Major Permian Projects Advance; Substantial

Growth Compared to Previous Period

Kinder Morgan, Inc. (NYSE: KMI) today announced that its board

of directors approved a cash dividend of $0.25 per share for the

first quarter ($1.00 annualized) payable on May 15, 2019, to common

stockholders of record as of the close of business on April 30,

2019. This is a 25 percent increase over the fourth quarter 2018

dividend. KMI is reporting first quarter net income available to

common stockholders of $556 million, compared to $485 million in

the first quarter of 2018; and distributable cash flow (DCF) of

$1,371 million, a 10 percent increase over the first quarter of

2018. In the first quarter of 2019, KMI continued to fund most of

its growth capital through operating cash flows with no need to

access capital markets for that purpose. During the first quarter

KMI also paid down $1.3 billion of maturing bond debt with cash

from the return of capital distribution from the Trans Mountain

sale.

“We are pleased to continue the dividend growth plan that we

outlined to shareholders during the summer of 2017,” said Richard

D. Kinder, Executive Chairman. “We continue to maintain a strong

balance sheet and have been upgraded by two of the three ratings

agencies. We are well positioned for a successful 2019 and remain

on positive outlook for an upgrade by Fitch later in the year.”

“Contributions from our Natural Gas Pipelines segment were up

substantially compared to the first quarter of 2018,” Chief

Executive Officer Steve Kean noted. “We continued to make progress

on two projects critical to the development of resources in the

Permian Basin: the Gulf Coast Express and Permian Highway Pipeline

projects, as well as our Elba Liquefaction facility,” continued

Kean. “On the regulatory front, we were very pleased to achieve

settlements with our shippers on both Tennessee Gas Pipeline (TGP)

and El Paso Natural Gas (EPNG) that address the Federal Energy

Regulatory Commission’s (FERC’s) 501-G process. These two

agreements, pending FERC approval, should resolve the vast majority

of KMI’s 501-G exposure.”

KMI President Kim Dang said, “The first quarter of 2019 showed

that we continue to benefit from strategically located, fee-based

assets that generate predictable cash flows from a network that

provides our customers with unmatched flexibility. Our commercial

and operating performance continues to be very good, and we

generated first quarter earnings per common share of $0.24,

compared to $0.22 per common share in the first quarter of 2018,

and DCF of $0.60 per common share, representing 7 percent growth

over the first quarter of 2018. This resulted in more than $800

million of excess DCF above our declared dividend.”

As noted above, KMI reported first quarter net income available

to common stockholders of $556 million, compared to $485 million

for the first quarter of 2018, and DCF of $1,371 million, up 10

percent from $1,247 million for the comparable period in 2018.

These increases were due to greater contributions from the Natural

Gas Pipelines segment, and lower preferred equity dividend

payments, partially offset by the elimination of Kinder Morgan

Canada earnings following the Trans Mountain sale and reduced

contributions from our CO2 segment. KMI’s project backlog for the

first quarter stood at $6.1 billion, approximately $400 million

more than the fourth quarter of 2018, with additions of

approximately $600 million in new projects, primarily in the

Natural Gas Pipelines segment, offset by approximately $200 million

in projects placed in service and other project capital

adjustments. Excluding the CO2 segment projects, KMI expects

projects in the backlog to generate an average Project EBITDA

multiple of approximately 5.5 times.

2019 Outlook

For 2019, KMI’s budget contemplates declared dividends of $1.00

per common share, DCF of approximately $5.0 billion ($2.20 per

common share) and Adjusted EBITDA of approximately $7.8 billion.

Adjusted EBITDA is likely to be slightly below budget while DCF is

expected to be on budget as lower interest expense offsets the

slightly lower Adjusted EBITDA. KMI budgeted to invest $3.1 billion

in growth projects and contributions to joint ventures during 2019.

KMI expects to use internally generated cash flow to fully fund its

2019 dividend payments as well as the vast majority of its 2019

discretionary spending, without the need to access equity markets.

Due to the Adjusted EBITDA impact discussed above, KMI now expects

to end 2019 with a Net Debt-to-Adjusted EBITDA ratio of

approximately 4.6 times, but still consistent with its long-term

target of approximately 4.5 times.

KMI does not provide budgeted net income attributable to common

stockholders (the GAAP financial measure most directly comparable

to DCF and Adjusted EBITDA) or budgeted project net income (the

GAAP financial measure most directly comparable to Project EBITDA)

due to the impracticality of predicting certain amounts required by

GAAP, such as unrealized gains and losses on derivatives marked to

market, and potential changes in estimates for certain contingent

liabilities.

KMI’s budgeted expectations assume average annual prices for

West Texas Intermediate (WTI) crude oil of $60.00 per barrel and

Henry Hub natural gas of $3.15 per million British Thermal Units

(MMBtu), consistent with forward pricing during the company’s

budget process. The vast majority of revenue KMI generates is

fee-based and therefore not directly exposed to commodity prices.

