Earnings Key Driver for the S&P 500 This Week

July 17 2022 - 5:18PM

Finscreener.org

In the week ended on July 15,

equity markets remained volatile due to red-hot inflation data that

stood at 9.1% for June, compared to estimates of 8.8%. This

triggered the possibility of the Federal Reserve raising interest

rates by 100 basis points later this month.

Despite sharp gains on Friday,

the S&P 500 index lost 1% in the last week. Higher commodity

prices have compelled the Fed to increase interest rates despite

the threat of an upcoming recession. However, comments from Fed

officials and a 1% gain in retail sales for June, as well as

better-than-expected consumer inflation data estimates may have

reversed expectations in the futures market.

In an interview with CNBC, Art

Hogan, chief market strategist at National Securities, stated, “It

really was a great study in mob psychology. We went into the week

with a 92% chance it was a 75 basis point hike, and we exited

Wednesday with an 82% chance it was going to be 100 basis points.”

On Friday, there was just a 20% chance for a 100-basis point hike

in July.

The most significant catalyst for

the S&P 500 in the next week is the upcoming earnings

season.

Big banks, including

Bank of America (NYSE:

BAC) and

Goldman Sachs (NYSE:

GS), will report earnings on Monday. On Tuesday,

large-cap heavyweights such as Netflix

(NASDAQ: NFLX), Johnson & Johnson

(NYSE:

JNJ), and Lockheed Martin

(NYSE:

LMT) will report Q2 results on Tuesday. Other

note-able companies reporting quarterly results include

AT&T (NYSE: T), Union Pacific

(NYSE:

UNP), and

Travelers (NYSE:

TRV).

In addition to earnings,

macroeconomic data around housing will be released as well. While

housing starts will be released on Tuesday, existing home sales are

expected on Wednesday. Further, manufacturing and services PMI data

will be released on Friday.

Quincy Krosby, the chief

financial strategist at LPL Financial emphasized, “Every data point

matters and also what companies are saying. Next week... it’s a

much broader picture in terms of earnings and the economy.If there

are negative revisions and mounting concerns from the guidance, I

think then you are going to see questions as to how the Fed is

going to interpret that…The other point is whether or not the

market can build off today’s rally.”

What should investors expect from the S&P 500 in

Q2?

Market experts expect the Q2

earnings season will disappoint investors resulting in downward

revisions due to issues such as supply chain disruptions,

inflation, and many others. According to Refinitiv data, earnings

for S&P 500 companies might rise by 5.6% on average,

year-over-year. Around 35 companies part of the S&P 500 have

reported earnings as of Friday morning, 80% of which beat consensus

earnings estimates.

Historically, 65% of these

companies beat earnings estimates. It will be interesting to see if

this number falls lower in Q2 of 2022. Consumer giant

Pepsi (NASDAQ: PEP) reported

its quarterly results and maintained its guidance for 2022, and

this development was cheered by investors.

In addition to Q2 results,

investors will also be watching to see how rising mortgage rates

will impact housing data.

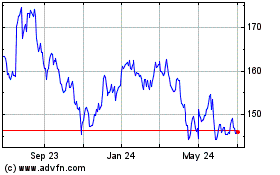

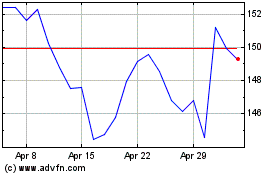

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024