Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

October 07 2022 - 4:54PM

Edgar (US Regulatory)

Index supplement to the prospectus dated April 8, 2020, the prospectus supplement dated April 8, 2020, the product supplement no. 3-II

dated November 4, 2020 and the underlying supplement no. 4-II dated November 4, 2020. Registration Statement Nos. 333-236659 and 333-236659-01

Dated October 6, 2022 Rule 424(b)(3) OCTOBER 2022 J.P. Morgan Mojave Index Hypothetical and Actual Historical Monthly and Annual Returns

ƒÞ Backtested using proxies ƒÞ Backtested ƒÞ Actual Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year

2004 0.44% 0.10% 1.47% 2.19% 1.06% 2.33% 1.56% 9.50% 2005 0.25% 1.14% -1.51% 1.05% 1.77% 1.32% -0.44% 1.64% -0.45% -3.42% 0.45% 0.45%

2.14% 2006 1.90% -1.27% -0.13% 0.03% -2.20% -0.37% -0.41% 0.25% 0.63% 1.35% 1.81% -0.87% 0.63% 2007 0.91% -0.65% -0.30% 1.10% 0.72% -1.97%

-1.38% 0.65% 1.91% 1.09% 1.14% 0.09% 3.29% 2008 -1.68% -0.18% -0.12% 0.95% 0.31% -1.27% -2.50% 0.21% -4.86% -1.30% 3.12% 2.51% -4.96%

2009 -2.18% -1.92% 1.42% 0.45% 2.14% 1.53% 2.58% 0.44% 2.16% -0.86% 2.49% 0.63% 9.07% 2010 -1.24% 1.24% 2.13% 0.68% -2.70% 2.40% 1.87%

2.40% 1.51% 0.72% -0.70% -0.31% 8.16% 2011 -0.02% 1.17% 0.76% 2.19% -0.01% -0.90% 2.54% 0.53% 0.11% 1.46% -0.55% 1.69% 9.26% 2012 0.77%

1.76% 0.95% 1.45% -1.82% 1.46% 2.33% 0.38% 0.65% -0.92% 0.75% -0.44% 7.47% 2013 1.45% 1.09% 2.36% 1.90% -2.00% -1.53% 0.34% -1.52% 1.41%

2.02% 1.02% 1.07% 7.74% 2014 -0.54% 2.63% -0.84% 0.38% 2.64% 0.92% -0.81% 3.04% -1.54% 1.32% 2.00% 0.21% 9.70% 2015 2.93% 0.08% -0.41%

-0.84% -0.20% -1.47% 1.18% -3.49% -0.06% 1.48% -0.02% -0.16% -1.11% 2016 0.26% 0.45% 1.88% 0.01% 0.76% 3.30% 1.51% -0.37% -0.54% -2.00%

-2.71% 0.35% 2.77% 2017 0.72% 1.93% 1.08% 1.78% 2.68% 0.16% 1.33% 1.15% 0.91% 2.74% 1.48% 0.40% 17.61% 2018 3.29% -3.06% -0.71% -0.44%

0.54% -0.31% 0.17% 2.18% -0.47% -4.86% 0.17% -0.77% -4.43% 2019 1.80% 0.27% 1.69% 0.51% 0.52% 3.85% -0.09% 3.34% -1.52% 0.05% 0.28% 0.32%

11.45% 2020 2.68% -1.93% -2.68% 0.33% 0.24% 0.23% 0.75% 0.13% -0.37% -1.15% 3.89% 1.31% 3.28% 2021 -0.73% -1.48% 0.13% 1.12% 0.17% 0.70%

0.86% 0.91% -1.93% 1.21% -0.55% 0.09% 0.46% 2022 -2.73% -0.64% -1.65% -2.55% 0.69% -2.89% 2.07% -2.11% -2.84% -12.08% Please refer to

the ¡§Selected Risks¡¨ and ¡§Disclaimer¡¨ on the following page. Historical performance measures

for the J.P. Morgan Mojave Index (the ¡§Index¡¨) represent hypothetical backtested performance using alternative

performance for some constituents of the Index (the ¡§Constituents¡¨) from June 2, 2004 through September 1, 2015,

hypothetical backtested performance using the actual performance of each Constituent from September 2, 2015 through January 24, 2020,

and actual performance from January 27, 2020 through September 30, 2022. Please see ¡§Use of hypothetical backtested returns¡¨

and ¡§Use of alternative performance¡¨ at the end of this presentation for additional information related to backtesting

and the use of alternative performance. Except as noted above and in the sections entitled ¡§Use of alternative performance¡¨

and ¡§Use of hypothetical backtested returns¡¨ at the end of this document, the hypothetical monthly and annual returns

set forth above were determined using the methodology currently used to calculate the Index. PAST PERFORMANCE AND BACKTESTED PERFORMANCE

ARE NOT INDICATIVE OF FUTURE RESULTS. Investing in the notes linked to the Index involves a number of risks. See ¡§Selected

Risks¡¨ on page 2 of this document, ¡§Risk Factors¡¨ in the relevant product supplement and underlying

supplement and ¡§Selected Risk Considerations¡¨ in the relevant pricing supplement. Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of

this document or the accompanying product supplement, underlying supplement, prospectus supplement or prospectus. Any representation to

the contrary is a criminal offense. The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any

other governmental agency and are not obligations of, or guaranteed by, a bank.

