By Peter Loftus

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 15, 2019).

Johnson & Johnson, facing lawsuits from more than 100,000

plaintiffs over its product safety and marketing tactics, has taken

the aggressive strategy of battling many of the cases in court.

And it is losing. A lot.

Juries and judges have ordered the health-products giant to pay

billions of dollars in several recent trials over claims that

J&J's signature baby powder and certain drugs and medical

devices injured people, and that its marketing practices fueled the

opioid-addiction epidemic.

The latest: A Philadelphia jury awarded $8 billion in punitive

damages last week to a man claiming his use of J&J's

antipsychotic Risperdal when he was a boy caused abnormal breast

enlargement. J&J has said it properly disclosed the drug's

risks and benefits, and plans to appeal the verdict.

In August, an Oklahoma judge ordered J&J to pay $572 million

to the state for contributing to the opioid-addiction crisis, a

judgment the company is appealing. Last year, a St. Louis jury

found that J&J should pay $4.7 billion to 22 women and their

families who alleged the company's baby powder caused ovarian

cancer. J&J has said the talcum powder is safe and doesn't

cause cancer; the company is appealing the decision.

The New Brunswick, N.J., company faced lawsuits from at least

103,300 people or entities in U.S. courts at the middle of this

year, up from the 8,580 plaintiffs pending in October 2011,

according to a Wall Street Journal review of J&J's securities

filings.

J&J discloses the number of plaintiffs for the most

significant of its product-liability cases in its filings.

The number of talc-lawsuit plaintiffs surged to 15,500 as of

June 30, from 1,400 in early 2016, the Journal analysis found.

Plaintiffs in personal-injury lawsuits over J&J's pelvic mesh

devices for women have declined from a peak of more than 55,000

pending in 2017 but still number about 24,800.

J&J is challenging many of the lawsuits, rather than quickly

settling, according to lawyers on both sides. "Their natural reflex

is to fight and delay, drag it out as long as they can," said Andy

Birchfield, an attorney with Beasley Allen in Montgomery, Ala., who

has sued J&J over baby powder and other products.

The Risperdal damages and some other awards are likely to be

reduced by judges, and possibly overturned, on appeal. Yet the

losses signal J&J may ultimately have to pay a costly sum to

resolve the lawsuits. The opioid litigation alone could cost

J&J $5 billion to $10 billion to settle, Wells Fargo analysts

have estimated.

J&J has won its share of trials. The company has argued

science supports the safety of its products and that its increasing

caseload is a product of aggressive plaintiffs' lawyers eyeing the

company's big pockets. It is in the company's best interest, its

outside lawyers said, to deter more lawsuits lacking merit by

avoiding premature settlements now.

J&J is approaching the litigation "with an eye to managing

this onslaught overall, and not creating false incentives for

lawyers to file even more claims that are marginal at best," said

John Beisner, a partner with Skadden, Arps, Slate, Meagher &

Flom LLP who is defending J&J in litigation over talc and some

other products.

J&J may be following in the footsteps of Merck & Co.,

which took to trial a number of lawsuits alleging its Vioxx

painkiller caused heart attacks and strokes, said Nora Freeman

Engstrom, a law professor at Stanford Law School who studies

personal-injury litigation. Merck won more verdicts than it lost

and ultimately agreed in 2007 to settle nearly all of the lawsuits

for $4.85 billion, lower than analysts initially expected. Yet a

key difference, Ms. Engstrom said, is that J&J is battling

litigation on a large scale for multiple products.

Concerns about J&J's litigation risk have weighed on its

stock, which is down 12% since its 52-week high in December,

through Monday. In comparison, over that span, the S&P 500 is

up about 10% and the index's health-care members are down 3%. Some

analysts said J&J's slide reflects investors' expectations that

J&J might have to spend from $20 billion to $50 billion to

resolve all of the litigation. J&J had $81.6 billion in revenue

last year; the company is expected to report its third-quarter

results Tuesday.

In August, Moody's Investors Service changed its outlook for

J&J's bond rating to negative from stable, citing uncertainty

over the outcome of litigation.

Attention-getting verdicts also are hurting the company's

reputation for trustworthiness, amassed from decades of careful

marketing to parents and its famous handling of a Tylenol scare.

Recent legal losses have dropped J&J to 57th out of 58

companies in a pharmaceutical reputation index developed by Alva

Group, which bases its scores on mentions in the news, social media

and analyst reports. J&J was in the index's top 10 in 2014.

A J&J spokesman said the company's reputation remains strong

because it has developed high-quality consumer products and

treatments for cancer and HIV. He said the company's victories at

trial and reversals of losses on appeal don't garner the same level

of attention as high-dollar trial losses.

The company's wins include two talc trials last week in which

California juries sided with the company. And it has settled

others.

In March, J&J and partner Bayer AG said they agreed to pay

$775 million to resolve most claims that their blood thinner

Xarelto causes excessive bleeding. The companies had won several

Xarelto trials and didn't admit liability in the settlement. This

month, J&J agreed to pay $20.4 million to settle opioid

lawsuits filed by two Ohio counties, avoiding a trial.

Some lawyers said the longer litigation continues, the easier

the cases become for plaintiffs to win because more documentation

is unearthed and plaintiffs' lawyers can refine their strategies

based on earlier trials.

"The cases only get better for plaintiffs, not worse," said

Richard Golomb, a Philadelphia attorney representing women who have

sued over J&J's baby powder.

J&J, however, has a reason for holding out on a large talc

settlement. It has asked a federal judge in New Jersey overseeing

pretrial proceedings for a majority of the talc suits to exclude

testimony from the plaintiffs' expert witnesses who claim talc

causes cancer. Plaintiffs' lawyers said the testimony should be

allowed.

If the judge sides with J&J, it could effectively wipe out

most of the talc lawsuits; a decision is expected in the coming

months.

Write to Peter Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

October 15, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

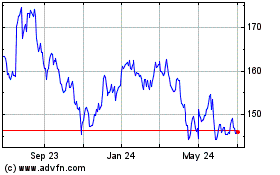

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

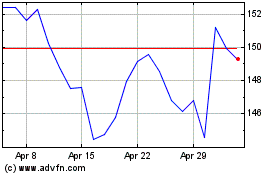

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024