Current Report Filing (8-k)

July 29 2022 - 4:10PM

Edgar (US Regulatory)

0000056047true00000560472022-07-292022-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 29, 2022 |

KIRBY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada |

1-7615 |

74-1884980 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

55 Waugh Drive, Suite 1000 |

|

Houston, Texas |

|

77007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: 713-435-1000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KEX |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On July 29, 2022, Kirby Corporation ("Kirby") entered into a credit agreement (the “2027 Credit Agreement”) with a group of commercial banks that replaces Kirby’s amended and restated credit agreement previously in place (the "2024 Credit Agreement") with a $500 million revolving credit facility and a term loan facility in an amount of $250 million with a maturity date of July 29, 2027 (the "Maturity Date"). The 2027 Credit Agreement provides for a variable interest rate based on the Secured Overnight Financing Rate (“SOFR”) or a base rate calculated with reference to the prime rate quoted by The Wall Street Journal, the Federal Reserve Bank of New York Rate plus 0.5%, or the adjusted SOFR rate for a one month interest period plus 1.0%, among other factors (the “Alternate Base Rate”). The interest rate varies with Kirby’s credit rating and is currently 137.5 basis points over SOFR or 37.5 basis points over the Alternate Base Rate. Revolving credit loans are repayable on the Maturity Date. The term loan is repayable in quarterly installments commencing December 31, 2022, in increasing percentages of the original principal amount of the loan, with the remaining unpaid balance of $43.8 million payable on the Maturity Date, assuming no prepayment. The 2027 Credit Agreement contains covenants including an interest coverage ratio and debt-to-capitalization ratio. In addition to financial covenants, the 2027 Credit Agreement contains covenants that, subject to exceptions, restrict debt incurrence, mergers and acquisitions, sales of assets, dividends and investments, liquidations and dissolutions, capital leases, transactions with affiliates, and changes in lines of business. The 2027 Credit Agreement specifies certain events of default, upon the occurrence of which the maturity of the outstanding loans may be accelerated, including the failure to pay principal or interest, violation of covenants and default on other indebtedness, among other events. Borrowings under the 2027 Credit Agreement may be used for general corporate purposes, including acquisitions. As of July 29, 2022, Kirby had outstanding borrowings under the 2027 Credit Agreement revolving credit facility of $35.0 million and outstanding borrowings under the 2027 Credit Agreement term loan facility of $250.0 million. The proceeds were used to repay $285.0 million in borrowings previously outstanding under the 2024 Credit Agreement, which was then terminated.

Item 1.02. Termination of a Material Definitive Agreement.

As described in Item 1.01 of this report, proceeds of the 2027 Credit Agreement were used to refinance the outstanding indebtedness under the 2024 Credit Agreement, which was then terminated.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

On July 29, 2022, Kirby borrowed $35.0 million under the revolving credit facility and $250.0 million under the term loan facility described in Item 1.01 of this report. The terms of the borrowings are summarized in the description of the 2027 Credit Agreement in Item 1.01.

Item 9.01. Financial Statements and Exhibits

EXHIBIT INDEX

* Certain portions of this exhibit have been redacted in compliance with Item 601(b)(10)(iv) of Regulation S-K. The Company agrees to furnish supplementally to the Securities and Exchange Commission an unredacted copy of the exhibit upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

KIRBY CORPORATION |

|

|

|

|

Date: |

July 29, 2022 |

By: |

/s/ Raj Kumar |

|

|

|

Raj Kumar

Executive Vice President

and Chief Financial Officer |

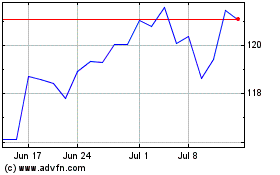

Kirby (NYSE:KEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

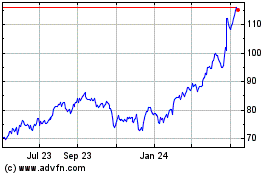

Kirby (NYSE:KEX)

Historical Stock Chart

From Apr 2023 to Apr 2024