John Hancock Investors Trust (the Fund)

John Hancock Tax-Advantaged Global Shareholder Yield Fund (the

Fund)

Supplement dated January 1, 2021 to the current Prospectus (the

Prospectus), as may be supplemented

Effective January 1, 2021, the following information under “Determination

of Net Asset Value” in the “Custodian and Transfer Agent” section is amended and restated as follows:

The Fund’s net asset value per Common

Share (“NAV”) is normally determined each business day at the close of regular trading on the NYSE (typically 4:00

p.m. Eastern Time, on each business day that the NYSE is open) by dividing the Fund’s net assets by the number of Common

Shares outstanding. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing

at a time other than the regularly scheduled close, the NAV may be determined as of the regularly scheduled close of the NYSE pursuant

to the Fund’s Valuation Policies and Procedures. The time at which shares and transactions are priced and until which orders

are accepted may vary to the extent permitted by the Securities and Exchange Commission and applicable regulations. On holidays

or other days when the NYSE is closed, the NAV is not calculated. Trading of securities that are primarily listed on foreign exchanges

may take place on weekends and U.S. business holidays on which the Fund’s NAV is not calculated. Consequently, the Fund’s

portfolio securities may trade and the NAV of the Fund’s Common Shares may be significantly affected on days when a shareholder

will not be able to purchase or sell the Fund’s Common Shares.

Portfolio securities are valued by various methods

that are generally described below. Portfolio securities also may be fair valued by the Fund’s Pricing Committee in certain

instances pursuant to procedures established by the Trustees. Equity securities are generally valued at the last sale price or,

for certain markets, the official closing price as of the close of the relevant exchange. Securities not traded on a particular

day are valued using last available bid prices. A security that is listed or traded on more than one exchange is typically valued

at the price on the exchange where the security was acquired or most likely will be sold. In certain instances, the Pricing Committee

may determine to value equity securities using prices obtained from another exchange or market if trading on the exchange or market

on which prices are typically obtained did not open for trading as scheduled, or if trading closed earlier than scheduled, and

trading occurred as normal on another exchange or market. Equity securities traded principally in foreign markets are typically

valued using the last sale price or official closing price in the relevant exchange or market, as adjusted by an independent pricing

vendor to reflect fair value. On any day a foreign market is closed and the NYSE is open, any foreign securities will typically

be valued using the last price or official closing price obtained from the relevant exchange on the prior business day adjusted

based on information provided by an independent pricing vendor to reflect fair value. Debt obligations are typically valued based

on evaluated prices provided by an independent pricing vendor. The value of securities denominated in foreign currencies is converted

into U.S. dollars at the exchange rate supplied by an independent pricing vendor. Forward foreign currency contracts are valued

at the prevailing forward rates which are based on foreign currency exchange spot rates and forward points supplied by an independent

pricing vendor. Exchange-traded options are valued at the mid-price of the last quoted bid and ask prices. Futures contracts whose

settlement prices are determined as of the close of the NYSE are typically valued based on the settlement price while other futures

contracts are typically valued at the last traded price on the exchange on which they trade. Foreign equity index futures that

trade in the electronic trading market subsequent to the close of regular trading may be valued at the last traded price in the

electronic trading market as of the close of the NYSE, or may be fair valued based on fair value adjustment factors provided by

an independent pricing vendor in order to adjust for events that may occur between the close of foreign exchanges or markets and

the close of the NYSE. Swaps and unlisted options are generally valued using evaluated prices obtained from an independent pricing

vendor. Shares of open-end investment companies that are not exchange-traded funds (“ETFs”) held by the Fund are valued

based on the NAVs of such other investment companies.

Pricing vendors may use matrix pricing or valuation

models that utilize certain inputs and assumptions to derive values, including transaction data, broker-dealer quotations, credit

quality information, general market conditions, news, and other factors and assumptions. The Fund may receive different prices

when it sells odd-lot positions than it would receive for sales of institutional round lot positions. Pricing vendors generally

value securities assuming orderly transactions of institutional round lot sizes, but the Fund may hold or transact in such securities

in smaller, odd lot sizes.

