Philips Adds More Targets to 2021-25 Growth Plan

November 06 2020 - 2:59AM

Dow Jones News

By Matteo Castia

Koninklijke Philips NV said Friday that it has included more

targets in its 2021-25 growth plan, building on those announced in

October.

The Dutch medical-technology group said it is now targeting

accelerated sales growth and an adjusted earnings before interest,

taxes, depreciation and amortization margin in the high-teens by

2025.

The company said it is also aiming for an extra 400 million

euros ($473.2 million) of net savings a year between 2021 and 2025,

in an effort to reach extra cumulative net savings of EUR2 billion

by the end of that period.

Philips added that it is seeking to achieve mid-to-high-teens

organic return on invested capital by 2025.

The company also reiterated the targets it had outlined in its

third-quarter earnings on Oct. 19, when it said it was targeting an

acceleration in the average annual comparable sales growth to

5%-6%, an adjusted Ebita margin improvement of 60-80 basis points

on average annually from 2021 and a free cash flow above EUR2

billion by 2025.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

November 06, 2020 02:44 ET (07:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

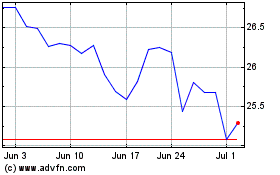

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024