campaigns to maintain brand momentum and with a tactical approach to expand its store network.

Note: All % changes are calculated on an actual

currency exchange rate basis.

Note: This communication includes certain non-IFRS

financial measures such as Contribution Profit, Contribution Profit Margin, Adjusted Operating Profit, adjusted earnings before interest

and taxes (“Adjusted EBIT”), and adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted

EBITDA”). Please see Use of Non-IFRS Financial Metrics and Non-IFRS Financial Measures and Definition.

| (1) | Contribution Profit defined as Gross Profit

less Selling and Marketing Expenses |

***

Semi-Annual Report

Our semi-annual report, including the interim

condensed consolidated financial statements as of and for the six months ended June 30, 2024, can be downloaded from the Company’s

investor relations website (ir.lanvin-group.com) under the section Financials / SEC Filings, or from the SEC’s website (www.sec.gov).

***

Conference Call

As previously announced, today at 8:00AM EST/8:00PM

CST/2:00PM CET, Lanvin Group will host a conference call to discuss its results for the first half of 2024 and provide an outlook for

the remainder of the year. Management will refer to a slide presentation during the call, which will be made available on the day of

the call. To view the presentation, please visit the "Events" tab of the Group's investor relations website at https://ir.lanvin-group.com.

All participants who would like to join the conference

call must pre-register using the link provided below. Once the registration is complete, participants will receive dial-in numbers, a

passcode, and a registrant ID which can be used to join the conference call. Participants may register at any time, including up to and

after the call starts.

Registration Link:

https://dpregister.com/sreg/10191932/fd4d899a20

A replay of the conference call will be accessible

approximately one hour after the live call until September 2, 2024, by dialing the following numbers:

US Toll Free: 1-877-344-7529

International Toll: 1-412-317-0088

Canada Toll Free: 855-669-9658

Replay Access Code: 9453870

A recorded webcast of the conference call and

a slide presentation will also be available on the Group's investor relations website at https://ir.lanvin-group.com.

***

About Lanvin Group

Lanvin Group is a leading global luxury fashion

group headquartered in Shanghai, China, managing iconic brands worldwide including Lanvin, Wolford, Sergio Rossi, St. John Knits, and

Caruso. Harnessing the power of its unique strategic alliance of industry-leading partners in the luxury fashion sector, Lanvin Group

strives to expand the global footprint of its portfolio brands and achieve sustainable growth through strategic investment and extensive

operational know-how, combined with an intimate understanding and unparalleled access to the fastest-growing luxury fashion markets in

the world. Lanvin Group is listed on the New York Stock Exchange under the ticker symbol 'LANV'. For more information about Lanvin Group,

please visit www.lanvin-group.com, and to view our investor presentation, please visit https://ir.lanvin-group.com.

***

Forward-Looking Statements

This communication, including the section “2024

Full-Year Outlook”, contains “forward-looking statements” within the meaning of the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook,” “project” and similar expressions that

predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include,

but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market

opportunity. These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations

of the respective management of Lanvin Group and are not predictions of actual performance. These forward-looking statements are provided

for illustrative purposes only and must not be relied on by an investor as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many

actual events and circumstances are beyond the control of Lanvin Group. Potential risks and uncertainties that could cause the actual

results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, changes adversely

affecting the business in which Lanvin Group is engaged; Lanvin Group’s projected financial information, anticipated growth rate,

profitability and market opportunity may not be an indication of its actual results or future results; management of growth; the impact

of COVID-19 or similar public health crises on Lanvin Group’s business; Lanvin Group’s ability to safeguard the value, recognition

and reputation of its brands and to identify and respond to new and changing customer preferences; the ability and desire of consumers

to shop; Lanvin Group’s ability to successfully implement its business strategies and plans; Lanvin Group’s ability to effectively

manage its advertising and marketing expenses and achieve desired impact; its ability to accurately forecast consumer demand; high levels

of competition in the personal luxury products market; disruptions to Lanvin Group’s distribution facilities or its distribution

partners; Lanvin Group’s ability to negotiate, maintain or renew its license agreements; Lanvin Group’s ability to protect

its intellectual property rights; Lanvin Group’s ability to attract and retain qualified employees and preserve craftmanship skills;

Lanvin Group’s ability to develop and maintain effective internal controls; general economic conditions; the result of future financing

efforts; and those factors discussed in the reports filed by Lanvin Group from time to time with the SEC. If any of these risks materialize

or Lanvin Group’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking

statements. There may be additional risks that Lanvin Group presently does not know, or that Lanvin Group currently believes are immaterial,

that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements

reflect Lanvin Group’s expectations, plans, or forecasts of future events and views as of the date of this communication. Lanvin

Group anticipates that subsequent events and developments will cause Lanvin Group’s assessments to change. However, while Lanvin

Group may elect to update these forward-looking statements at some point in the future, Lanvin Group specifically disclaim any obligation

to do so. These forward-looking statements should not be relied upon as representing Lanvin Group’s assessments of any date subsequent

to the date of this communication. Accordingly, reliance should not be placed upon the forward-looking statements.

