Current Report Filing (8-k)

November 05 2019 - 5:08PM

Edgar (US Regulatory)

false 0000056679 0000056679 2019-11-01 2019-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2019

KORN FERRY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-14505

|

|

95-2623879

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1900 Avenue of the Stars, Suite 2600

Los Angeles, California

|

|

90067

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (310) 552-1834

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

KFY

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.05

|

Costs Associated with Exit or Disposal Activities.

|

On November 1, 2019, Korn Ferry (the “Company”) adopted a restructuring plan relating to actions in respect of the integration of Miller Heiman Group, AchieveForum and Strategy Execution (the “Acquired Entities”). The purpose of this plan is to rationalize the Company’s cost structure as a result of efficiencies and operational improvements that the Company will be positioned to realize upon integration of the Acquired Entities into the Company. The plan will include the elimination of redundant positions and consolidation of office space. The estimated cost of the actions contemplated by the plan is between $20 million to $26 million, of which $18 million to $22 million relates to severance and $2 million to $4 million relates to office consolidation and abandonment of premises. These charges are expected to include approximately $18 million to $24 million of cash expenditures. The Company expects to recognize these charges between Q3 FY’20 and Q1 FY’21 and expects the restructuring actions to be completed by the end of Q1 FY’21.

On November 1, 2019, the Company issued a press release announcing the closing of the acquisition of the Acquired Entities. A copy of the press release is attached hereto as Exhibit 99.1.

Forward-Looking Statements

This current report on Form 8-K contains “forward-looking statements”, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally can be identified by use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “will,” “likely,” “estimates,” “potential,” “continue” or other similar words or phrases. Such forward-looking statements include statements regarding the timing and scope of the restructuring actions; the amount and timing of the related charges and cash expenditures; and the expected cost savings resulting from such actions. Many factors could affect the actual results of the restructuring actions, and variances from the Company’s current expectations regarding such factors could cause actual results of the restructuring actions to differ materially from those expressed in these forward-looking statements. A discussion of these and other risks and uncertainties that could cause the Company’s actual results to differ materially from these forward-looking statements is included in the documents that the Company files with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K. These forward-looking statements speak only as of the date of this report, and the Company does not undertake any obligation to revise or update such statements, whether as a result of new information, future events, or otherwise.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

KORN FERRY

(Registrant)

|

|

|

|

|

|

|

|

Date: November 5, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Robert Rozek

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

Name:

|

|

Robert Rozek

|

|

|

|

|

|

Title:

|

|

EVP – CFO and CCO

|

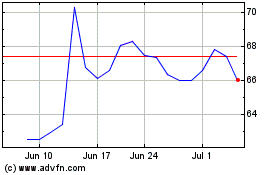

Korn Ferry (NYSE:KFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

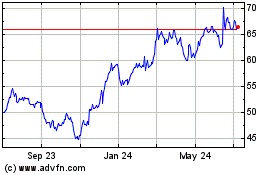

Korn Ferry (NYSE:KFY)

Historical Stock Chart

From Apr 2023 to Apr 2024