Current Report Filing (8-k)

June 10 2020 - 4:30PM

Edgar (US Regulatory)

0001395942false12-3100013959422020-06-092020-06-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 9, 2020

KAR Auction Services, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-34568

|

|

20-8744739

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer

Identification No.)

|

11299 N. Illinois Street

Carmel, Indiana 46032

(Address of principal executive offices)

(Zip Code)

(800) 923-3725

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

KAR

|

|

New York Stock Exchange

|

INTRODUCTORY NOTE

On June 10, 2020 (the “Initial Closing Date”), KAR Auction Services, Inc. (NYSE: KAR) (the “Company”), a Delaware corporation, and Ignition Parent LP (“Apax”), a Delaware limited partnership and affiliate fund of Apax Partners, L.P., completed the previously announced initial issuance and sale of 500,000 shares of the Company’s Series A Convertible Preferred Stock, par value $0.01 per share (the “Series A Preferred Stock”), to an affiliate of Apax for an aggregate purchase price of $500 million (the “Initial Apax Closing”), pursuant to the terms of the Investment Agreement, dated as of May 26, 2020 (the “Apax Investment Agreement”), by and between the Company and Apax.

Concurrently with the Initial Apax Closing, on June 10, 2020, the Company completed the previously announced initial issuance and sale of 20,000 shares of Series A Preferred Stock to an affiliate of Periphas Capital GP, LLC (“Periphas” and together with Apax, the “Investors”) for an aggregate purchase price of $20 million, pursuant to the terms of the Investment Agreement, dated as of May 26, 2020 (the “Periphas Investment Agreement” and together with the Apax Investment Agreement, the “Investment Agreements”), by and between the Company and Periphas.

As previously disclosed, the Investment Agreements also contemplate a second issuance of shares of Series A Preferred Stock in an amount up to $30 million, at a price per share of $1,000 plus the amount of dividends accrued on a share of Series A Preferred Stock from and including the Initial Closing Date through to but excluding the Second Closing Date (as defined herein). With respect to the second issuance, Periphas will have the option, in its sole discretion, to purchase up to 30,000 shares of Series A Preferred Stock by delivering to the Company a notice of Periphas’ intention to exercise such option no later than June 17, 2020. The Company will have the option, in its sole discretion, to sell to Apax shares of Series A Preferred Stock in an amount up to $30 million, less the amount (if any) invested by Periphas on the Second Closing Date by delivering to Apax a notice of the Company’s intention to exercise such option no later than June 17, 2020. The second closing of the Series A Preferred Stock is conditioned upon the satisfaction or waiver of certain customary closing conditions and will occur no earlier than June 29, 2020, unless otherwise agreed to by the Investors, as applicable, but in no event after June 30, 2020 (the date on which the second closing occurs, the “Second Closing Date” and together with the Initial Closing Date, the “Closing Dates”).

|

|

|

|

|

|

|

|

Item 1.01

|

Entry Into a Material Definitive Agreement.

|

On the Initial Closing Date, in connection with the Initial Apax Closing, the Company and an affiliate of Apax entered into a Registration Rights Agreement (the “Apax Registration Rights Agreement”), pursuant to which the Company has agreed to provide to such affiliate and each other holder party thereto from time to time (each, a “Holder”), following a one-year lock-up period (the “lock-up period”), certain customary registration rights with respect to each Holder’s shares of Series A Preferred Stock and the Company’s Common Stock, par value $0.01 per share (the “Common Stock”), issued in connection with any future conversion of shares of Series A Preferred Stock (together, the “Registrable Securities”) until such Holder’s Registrable Securities have been sold (subject to certain exceptions), or in the case of any shares of Common Stock held by such Holder, all shares of Common Stock held by such Holder, on an as-converted basis, constitute less than 1% of the total number of outstanding shares of Common Stock and may be sold in a single day pursuant to Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”).