***

Use of Non-IFRS Financial Metrics

This communication includes certain non-IFRS

financial measures such as Contribution Profit, Contribution Profit Margin, Adjusted Operating Profit, adjusted earnings before interest

and taxes (“Adjusted EBIT”), and adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted

EBITDA”). These non-IFRS measures are an addition, and not a substitute for or superior to measures of financial performance prepared

in accordance with IFRS and should not be considered as an alternative to net income, operating income or any other performance measures

derived in accordance with IFRS. Reconciliations of non-IFRS measures to their most directly comparable IFRS counterparts are included

in the Appendix to this communication. Lanvin Group believes that these non-IFRS measures of financial results provide useful supplemental

information to investors about Lanvin Group. Lanvin Group believes that the use of these non-IFRS financial measures provides an additional

tool for investors to use in evaluating projected operating results and trends in and in comparing Lanvin Group's financial measures

with other similar companies, many of which present similar non-IFRS financial measures to investors. However, there are a number of

limitations related to the use of these non-IFRS measures and their nearest IFRS equivalents. For example, other companies may calculate

non-IFRS measures differently, or may use other measures to calculate their financial performance, and therefore Lanvin Group's non-IFRS

measures may not be directly comparable to similarly titled measures of other companies. Lanvin Group does not consider these non-IFRS

measures in isolation or as an alternative to financial measures determined in accordance with IFRS. The principal limitation of these

non-IFRS financial measures is that they exclude significant expenses, income and tax liabilities that are required by IFRS to be recorded

in Lanvin Group's financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgements

by Lanvin Group about which expense and income are excluded or included in determining these non-IFRS financial measures. In order to

compensate for these limitations, Lanvin Group presents non-IFRS financial measures in connection with IFRS results.

***

Enquiries:

Media

Lanvin Group

Kimberly Zhang

kimberly.zhang@lanvin-group.com

Investors

Lanvin Group

James Kim

james.kim@lanvin-group.com

Appendix

Lanvin Group Consolidated Income Statement

(€ in Thousands, unless otherwise noted)

| |

2022 | | |

2023 | | |

2024 | |

| Lanvin

Group Consolidated P&L | |

H1 | | |

% | | |

H1 | | |

% | | |

H1 | | |

% | |

| Revenue | |

| 201,700 | | |

| 100.0 | % | |

| 214,537 | | |

| 100.0 | % | |

| 170,976 | | |

| 100.0 | % |

| Cost of sales | |

| -88,957 | | |

| -44.1 | % | |

| -89,083 | | |

| -41.5 | % | |

| -72,598 | | |

| -42.5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 112,743 | | |

| 55.9 | % | |

| 125,454 | | |

| 58.5 | % | |

| 98,378 | | |

| 57.5 | % |

| Marketing and selling expenses | |

| -106,810 | | |

| -53.0 | % | |

| -110,600 | | |

| -51.6 | % | |

| -105,591 | | |

| -61.8 | % |

| General and administrative expenses | |

| -75,771 | | |

| -37.6 | % | |

| -76,544 | | |

| -35.7 | % | |

| -58,065 | | |

| -34.0 | % |

| Other operating income and expenses | |

| 8,378 | | |

| 4.2 | % | |

| -7,960 | | |

| -3.7 | % | |

| 5,457 | | |

| 3.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from operations before

non-underlying items | |

| -61,460 | | |

| -30.5 | % | |

| -69,650 | | |

| -32.5 | % | |

| -59,821 | | |

| -35.0 | % |

| Non-underlying items | |

| 570 | | |

| 0.3 | % | |

| 9,666 | | |

| 4.5 | % | |

| 3,143 | | |

| 1.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| -60,890 | | |

| -30.2 | % | |

| -59,984 | | |

| -28.0 | % | |

| -56,678 | | |

| -33.1 | % |

| Finance cost – net | |

| -8,080 | | |

| -4.0 | % | |

| -11,970 | | |

| -5.6 | % | |

| -13,187 | | |

| -7.7 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax | |

| -68,970 | | |

| -34.2 | % | |

| -71,954 | | |

| -33.5 | % | |

| -69,865 | | |

| -40.9 | % |

| Income tax benefits / (expenses) | |

| 256 | | |

| 0.1 | % | |

| -271 | | |

| -0.1 | % | |

| 489 | | |

| 0.3 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss for the period | |

| -68,714 | | |

| -34.1 | % | |

| -72,225 | | |

| -33.7 | % | |

| -69,376 | | |

| -40.6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contribution Profit (1) | |

| 5,933 | | |

| 2.9 | % | |

| 14,854 | | |

| 6.9 | % | |

| -7,213 | | |

| -4.2 | % |

| Adjusted Operating Profit (1) | |

| -69,838 | | |

| -34.6 | % | |

| -61,690 | | |

| -28.8 | % | |

| -65,278 | | |

| -38.2 | % |

| Adjusted EBIT (1) | |

| -57,163 | | |

| -28.3 | % | |

| -67,679 | | |

| -31.5 | % | |

| -58,994 | | |

| -34.5 | % |

| Adjusted EBITDA (1) | |

| -35,519 | | |

| -17.6 | % | |

| -40,916 | | |

| -19.1 | % | |

| -42,111 | | |

| -24.6 | % |

Lanvin Group Consolidated Balance Sheet

(€ in Thousands, unless otherwise noted)

| | |

2023 | | |

2024 | |

| Lanvin Group Consolidated Balance Sheet | |

FY | | |

H1 | |

| Assets | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Intangible assets | |

| 210,439 | | |

| 211,818 | |

| Goodwill | |

| 69,323 | | |

| 69,323 | |

| Property, plant and equipment | |

| 43,731 | | |

| 42,972 | |

| Right-of-use assets | |

| 128,853 | | |

| 139,126 | |

| Deferred income tax assets | |

| 13,427 | | |

| 12,905 | |

| Other non-current assets | |

| 15,540 | | |

| 15,383 | |

| | |

| 481,313 | | |

| 491,527 | |

| Current assets | |

| | | |

| | |

| Inventories | |

| 107,184 | | |

| 106,809 | |

| Trade receivables | |

| 45,657 | | |

| 35,436 | |

| Other current assets | |

| 25,650 | | |

| 25,487 | |

| Cash and bank balances | |

| 28,130 | | |

| 18,308 | |

| | |

| 206,621 | | |

| 186,040 | |

| Total Assets | |

| 687,934 | | |

| 677,567 | |

| Liabilities | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Non-current borrowings | |

