Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

October 07 2022 - 4:55PM

Edgar (US Regulatory)

Index supplement to underlying supplement no. 7-I dated July 12, 2021 and the prospectus and prospectus supplement, each dated April

8, 2020. Registration Statement Nos. 333-236659 and 333-236659-01 Dated October 6, 2022 Rule 424(b)(3) OCTOBER 2022 MerQube US Tech+ Vol

Advantage Index Hypothetical and Actual Historical Monthly and Annual Returns ƒÞ Backtested ƒÞ Actual Jan Feb Mar

Apr May Jun Jul Aug Sep Oct Nov Dec Year 2005 -5.28% -2.09% -3.95% -9.91% 15.21% -7.99% 15.45% -4.17% 0.96% -5.50% 10.42% -4.38% -5.19%

2006 6.01% -5.51% 2.13% -1.60% -15.16% -2.20% -8.41% 6.12% 6.63% 7.89% 4.93% -6.03% -7.92% 2007 1.71% -5.93% -1.92% 9.21% 5.14% -1.36%

-1.60% 3.62% 6.61% 10.34% -10.67% -2.15% 11.42% 2008 -16.76% -7.12% 1.14% 8.31% 6.12% -13.69% 0.06% -0.01% -15.53% -12.66% -8.22% 0.46%

-47.20% 2009 -3.03% -4.48% 7.15% 10.66% 2.83% 3.05% 10.44% 1.31% 7.10% -6.12% 7.50% 8.00% 51.98% 2010 -10.73% 5.64% 14.97% 2.94% -14.37%

-9.45% 6.68% -8.87% 19.84% 10.28% -2.14% 7.44% 16.92% 2011 5.09% 5.18% -2.79% 5.15% -3.28% -6.73% 1.09% -7.02% -5.90% 7.48% -4.30% -1.61%

-8.77% 2012 14.00% 11.94% 10.30% -3.54% -14.85% 4.21% 1.25% 10.76% 0.62% -11.99% 1.98% -2.99% 18.39% 2013 3.11% 1.00% 5.85% 1.32% 8.11%

-6.53% 15.10% -2.51% 9.98% 10.50% 8.81% 5.83% 77.22% 2014 -5.51% 10.97% -7.35% -1.98% 10.71% 8.24% 2.88% 11.56% -3.03% 0.65% 12.36% -10.32%

28.79% 2015 -7.51% 14.58% -9.79% 0.69% 5.49% -5.73% 5.72% -17.96% -4.47% 21.17% -2.96% -5.50% -11.86% 2016 -13.93% -3.87% 12.09% -7.39%

10.28% -8.77% 17.90% 2.45% 1.59% -4.92% -1.96% -1.07% -2.22% 2017 11.95% 15.25% 4.16% 2.96% 12.10% -7.52% 9.42% 4.32% -2.99% 12.47% 5.13%

-1.64% 84.72% 2018 22.65% -8.29% -11.95% -0.65% 9.50% 2.14% 4.06% 12.54% -2.07% -15.19% -2.12% -11.61% -7.39% 2019 11.79% 4.92% 5.24%

13.01% -16.43% 12.24% 1.90% -5.97% -0.45% 7.94% 10.26% 9.22% 62.25% 2020 7.64% -9.33% -4.28% 12.28% 5.82% 4.77% 8.32% 15.09% -6.33% -4.30%

9.26% 6.26% 50.88% 2021 -1.19% -3.04% 1.32% 8.06% -3.00% 12.03% 4.99% 8.08% -11.79% 15.93% 2.71% -1.49% 33.83% 2022 -15.70% -5.11% 4.56%

-16.54% -1.99% -11.35% 13.36% -8.01% -11.92% -44.30% Please refer to the ¡§Selected Risks¡¨ and ¡§Disclaimer¡¨

on the following page. Historical performance measures for the Index represent hypothetical backtested performance from January 7, 2005

through June 21, 2021 and the actual performance of the Index from June 22, 2021 through September 30, 2022. Please see ¡§Use

of hypothetical backtested returns¡¨ at the end of this presentation for further information related to backtesting including

a discussion of certain limitation of backtesting and simulated returns. The hypothetical backtested and historical levels presented herein

have not been verified by J.P. Morgan, and hypothetical historical levels have inherent limitations. PAST PERFORMANCE AND BACKTESTED PERFORMANCE

ARE NOT INDICATIVE OF FUTURE RESULTS. Investing in the notes linked to the Index involves a number of risks. See ¡§Selected

Risks¡¨ on page 2 of this document, ¡§Risk Factors¡¨ in the prospectus supplement and the relevant product

supplement and underlying supplement and ¡§Selected Risk Considerations¡¨ in the relevant pricing supplement. Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the

accuracy or the adequacy of this document or the accompanying product supplement, underlying supplement, prospectus supplement or prospectus.

