UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 11)*

JANUS HENDERSON GROUP PLC

(Name of Issuer)

Ordinary Shares, $1.50 per share par value

(Title of Class of Securities)

(CUSIP Number)

|

Brian L. Schorr, Esq.

Trian Fund Management, L.P.

280 Park Avenue, 41st Floor

New York, New York 10017

Tel. No.: (212) 451-3000

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The Information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the

liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Nelson Peltz

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

|

8

|

SHARED VOTING POWER

31,867,800

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

31,867,800

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,867,800

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.24%*

|

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

_______

*Calculated based on 165,657,905 Ordinary Shares outstanding as of October 31, 2022 as reported by the Issuer on its “Statement of CDIs on Issue” filed with the Australian Securities Exchange on November 2, 2022 (the

“Statement of CDIs on Issue”).

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Peter W. May

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

31,867,800

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

31,867,800

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,867,800

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.24%*

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

_______

*Calculated based on 165,657,905 Ordinary Shares outstanding as of October 31, 2022 as reported by the Issuer on its Statement of CDIs on Issue.

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Edward P. Garden

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

31,867,800

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

31,867,800

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,867,800

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.24%*

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

_______

* Calculated based on 165,657,905 Ordinary Shares outstanding as of October 31, 2022 as reported by the Issuer on its Statement of CDIs on Issue.

|

1

|

NAME OF REPORTING PERSON

Trian Fund Management, L.P.

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

20-3454182

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

31,867,800

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

31,867,800

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,867,800

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.24%*

|

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

_______

* Calculated based on 165,657,905 Ordinary Shares outstanding as of October 31, 2022 as reported by the Issuer on its Statement of CDIs on Issue.

|

1

|

NAME OF REPORTING PERSON

Trian Fund Management GP, LLC

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

20-3454087

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

31,867,800

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

31,867,800

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,867,800

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.24%*

|

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

_______

* Calculated based on 165,657,905 Ordinary Shares outstanding as of October 31, 2022 as reported by the Issuer on its Statement of CDIs on Issue.

|

1

|

NAME OF REPORTING PERSON

Trian Partners AM Holdco II, Ltd.

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

85-2619230

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

WC

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

31,867,800

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

31,867,800

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,867,800

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[X]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.24%*

|

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

_______

* Calculated based on 165,657,905 Ordinary Shares outstanding as of October 31, 2022 as reported by the Issuer on its Statement of CDIs on Issue.

This Amendment No. 11 amends and supplements the Schedule 13D filed with the Securities and Exchange Commission on October 2, 2020 as amended by Amendment No. 1, filed on May 12, 2021, as amended by Amendment No. 2 filed

on May 19, 2021, as amended by Amendment No. 3 filed on July 19, 2021, as amended by Amendment No. 4 filed on October 4, 2021, as amended by Amendment No. 5 filed on November 16, 2021, as amended by Amendment No. 6 filed on December 13, 2021, as

amended by Amendment No. 7 filed on January 6, 2022, as amended by Amendment No. 8 filed on February 1, 2022, as amended by Amendment No. 9 filed on March 9, 2022, and as amended by Amendment No. 10 (“Amendment No. 10”) filed on March 31, 2022 (as

amended, the “Schedule 13D”), relating to the Ordinary Shares, $1.50 per share par value (the “Shares”), of Janus Henderson Group plc, a company incorporated and registered in Jersey, Channel Islands (the “Issuer”). The address of the principal

executive office of the Issuer is 201 Bishopsgate, London, EC2M 3AE United Kingdom.

Capitalized terms not defined herein shall have the meaning ascribed to them in the Schedule 13D. Except as set forth herein, the Schedule 13D is unmodified.

Items 4 and 7 of the Schedule 13D are hereby amended and supplemented as follows:

Item 4. Purpose of Transaction

Item 4 of the Schedule 13D is hereby amended and supplemented by adding the following information:

On November 15, 2022, the Issuer appointed Brian Baldwin, a Partner and Senior Analyst at Trian Management, in place of Nelson Peltz, who resigned as a Non-Executive Director of the Issuer on the same date.