| 32,381 | | |

| 28,070 | |

| Non-current lease liabilities | |

| 112,898 | | |

| 120,250 | |

| Non-current provisions | |

| 3,174 | | |

| 3,932 | |

| Employee benefits | |

| 17,972 | | |

| 17,320 | |

| Deferred income tax liabilities | |

| 52,804 | | |

| 51,623 | |

| Other non-current liabilities | |

| 14,733 | | |

| 15,021 | |

| | |

| 233,962 | | |

| 236,216 | |

| Current liabilities | |

| | | |

| | |

| Trade payables | |

| 78,576 | | |

| 81,052 | |

| Bank overdrafts | |

| 280 | | |

| 429 | |

| Current borrowings | |

| 35,720 | | |

| 98,219 | |

| Current lease liabilities | |

| 32,871 | | |

| 35,649 | |

| Current provisions | |

| 6,270 | | |

| 5,273 | |

| Other current liabilities | |

| 134,627 | | |

| 128,005 | |

| | |

| 288,344 | | |

| 348,627 | |

| Total Liabilities | |

| 522,306 | | |

| 584,843 | |

| Net assets | |

| 165,628 | | |

| 92,724 | |

| Equity | |

| | | |

| | |

| Equity attributable to owners of the Company | |

| | | |

| | |

| Share capital | |

| *(2) | | |

| *(2) | |

| Treasury shares | |

| -65,405 | | |

| -55,991 | |

| Other reserves | |

| 806,677 | | |

| 793,990 | |

| Accumulated losses | |

| -571,931 | | |

| -629,248 | |

| | |

| 169,341 | | |

| 108,751 | |

| Non- controlling interests | |

| -3,713 | | |

| -16,027 | |

| Total Equity | |

| 165,628 | | |

| 92,724 | |

Lanvin Group Consolidated Cash Flow

(€

in Thousands, unless otherwise noted)

| | |

2022 | | |

2023 | | |

2024 | |

| Lanvin Group Consolidated Cash Flow | |

H1 | | |

H1 | | |

H1 | |

| Net cash used in operating activities | |

| -51,825 | | |

| -58,118 | | |

| -33,483 | |

| Net cash used in investing activities | |

| -5,556 | | |

| -28,531 | | |

| -3,780 | |

| Net cash flows generated from financing activities | |

| 17,465 | | |

| 26,396 | | |

| 26,646 | |

| Net change in cash and cash equivalents | |

| -39,916 | | |

| -60,253 | | |

| -10,617 | |

| | |

| | | |

| | | |

| | |

| Cash and cash equivalents less bank overdrafts at the beginning of the period | |

| 88,658 | | |

| 91,749 | | |

| 27,850 | |

| Effect of foreign exchange differences on cash and cash equivalents | |

| 2,185 | | |

| -649 | | |

| 646 | |

| Cash and cash equivalents less bank overdrafts at end of the period | |

| 50,927 | | |

| 30,847 | | |

| 17,879 | |

Lanvin Brand Key Financials(3)

(€

in thousands, unless otherwise noted)

| Lanvin Brand | |

2022 | | |

2023 | | |

2024 | | |

23

H1

v | | |

24

H1

v | | |

22

H1–

24 H1 | |

| Key Financials | |

H1 |

| |

% | | |

H1 |

| |

% | | |

H1 |

| |

% | | |

22 H1 | | |

23 H1 | | |

CAGR | |

| Key Financials on P&L | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

| | |

| | |

| |

| Revenues | |

63,949 |

| |

100.0 | % | |

57,052 |

| |

100.0 | % | |

48,272 |

| |

100.0 | % | |

-10.8 | % | |

-15.4 | % | |

-13.1 | % |

| Gross Profit | |

30,048 |

| |

47.0 | % | |

31,959 |

| |

56.0 | % | |

28,004 |

| |

58.0 | % | |

| | |

| | |

| |

| Selling and distribution expenses | |

-34,360 |

| |

-53.7 | % | |

-36,793 |

| |

-64.5 | % | |

-37,389 |

| |

-77.5 | % | |

| | |

| | |

| |

| Contribution Profit (1) | |

-4,312 |

| |

-6.7 | % | |

-4,834 |

| |

-8.5 | % | |

-9,385 |

| |

-19.4 | % | |

| | |

| | |

| |

| | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

| | |

| | |

| |

| Revenues by Geography | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

| | |

| | |

| |

| EMEA | |

34,779 |

| |

54.4 | % | |

29,443 |

| |

51.6 | % | |

23,154 |

| |

48.0 | % | |

-15.3 | % | |

-21.4 | % | |

-18.4 | % |

| North America | |

15,255 |

| |

23.9 | % | |

13,195 |

| |

23.1 | % | |

11,981 |

| |

24.8 | % | |

-13.5 | % | |

-9.2 | % | |

-11.4 | % |

| Greater China | |

12,362 |

| |

19.3 | % | |

11,092 |

| |

19.4 | % | |

9,527 |

| |

19.7 | % | |

-10.3 | % | |

-14.1 | % | |

-12.2 | % |

| Other | |

1,553 |

| |

2.4 | % | |

3,322 |

| |

5.8 | % | |

3,610 |

| |

7.5 | % | |

113.9 | % | |

8.7 | % | |

52.5 | % |

| | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

| | |

| | |

| |

| Revenues by Channel | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

| | |

| | |

| |

| DTC | |

30,879 |

| |

48.3 | % | |

26,780 |

| |

46.9 | % | |

24,072 |

| |

49.9 | % | |

-13.3 | % | |

-10.1 | % | |

-11.7 | % |

| Wholesale | |

30,799 |

| |

48.2 | % | |

23,022 |

| |

40.4 | % | |

17,639 |

| |

36.5 | % | |

-25.2 | % | |

-23.4 | % | |

-24.3 | % |

| Other | |

2,271 |

| |

3.6 | % | |

7,250 |

| |

12.7 | % | |

6,561 |

| |

13.6 | % | |

219.3 | % | |

-9.5 | % | |

70.0 | % |

Wolford Brand Key Financials(3)

