Kellogg's Snacks Help Results, but Cereal Remains a Challenge--Update

October 29 2019 - 12:55PM

Dow Jones News

By Annie Gasparro and Micah Maidenberg

Kellogg Co. is leaning on snacks like Pringles and Cheez-Its for

growth, as its U.S. cereal sales continue to decline.

The maker of Frosted Flakes, Special K and Rice Krispies said

Tuesday that its cereal sales in North America fell 4.8% in the

third quarter on a comparable basis, while snacks sales in the

region rose 5.2%.

Kellogg's shares rose 4.6%, as the company's adjusted profit of

$1.05 a share, excluding currency effects, exceeded forecasts from

analysts.

Long a breakfast staple, cereal has struggled in recent years as

consumers have opted for more protein-heavy meals at the start of

the day and fast-food chains have moved to expand their breakfast

businesses.

"What we haven't done as an industry is respond quickly enough

to some of the trends," Chief Executive Steve Cahillane said on a

conference call.

More marketing investments and production capacity for cereals

over the next couple months will help, he said. Kellogg is also

replacing some underselling and low-margin brands with new ones,

like Pop-Tarts cereal.

Kellogg's salty snacks, including Pringles, indulgent ones like

Rice Krispies Treats, and "wholesome" brands, like Nutri-Grain, are

driving growth. Also contributing are new products such as Pringles

Wavy, Nutri-Grain bites and smaller or single-serving packages

meant for people to eat on the go.

New Cheez-It Snap'd crisps, for instance, have been such a

success that Kellogg is at peak capacity, selling every box it

makes, executives said.

Kellogg's frozen-food brands, including Eggo and MorningStar

Farms, are also gaining traction. Americans' increasing interest in

meat alternatives coupled with new product launches from

MorningStar Farms helped the company gain market share and shelf

space in the latest quarter.

Battle Creek, Mich.-based Kellogg reported third-quarter sales

of $3.37 billion for the quarter, slightly more than expectations

from analysts polled by FactSet but down from $3.47 billion a year

earlier.

The company said its sale of Keebler cookies and other brands, a

deal that was completed in July, weighed on results compared with

last year's third quarter. But that move has allowed Kellogg to

focus more attention and resources on its core U.S. brands,

executives said.

"The heaviest lifting and the biggest, most disruptive actions

are largely behind us," Mr. Cahillane said.

The company reported a profit of $247 million, or 72 cents a

share, compared with $380 million, or $1.09 a share, last year.

Excluding currency fluctuations, mergers and asset sales, global

sales rose 2.4% in the quarter, Kellogg said.

Kellogg's costs of goods sold grew about 3% in the quarter as it

paid more for ingredients, but it raised its prices to help offset

that. Selling, general and administrative expenses fell 6%, aiding

its profit margin.

Write to Annie Gasparro at annie.gasparro@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

October 29, 2019 12:40 ET (16:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

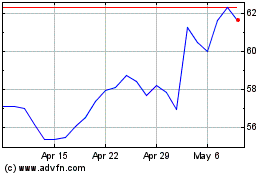

Kellanova (NYSE:K)

Historical Stock Chart

From Mar 2024 to Apr 2024

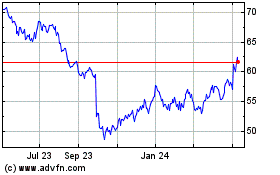

Kellanova (NYSE:K)

Historical Stock Chart

From Apr 2023 to Apr 2024