The Pricing Committee engages in oversight activities

with respect to the Fund’s pricing vendors, which includes, among other things, monitoring significant or unusual price fluctuations

above predetermined tolerance levels from the prior day, back-testing of pricing vendor prices against actual trades, conducting

periodic due diligence meetings and reviews, and

periodically reviewing the inputs, assumptions

and methodologies used by these vendors. Nevertheless, market quotations, official closing prices, or information furnished by

a pricing vendor could be inaccurate, which could lead to a security being valued incorrectly.

If market quotations, official closing prices,

or information furnished by a pricing vendor are not readily available or are otherwise deemed unreliable or not representative

of the fair value of such security because of market- or issuer-specific events, a security will be valued at its fair value as

determined in good faith by the Trustees. The Trustees are assisted in their responsibility to fair value securities by the Fund’s

Pricing Committee, and the actual calculation of a security’s fair value may be made by the Pricing Committee acting pursuant

to the procedures established by the Trustees. In certain instances, therefore, the Pricing Committee may determine that a reported

valuation does not reflect fair value, based on additional information available or other factors, and may accordingly determine

in good faith the fair value of the assets, which may differ from the reported valuation.

Fair value pricing of securities is intended

to help ensure that the Fund’s NAV reflects the fair market value of the Fund’s portfolio securities as of the close

of regular trading on the NYSE (as opposed to a value that no longer reflects market value as of such close). The use of fair value

pricing has the effect of valuing a security based upon the price the Fund might reasonably expect to receive if it sold that security

in an orderly transaction between market participants, but does not guarantee that the security can be sold at the fair value price.

Further, because of the inherent uncertainty and subjective nature of fair valuation, a fair valuation price may differ significantly

from the value that would have been used had a readily available market price for the investment existed and these differences

could be material.

Regarding the Fund’s investment in an

open-end investment company that is not an ETF, which (as noted above) is valued at such investment company’s NAV, the prospectus

for such investment company explains the circumstances and effects of fair value pricing for that investment company.

You should read this Supplement in conjunction

with the Prospectus and retain it for your future reference.

John Hancock Investors Trust (the Fund)

John Hancock Tax-Advantaged Global Shareholder Yield Fund (the

Fund)

Supplement dated January 1, 2021 to the current Statement of Additional

Information (the SAI), as may be supplemented

Effective January 1, 2021, the following information under the heading

“Determination of Net Asset Value” is amended and restated as follows:

The Fund’s net asset value per Common

Share (“NAV”) is normally determined each business day at the close of regular trading on the NYSE (typically 4:00

p.m. Eastern Time, on each business day that the NYSE is open) by dividing the Fund’s net assets by the number of Common

Shares outstanding. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing

at a time other than the regularly scheduled close, the NAV may be determined as of the regularly scheduled close of the NYSE pursuant

to the Fund’s Valuation Policies and Procedures. The time at which shares and transactions are priced and until which orders

are accepted may vary to the extent permitted by the Securities and Exchange Commission and applicable regulations. On holidays

or other days when the NYSE is closed, the NAV is not calculated. Trading of securities that are primarily listed on foreign exchanges

may take place on weekends and U.S. business holidays on which the Fund’s NAV is not calculated. Consequently, the Fund’s

portfolio securities may trade and the NAV of the Fund’s Common Shares may be significantly affected on days when a shareholder

will not be able to purchase or sell the Fund’s Common Shares.

Portfolio securities are valued by various methods

that are generally described below. Portfolio securities also may be fair valued by the Fund’s Pricing Committee in certain

instances pursuant to procedures established by the Trustees. Equity securities are generally valued at the last sale price or,

for certain markets, the official closing price as of the close of the relevant exchange. Securities not traded on a particular

day are valued using last available bid prices. A security that is listed or traded on more than one exchange is typically valued

at the price on the exchange where the security was acquired or most likely will be sold. In certain instances, the Pricing Committee

may determine to value equity securities using prices obtained from another exchange or market if trading on the exchange or market

on which prices are typically obtained did not open for trading as scheduled, or if trading closed earlier than scheduled, and

trading occurred as normal on another exchange or market. Equity securities traded principally in foreign markets are typically

valued using the last sale price or official closing price in the relevant exchange or market, as adjusted by an independent pricing

vendor to reflect fair value. On any day a foreign market is closed and the NYSE is open, any foreign securities will typically

be valued using the last price or official closing price obtained from the relevant exchange on the prior business day adjusted