(€

in thousands, unless otherwise noted)

| Wolford Brand | |

2022 | | |

2023 | | |

2024 | | |

23 H1

v | | |

24 H1

v | | |

22

H1 –

24 H1 | |

| Key

Financials | |

H1 | | |

% | | |

H1 | | |

% | | |

H1 | | |

% | | |

22

H1 | | |

23

H1 | | |

CAGR | |

| Key Financials on P&L | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

54,261 | | |

100.0 | % | |

58,802 | | |

100.0 | % | |

42,594 | | |

100.0 | % | |

8.4 | % | |

-27.6 | % | |

-11.4 | % |

| Gross Profit | |

38,383 | | |

70.7 | % | |

42,062 | | |

71.5 | % | |

26,795 | | |

62.9 | % | |

| | |

| | |

| |

| Selling and distribution expenses | |

-40,337 | | |

-74.3 | % | |

-38,128 | | |

-64.8 | % | |

-34,916 | | |

-82.0 | % | |

| | |

| | |

| |

| Contribution Profit (1) | |

-1,954 | | |

-3.6 | % | |

3,934 | | |

6.7 | % | |

-8,121 | | |

-19.1 | % | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues by Geography | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| EMEA | |

38,202 | | |

70.4 | % | |

40,083 | | |

68.2 | % | |

26,453 | | |

62.1 | % | |

4.9 | % | |

-34.0 | % | |

-16.8 | % |

| North America | |

12,891 | | |

23.8 | % | |

14,224 | | |

24.2 | % | |

12,747 | | |

29.9 | % | |

10.3 | % | |

-10.4 | % | |

-0.6 | % |

| Greater China | |

2,799 | | |

5.2 | % | |

4,107 | | |

7.0 | % | |

3,274 | | |

7.7 | % | |

46.7 | % | |

-20.3 | % | |

8.2 | % |

| Other | |

370 | | |

0.7 | % | |

388 | | |

0.7 | % | |

120 | | |

0.3 | % | |

4.9 | % | |

-69.1 | % | |

-43.0 | % |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues by Channel | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| DTC | |

39,102 | | |

72.1 | % | |

39,453 | | |

67.1 | % | |

33,812 | | |

79.4 | % | |

0.9 | % | |

-14.3 | % | |

-7.0 | % |

| Wholesale | |

14,557 | | |

26.8 | % | |

18,665 | | |

31.7 | % | |

8,715 | | |

20.5 | % | |

28.2 | % | |

-53.3 | % | |

-22.6 | % |

| Other | |

602 | | |

1.1 | % | |

684 | | |

1.2 | % | |

67 | | |

0.2 | % | |

13.6 | % | |

-90.2 | % | |

-66.6 | % |

Sergio Rossi Brand Key Financials(3)

(€

in thousands, unless otherwise noted)

| Sergio Rossi | |

| | |

| | |

| | |

23 H1 | | |

24 H1 | | |

22 H1 – | |

| Brand Key | |

2022 | | |

2023 | | |

2024 | | |

v | | |

v | | |

24 H1 | |

| Financials | |

H1 | | |

% | | |

H1 | | |

% | | |

H1 | | |

% | | |

22

H1 | | |

23

H1 | | |

CAGR | |

| Key Financials on P&L | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

26,969 | | |

100.0 | % | |

33,019 | | |

100.0 | % | |

20,404 | | |

100.0 | % | |

22.4 | % | |

-38.2 | % | |

-13.0 | % |

| Gross Profit | |

14,798 | | |

54.9 | % | |

17,135 | | |

51.9 | % | |

10,218 | | |

50.1 | % | |

| | |

| | |

| |

| Selling and distribution expenses | |

-11,180 | | |

-41.5 | % | |

-11,355 | | |

-34.4 | % | |

-9,490 | | |

-46.5 | % | |

| | |

| | |

| |

| Contribution Profit (1) | |

3,618 | | |

13.4 | % | |

5,780 | | |

17.5 | % | |

728 | | |

3.6 | % | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues by Geography | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| EMEA | |

14,267 | | |

52.9 | % | |

18,509 | | |

56.0 | % | |

9,528 | | |

46.7 | % | |

29.7 | % | |

-48.5 | % | |

-18.3 | % |

| North America | |

643 | | |

2.4 | % | |

846 | | |

2.6 | % | |

281 | | |

1.4 | % | |

31.5 | % | |

-66.8 | % | |

-33.9 | % |

| Greater China | |

5,252 | | |

19.5 | % | |

6,350 | | |

19.2 | % | |

4,174 | | |

20.5 | % | |

20.9 | % | |

-34.3 | % | |

-10.8 | % |

| Other | |

6,808 | | |

25.2 | % | |

7,315 | | |

22.2 | % | |

6,420 | | |

31.5 | % | |

7.5 | % | |

-12.2 | % | |

-2.9 | % |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues by Channel | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| DTC | |

14,650 | | |

54.3 | % | |

16,847 | | |

51.0 | % | |

13,976 | | |

68.5 | % | |

15.0 | % | |

-17.0 | % | |

-2.3 | % |

| Wholesale | |

12,319 | | |

45.7 | % | |

16,172 | | |

49.0 | % | |

6,428 | | |

31.5 | % | |

31.3 | % | |

-60.3 | % | |

-27.8 | % |

| Other | |

0 | | |

0.0 | % | |

0 | | |

0.0 | % | |

0 | | |

0.0 | % | |

NM | | |

NM | | |

NM | |

St. John Brand Key Financials(3)