Under the Apax Registration Rights Agreement, the Company is required, no later than the expiration of the lock-up period, to file a shelf registration statement covering the resale of all Registrable Securities of each Holder, and to use reasonable best efforts to maintain the effectiveness of such shelf registration statement. The Holders have the right, by delivering written notice to the Company, to request up to three underwritten take-downs, equal to at least $50 million per request, off of the shelf registration statement during any 365-day period, subject to certain cut-back priorities and certain other exceptions (each such written notice, a “Take-Down Notice”) and the Holders have the right to request unlimited non-underwritten shelf take-downs. Additionally, the Apax Registration Rights Agreement grants each Holder customary demand registration rights for a minimum number of Registrable Securities equal to at least $50 million per demand, exercisable by delivering written notice to the Company (each such written notice, a “Demand Notice” and, together with a Take-Down Notice, a “Notice”), which includes underwritten offerings and is subject to certain cut-back priorities and certain other restrictions, including a cool-off period of at least 60 days after effectiveness of any previous demand registration. Holders are entitled to deliver a maximum of two Notices involving substantial marketing efforts in any 365-day period, and a maximum of four Notices involving substantial marketing efforts in the aggregate.

The Apax Registration Rights Agreement also grants each Holder customary “piggyback” registration rights. If, following the lock-up period, the Company proposes to register any shares of Common Stock, whether or not for its own account, each Holder will be entitled, subject to certain exceptions, to include such Holder’s Registrable Securities in the registration, subject to certain cut-back priorities.

The Apax Registration Rights Agreement permits the Company to postpone the filing or use of a registration statement for a certain period (such period, a “Postponement Period”) if the filing or continued use of the registration statement would, in the good faith judgment of the Board, (i) require the Company to disclose material non-public information that, in the Company’s good faith judgment, the Company has a bona fide business purpose for not disclosing publicly or (ii) materially interfere with any material proposed acquisition, disposition, financing, reorganization, recapitalization or similar transaction involving the Company or any of its subsidiaries then under consideration. There will not be more than one Postponement Period in any 180-day period, and no single Postponement Period will exceed 60 days.

The foregoing description of the Apax Registration Rights Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Apax Registration Rights Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

|

|

|

|

|

|

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

As described in the section above entitled “Introductory Note,” pursuant to the terms of the Investment Agreements, the Company has agreed to issue and sell shares of the Series A Preferred Stock to the Investors. These issuances and sales are exempt from registration pursuant to Section 4(a)(2) of the Securities Act. Each Investor has represented to the Company in the applicable Investment Agreement that it is an “accredited investor” as defined in Rule 501 of the Securities Act and that the Series A Preferred Stock is being acquired for investment purposes and not with a view to, or for sale in connection with, any distribution thereof, and appropriate legends will be affixed to any certificates evidencing shares of the Series A Preferred Stock or shares of the Common Stock issued in connection with any future conversion of the Series A Preferred Stock.

The information contained in the section above entitled “Introductory Note” is incorporated herein by reference and Item 5.03 with respect to the Certificate of Designations (as defined herein) is incorporated herein by reference.

|

|

|

|

|

|

|

|

Item 3.03

|

Material Modification to Rights of Security Holders.

|

The information contained in the section above entitled “Introductory Note” with respect to the Investment Agreements, Item 1.01 with respect to the Apax Registration Rights Agreement and Item 5.03 with respect to the Certificate of Designations is incorporated herein by reference.

|

|

|

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers.

|

Pursuant to the Apax Investment Agreement, on June 10, 2020, the Board of Directors of the Company (the “Board”) increased the size of the Board to ten (10) directors and appointed Roy Mackenzie, an individual designated by Apax under the terms of the Apax Investment Agreement, to the Board, effective immediately following Closing. Mr. Mackenzie will serve for a term expiring at the 2021 annual meeting of the Company’s stockholders and until his successor is duly elected and qualified.

Mr. Mackenzie has elected to waive his rights to the compensation arrangements for non-employee directors as described in the Company’s proxy statement for the 2020 annual meeting of the Company’s stockholders filed with the Securities and Exchange Commission.

There are no transactions in which Mr. Mackenzie has an interest requiring disclosure under Item 404(a) of Regulation S-K.

|

|

|

|

|

|

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws.

|

Certificate of Designations Designating the Series A Preferred Stock

On June 9, 2020, the Company filed with the Secretary of State of the State of Delaware a Certificate of Designations designating the Series A Preferred Stock (the “Certificate of Designations”) and establishing the powers, designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations and restrictions of the shares of Series A Preferred Stock. The Certificate of Designations became effective upon filing.

The Series A Preferred Stock ranks senior to the Common Stock with respect to dividend rights and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company. The Series A Preferred Stock has a liquidation preference of $1,000 per share. The holders of the Series A Preferred Stock are entitled to a cumulative dividend at the rate of 7% per annum, payable quarterly in arrears, as set forth in the Certificate of Designations. Dividends are payable in kind through the issuance of additional shares of Series A Preferred Stock for the first eight dividend payments following the initial issuance of Series A Preferred Stock, and thereafter, in cash or in kind, or in any combination of both, at the option of the Company.