For 2019, we estimate that every $1 per barrel change in the

average WTI crude oil price impacts DCF by approximately $9 million

and each $0.10 per MMBtu change in the price of natural gas impacts

DCF by approximately $1 million. The primary area where KMI has

commodity price sensitivity is in its CO2 segment, with the

majority of the segment’s next 12 months of oil and NGL production

hedged to minimize this sensitivity. The segment is currently

hedged for 35,581 barrels per day (Bbl/d) at $55.59/Bbl in 2019;

18,223 Bbl/d at $56.35/Bbl in 2020; 9,400 Bbl/d at $55.06/Bbl in

2021; 3,700 Bbl/d at $56.77/Bbl in 2022, and 300 Bbl/d at

$54.73/Bbl in 2023.

Overview of Business

Segments

“The Natural Gas Pipelines segment had another strong

quarter. The segment’s financial performance for the first quarter

of 2019 was significantly higher relative to the first quarter of

2018,” said Dang. “The transmission assets saw higher revenue on

TGP due to contributions from projects placed into service in 2018,

from EPNG due primarily to increased Permian-related activity, and

on Kinder Morgan Louisiana Pipeline (KMLP) due to the Sabine Pass

Expansion that went into service in December 2018. The segment also

benefited from continued growth on its gathering and processing

assets in Louisiana and Texas due to increased drilling and

production in the Haynesville and Eagle Ford basins,

respectively.”

Natural gas transport volumes were up 4.5 Bcf/d or 14 percent

compared to the first quarter of 2018. This constitutes the fifth

quarter in a row in which volumes exceeded the previous comparable

prior year period by 10 percent or more. Much of the increase in

the first quarter of 2019 was primarily driven by increased

production in the DJ and Permian basins that benefited EPNG,

Wyoming Interstate Company, and Colorado Interstate Gas Pipeline

Company; as well as new projects placed into service on TGP and

KMLP. Natural gas gathering volumes were up 21 percent from the

first quarter of 2018 due primarily to higher volumes on the

KinderHawk and South Texas Midstream systems. NGL volumes, which

are now being reported in the Natural Gas segment due to an

internal reporting reorganization, were up 4 percent compared to

the first quarter of 2018.

Natural gas is critical to the American economy and to meeting

the world’s evolving energy needs. Objective analysts project U.S.

natural gas demand, including net exports of liquefied natural gas

(LNG) and exports to Mexico, will increase from 2018 levels by 32

percent to nearly 119 Bcf/d by 2030. Of the natural gas consumed in

the U.S., about 40 percent moves on KMI pipelines, and roughly the

same percentage holds true for U.S. natural gas exports. Analysts

project that future natural gas infrastructure opportunities

through 2030 will be driven by greater demand for gas-fired power

generation across the country (forecast to increase by 15 percent),

net LNG exports (forecast to increase almost five-fold), exports to

Mexico (forecast to rise by 39 percent), and continued industrial

development, particularly in the petrochemical industry.

“The Products Pipelines segment earnings were down

slightly compared with the first quarter of 2018 as strong

performances by CalNev, Plantation, KMST, and Bakken Crude were

offset by reduced contributions from Kinder Morgan Crude &

Condensate (KMCC) and SFPP,” Dang said.

Crude and condensate pipeline volumes were up 8 percent compared

to the first quarter of 2018, though lower re-contracted rates

reduced earnings contributions. Total refined products volumes were

flat versus the same period in 2018.

“Terminals segment earnings were up modestly compared to

the first quarter of 2018. Contributions from our liquids business,

which accounts for nearly 80 percent of the segment’s total

earnings, were up almost 1 percent due to strength in key hubs

along the Houston Ship Channel and in Edmonton, Alberta, including

the impact of our new Base Line Terminal joint venture,” said Dang.

“These gains were partially offset by tank lease costs at KML’s

Edmonton South Terminal, paid pursuant to the lease arrangement

with Trans Mountain that was extended for a 20-year term and became

a third-party arrangement due to the Trans Mountain Sale.”

Dang continued, “Contributions from our bulk business were

roughly flat compared to the first quarter of 2018.”

“CO2 segment earnings were down 20 percent versus

the first quarter of 2018, primarily on lower NGL and crude oil

prices, as well as slightly lower crude oil volumes. Our realized

weighted average crude oil price for the quarter was down 19

percent at $48.67 per barrel compared to $59.72 per barrel for the

first quarter of 2018, largely driven by our Midland/Cushing basis

hedges. Our weighted average NGL price for the quarter was down

$4.41 per barrel, or 15 percent from the first quarter of 2018,”

said Dang. “First quarter 2019 combined oil production across all

of our fields was down 3 percent compared to the same period in

2018 on a net to KMI basis, with a 25 percent increase in Tall

Cotton volumes offset by declines at our other assets. CO2 volumes

were up 5 percent on a net to KMI basis compared to the first

quarter of 2018. McElmo Dome achieved record production in the

quarter, while Doe Canyon experienced lower production compared to

the previous comparable period. First quarter 2019 net NGL sales

volumes of 10.1 thousand barrels per day (MBbl/d) were down 1

percent compared to the same period in 2018.”

