By Andrea Riquier and Clive McKeef

Dow down 3.1% so far this quarter, wiping out the 1.2% gain last

quarter, but remains up 11.8% for the year

U.S. stocks continued their slide Wednesday and posted the worst

start to a quarter since 2008, with data showing slower job

creation adding to concerns about a weakening manufacturing sector

as President's Trump's trade policies take their toll.

Automobile manufacturers stocks fell after quarterly sales

reports from Ford and General Motors added to concern over profit

margins in the industry. All 11 S&P 500 sectors were down with

industries sensitive to economic growth dropping most. The last

time all 11 sectors fell for two straight days was December 24,

2018.

What did major stock indexes do?

Late afternoon the Dow Jones Industrial Average fell 494.42

points, or 1.86%, to 26,078 while the S&P 500 index lost 52.64

points or 1.79% to 2,887.61. The Nasdaq fell 123.44 points, or

1.56%, to 7,785.25.

The Dow and S&P 500 are now both below their 100-day moving

averages.

On Tuesday, the Dow lost 344 points, or 1.3%, to finish

26,573.04, the S&P 500 fell 37 points, or 1.2%, to end at

2,940.25. The Nasdaq Composite Index retreated 91 points, or 1.1%,

to close at 7,908.68. The small-capitalization Russell 2000 index

saw a steeper drop, losing 1.9% to 1,493.43.

Read: Dow, S&P 500 on track for worst start to a quarter

since 2008 financial crisis as recession fears accelerate

(http://www.marketwatch.com/story/dow-sp-500-on-track-for-worst-start-to-a-quarter-since-2008-financial-crisis-as-recession-fears-accelerate-2019-10-02)

What's driving the stock market?

A private-sector employment report

(http://www.marketwatch.com/story/adp-says-135000-private-sector-jobs-created-in-september-as-hiring-continues-to-slow-2019-10-02)

from Automatic Data Processing showed that a modest 135,000 jobs

were created in September, and the average monthly job growth for

the past three months also fell to 145,000 from 214,000 for the

same time period last year.

The ADP payrolls report was published ahead of the more closely

followed U.S. Labor Department's nonfarm-payroll report due on

Friday

(http://www.marketwatch.com/story/another-poor-us-jobs-report-would-add-to-wall-street-gloom-heres-what-to-look-for-2019-10-02).

The Alanta Federal Reserve's GDPNow forecast

(https://www.frbatlanta.org/cqer/research/gdpnow)for U.S. economic

growth in the fourth quarter has fallen 1.8%.

Market participants are hoping the Federal Reserve will cut

interest rates again when it meets in October, but the Fed may be

reluctant to lower rates again after two cuts so far this year.

New York Fed President John Williams on Wednesday pushed back on

market fears of a looming recession

(http://www.marketwatch.com/story/feds-williams-downplaying-recession-fears-says-outlook-very-favorable-2019-10-02),

saying that the baseline economic forecast remains "a positive

one."

"Right now, the outlook is actually very favorable," Williams

said during a talk at the University of California, San Diego. He

said GDP growth is around 2% rate, with a "very strong" labor

market and inflation near a 2% rate.

In international trade news on Wednesday, the U.S. won World

Trade Organization backing for tariffs on EU goods

(http://www.marketwatch.com/story/us-wins-wto-backing-for-tariffs-on-eu-goods-in-airbus-case-2019-10-02)

in an Airbus case over what the Trump administration said was

illegal subsidies granted to Airbus. The Trump administration will

put tariffs on $7.5 billion of imports from the EU as a result, the

Wall Street Journal reported

(https://www.wsj.com/articles/u-s-can-levy-tariffs-on-eu-exports-over-airbus-wto-says-11570025040?mod=hp_lead_pos6).

Meanwhile, the U.S. and China are due to resume talks next week

on resolving the trade dispute between the world's two largest

economies.