OCTOBER 2022 | J.P. Morgan Mojave Index Selected Risks Risk relating to the Index Our affiliate, J.P. Morgan Securities LLC (“JPMS”),

is the Index Sponsor for the Index and the Bond Constituent, and may adjust the Index and the Bond Constituent in ways that affects their

level. The policies and judgments for which JPMS is responsible could have an impact, positive or negative, on the level of the Index

and the Bond Constituent and the value of your investment. JPMS is under no obligation to consider your interest as an investor with returns

linked to the Index. The level of the Index is calculated on an excess return basis (net of a notional financing cost) and reflects the

daily deduction of a fee of 0.50% per annum. The Index may not be successful, may not outperform any alternative strategy and may not

approximate its target volatility of 5%. Likewise, the Equity Constituent may not be successful; and the Bond Constituent may not be successful,

may not outperform any alternative strategy and may not maintain volatility below its historical volatility threshold of 5%. The investment

strategy used to construct the Index involves daily adjustments to the exposures to the Constituents, which may adversely impact performance.

The exposure of the Index to the Bond Constituent may be greater, perhaps significantly greater, than its exposure to the Equity Constituent.

The Index will be partially uninvested when every unlevered long-only portfolio of the Constituents whose weights sum to 100% have volatility

above the target volatility. Any uninvested portion will earn no return. Changes in the values of the Constituents may offset each other.

There are risks associated with correlation between the Constituents. If the performances of the Constituents become highly correlated

during periods of negative performance, Index performance may be adversely impacted. Each Constituent composing the Index may be replaced

by a substitute constituent upon the occurrence of certain extraordinary events. The securities of our parent company, JPMorgan Chase

& Co., may be held by the Equity Constituent and are held by several of the ETFs included in the Bond Constituent. Other key risks

The Index was established on January 27, 2020 and the Bond Constituent was established on July 13, 2017, and each has a limited operating

history. The Index comprises notional assets and liabilities. There is no actual portfolio of assets to which any person is entitled or

in which any person has any ownership interest. The Index should not be compared to any other index or strategy sponsored by any of our

affiliates and cannot necessarily be considered a revised, enhanced or modified version of any other J.P. Morgan index. There are risks

associated with the Constituents’ momentum-based investment strategy. If market conditions do not represent a continuation of prior

observed trends, Index performance may be adversely impacted. The performance of an ETF, particularly during periods of market volatility,

may not correlate with the performance of its reference index. The notional financing cost will depend on SOFR—SOFR has a limited

history and its future performance cannot be predicted based on historical performance. SOFR may be more volatile than other benchmark

or market interest rates. The Index is subject to significant risks associated with fixed-income securities (including interest rate-related

risks and credit risk), high-yield and investment-grade fixed-income securities (including credit risk), floating rate notes, mortgage-backed

securities, preferred stock, hybrid securities, U.S. treasury inflation-protected securities and non-U.S. securities markets, including

emerging markets. Investments linked to the index may be subject to the credit risk of JPMorgan Chase Bank, N.A. The risks identified

above are not exhaustive. You should also review carefully the related “Risk Factors” section in the prospectus supplement

and the relevant product supplement and underlying supplement and the “Selected Risk Considerations” in the relevant pricing

supplement. Disclaimer Important Information The information contained in this document is for discussion purposes only. Any information

relating to performance contained in these materials is illustrative and no assurance is given that any indicative returns, performance

or results, whether historical or hypothetical, will be achieved. All information herein is subject to change without notice, however,

J.P. Morgan undertakes no duty to update this information. In the event of any inconsistency between the information presented herein

and any offering documents, the offering documents shall govern. Use of hypothetical backtested returns Any backtested historical performance

information included herein is hypothetical. The constituents and proxy constituents may not have traded together in the manner shown

in the hypothetical backtest of the Index included herein, and no representation is being made that the Index will achieve similar performance.

There are frequently significant differences between hypothetical backtested performance and actual subsequent performance. The use of

alternative “proxy” information may create additional differences between hypothetical backtested and actual performance and

allocations. The results obtained from backtesting information should not be considered indicative of the actual results that might be

obtained from an investment or participation in a financial instrument or transaction referencing the Index. J.P. Morgan provides no assurance

or guarantee that investments linked to the Index will operate or would have operated in the past in a manner consistent with these materials.