Other News

Corporate

- On February 1, 2019, KMI used its share

of the January 3, 2019 return of capital distribution from the

Trans Mountain sale to pay down $1.3 billion of maturing bond

debt.

- KMI, as holder of an approximately 70

percent majority voting interest in Kinder Morgan Canada Limited

(TSX: KML), notes that following the Trans Mountain sale, and given

that the original purpose of KML as a funding vehicle for the Trans

Mountain expansion no longer exists, KML announced that it would

undertake a strategic review of KML to determine a course of action

that maximizes value to all KML shareholders. The options being

evaluated include, among others, continuing to operate as a

standalone enterprise, a disposition by sale, and a strategic

combination with another company. This process involves a rigorous

analysis of a variety of potential alternatives, and, while the

complexity of the situation is requiring more time than originally

anticipated, the process is near its conclusion. KML expects to

complete the review and announce the outcome in the coming

weeks.

Natural Gas Pipelines

- Progress continues on the Permian

Highway Pipeline Project (PHP Project). The civil and environmental

surveys are substantially complete, and the land acquisition

process is underway. In November 2018, the project partners

approved an expansion of the PHP Project capacity by approximately

0.1 Bcf/d, which is currently being marketed. The approximately $2

billion PHP Project is now designed to transport up to 2.1 Bcf/d of

natural gas through approximately 430 miles of 42-inch pipeline

from the Waha, Texas area to the U.S. Gulf Coast and Mexico markets

and is expected to be in service in October 2020, pending

regulatory approvals. The original 2.0 Bcf/d of capacity is fully

subscribed under long term binding agreements. Kinder Morgan Texas

Pipeline’s (KMTP) and EagleClaw Midstream each have a 40 percent

ownership interest, and an affiliate of an anchor shipper has a 20

percent interest. Altus Midstream (a gas gathering, processing and

transportation company formed by shipper Apache Corporation) has an

option to acquire an equity interest in the project that expires in

September 2019. If Altus exercises its option, KMI, EagleClaw and

Altus will each hold a 26.67 percent ownership interest in the

project. KMTP will build and operate the pipeline.

- Construction continues on the Gulf

Coast Express Pipeline Project (GCX Project). The remaining 40

miles of the 36-inch Midland lateral was placed in service at the

beginning of April 2019. Construction is progressing well on the

42-inch mainline and compressor stations associated with the

project, which remains on schedule for a full in-service date of

October 2019. The approximately $1.75 billion project is designed

to transport about 2.0 Bcf/d of natural gas from the Permian Basin

to the Agua Dulce, Texas area, and is fully subscribed under

long-term, binding agreements. KMTP owns a 35 percent interest in

the Project and is building and will operate the pipeline. Other

equity holders include Altus Midstream, DCP Midstream and an

affiliate of Targa Resources.

- The first of ten liquefaction units of

the nearly $2 billion Elba Liquefaction Project is expected to be

placed in service by approximately May 1, 2019. The remaining nine

units are expected to be placed in service sequentially, one per

month thereafter. The federally approved project at the existing

Southern LNG Company facility at Elba Island near Savannah,

Georgia, will have a total liquefaction capacity of approximately

2.5 million tonnes per year of LNG, equivalent to

approximately 350 million cubic feet per day of natural gas. The

project is supported by a 20-year contract with Shell. Elba

Liquefaction Company, L.L.C., a KMI joint venture with EIG Global

Energy Partners as a 49 percent partner, will own the liquefaction

units and other ancillary equipment. Certain other facilities

associated with the project are 100 percent owned by KMI.

- NGPL is proceeding with a second Gulf

Coast southbound expansion project and made its FERC filing on

February 28, 2019. The approximately $230 million project (KMI’s

share: $115 million) will increase southbound capacity on NGPL’s

Gulf Coast System by approximately 300,000 Dth/d to serve Corpus

Christi Liquefaction, LLC. The project is supported by a long-term

take-or-pay contract and is expected to be placed into service in

the first half of 2021 pending appropriate regulatory

approvals.

- KMI is investing more than $500 million

towards its gas gathering and processing footprint in the Williston

Basin. Approximately 275 MMCF/d of gathering capacity is being

created through pipeline and compression additions. Construction is

also underway on a new 150 MMCF/d cryogenic plant in McKenzie

County, North Dakota, with an estimated in-service date of November

1, 2019.

- In July 2018, the FERC issued an order

requiring an informational filing by interstate natural gas

pipelines on a new Form 501-G, evaluating the impact of the 2017

Tax Reform and the Revised Tax Policy on tax allowances for the

pipelines. In the fourth quarter of 2018, KMI filed Form 501-G for

19 of its FERC-regulated assets. The FERC granted SNG a waiver from

filing the 501-G based on its previously filed negotiated

settlement and TGP was granted an extension from filing based on

ongoing negotiations with customers.

