Current Report Filing (8-k)

March 01 2023 - 5:30PM

Edgar (US Regulatory)

0001072627

false

0001072627

2023-02-28

2023-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

February 28, 2023

KINGSWAY FINANCIAL SERVICES INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

001-15204 |

|

85-1792291 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

10 S. Riverside Plaza,

Suite 1520, Chicago, IL 60606

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (312)

766-2138

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

KFS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

On February 28, 2023, certain subsidiaries

(such subsidiaries, collectively the “Loan Parties”) of Kingsway Financial Services, Inc. (the “Company”) entered

into the Second Amendment to Loan and Security Agreement (the “Amendment”) with CIBC Bank USA as lender (“Lender”).

The Amendment provides for an additional delayed

draw term loan in the principal amount of up to Ten Million Dollars ($10,000,000) (the “DDTL”), with a maturity date of December

1, 2025. All or any portion, subject to a Two Million Dollar ($2,000,000) minimum amount, of the DDTL may be requested by the Loan Parties

at any time through February 27, 2024. The principal amount of any drawn DDTL shall be repaid in quarterly installments in an amount equal

to 3.75% of the original amount of the drawn DDTL. In connection with the DDTL, the Loan Parties are obligated to pay certain fees, including

a commitment fee equal to Twenty Five Thousand Dollars ($25,000) and draw fees equal to seventy five (75) basis points of the amount of

any drawn DDTL.

The Amendment also modifies the Senior Cash

Flow Leverage Ratio (as such term is defined in the Amendment) to increase the maximum permissible Senior Cash Flow Leverage Ratio of

the Loan Parties for certain periods.

The description of the Amendment does not

purport to be complete, and is qualified in its entirety by reference to the text of the Amendment, which will be filed as an exhibit

to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

Item 2.03 Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Please see Item 1.01 above, which information

is incorporated by reference into this Item 2.03.

Item 8.01 Other Events.

On March 1, 2023, the

Company plans to notify holders of its outstanding Class A Preferred Stock, Series 1, par value $0.01 per share (“Class A

Preferred Stock”) of its intention to redeem all the outstanding Class A Preferred Stock on March 15, 2023 (the

“Anticipated Redemption Date”).

As previously disclosed,

the Class A Preferred Stock is convertible into shares of the Company’s common stock, no par value, at the discretion of the holders.

The Company anticipates

redeeming all Class A Preferred Stock that remain outstanding on, and is not converted by, the Anticipated Redemption Date for the price

of $25.00 per Preferred Share, plus accrued and unpaid dividends thereon, whether or not declared, up to and including the Anticipated

Redemption Date.

In the event 100% of

the Class A Preferred Stock is redeemed by the Company on the Anticipated Redemption Date, the Company estimates that the aggregate amount

required to redeem such shares of Class A Preferred Stock will be approximately $6.1 million, which such amount will be paid using cash

on hand.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

KINGSWAY FINANCIAL SERVICES INC. |

| |

|

| Date: March 1, 2023 |

By: |

/s/ Kent A. Hansen |

| |

|

Kent A. Hansen |

| |

|

Chief Financial Officer |

| |

|

2

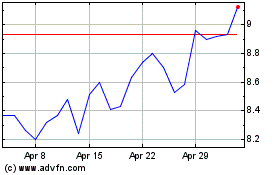

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

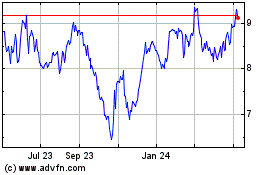

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From Apr 2023 to Apr 2024