(€

in thousands, unless otherwise noted)

| St. John Brand |

|

2022 |

|

|

2023 |

|

|

2024 |

|

|

23 H1

v |

|

|

24 H1

v |

|

|

22 H1 –

24 H1 |

|

| Key Financials |

|

% |

|

|

H1 |

|

|

% |

|

|

% |

|

|

H1 |

|

|

% |

|

|

22 H1 |

|

|

23 H1 |

|

|

CAGR |

|

| Key Financials on P&L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

41,924 |

|

|

100.0 |

% |

|

46,663 |

|

|

100.0 |

% |

|

39,981 |

|

|

100.0 |

% |

|

11.3 |

% |

|

-14.3 |

% |

|

-2.3 |

% |

| Gross Profit |

|

25,754 |

|

|

61.4 |

% |

|

29,024 |

|

|

62.2 |

% |

|

27,696 |

|

|

69.3 |

% |

|

|

|

|

|

|

|

|

|

| Selling and distribution expenses |

|

-21,167 |

|

|

-50.5 |

% |

|

-23,719 |

|

|

-50.8 |

% |

|

-23,036 |

|

|

-57.6 |

% |

|

|

|

|

|

|

|

|

|

| Contribution Profit (1) |

|

4,587 |

|

|

10.9 |

% |

|

5,305 |

|

|

11.4 |

% |

|

4,660 |

|

|

11.7 |

% |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues by Geography |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMEA |

|

343 |

|

|

0.8 |

% |

|

731 |

|

|

1.6 |

% |

|

299 |

|

|

0.7 |

% |

|

113.2 |

% |

|

-59.1 |

% |

|

-6.6 |

% |

| North America |

|

39,130 |

|

|

93.3 |

% |

|

41,585 |

|

|

89.1 |

% |

|

37,316 |

|

|

93.3 |

% |

|

6.3 |

% |

|

-10.3 |

% |

|

-2.3 |

% |

| Greater China |

|

2,283 |

|

|

5.4 |

% |

|

4,251 |

|

|

9.1 |

% |

|

2,247 |

|

|

5.6 |

% |

|

86.2 |

% |

|

-47.1 |

% |

|

-0.8 |

% |

| Other |

|

168 |

|

|

0.4 |

% |

|

96 |

|

|

0.2 |

% |

|

119 |

|

|

0.3 |

% |

|

-42.8 |

% |

|

24.8 |

% |

|

-15.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues by Channel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTC |

|

30,493 |

|

|

72.7 |

% |

|

37,760 |

|

|

80.9 |

% |

|

32,161 |

|

|

80.4 |

% |

|

23.8 |

% |

|

-14.8 |

% |

|

2.7 |

% |

| Wholesale |

|

11,431 |

|

|

27.3 |

% |

|

8,828 |

|

|

18.9 |

% |

|

7,704 |

|

|

19.3 |

% |

|

-22.8 |

% |

|

-12.7 |

% |

|

-17.9 |

% |

| Other |

|

0 |

|

|

0.0 |

% |

|

75 |

|

|

0.2 |

% |

|

116 |

|

|

0.3 |

% |

|

NM |

|

|

55.3 |

% |

|

NM |

|

Caruso Brand Key Financials(3)

(€ in thousands, unless otherwise noted)

| Caruso Brand Key |

|

2022 |

|

|

2023 |

|

|

2024 |

|

|

23 H1

v |

|

|

24 H1

v |

|

|

22 H1 –

24 H1 |

|

| Financials |

|

H1 |

|

|

% |

|

|

H1 |

|

|

% |

|

|

H1 |

|

|

% |

|

|

22 H1 |

|

|

23 H1 |

|

|

CAGR |

|

| Key Financials on P&L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

14,919 |

|

|

100.0 |

% |

|

19,926 |

|

|

100.0 |

% |

|

19,734 |

|

|

100.0 |

% |

|

33.6 |

% |

|

-1.0 |

% |

|

15.0 |

% |

| Gross Profit |

|

3,731 |

|

|

25.0 |

% |

|

5,233 |

|

|

26.3 |

% |

|

5,723 |

|

|

29.0 |

% |

|

|

|

|

|

|

|

|

|

| Selling and distribution expenses |

|

-668 |

|

|

-4.5 |

% |

|

-842 |

|

|

-4.2 |

% |

|

-936 |

|

|

-4.7 |

% |

|

|

|

|

|

|

|

|

|

| Contribution Profit (1) |

|

3,063 |

|

|

20.5 |

% |

|

4,391 |

|

|

22.0 |

% |

|

4,787 |

|

|

24.3 |

% |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues by Geography |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMEA |

|

11,380 |

|

|

76.2 |

% |

|

16,260 |

|

|

81.6 |

% |

|

16,795 |

|

|

85.1 |

% |

|

42.9 |

% |

|

3.3 |

% |

|

21.5 |

% |

| North America |

|

2,710 |

|

|

18.2 |

% |

|

2,674 |

|

|

13.4 |

% |

|

2,003 |

|

|

10.1 |

% |

|

-1.3 |

% |

|

-25.1 |

% |

|

-14.0 |

% |

| Greater China |

|

219 |

|

|

1.5 |

% |

|

32 |

|

|

0.2 |

% |

|

18 |

|

|

0.1 |

% |

|

-85.5 |

% |

|

-43.4 |

% |

|

-71.3 |

% |

| Other |

|

610 |

|

|

4.1 |

% |

|

960 |

|

|

4.8 |

% |

|

918 |

|

|

4.7 |

% |

|

57.3 |

% |

|

-4.4 |

% |

|

22.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues by Channel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTC |

|

0 |

|

|

0.0 |

% |

|

0 |

|

|

0.0 |

% |

|

31 |

|

|

0.2 |

% |

|

NM |

|

|

NM |

|

|

NM |

|

| Wholesale |

|

14,919 |

|

|

100.0 |

% |

|

19,926 |

|

|

100.0 |

% |

|

19,703 |

|

|

99.8 |

% |

|

33.6 |

% |

|

-1.1 |

% |

|

14.9 |

% |

| Other |

|

0 |

|

|

0.0 |

% |

|

0 |

|

|

0.0 |

% |

|

0 |

|

|

0.0 |

% |

|

NM |

|

|

NM |

|

|

NM |

|

Lanvin Group Brand Footprint

| | |

Jun 2023 | | |

Dec 2023 | | |

Jun 2024 | |

| DOS by Brand | |

DOS (4) | | |

DOS (4) | | |

DOS (4) | |

| Lanvin | |

| 32 | | |

| 36 | | |

| 37 | |

| Wolford | |

| 156 | | |

| 150 | | |

| 140 | |

| St. John | |

| 44 | | |

| 45 | | |

| 42 | |

| Sergio Rossi | |

| 50 | | |

| 48 | | |

| 47 | |

| Caruso | |

| 0 | | |

| 0 | | |

| 0 | |

| Total | |

| 282 | | |

| 279 | | |

| 266 | |

Non-IFRS Financial Measures Reconciliation

(€

in Thousands, unless otherwise noted)