- On April 8, 2019, KMI announced that

TGP and EPNG agreed to settlements with their shippers to address

FERC’s 501-G process. KMI successfully worked with its shippers

without the need for litigation or any additional intervention by

the FERC. Rate adjustments set forth in the agreements by TGP and

EPNG will have a combined approximately $50 million Adjusted EBITDA

impact for 2019; and when fully implemented, will have an

approximately $100 million combined annual impact on Adjusted

EBITDA.

- FERC has approved a settlement that

Young Gas Storage reached with its customers and has terminated all

but three of the remaining 501-G proceedings without taking further

action. FERC initiated a rate investigation of Bear Creek Storage

Company. Bear Creek Storage Company filed a cost and revenue study

in compliance with the FERC investigation on April 1, 2019. Two

other KMI 501-G filings remain pending but relate to systems under

rate moratoria.

- KMI expects the vast majority of KMI's

501-G exposure to be resolved upon FERC’s approval of the EPNG and

TGP settlements discussed above.

Products Pipelines

- On April 11, 2019, FERC approved the

Petition for Declaratory Order regarding the regulatory framework

and commercial terms for the Roanoke Expansion project on the

Plantation Pipe Line system. The project is on track for interim

capacity of 21,000 barrels per day (bpd) to be available on the

Collins to Greensboro segment by May 1, 2019. Service from the

Baton Rouge to Collins segment is expected to be available starting

September 1, 2019. This project will provide approximately 21,000

bpd of incremental refined petroleum products capacity on the

Plantation Pipe Line system from the Baton Rouge, Louisiana and

Collins, Mississippi origin points to the Roanoke, Virginia area,

and consists primarily of additional pump capacity and operational

storage. The full project from Baton Rouge to Roanoke is expected

to be in service by April 1, 2020.

- In January 2019, Kinder Morgan and

Tallgrass Energy, LP (TGE) announced an agreement to jointly

develop a solution to increase existing crude oil takeaway capacity

in the growing Powder River and Denver-Julesburg basins, as well as

to add incremental takeaway capacity to the Williston Basin and

portions of Western Canada. The proposed venture would include both

existing and newly constructed assets. TGE would contribute its

Pony Express Pipeline System. KMI would contribute portions of its

Wyoming Intrastate Company and Cheyenne Plains Gas Pipeline and

begin the process of their abandonment and conversion to crude oil

service. In addition, approximately 200 miles of new pipeline would

be constructed to provide crude oil deliveries into Cushing,

Oklahoma.

- In February 2019, Kinder Morgan and

Phillips 66 announced a joint open season through April 30, 2019 by

Gray Oak Pipeline, LLC (Gray Oak) and KMCC to provide shippers with

long-term crude oil transportation from Gray Oak Pipeline origin

points in the Permian Basin to KMCC delivery points at or near the

Houston Ship Channel under a binding joint transportation services

agreement. Delivery from the Gray Oak Pipeline to the Houston Ship

Channel would be achieved through a connection in South Texas.

Terminals

- Kinder Morgan has authorized an

expansion of its market-leading Argo ethanol hub. The project

scope, which spans both the Argo and Chicago Liquids facilities,

includes 105,000 barrels of additional ethanol storage capacity and

enhancements to the system’s rail loading, rail unloading and barge

loading capabilities. The approximately $20 million project will

improve the system’s inbound and outbound modal balances adding

greater product-clearing efficiencies to this industry-critical

pricing and liquidity hub.

- All material permits have been secured

and construction activities will commence shortly on the distillate

storage expansion project at KML’s Vancouver Wharves terminal in

North Vancouver, British Columbia. The C$43 million capital

project, which calls for the construction of two new distillate

tanks with combined storage capacity of 200,000 barrels and

enhancements to the railcar unloading capabilities, is supported by

a 20-year initial term, take-or-pay contract with an affiliate of a

large, international integrated energy company. The project is

expected to be placed in service late first quarter of 2021.

CO2

- The SACROC field continues to exceed

expectations, surpassing KMI’s production budget for the first

quarter. This continued production is due to KMI’s on-going success

in exploiting the transition zone, which holds an estimated

incremental 700 million barrels of original oil in place.

- CO2 demand in the Permian Basin

supported record production from the McElmo Dome field of 1.209

Bcf/d for the first quarter of 2019.

- Oil production in the first quarter at

KMI’s Tall Cotton facility grew by 25 percent relative to the same

period in 2018 (though below plan) following the completion of the

second phase of its field project.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy

infrastructure companies in North America. We own an interest in or

operate approximately 84,000 miles of pipelines and

157 terminals. Our pipelines transport natural gas, refined

petroleum products, crude oil, condensate, CO2 and other products,

and our terminals transload and store liquid commodities including

petroleum products, ethanol and chemicals, and bulk products,

including petroleum coke, metals and ores. For more information

please visit www.kindermorgan.com.