The Series A Preferred Stock will be convertible at the option of the holders thereof at any time after the one-year anniversary of the Initial Closing Date into shares of Common Stock at an initial conversion price of $17.75 per share of Series A Preferred Stock and an initial conversion rate of 56.3380 shares of Common Stock per share of Series A Preferred Stock, subject to certain anti-dilution adjustments. At any time after the three-year anniversary of the Initial Closing Date, if the closing price of the Common Stock exceeds $31.0625 per share, as may be adjusted pursuant to the Certificate of Designations, for at least 20 trading days in any period of 30 consecutive trading days, all or any portion of the Series A Preferred Stock may be converted into the relevant number of shares of Common Stock at the option of the Company.

Following the expiration or early termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, the holders of the Series A Preferred Stock will be entitled to vote with the holders of the Common Stock as a single class. The holders of the Series A Preferred Stock will be entitled to vote as a separate class with respect to, among other things, any amendment to the Company’s organizational documents that have an adverse effect on the Series A Preferred Stock, authorization or issuance by the Company of securities that are senior or equal in priority to the Series A Preferred Stock, increase or decrease in the number of authorized shares of Series A Preferred Stock and issuance of shares of the Series A Preferred Stock after the Initial Closing Date, other than the issuance of shares on the Second Closing Date, and the issuance of shares as dividends in kind with respect to shares of the Series A Preferred Stock issued on any of the Closing Dates or with respect to such shares issued as dividends in kind.

At any time after the six-year anniversary of the Initial Closing Date, the Company may redeem some or all of the Series A Preferred Stock for a per share amount in cash equal to: (i) the sum of (x) the liquidation preference thereof, plus (y) all accrued and unpaid dividends, multiplied by (ii) (A) 105% if the redemption occurs at any time after the six-year anniversary of the Initial Closing Date and prior to the seven-year anniversary of the Initial Closing Date or (B) 100% if the redemption occurs at any time after the seven-year anniversary of the Initial Closing Date.

Upon certain change of control events involving the Company, and subject to certain limitations set forth in the Certificate of Designations, each holder of the Series A Preferred Stock will either (i) receive such number of shares of Common Stock into which such holder is entitled to convert all or a portion of such holder’s shares of Series A Preferred Stock at the then-current conversion price, (ii) receive, in respect of all or a portion of such holder’s shares of Series A Preferred Stock, the greater of (x) the amount per share of Series A Preferred Stock that such holder would have received had such holder, immediately prior to such change of control, converted such share of Series A Preferred Stock into Common Stock and (y) a purchase price per share of Series A Preferred Stock, payable in cash, equal to the product of (A) 105% multiplied by (B) the sum of the liquidation preference and accrued dividends with respect to such share of Series A Preferred Stock, or (iii) unless the consideration in such change of control event is payable entirely in cash, retain all or a portion of such holder’s shares of Series A Preferred Stock.

The foregoing description of the Certificate of Designations does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Certificate of Designations, which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Forward-Looking Statements

Certain statements contained in this report include "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and which are subject to certain risks, trends and uncertainties. In particular, statements made that are not historical facts may be forward-looking statements. Words such as “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar expressions identify forward-looking statements. Such statements are based on management's current expectations, are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include those uncertainties regarding the impact of the COVID-19 virus on our business and the economy generally, and those other matters disclosed in the Company’s Securities and Exchange Commission filings. The Company does not undertake any obligation to update any forward-looking statements.

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT NO.

|

|

DESCRIPTION OF EXHIBIT

|

|

3.1

|

|

|

|

|

|

|

|

10.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

KAR Auction Services, Inc.

Date: June 10, 2020 By: /s/ Eric M. Loughmiller

Eric M. Loughmiller

Executive Vice President and Chief Financial Officer

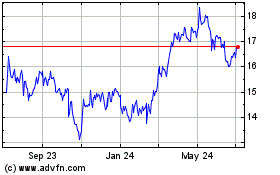

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

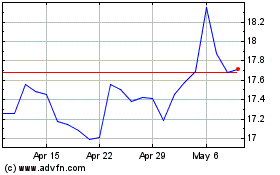

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Apr 2023 to Apr 2024