| | |

2022 | | |

2023 | | |

2024 | |

| Reconciliation of Contribution Profit | |

H1 | | |

H1 | | |

H1 | |

| Revenue | |

| 201,700 | | |

| 214,537 | | |

| 170,976 | |

| Cost of sales | |

| -88,957 | | |

| -89,083 | | |

| -72,598 | |

| Gross Profit | |

| 112,743 | | |

| 125,454 | | |

| 98,378 | |

| Marketing and selling expenses | |

| -106,810 | | |

| -110,600 | | |

| -105,591 | |

| Contribution Profit (1) | |

| 5,933 | | |

| 14,854 | | |

| -7,213 | |

| General and administrative expenses | |

| -75,771 | | |

| -76,544 | | |

| -58,065 | |

| Adjusted Operating Profit (1) | |

| -69,838 | | |

| -61,690 | | |

| -65,278 | |

| | |

2022 | | |

2023 | | |

2024 | |

| Reconciliation of Adjusted EBIT | |

H1 | | |

H1 | | |

H1 | |

| Loss for the period | |

| -68,714 | | |

| -72,225 | | |

| -69,376 | |

| Add / (Deduct) the impact of: | |

| | | |

| | | |

| | |

| Income tax expenses | |

| -256 | | |

| 271 | | |

| -489 | |

| Finance cost—net | |

| 8,080 | | |

| 11,970 | | |

| 13,187 | |

| Non-underlying items | |

| -570 | | |

| -9,666 | | |

| -3,143 | |

| Loss from operations before non-underlying items | |

| -61,460 | | |

| -69,650 | | |

| -59,821 | |

| Add / (Deduct) the impact of: | |

| | | |

| | | |

| | |

| Share based compensation | |

| 4,297 | | |

| 1,971 | | |

| 827 | |

| Adjusted EBIT (1) | |

| -57,163 | | |

| -67,679 | | |

| -58,994 | |

| | |

2022 | | |

2023 | | |

2024 | |

| Reconciliation of Adjusted EBITDA | |

H1 | | |

H1 | | |

H1 | |

| Loss from operations before non-underlying items | |

| -61,460 | | |

| -69,650 | | |

| -59,821 | |

| D&A post IFRS16 | |

| 23,094 | | |

| 21,518 | | |

| 22,456 | |

| Provision and impairment losses | |

| 6,500 | | |

| -3,241 | | |

| -2,220 | |

| FX (gains)/losses | |

| -7,950 | | |

| 8,486 | | |

| -3,353 | |

| ESOP | |

| 4,297 | | |

| 1,971 | | |

| 827 | |

| Adjusted EBITDA (1) | |

| -35,519 | | |

| -40,916 | | |

| -42,111 | |

Note:

| (1) | These are Non-IFRS Financial Measures

and will be mentioned throughout this communication. Please see Non-IFRS Financial Measures

and Definition. |

| (2) | The amount less than Euro 1,000 is indicated

with "*”. |

| (3) | Brand-level results are presented exclusive

of eliminations. |

| (4) | DOS refers to Directly Operated Stores

which include boutiques, outlets, concession shop-in-shops and pop-up stores. |

Non-IFRS Financial Measures and Definitions

Our management monitors and evaluates operating

and financial performance using several non-IFRS financial measures including: Contribution Profit, Contribution Profit Margin, Adjusted

Operating Profit, Adjusted EBIT and Adjusted EBITDA. Our management believes that these non-IFRS financial measures provide useful and

relevant information regarding our performance and improve their ability to assess financial performance and financial position. They

also provide comparable measures that facilitate management’s ability to identify operational trends, as well as make decisions

regarding future spending, resource allocations and other operational decisions. While similar measures are widely used in the industry

in which we operate, the financial measures that we use may not be comparable to other similarly named measures used by other companies

nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS.

Contribution Profit is defined as revenue

less the cost of sales and selling and marketing expenses. Contribution Profit subtracts the main variable expenses of selling and marketing

expenses from Gross Profit, and our management believes this measure is an important indicator of profitability at the marginal level.

Below contribution profit, the main expenses are general administrative expenses and other operating expenses (which include foreign

exchange gains or losses and impairment losses). As we continue to improve the management of our portfolio brands, we believe we can

achieve greater economy of scale across the different brands by maintaining the fixed expenses at a lower level as a proportion of revenue.

We therefore use Contribution Profit Margin as a key indicator of profitability at the group level as well as the portfolio brand level.

Contribution Profit Margin is defined

as Contribution Profit divided by revenue.

Adjusted Operating Profit is defined as

Contribution Profit margin less General and administrative expenses

Adjusted EBIT is defined as profit or

loss before income taxes, net finance cost, share based compensation, adjusted for income and costs which are significant in nature and

that management considers not reflective of underlying operational activities, mainly including net gains on disposal of long-term assets,

negative goodwill from acquisition of Sergio Rossi, gain on debt restructuring and government grants.

Adjusted EBITDA is defined as profit or

loss before income taxes, net finance cost, exchange gains/(losses), depreciation, amortization, share based compensation and provisions

and impairment losses adjusted for income and costs which are significant in nature and that management considers not reflective of underlying

operational activities, mainly including net gains on disposal of long-term assets, negative goodwill from acquisition of Sergio Rossi,

gain on debt restructuring and government grants.