Please join Kinder Morgan, Inc. at 4:30 p.m. Eastern Time on

Wednesday, April 17, at www.kindermorgan.com for a LIVE webcast

conference call on the company’s first quarter earnings. A

printer-friendly copy of this earnings release is available under

the “Earnings Releases” tab in the “Annual and Quarterly Reports”

section of our investor website, which can be accessed via the

following link: https://ir.kindermorgan.com/annual-quarterly-reports.

Non-GAAP Financial

Measures

The non-generally accepted accounting principles (non-GAAP)

financial measures of distributable cash flow (DCF), both in the

aggregate and per share, segment earnings before depreciation,

depletion, amortization and amortization of excess cost of equity

investments (DD&A) and Certain Items (Segment EBDA before

Certain Items), net income before interest expense, taxes, DD&A

and Certain Items (Adjusted EBITDA), Adjusted Earnings and Adjusted

Earnings per common share are presented herein.

Certain Items as used to calculate

our Non-GAAP measures, are items that are required by GAAP to be

reflected in net income, but typically either (1) do not have a

cash impact (for example, asset impairments), or (2) by their

nature are separately identifiable from our normal business

operations and in our view are likely to occur only sporadically

(for example certain legal settlements, enactment of new tax

legislation and casualty losses).

DCF is calculated by adjusting net

income available to common stockholders before Certain Items for

DD&A, total book and cash taxes, sustaining capital

expenditures and other items. DCF is a significant performance

measure useful to management and by external users of our financial

statements in evaluating our performance and to measure and

estimate the ability of our assets to generate cash earnings after

servicing our debt and preferred stock dividends, paying cash taxes

and expending sustaining capital, that could be used for

discretionary purposes such as common stock dividends, stock

repurchases, retirement of debt, or expansion capital expenditures.

We believe the GAAP measure most directly comparable to DCF is net

income available to common stockholders. A reconciliation of net

income available to common stockholders to DCF is provided herein.

DCF per share is DCF divided by average outstanding shares,

including restricted stock awards that participate in

dividends.

Segment EBDA before Certain Items

is used by management in its analysis of segment performance and

management of our business. General and administrative expenses are

generally not under the control of our segment operating managers,

and therefore, are not included when we measure business segment

operating performance. We believe Segment EBDA before Certain Items

is a significant performance metric because it provides us and

external users of our financial statements additional insight into

the ability of our segments to generate segment cash earnings on an

ongoing basis. We believe it is useful to investors because it is a

measure that management uses to allocate resources to our segments

and assess each segment’s performance. We believe the GAAP measure

most directly comparable to Segment EBDA before Certain Items is

segment earnings before DD&A and amortization of excess cost of

equity investments (Segment EBDA). Segment EBDA before Certain

Items is calculated by adjusting Segment EBDA for the Certain Items

attributable to a segment, which are specifically identified in the

footnotes to the accompanying tables.

Adjusted EBITDA is calculated by

adjusting net income before interest expense, taxes, and DD&A

(EBITDA) for Certain Items, net income attributable to

noncontrolling interests further adjusted for KML noncontrolling

interests, and KMI’s share of certain equity investees’ DD&A

(net of consolidating joint venture partners’ share of DD&A)

and book taxes, which are specifically identified in the footnotes

to the accompanying tables. Adjusted EBITDA is used by management

and external users, in conjunction with our net debt, to evaluate

certain leverage metrics. Therefore, we believe Adjusted EBITDA is

useful to investors. We believe the GAAP measure most directly

comparable to Adjusted EBITDA is net income.

Adjusted Earnings is net income

available to common stockholders before Certain Items. Adjusted

Earnings is used by certain external users of our financial

statements to assess the earnings of our business excluding Certain

Items as another reflection of the company’s ability to generate

earnings. We believe the GAAP measure most directly comparable to

Adjusted Earnings is net income available to common stockholders.

Adjusted Earnings per share uses Adjusted Earnings and applies the

same two-class method used in arriving at Basic Earnings Per Common

Share.

Net Debt and Adjusted Net Debt, as used in this news release,

are non-GAAP financial measures that management believes are useful

to investors and other users of our financial information in

evaluating our leverage. Net Debt is calculated by subtracting from

debt (i) cash and cash equivalents, (ii) the preferred interest in

the general partner of Kinder Morgan Energy Partners L.P., (iii)

debt fair value adjustments, (iv) the foreign exchange impact on

Euro-denominated bonds for which we have entered into currency

swaps and (v) 50% of the outstanding KML preferred equity. Adjusted

Net Debt is Net Debt with the cash component as of December 31,

2018, reduced by the amount of cash distributed to KML’s restricted

voting shareholders as a return of capital on January 3, 2019, and

increased by the net of the gain realized on settlement of net

investment hedges of our foreign current risk with respect to our

share of the KML return of capital on January 3, 2019. We believe

the most comparable measure to Net Debt and Adjusted Net Debt is

debt net of cash and cash equivalents as reconciled in the notes to

the accompanying Preliminary Consolidated Balance Sheets page.

