Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 16 2023 - 3:13PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

Filed Pursuant to Rule 433

Registration Statement Nos.

333-269534 and

333-269534-01

dated February 2, 2023 and

Preliminary Prospectus Supplement

dated May 16, 2023 |

Johnson Controls International plc

Tyco Fire & Security Finance S.C.A.

€800,000,000 4.250% Senior Notes due 2035

Pricing Term Sheet

May 16, 2023

|

|

|

| Issuers: |

|

Johnson Controls International plc Tyco

Fire & Security Finance S.C.A. |

|

|

| Trade Date: |

|

May 16, 2023 |

|

|

| Settlement Date**: |

|

May 23, 2023 (T+5) |

|

|

| Joint Book-Running Managers: |

|

Barclays Bank PLC Citigroup Global Markets

Limited Deutsche Bank Aktiengesellschaft Standard Chartered

Bank BofA Securities Europe SA ING Bank N.V., Belgian

Branch J. P. Morgan Securities plc Morgan Stanley &

Co. International plc The Toronto-Dominion Bank |

|

|

| Co-Managers: |

|

Banco Bilbao Vizcaya Argentaria, S.A.

Crédit Agricole Corporate and Investment Bank Danske Bank

A/S ICBC Standard Bank plc U.S. Bancorp Investments, Inc.

UniCredit Bank AG Westpac Banking Corporation |

|

|

| Denominations: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

|

| Day Count Convention: |

|

ACTUAL / ACTUAL (ICMA) |

|

|

| Business Day Convention: |

|

Following Business Day Convention |

|

|

| Listing: |

|

Application will be made to list the notes on the New York Stock Exchange |

|

|

| Clearing and Settlement: |

|

Euroclear / Clearstream |

|

|

| Stabilization: |

|

Stabilization/FCA |

|

|

| Law: |

|

State of New York |

|

|

|

|

|

| Aggregate Principal Amount Offered: |

|

€800,000,000 |

|

|

| Ratings (Moody’s / S&P)*: |

|

Baa2/BBB+ |

|

|

| Maturity Date: |

|

May 23, 2035 |

|

|

| Interest Rate: |

|

4.250% per annum |

|

|

| Benchmark Bund: |

|

DBR 0.000% due May 15, 2035 |

|

|

| Benchmark Bund Price and Yield: |

|

74.670; 2.466% |

|

|

| Spread to Benchmark Bund: |

|

+190.5 basis points |

|

|

| Mid-Swap Yield: |

|

3.021% |

|

|

| Spread to Mid-Swap Yield: |

|

+135 basis points |

|

|

| Yield to Maturity: |

|

4.371% |

|

|

| Price to Public: |

|

98.888%, plus accrued interest, if any, from May 23, 2023 |

|

|

| Gross Proceeds: |

|

€791,104,000 |

|

|

| Underwriting Discount: |

|

0.500% |

|

|

| Net Proceeds (before estimated offering expenses): |

|

€787,104,000 |

|

|

| Interest Payment Dates: |

|

Payable annually on May 23 of each year, beginning on May 23, 2024 |

|

|

| Optional Redemption: |

|

Prior to February 23, 2035 (three months prior to the maturity date of the notes), callable at make-whole (reference bond rate +30 basis points) |

|

|

| Par Call: |

|

On or after February 23, 2035 (three months prior to the maturity date of the notes) |

|

|

| Common Code / ISIN: |

|

262600793 / XS2626007939 |

| * |

The security ratings set forth above are not a recommendation to buy, sell or hold securities and may be

subject to revision or withdrawal by the assigning rating organization at any time. |

| ** |

It is expected that delivery of the notes will be made to investors on or about May 23, 2023, which

will be the fifth U.S. business day following the trade date set forth above (such settlement being referred to as “T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as

amended, trades in the secondary market are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to two business days before the notes are

delivered will be required, by virtue of the fact that the notes initially settle in T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the

notes more than two business days before the date of delivery should consult their own advisors. |

The issuers have filed a registration statement (including a prospectus) with the U.S. Securities and

Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuers have filed with the SEC for more

complete information about the issuers and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuers, any underwriter or any dealer participating in the offering will arrange

to send you the prospectus if you request it by calling Barclays Bank PLC collect at +1 888 603 5847; Citigroup Global Markets Limited toll-free at +1 800 831 9146; Deutsche Bank Aktiengesellschaft collect at +1 800 503 4611; or Standard Chartered

Bank collect at +44 2078 855739.

Relevant stabilization regulations including FCA/ICMA apply. UK MiFIR and MiFID II professionals/ECPs-only / No

UK or EEA PRIIPs KID – Manufacturer target market (MiFID II and UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels). No EEA or UK PRIIPs key information document (KID) has been

prepared as not available to retail in the EEA or the UK.

Any legends, disclaimers or other notices that may appear below are not applicable to

this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having been sent via Bloomberg or another system.

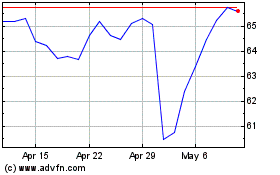

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024