Exhibit 99.2

| August 26, 2024 |

| 2

Forward-Looking Statements

This presentation, including the sections “2024 First Half Achievements”, “2024 Outlook”, “Brand-Level Performance” and “Appendix”, contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “guidance,” “project” and similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various

assumptions, whether or not identified in this presentation, and on the current expectations of the respective management of Lanvin Group and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and must not be relied on by an

investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lanvin Group. Potential risks

and uncertainties that could cause the actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, Lanvin Group's ability to timely complete its financial closing procedures and finalize its consolidated financial statements for the six

months ended June 30, 2024; changes adversely affecting the business in which Lanvin Group is engaged; Lanvin Group’s projected financial information, anticipated growth rate, profitability and market opportunity may not be an indication of its actual results or future results; management of

growth; the impact of health epidemics, pandemics and similar outbreaks, including the COVID-19 pandemic on Lanvin Group's businesses; Lanvin Group’s ability to safeguard the value, recognition and reputation of its brands and to identify and respond to new and changing customer preferences;

the ability and desire of consumers to shop; Lanvin Group’s ability to successfully implement its business strategies and plans; Lanvin Group’s ability to effectively manage its advertising and marketing expenses and achieve desired impact; its ability to accurately forecast consumer demand; high

levels of competition in the personal luxury products market; disruptions to Lanvin Group’s distribution facilities or its distribution partners; Lanvin Group’s ability to negotiate, maintain or renew its license agreements; Lanvin Group’s ability to protect its intellectual property rights; Lanvin Group’s

ability to attract and retain qualified employees and preserve craftmanship skills; Lanvin Group’s ability to develop and maintain effective internal controls; general economic conditions; the result of future financing efforts; and those factors discussed in the reports filed by Lanvin Group from time to

time with the SEC. If any of these risks materialize or Lanvin Group’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Lanvin Group presently does not know, or that Lanvin Group

currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Lanvin Group’s expectations, plans, or forecasts of future events and views as of the date of this presentation.

Lanvin Group anticipates that subsequent events and developments will cause Lanvin Group’s assessments to change. However, while Lanvin Group may elect to update these forward-looking statements at some point in the future, Lanvin Group specifically disclaim any obligation to do so. These

forward-looking statements should not be relied upon as representing Lanvin Group’s assessments of any date subsequent to the date of this presentation. Accordingly, reliance should not be placed upon the forward-looking statements.

Use of Non-IFRS Financial Metrics

This presentation includes certain non-IFRS financial measures (including on a forward-looking basis) such as Contribution Profit, Contribution Profit Margin, Adjusted Operating Profit, adjusted earnings before interest and taxes (“Adjusted EBIT”), and adjusted earnings before interest, taxes,

depreciation and amortization (“Adjusted EBITDA”). These non-IFRS measures are an addition, and not a substitute for or superior to measures of financial performance prepared in accordance with IFRS and should not be considered as an alternative to net income, operating income or any other

performance measures derived in accordance with IFRS. Reconciliations of non-IFRS measures to their most directly comparable IFRS counterparts are included in the Appendix to this presentation. Lanvin Group believes that these non- IFRS measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Lanvin Group. Lanvin Group's management uses forward looking non-IFRS measures to evaluate Lanvin Group's projected financial and operating performance. Lanvin Group believes that the use of these non-IFRS financial

measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Lanvin Group's financial measures with other similar companies, many of which present similar non-IFRS financial measures to investors. However, there are a number of

limitations related to the use of these non-IFRS measures and their nearest IFRS equivalents. For example, other companies may calculate non-IFRS measures differently, or may use other measures to calculate their financial performance, and therefore Lanvin Group's non-IFRS measures may not

be directly comparable to similarly titled measures of other companies. Lanvin Group does not consider these non-IFRS measures in isolation or as an alternative to financial measures determined in accordance with IFRS. The principal limitation of these non-IFRS financial measures is that they

exclude significant expenses, income and tax liabilities that are required by IFRS to be recorded in Lanvin Group's financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgements by Lanvin Group about which expense and income are excluded or

included in determining these non-IFRS financial measures. In order to compensate for these limitations, Lanvin Group presents non-IFRS financial measures in connection with IFRS results. |

| Global macro-economic headwinds were impactful

Appointment of Artistic Director at Lanvin and Creative Director at

Sergio Rossi

Integration challenges of Wolford’s new 3PL provider resulted in

significant shipping issues

Wholesale market challenges contributed to majority of the revenue

decrease

Group gross profit margin steady, with strong increases at Lanvin,

St. John, and Caruso from higher full-price sell-through and

strategic inventory management |

| 5

FIRST HALF ACHIEVEMENTS

• Peter Copping introduced as

upcoming Artistic Director

• Lanvin Lab 2.0 - partnered with

artist Erwin Wurm for a

monumental bag sculpture that

will tour five key cities in China

• Continued push of the iconic

ballerina and iconic dresses

with the Benjamin Millepied

video project

• Reopening of the South Coast

Plaza boutique in May

• Successful launch of W.O.W

leggings across all channels

with exceptional sell-through

• Opened store in Kuwait City,

marking its first location in the

Middle East

• Successful client events with

Central Park Conservancy and

JP Morgan

• NY flagship store opened

• Successful launch party with

Vogue for St. John Vintage Edit

• Edie Parker x St. John

campaign featuring Leighton

Meister had 2M+ views in 2

weeks with 1.1M likes; grew

TikTok followers by 2000%

• New AAA fashion maison

account gained, first orders

exceeding €1M (to impact H2)