Project EBITDA, as used in this

news release, is calculated for an individual capital project as

earnings before interest expense, taxes, DD&A and general and

administrative expenses attributable to such project, or for joint

venture projects, our percentage share of the foregoing. Management

uses Project EBITDA to evaluate our return on investment for

capital projects before expenses that are generally not

controllable by operating managers in our business segments. We

believe the GAAP measure most directly comparable to Project EBITDA

is project net income.

Our non-GAAP measures described above should not be considered

alternatives to GAAP net income or other GAAP measures and have

important limitations as analytical tools. Our computations of DCF,

Segment EBDA before Certain Items and Adjusted EBITDA may differ

from similarly titled measures used by others. You should not

consider these non-GAAP measures in isolation or as substitutes for

an analysis of our results as reported under GAAP. DCF should not

be used as an alternative to net cash provided by operating

activities computed under GAAP. Management compensates for the

limitations of these non-GAAP measures by reviewing our comparable

GAAP measures, understanding the differences between the measures

and taking this information into account in its analysis and its

decision-making processes.

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities and Exchange Act of 1934.

Generally the words “expects,” “believes,” anticipates,” “plans,”

“will,” “shall,” “estimates,” and similar expressions identify

forward-looking statements, which are generally not historical in

nature. Forward-looking statements are subject to risks and

uncertainties and are based on the beliefs and assumptions of

management, based on information currently available to them.

Although KMI believes that these forward-looking statements are

based on reasonable assumptions, it can give no assurance as to

when or if any such forward-looking statements will materialize nor

their ultimate impact on our operations or financial condition.

Important factors that could cause actual results to differ

materially from those expressed in or implied by these

forward-looking statements include the risks and uncertainties

described in KMI’s reports filed with the Securities and Exchange

Commission (SEC), including its Annual Report on Form 10-K for the

year-ended December 31, 2018 (under the headings “Risk Factors” and

“Information Regarding Forward-Looking Statements” and elsewhere)

and its subsequent reports, which are available through the SEC’s

EDGAR system at www.sec.gov and on our website at

ir.kindermorgan.com. Forward-looking statements speak only as of

the date they were made, and except to the extent required by law,

KMI undertakes no obligation to update any forward-looking

statement because of new information, future events or other

factors. Because of these risks and uncertainties, readers should

not place undue reliance on these forward-looking statements.

Kinder Morgan, Inc.

and Subsidiaries

Preliminary Consolidated Statements of

Income

(Unaudited)

(In millions, except per share

amounts)

Three Months Ended March

31,

2019 2018

Revenues $ 3,429

$ 3,418 Costs, expenses

and other Costs of sales 948 1,019 Operations and maintenance 598

619 Depreciation, depletion and amortization 593 570 General and

administrative 154 173 Taxes, other than income taxes

118 88

2,411

2,469 Operating income

1,018 949 Other income (expense) Earnings from equity

investments 192 220 Amortization of excess cost of equity

investments (21 ) (32 ) Interest, net (460 ) (467 ) Other, net

10 36

Income before income taxes 739 706

Income tax expense (172 )

(164 ) Net income 567 542

Net income attributable to noncontrolling interests

(11 ) (18 )

Net income attributable to Kinder Morgan, Inc. 556 524

Preferred stock dividends —

(39 )

Net income

available to common stockholders $

556 $ 485

Class P Shares Basic and diluted

earnings per common share $ 0.24

$ 0.22 Basic and diluted

weighted average common shares outstanding

2,262 2,207

Declared dividend per common share

$ 0.25 $ 0.20

Adjusted earnings per common

share (1) $ 0.25

$ 0.22

Segment EBDA (2)

% change Natural Gas Pipelines $ 1,203 $ 1,128

7 % Products Pipelines 276 266 4 % Terminals 299 296 1 % CO2 198

199 (1 )% Kinder Morgan Canada (2 )

46 (104 )%

Total Segment

EBDA $ 1,974

$ 1,935 2 %

Notes

(1) Adjusted earnings per common share uses adjusted

earnings and applies the same two-class method used in arriving at

diluted earnings per common share. See the following page,

Preliminary Earnings Contribution by Business Segment, for a

reconciliation of net income available to common stockholders to

adjusted earnings.

(2) For segment reporting purposes,

effective January 1, 2019, certain assets were transferred between

our business segments. As a result, three months ended March 31,

2018 amounts have been reclassified to conform to the current

presentation, which (decreased) increased Segment EBDA for the

following individual business segments: Natural Gas Pipelines $(8)

million, Products Pipelines $7 million, and Terminals $1 million.