The Trian Group is the Issuer’s largest shareholder, and Mr. Baldwin joins Ed Garden, Trian Management’s Chief Investment Officer and Founding Partner, on the Issuer’s Board. Mr. Baldwin has worked closely with Nelson

Peltz and Ed Garden on all of Trian Management’s investments in asset management and financial services. Mr. Garden has previously served as a director of several other major asset management and financial services companies including The Bank of New

York Mellon Corporation, Legg Mason, Inc. and Invesco Ltd.

The Trian Group strongly supports the Issuer’s new CEO, Ali Dibadj and his management team, the Issuer’s cost-efficiency program, the Issuer’s newly defined strategy, and the Issuer’s Board, which has undergone

significant refreshment, including electing a new Chair. With these changes in place, the Trian Group believes the Issuer is well-positioned to help clients define and achieve their desired investment outcomes while delivering significant long-term

shareholder value.

The Issuer’s Board appointed Mr. Baldwin as a member of the Nominating and Corporate Governance Committee and Risk Committee.

Item 7. Material to be Filed as Exhibits

5. Letter to Richard Gillingwater, Chairman, and Ali Dibadj, Chief Executive Officer, of the Issuer, dated November 15, 2022.

[INTENTIONALLY LEFT BLANK]

SIGNATURE

After reasonable inquiry and to the best of each of the undersigned knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: November 15, 2022

| |

TRIAN FUND MANAGEMENT, L.P.

|

|

|

By:

|

Trian Fund Management GP, LLC, its general partner

|

|

| |

|

|

|

By:

|

/s/EDWARD P. GARDEN

|

|

| |

Name:

|

Edward P. Garden

|

|

| |

Title:

|

Member

|

|

| |

|

|

| |

TRIAN FUND MANAGEMENT GP, LLC

|

|

| |

|

|

|

By:

|

/s/EDWARD P. GARDEN

|

|

| |

Name:

|

Edward P. Garden

|

|

| |

Title:

|

Member

|

|

| |

|

|

| |

TRIAN PARTNERS AM HOLDCO II, LTD.

|

|

| |

|

|

|

By:

|

/s/EDWARD P. GARDEN

|

|

| |

Name:

|

Edward P. Garden

|

|

| |

Title:

|

Director

|

|

| |

|

|

| |

/s/NELSON PELTZ

Nelson Peltz

|

| |

/s/PETER W. MAY

Peter W. May

|

| |

/s/EDWARD P. GARDEN

Edward P. Garden

|

Exhibit 5

NELSON PELTZ

November 15, 2022

VIA EMAIL

Janus Henderson Group plc

Richard Gillingwater, Chairman

Ali Dibadj, Chief Executive Officer

Dear Richard and Ali,

I am writing this letter to advise you that, effective immediately, I hereby resign from the Board of Directors of Janus Henderson Group plc (the “Company” or “JHG”) and from any other

positions I hold with the Company and its subsidiaries.

I wish to express my strong support for Ali, whom I am proud to have played a role in recruiting to the Company. I am also highly supportive of the Company’s management team, cost-efficiency program,

newly defined strategy and refreshed Board, which going forward will include two of my partners at Trian, Ed Garden (CIO and Co-Founder) and Brian Baldwin (Partner and Senior Analyst).

With these changes in place, I believe the Company is well-positioned to help clients define and achieve their desired investment outcomes while delivering significant long-term shareholder value.

On a personal note, I have enjoyed my time on the JHG Board and appreciated the opportunity to work with you and the rest of the Board.

Very truly yours,

/s/NELSON PELTZ

cc: Michelle Rosenberg (via email)

General Counsel and Company Secretary

Janus Henderson (NYSE:JHG)

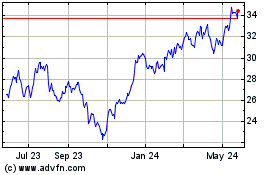

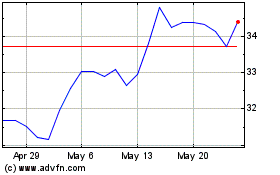

Historical Stock Chart

From Mar 2024 to Apr 2024

Janus Henderson (NYSE:JHG)

Historical Stock Chart

From Apr 2023 to Apr 2024