Statement of Changes in Beneficial Ownership (4)

February 15 2020 - 1:04AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Kite John A |

2. Issuer Name and Ticker or Trading Symbol

KITE REALTY GROUP TRUST

[

KRG

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chairman & CEO |

|

(Last)

(First)

(Middle)

KITE REALTY GROUP TRUST, 30 S MERIDIAN STREET, SUITE 1100 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/12/2020 |

|

(Street)

INDIANAPOLIS, IN 46204

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Limited Partnership Units of Kite Realty Group, L.P. | $17.76 (1)(2) | 2/12/2020 | | A | | $2560000 (1)(2)(3) | | (1)(2) | (1)(2) | Common Shares | $2560000.0 (1)(2)(3) | $0 (1)(2) | $2560000 | D | |

| Explanation of Responses: |

| (1) | The reporting person received a grant of limited partnership units in Kite Realty Group L.P. designated as Class AO LTIP Units ("AO LTIPs"), pursuant to the Kite Realty Group Trust 2013 Equity Incentive Plan, as amended and restated as of February 28, 2019. AO LTIPs are similar to "net exercise" stock option awards and are convertible, once vested, into a number of vested limited partnership units of Kite Realty Group L.P. designated as LTIP Units ("LTIPs"), determined by the quotient of (i) the excess of the value of a common share of beneficial interest, par value of $.01 per share ("Common Share") of Kite Realty Group Trust as of the date of conversion over $17.76 (the "Participation Threshold per AO LTIP"), divided by (ii) the value of a Common Share as of the date of conversion. Vested LTIPs into which AO LTIPs have been converted are further convertible, [footnote continued] |

| (2) | [Continued from footnote] conditioned upon minimum allocations to the capital accounts of the LTIPs for U.S. federal income tax purposes, into an equal number of limited partnership units in Kite Realty Group L.P. ("LP Units"). The resulting LP Units are redeemable by the holder for one Common Share per LP Unit or the cash value of a Common Share, at the Issuer's option. The AO LTIPs will vest and become exercisable as of the date that both of the following requirements have been met: (i) the grantee remains in continuous service from the grant date through the third anniversary of the grant date; and (ii) at any time during the period between the second year and the fifth year following the grant date, the reported closing price per Common Share appreciates at least 15% over the applicable Participation Threshold per AO LTIP (as set forth in the table above) for a minimum of 20 consecutive trading days. Under the award agreement, the AO LTIPs have a six-year term from the grant date. |

| (3) | The Compensation Committee approved a grant of AO LTIPs for the reporting person based on a target dollar value of $2,560,000. The number of AO LTIPs will be determined by dividing the target dollar value by the grant date fair value per AO LTIP Unit; the grant date fair value per AO LTIP Unit is pending appraisal. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Kite John A

KITE REALTY GROUP TRUST

30 S MERIDIAN STREET, SUITE 1100

INDIANAPOLIS, IN 46204 | X |

| Chairman & CEO |

|

Signatures

|

| /s/ John A. Kite | | 2/14/2020 |

| **Signature of Reporting Person | Date |

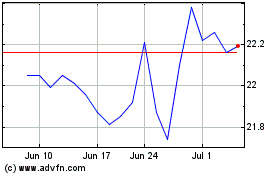

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

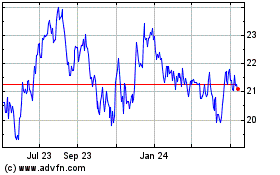

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024