Kinder Morgan, Inc.

and Subsidiaries

Preliminary Earnings Contribution by

Business Segment

(Unaudited)

(In millions, except per share

amounts)

Three Months Ended March

31,

2019 2018

% change Segment EBDA before certain items (1)

Natural Gas Pipelines $ 1,201 $ 1,074 12 % Products Pipelines 293

297 (1 )% Terminals 299 297 1 % CO2 189 237 (20 )% Kinder Morgan

Canada — 46

(100 )%

Subtotal

1,982 1,951 2 % DD&A and amortization of excess cost of

equity investments (614 ) (602 ) General and administrative and

corporate charges (1) (2) (158 ) (164 ) Interest, net (1)

(458 ) (472 ) Subtotal

752 713

Book taxes (1) (170 )

(167 ) Certain items Fair value amortization 8

11 Legal and environmental reserves — (37 ) Change in fair market

value of derivative contracts (3) (10 ) (40 ) Refund and reserve

adjustment of taxes, other than income taxes (17 ) 18 Other

6 (3 ) Subtotal

certain items before tax (13 ) (51 ) Book tax certain items (2 ) 3

Impact of 2017 Tax Cuts and Jobs Act —

44 Total certain items

(15 ) (4 ) Net

income attributable to noncontrolling interests before certain

items (11 ) (18 )

Preferred stock dividends —

(39 )

Net income available to common

stockholders $ 556

$ 485 Net

income available to common stockholders $ 556 $ 485 Total certain

items 15 4

Adjusted earnings 571 489 DD&A and amortization of

excess cost of equity investments (4) 708 690 Total book taxes (5)

195 184 Cash taxes (6) (13 ) (13 ) Other items (7) 25 11 Sustaining

capital expenditures (8) (115 ) (114 )

DCF $ 1,371

$ 1,247

Weighted average common shares outstanding for

dividends (9) 2,275 2,218 DCF per common share $ 0.60 $ 0.56

Declared dividend per common share $ 0.25 $ 0.20 Adjusted

EBITDA (10) $ 1,947 $ 1,902 2 %

Notes ($

million)

(1) Excludes certain items:1Q 2019 - Natural Gas

Pipelines $2, Products Pipelines $(17), CO2 $9, Kinder Morgan

Canada $(2), general and administrative and corporate charges $(3),

interest expense $(2), book tax $(2).1Q 2018 - Natural Gas

Pipelines $54, Products Pipelines $(31), Terminals $(1), CO2 $(38),

general and administrative and corporate charges $4, interest

expense $5, book tax $3.

(2) Includes corporate (benefit)

charges:1Q 2019 - $71Q 2018 - $(13)

(3) Gains or losses are

reflected in our DCF when realized.

(4) Includes KMI's share

of equity investees' DD&A, net of the noncontrolling interests'

portion of KML DD&A and consolidating joint venture partners'

share of DD&A:1Q 2019 - $941Q 2018 - $88

(5) Excludes

book tax certain items. Also, includes KMI's share of taxable

equity investees' book taxes, net of the noncontrolling interests'

portion of KML book taxes:1Q 2019 - $251Q 2018 - $17

(6)

Includes KMI's share of taxable equity investees' cash taxes:1Q

2018 - $(10)

(7) Includes non-cash pension expense and

non-cash compensation associated with our restricted stock program.

(8) Includes KMI's share of equity investees' sustaining

capital expenditures (the same equity investees for which DD&A

is added back):1Q 2019 - $(19)1Q 2018 - $(16)

(9) Includes

restricted stock awards that participate in common share dividends.

(10) Net income is reconciled to Adjusted EBITDA as follows,

with any difference due to rounding:

Three

Months Ended

March 31,

2019 2018 Net

income 567 542 Total certain items 15 4 Net income

attributable to noncontrolling interests (11) (3 ) (4 ) DD&A

and amortization of excess cost of equity investments (4) (12) 713

700 Book taxes (5) (12) 197 188 Interest, net (1) 458

472 Adjusted EBITDA $

1,947 $ 1,902

(11)

Excludes KML noncontrolling interests before certain items:1Q 2019

- $91Q 2018 - $14

(12) Includes the noncontrolling

interests' portion of KML before certain items:1Q 2019 - DD&A

$5; Book taxes $21Q 2018 - DD&A $9; Book taxes $4

Volume Highlights

(historical pro forma for acquired and

divested assets)

Three Months Ended March

31,

2019

2018 Natural Gas Pipelines (1)

Transport Volumes (BBtu/d) 36,674 32,124 Sales Volumes (BBtu/d)

2,332 2,491 Gas Gathering Volumes (BBtu/d) 3,301 2,731 NGLs

(MBbl/d) (2) 121 116 Products Pipelines (MBbl/d) (1)

Gasoline (3) 980 978 Diesel Fuel 337 342

Jet Fuel

294 289

Total Refined Product Volumes 1,611 1,609 Crude and Condensate (4)

643 593

Total Delivery Volumes (MBbl/d) 2,254

2,202 Terminals (1) Liquids

Leasable Capacity (MMBbl) 91.9 90.5 Liquids Utilization % 93.9 %

91.4 % Bulk Transload Tonnage (MMtons) 14.7 14.4 CO2 (1)

Sacroc Oil Production - Net 24.43 24.61 Yates Oil Production 7.25

7.73 Katz and Goldsmith Oil Production 4.11 5.20 Tall Cotton Oil

Production 2.61

2.09 Total Oil Production - Net (MBbl/d)

38.40 39.63 NGL Sales

Volumes (MBbl/d) 10.10 10.16 Southwest Colorado Production - Gross

(Bcf/d) 1.31 1.25 Southwest Colorado Production - Net (Bcf/d) 0.61

0.58 Realized Weighted Average Oil Price per Bbl $ 48.67 $ 59.72

Realized Weighted Average NGL Price per Bbl $ 25.98 $ 30.39

Notes

(1) Joint Venture volumes reported at KMI share.