• Successful showcasing of

FW24 and SS25 collections at

Pitti Uomo with great press

coverage; led to new business

development

• First flagship store opened in

Dubai Mall; future store opening

in Abu Dhabi in 2025

• Successful retail pop-ups in

Japan to celebrate the iconic

Mermaid collection SS24

• Paul Andrew announced as

new Creative Director in July

2024; first major seasonal

launch will be in 2025 |

| 6

Hired new brand managers to facilitate cost-efficiency measures

Focused planning for first collections with new creative/artistic

directors; to provide boost to wholesale channel in 2025

Further reduction of cost base and more aggressive culling of

retail network

Adapt marketing and expansion initiatives to improve ROI; but

continue to invest in marketing to promote highly-anticipated

new collections from Lanvin and Sergio Rossi

6

DRIVE COST-EFFICIENCY INITIATVES TO MAINTAIN MARGIN IMPROVEMENT |

| 7

THE GROUP IS WORKING ON NEW INITIATIVES TO SUPPORT ITS BRANDS

Working on Group-level partnerships

for product category expansion

opportunities and global logistics

support

Pursuing partnerships for Middle East

expansion as well as building an investor

network

Further synergizing back-office

functions to reduce overhead costs

and improve efficiency |

| (1) These are Non-IFRS Financial Measures and will be mentioned throughout this presentation. Please see Page 35 for Non-IFRS Financial Measures and Definitions. 8

H1 24

Global Revenue

H1 24 Wholesale

Revenue Growth

H1 24 Global

Revenue Growth

H1 24 vs. H1 23

Contribution Profit %(1) Change

H1 24 vs. H1 23

Gross Profit Margin Change

H1 24 vs. H1 23

Adj. EBITDA Period-over-Period Change

(1) |

| 9

FIRST HALF REVENUE WAS IMPACTED BY MACROECONOMIC TRENDS AND CHALLENGES IN THE WHOLESALE CHANNEL

• Ongoing wholesale market weakness was leading driver of revenue decline

• Additions of new creative talent at Lanvin and Sergio Rossi to improve wholesale channel in 2025

• Wolford impacted by a delay in shipments due to integration issues with new 3PL provider

• Sergio Rossi’s planned third-party production reduction contributed to the decline in revenue

H1 2021 H1 2022 H1 2023 Eliminations H1 2024

€ 117

€ 202

€ 215

-€ 9

-€ 16

-€ 13

-€ 7 -€ 0

€ 1 € 171 |

| (1) Other includes: Japan, South Korea, Thailand, Malaysia, Vietnam, Indonesia, Philippines, Australia, New Zealand, India and other Southeast Asian countries. 10

44.3%

37.6%

11.6%

6.5%

North

America

-11.3%

EMEA

-27.1%

Greater

China

-24.2%

Other(1)

-7.4%

€215

61.2%

34.9%

4.0%

Other(1)

-15.4%

DTC

-13.6%

Wholesale

-30.3%

€171

-€28

-€8 -€6 -€1

€215

-€16 €171

-€26 -€1 |

| 11

• Gross Profit Margin held steady with only a 1% reduction

• Contribution profit was impacted due to the decline in revenue; all brands took measures to reallocate marketing investments to improve ROI

• All brands pushed G&A cost-reduction measures to offset market weakness

• Adjusted EBITDA decreased 3% to -€42 million from -€41 million; holding steady despite lower revenue

(1) These are Non-IFRS Financial Measures and will be mentioned throughout this presentation. Please see Page 35 for Non-IFRS Financial Measures and Definitions.

GP% 51.8%

CHANGE IN GROUP’S GROSS PROFIT AND CONTRIBUTION PROFIT MARGINS

€ 61

€ 113

€ 125

€ 98

H1 21 H1 22 H1 23 H1 24

55.9% 58.5% 57.5%

-€ 10

€ 6

€ 15

-€ 7

H1 21 H1 21 H1 22 H1 23 H1 24

CP% -8.7% 2.9% 6.9% -4.2%

-€ 36

-€ 36

-€ 41

-€ 42

H1 21 H1 22 H1 23 H1 24

Adj.

EBITDA% -30.7% -17.6% -19.1% -24.6% |

| 12

€ 20

€ 16

€ 11

€ 14

€ 5

€ 14 € 14

€ 10

€ 11

€ 4

0

5

10

15

20

25

H1 2023 G&A expenses (€ in mm)

H1 2024 G&A expenses (€ in mm)

-29% -11% -9% -20% -4% YoY

Improvement |

| 13

€ 71

€ 107 € 111 € 106

€ 55

€ 76 € 77

€ 58

0

20

40

60

80

100

120

140

160

180

200

H1 2021 H1 2022 H1 2023 H1 2024

G&A expenses(€ in mm)

Marketing and selling expenses(€ in mm)

€ 126

€ 183

€ 188

€ 164

(1) H1 2021 Group

-level financials did not include Sergio Rossi.

% of Revenue 107.4% 90.5% 87.2% 95.7%

(1) |

| Note: DOS as of 31st December 2023 and 30th June 2024 and refers to Directly Operated Stores which include shop-in-shop, retail, outlet & pop-up stores. 14

ONGOING UPGRADE OF STORE NETWORK, WITH DISCIPLINED NEW OPENINGS AND CLOSURES OF UNDERPERFORMING LOCATIONS

Lanvin Group DOS Evolution by Brand

Lanvin Group DOS Evolution by Region

FY23 Total

Closures H1 24

FY23 EMEA North

America

Greater

China

Other

Asia

Total

Closures H1 24

Lanvin – Cannes Lanvin - Hangzhou

Sergio Rossi - Dubai Mall St. John – Hong Kong Lee Garden

Selected Recently Opened and Upgraded Boutiques |

| 15

Implement action plan to further reduce costs and improve

margins

Tactical approach to marketing and footprint expansion;

focusing on ROI

Build the brand story at Lanvin and Sergio Rossi with new

creative leaders

15

DRIVE COST-EFFICIENCIES |

| 17

(1) Non-IFRS Financial Measure. Please see Page 35 for Non-IFRS Financial Measures and Definitions.

Note: Brand-level results are presented exclusive of eliminations.

H1 Results

• Revenue decreased by 15% due to macro headwinds, contracting wholesale network