based on information provided by an independent pricing vendor to reflect fair value. Debt obligations are typically valued based

on evaluated prices provided by an independent pricing vendor. The value of securities denominated in foreign currencies is converted

into U.S. dollars at the exchange rate supplied by an independent pricing vendor. Forward foreign currency contracts are valued

at the prevailing forward rates which are based on foreign currency exchange spot rates and forward points supplied by an independent

pricing vendor. Exchange-traded options are valued at the mid-price of the last quoted bid and ask prices. Futures contracts whose

settlement prices are determined as of the close of the NYSE are typically valued based on the settlement price while other futures

contracts are typically valued at the last traded price on the exchange on which they trade. Foreign equity index futures that

trade in the electronic trading market subsequent to the close of regular trading may be valued at the last traded price in the

electronic trading market as of the close of the NYSE, or may be fair valued based on fair value adjustment factors provided by

an independent pricing vendor in order to adjust for events that may occur between the close of foreign exchanges or markets and

the close of the NYSE. Swaps and unlisted options are generally valued using evaluated prices obtained from an independent pricing

vendor. Shares of open-end investment companies that are not exchange-traded funds (“ETFs”) held by the Fund are valued

based on the NAVs of such other investment companies.

Pricing vendors may use matrix pricing or valuation

models that utilize certain inputs and assumptions to derive values, including transaction data, broker-dealer quotations, credit

quality information, general market conditions, news, and other factors and assumptions. The Fund may receive different prices

when it sells odd-lot positions than it would receive for sales of institutional round lot positions. Pricing vendors generally

value securities assuming orderly transactions of institutional round lot sizes, but the Fund may hold or transact in such securities

in smaller, odd lot sizes.

The Pricing Committee engages in oversight activities

with respect to the Fund’s pricing vendors, which includes, among other things, monitoring significant or unusual price fluctuations

above predetermined tolerance levels from the prior day, back-testing of pricing vendor prices against actual trades, conducting

periodic due diligence meetings and reviews, and periodically reviewing the inputs, assumptions and methodologies used by these

vendors.

Nevertheless, market quotations, official closing

prices, or information furnished by a pricing vendor could be inaccurate, which could lead to a security being valued incorrectly.

If market quotations, official closing prices,

or information furnished by a pricing vendor are not readily available or are otherwise deemed unreliable or not representative

of the fair value of such security because of market- or issuer-specific events, a security will be valued at its fair value as

determined in good faith by the Trustees. The Trustees are assisted in their responsibility to fair value securities by the Fund’s

Pricing Committee, and the actual calculation of a security’s fair value may be made by the Pricing Committee acting pursuant

to the procedures established by the Trustees. In certain instances, therefore, the Pricing Committee may determine that a reported

valuation does not reflect fair value, based on additional information available or other factors, and may accordingly determine

in good faith the fair value of the assets, which may differ from the reported valuation.

Fair value pricing of securities is intended

to help ensure that the Fund’s NAV reflects the fair market value of the Fund’s portfolio securities as of the close

of regular trading on the NYSE (as opposed to a value that no longer reflects market value as of such close). The use of fair value

pricing has the effect of valuing a security based upon the price the Fund might reasonably expect to receive if it sold that security

in an orderly transaction between market participants, but does not guarantee that the security can be sold at the fair value price.

Further, because of the inherent uncertainty and subjective nature of fair valuation, a fair valuation price may differ significantly

from the value that would have been used had a readily available market price for the investment existed and these differences

could be material.

Regarding the Fund’s investment in an

open-end investment company that is not an ETF, which (as noted above) is valued at such investment company’s NAV, the prospectus

for such investment company explains the circumstances and effects of fair value pricing for that investment company.

You should read this Supplement in conjunction

with the SAI and retain it for future reference.

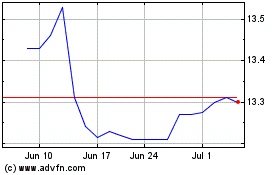

John Hancock Investors (NYSE:JHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

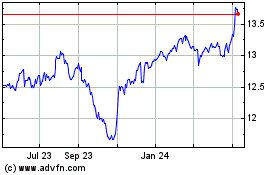

John Hancock Investors (NYSE:JHI)

Historical Stock Chart

From Apr 2023 to Apr 2024