(2) Reflects January 1, 2019 transfer of certain assets and

includes Cochin, Utopia, and Cypress.

(3) Gasoline volumes

include ethanol pipeline volumes.

(4) Reflects January 1,

2019 transfer of certain assets and includes KMCC, Camino Real

Crude, Double Eagle, Hiland Crude Gathering, and Double H.

Kinder Morgan, Inc. and Subsidiaries

Preliminary Consolidated Balance

Sheets

(Unaudited)

(In millions)

March 31, December 31,

2019 2018

ASSETS Cash and cash equivalents $ 221 $ 3,280 Other current

assets 2,041 2,442 Property, plant and equipment, net 37,782 37,897

Investments 7,770 7,481 Goodwill 21,965 21,965 Deferred charges and

other assets 6,513 5,801

TOTAL ASSETS $ 76,292

$ 78,866 LIABILITIES,

REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS' EQUITY

Liabilities Short-term debt $ 2,502 $ 3,388 Other

current liabilities 2,507 4,169 Long-term debt 32,368 33,105

Preferred interest in general partner of KMP 100 100 Debt fair

value adjustments 860 731 Other 2,794

2,176 Total liabilities 41,131

43,669

Redeemable Noncontrolling

Interest 705 666

Shareholders' Equity Other shareholders' equity

34,120 34,008 Accumulated other comprehensive loss

(508 ) (330 ) KMI equity 33,612 33,678 Noncontrolling

interests 844 853 Total

shareholders' equity 34,456

34,531

TOTAL LIABILITIES, REDEEMABLE NONCONTROLLING

INTEREST AND SHAREHOLDERS' EQUITY $

76,292 $ 78,866

Net Debt (1) $ 34,819 $

33,352 Adjusted Net Debt (2) 34,819

34,151 Adjusted EBITDA

Twelve Months Ended

March 31, December 31, Reconciliation of Net

Income to Adjusted EBITDA 2019

2018 Net income $ 1,945 $ 1,919 Total certain items

512 501 Net income attributable to noncontrolling interests (3)

(251 ) (252 ) DD&A and amortization of excess cost of equity

investments (4) 2,795 2,782 Income tax expense before certain items

(5) 736 727 Interest, net before certain items 1,877

1,891

Adjusted EBITDA

$ 7,614 $

7,568 Net Debt to Adjusted EBITDA

4.6 4.4 Adjusted Net Debt to Adjusted EBITDA

4.6 4.5

Notes

(1) Amounts include 50% of KML preferred shares,

which is included in noncontrolling interests, of $215 million.

Amounts exclude: (i) the preferred interest in general partner of

KMP; (ii) debt fair value adjustments; and (iii) the foreign

exchange impact on our Euro denominated debt of $45 million and $76

million as of March 31, 2019 and December 31, 2018, respectively,

as we have entered into swaps to convert that debt to U.S.$.

(2) The December 31, 2018 cash component was (i) reduced by

$890 million, representing the portion of cash KML distributed to

KML restricted voting shareholders on January 3, 2019 as a return

of capital; and (ii) increased by $91 million, representing the

unrecognized gain as of December 31, 2018 on net investment hedges

which hedged our exposure to foreign currency risk associated with

a substantial portion of our share of the proceeds from the sale of

TMPL, TMEP and related assets.

(3) 2019 and 2018 amounts

exclude KML noncontrolling interests before certain items of $52

million and $58 million, respectively.

(4) 2019 and 2018

amounts include KMI's share of certain equity investees' DD&A

of $392 million and $390 million, respectively.

(5) 2019 and

2018 amounts include KMI's share of taxable equity investees' book

taxes before certain items of $88 million and $82 million,

respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190417005711/en/

Dave ConoverMedia Relations(713)

420-6397Newsroom@kindermorgan.com

Investor Relations(800)

348-7320km_ir@kindermorgan.comwww.kindermorgan.com

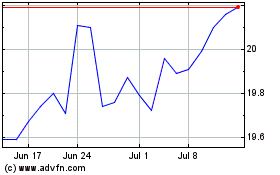

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

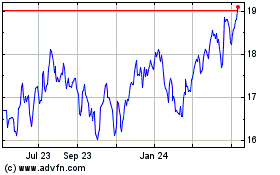

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Apr 2023 to Apr 2024