Any representation to the contrary is a criminal offense. The notes are not bank deposits, are not insured by the Federal Deposit Insurance

Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

OCTOBER 2022 | MerQube US Tech+ Vol Advantage Index Selected Risks Our affiliate, J.P. Morgan Securities LLC (“JPMS”),

coordinated with the Index Sponsor in the development of the Index. The level of the Index will include the deduction of a fee of 6.0%

per annum. The Index may not approximate its target volatility. The Index is subject to risks associated with the use of significant leverage.

The Index may be significantly uninvested. The Index may be adversely affected if later futures contracts have higher prices than an expiring

futures contract included in the Index. The Index is an “excess return” index and not a “total return” index because

it does not reflect interest that could be earned on funds notionally committed to the trading of futures contracts. The Index, which

was established on June 22, 2021, has a limited operating history and may perform in unanticipated ways. The Index is subject to significant

risks associated with futures contracts, including volatility. An investment linked to the Index will be subject to risks associated with

non-U.S. securities. Concentration risks associated with the Index may adversely affect the value of investments linked to the Index.

Suspension or disruptions of market trading in the futures contracts included in the Index may adversely affect the value of investments

linked to the Index. The official settlement price and intraday trading prices of the relevant futures contracts included in the Index

may not be readily available. Changes in the margin requirements for the underlying futures contracts included in the Index may adversely

affect the value of investments linked to the Index. The Index may not be successful or outperform any alternative strategy that may be

employed of the Constituent. The risks identified above are not exhaustive. You should also review carefully the related “Risk Factors”

section in the prospectus supplement and the relevant product supplement and underlying supplement and the “Selected Risk Considerations”

in the relevant pricing supplement. Disclaimer Important Information The information contained in this document is for discussion purposes

only. Any information relating to performance contained in these materials is illustrative and no assurance is given that any indicative

returns, performance or results, whether historical or hypothetical, will be achieved. All information herein is subject to change without

notice, however, J.P. Morgan undertakes no duty to update this information. In the event of any inconsistency between the information

presented herein and any offering document, the offering document shall govern. Use of hypothetical backtested returns Any backtested

historical performance and weighting information included herein is hypothetical. The constituent may not have traded in the manner shown

in the hypothetical backtest of the Index included herein, and no representation is being made that the Index will achieve similar performance.

The hypothetical historical levels presented herein have not been verified by an independent third party, and such hypothetical historical

levels have inherent limitations. There are frequently significant differences between hypothetical backtested performance and actual

subsequent performance. The results obtained from backtesting information should not be considered indicative of the actual results that

might be obtained from an investment in notes referencing the Index. J.P. Morgan provides no assurance or guarantee that notes linked

to the Index will operate or would have operated in the past in a manner consistent with these materials. The hypothetical historical

levels presented herein have not been verified by an independent third party, and such hypothetical historical levels have inherent limitations.

Alternative simulations, techniques, modeling or assumptions might produce significantly different results and prove to be more appropriate.

Actual results will vary, perhaps materially, from the hypothetical backtested returns and allocations presented in this document. HISTORICAL

AND BACKTESTED PERFORMANCE AND ALLOCATIONS ARE NOT INDICATIVE OF FUTURE RESULTS. Investment suitability must be determined individually

for each investor, and investments linked to the Index may not be suitable for all investors. This material is not a product of J.P. Morgan

Research Departments. Neither MerQube, Inc. nor any of its affiliates (collectively, “MerQube”) is the issuer or producer

of any investment linked to the Index referenced herein and MerQube has no duties, responsibilities, or obligations to investors in such

investment. The Index is a product of MerQube and has been licensed for use by JPMS (“Licensee”) and its affiliates. Such

index is calculated using, among other things, market data or other information (“Input Data”) from one or more sources (each

a “Data Provider”). MerQube® is a registered trademark of MerQube, Inc. These trademarks have been licensed for certain

purposes by Licensee, including use by Licensee’s affiliate in its capacity as the issuer of investments linked to the Index. Such

investments are not sponsored, endorsed, sold or promoted by MerQube, any Data Provider, or any other third party, and none of such parties

make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions,

or interruptions of the Input Data, Index or any associated data. Copyright © 2022 JPMorgan Chase & Co. All rights reserved.

For additional regulatory disclosures, please consult: www.jpmorgan.com/disclosures. Information contained on this website is not incorporated

by reference in, and should not be considered part of, this document. This monthly update document replaces and supersedes all prior written

materials of this type previously provided with respect to the Index.

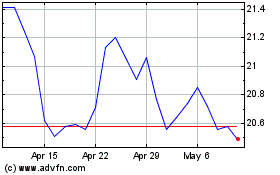

JP Morgan Chase (NYSE:JPM-L)

Historical Stock Chart

From Mar 2024 to Apr 2024

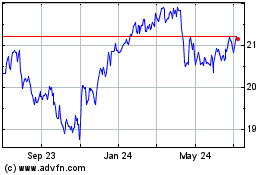

JP Morgan Chase (NYSE:JPM-L)

Historical Stock Chart

From Apr 2023 to Apr 2024