KeyBank Sells $3.2 Billion Indirect Retail Auto Loan Portfolio

September 10 2021 - 7:13PM

Dow Jones News

By Josh Beckerman

KeyCorp unit KeyBank sold its $3.2 billion indirect retail auto

loan portfolio to a vehicle managed by a unit of Waterfall Asset

Management LLC.

KeyBank will remain the servicer of the auto loans.

Concurrently with the sale, KeyBank bought $2.8 billion of

senior notes from a securitization collateralized by the sold

loans.

In October, KeyCorp said it planned to end origination of

indirect auto loans.

KeyCorp said Friday that it entered an accelerated stock buyback

agreement for up to $585 million, part of its previously disclosed

repurchase program. KeyCorp will initially receive delivery of

about 23.5 million shares on Sept. 14.

The accelerated buyback was aided by capital generated from the

sale of the auto loan portfolio, KeyCorp said, and the company is

"committed to returning capital to our shareholders."

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

September 10, 2021 18:58 ET (22:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

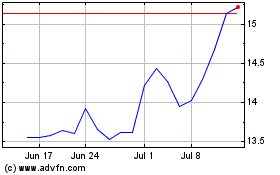

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

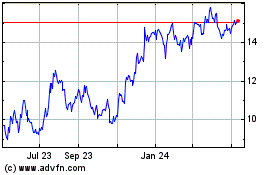

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024