The hypothetical historical levels presented herein have not been verified by an independent third party, and such hypothetical historical

levels have inherent limitations. Alternative simulations, techniques, modeling or assumptions might produce significantly different results

and prove to be more appropriate. Actual results will vary, perhaps materially, from the hypothetical backtested returns and allocations

presented in this document. Each Constituent is subject to a notional financing cost calculated based on the overnight SOFR rate plus

fixed spreads. Prior to January 3, 2022, the notional financing cost was calculated based on 2M and 3M USD LIBOR rates. HISTORICAL AND

BACKTESTED PERFORMANCE AND ALLOCATIONS ARE NOT INDICATIVE OF FUTURE RESULTS. Use of alternative performance The information provided herein

uses “backtesting” and considers other hypothetical circumstances to estimate how the Index may have performed and how Portfolio

Constituents may have been allocated prior to the actual existence of the Index. For the Equity Constituent, prior to 9/2/15 (the first

date on which it satisfied a minimum liquidity standard), in lieu of actual performance, the backtesting uses alternative “proxy”

performance derived from the associated reference index, after deduction of a 0.15% p.a. hypothetical fund fee equal to its expense ratio

as of the Index’s inception date. Additionally, the Bond Constituent’s hypothetical backtested performance prior to 6/25/14

relies on alternative “proxy” performance information for some of its underlying exchange-traded funds (“ETFs”),

identified (along with their tickers) on p. 5. Prior to each such underlying ETFs’ launch and satisfaction of a minimum liquidity

standard, the backtesting uses (in lieu of actual ETF performance) alternative performance derived from a related index (for each of the

U.S. Treasury bond ETFs, the reference index tracked by that ETF at the inception of that ETF and, for each of the remaining relevant

ETFs, the reference index tracked by that ETF as of the Bond Constituent’s live date), after deduction of hypothetical fund expenses

(in each case, as specified in the accompanying parenthetical) equal to that ETF’s expense ratio as of the Bond Constituent’s

inception date, as follows: the Barclays U.S. 7-10 Year Treasury Bond Index was used as a proxy for IEF through 4/23/04 (-0.15% p.a.);

the Barclays U.S. 20+ Year Treasury Bond Index was used as a proxy for TLT through 4/16/04 (-0.15% p.a.); the Bloomberg Barclays US 1-3

Year Credit Bond Index was used as a proxy for IGSB through 1/13/09 (-0.2% p.a.); the Bloomberg Barclays US Intermediate Credit Bond Index

was used as a proxy for IGIB through 4/6/09 (-0.2% p.a.); the Bloomberg Barclays US Long Credit Bond Index was used as a proxy for IGLBthrough

6/25/14 (-0.2% p.a.); the Bloomberg Barclays US Mortgage Backed Securities (MBS) Index was used as a proxy for MBB through 9/11/08 (-0.29%

p.a.); the Bloomberg Barclays US Treasury Inflation Protected Securities (TIPS) Index (Series-L) was used as a proxy for TIP through 5/27/04

(-0.2% p.a.); the J.P. Morgan EMBISM Global Core Index was used as a proxy for EMB through 11/17/09 (-0.4% p.a.); the Markit iBoxx®

USD Liquid High Yield Index was used as a proxy for HYG through 5/23/08 (-0.5% p.a.); the Bloomberg Barclays US Floating Rate Note <

5 Years Index was used as a proxy for FLOT through 1/15/13 (-0.2% p.a.); and the S&P U.S. Preferred Stock Index was used as a proxy

for PFF through 10/20/08 (-0.47% p.a.). Investment suitability must be determined individually for each investor, and investments linked

to the Index may not be suitable for all investors. This material is not a product of J.P. Morgan Research Departments. Copyright ©

2022 JPMorgan Chase & Co. All rights reserved. For additional regulatory disclosures, please consult: www.jpmorgan.com/disclosures.

Information contained on this website is not incorporated by reference in, and should not be considered part of, this document. This monthly

update document replaces and supersedes all prior written materials of this type previously provided with respect to the Index.

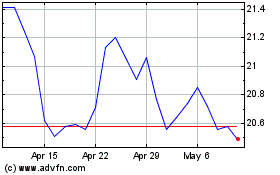

JP Morgan Chase (NYSE:JPM-L)

Historical Stock Chart

From Mar 2024 to Apr 2024

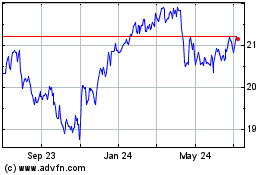

JP Morgan Chase (NYSE:JPM-L)

Historical Stock Chart

From Apr 2023 to Apr 2024