"Supportive central banks, bearish sentiment and attractive

yield opportunities are supportive of stocks," Bank of America

Securities said in a note. But "trade tensions, global growth

concerns, geopolitical risks plus signs of (profit) margin

compression and further downward risk to (earnings) estimates are

likely to limit upside going forward," the bank said.

Read: Stocks just delivered a reminder about October's

reputation for volatility

(http://www.marketwatch.com/story/history-shows-october-is-the-stock-markets-most-volatile-month-2019-10-01)

Which stocks are in focus?

Ford (F) fell after the automaker reported third-quarter vehicle

sales fell 4.9%

(http://www.marketwatch.com/story/ford-third-quarter-vehicle-sales-fall-as-declines-in-suv-and-car-sales-offset-truck-sales-growth-2019-10-02)

from a year ago, while General Motors (GM) also fell after

reporting poor quarterly sales

(http://www.marketwatch.com/story/gm-stock-falls-nearly-4-after-companys-q3-sales-2019-10-02-1191122).

Boeing (BA) was lower after a report

(http://www.marketwatch.com/story/boeing-shares-slide-13-on-report-engineer-filed-ethics-complaint-about-737-max-safety-issues-2019-10-02)said

an engineer filed an internal ethics complaint over the company's

decision to reject a safety system for the 737 Max on cost grounds

that he believed could have reduced risks tied to two fatal

crashes.

Discount-broker stocks continued to fall after the Tuesday

announcement by Charles Schwab Corp. (SCHW) that it would cut most

trading commissions to zero

(http://www.marketwatch.com/story/can-it-get-any-cheaper-to-be-an-investor-2019-10-01).

TD Ameritrade Holdings Corp. (AMTD) fell also.

Shares of pharmaceutical company Savara Inc.(SVRA) tumbled 47%

in morning trading after the company said the U.S. Food and Drug

Administration had found its application for a new medication

insufficient.

Johnson & Johnson(JNJ) shares rose after the company cut a

deal to avoid an upcoming opioid litigation trial.

How did other markets trade?

U.S. Treasury yields fell sharply Wednesday

(http://www.marketwatch.com/story/treasury-yields-tick-lower-as-investors-gear-up-for-us-private-sector-jobs-data-2019-10-02)

after growing worries about the health of the American economy drew

investors into government bonds at the expense of stocks. The yield

on the 10-year U.S. Treasury note was down about 6 basis points to

1.59% on Wednesday.

Gold prices settled back above the key $1,500 mark on Wednesday

(http://www.marketwatch.com/story/gold-edges-higher-as-traders-watch-for-us-private-sector-employment-data-2019-10-02),

after private-sector employment showed that the pace of hiring in

the U.S. is slowing, reviving worries about a recession in the U.S.

economy and spurring the purchase of assets perceived as havens.

Gold for December delivery jumped $18.90, or 1.3%, to reach

$1,507.90 an ounce, after rising 1.1% on Tuesday.

Oil futures declined Wednesday, with U.S. prices set for their

lowest finish in almost two months, as downbeat economic data

weighed on prospects for energy demand, and domestic crude

stockpiles registered a third straight weekly climb. West Texas

Intermediate crude-oil for November delivery was down 96 cents,

about 1.8%, to $52.66 a barrel on the New York Mercantile

Exchange.

In Asia overnight Wednesday, Chinese equity benchmarks were

closed in observance of the 70th anniversary of Communist rule.

Japan's Nikkei 225 meanwhile, fell 0.5%, wiping out a similar loss

from Monday. European stocks traded lower, with the Stoxx Europe

600 down 1.6%.

(END) Dow Jones Newswires

October 02, 2019 16:29 ET (20:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

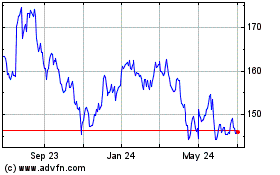

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

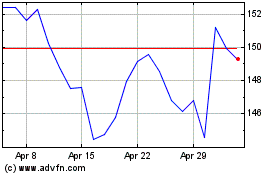

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024