UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x

|

|

|

|

Filed by a Party other than the Registrant ¨

|

|

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material under §240.14a-12

|

|

|

|

International Business Machines Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

Persons who are to respond to the collection of information

contained in this form are not required to respond unless the form displays a currently valid OMB control number.

April 2021

Dear IBM Stockholder,

As the independent Lead Director and the Chairs of the Committees of

the IBM Board of Directors, we are writing to you on behalf of the entire Board to thank you for your support and your investment in IBM,

and to share our perspective on the Company and the Board’s role in driving long-term stockholder value. As we continue to prioritize

the health and safety of our stockholders and employees, we will once again have a virtual-only stockholder meeting this year. We strongly

encourage you to vote your shares by proxy.

Positioned to Lead the Era of Hybrid Cloud and

AI

2020 was an eventful year for our Company, its stakeholders and the

world. With your Board’s oversight, IBM has taken several actions to accelerate its hybrid cloud and AI strategy. In 2020, IBM announced

the separation of our managed infrastructure business, closed seven strategic acquisitions and launched new industry clouds for banking

and telecommunications. Additionally, in 2020, IBM:

|

|

·

|

Achieved $73.6 billion in revenue;

|

|

|

·

|

Grew Cloud revenues to more than $25 billion, with strong double digit growth, representing 34% of overall revenue;

|

|

|

·

|

Achieved strong cash generation with net cash from operating activities of $18.2 billion and free cash flow of about $11 billion;

|

|

|

·

|

Expanded full year GAAP gross margins 100 basis points and non-GAAP operating gross margins; 130 basis points, reflecting a continued

shift to a higher-value businesses and improved Services productivity; and

|

|

|

·

|

Raised the dividend for the 25th consecutive year – IBM’s 105th straight year of providing one.

|

Engaged oversight of the Company’s strategy has been a fundamental

responsibility of the IBM Board for generations and is essential for the creation of long-term sustainable value. As we continue into

2021, your Board is focused on growth at IBM and ensuring the successful spin of the Company’s managed infrastructure services business.

Commitment to ESG and an Ethical Business Culture

Commitment to ESG principles has been a hallmark of IBM’s culture

for over 100 years and the Board is actively engaged in overseeing the Company’s ESG efforts. With the Board’s oversight,

the Company has long embraced a corporate philosophy that is inclusive of all its stakeholders – from our customers, employees,

suppliers and stockholders to our communities and the world around us. Based on engagement with those stakeholders, we continue to take

bold action that builds upon our legacy of responsible stewardship.

Earlier this year, following record progress toward our renewable electricity

and greenhouse gas emissions goals, IBM set next generation goals to (1) reach net zero greenhouse gas emissions by 2030, (2) reduce our

greenhouse gas emissions by 65% by 2025 and (3) have 75% renewable electricity by 2025 and 90% by 2030.

Consistent with IBM’s legacy of welcoming and supporting a diverse

and inclusive workforce, as a Board, we formally adopted a policy committing the Company to publish a report annually assessing the Company’s

diversity, equity and inclusion efforts and programs. Further, in the spirit of enhanced transparency, we have committed to publish EEO-1

data in 2022 after the completion of the separation of our managed infrastructure services business.

In same spirit of transparency and based on feedback from our investors,

IBM’s Proxy Statement contains additional disclosure this year in a new “Environmental and Social Responsibility” section,

detailing how we are (1) working to protect our environment for future generations, (2) managing the historic challenges presented by

COVID-19, (3) embracing a diverse and inclusive workforce, (4) being a responsible steward of technology and (5) advocating for responsible

public policy positions.

Strong Leadership Structure: Vote AGAINST Item

of Business 6

One of the Board’s most important tasks is to ensure that IBM’s

leadership serves the best interests of the Company and its stockholders. As a Board, we regularly evaluate the appropriate leadership

structure for IBM to ensure that it has the optimal structure, recognizing that different structures may be appropriate under different

circumstances. For example, last year, we split the Chairman and CEO roles to ensure a seamless and successful leadership transition from

IBM Executive Chairman Ginni Rometty to IBM’s Chief Executive Officer Arvind Krishna. At this time, the Board believes that its

leadership structure of Arvind Krishna as Chairman and Chief Executive Officer and Mike Eskew as the independent Lead Director is in the

best interests of IBM and its stockholders. This structure strikes the right balance by promoting a clear, unified vision for the Company’s

strategy, providing the leadership critical for effectively and efficiently implementing the actions needed to ensure strong performance

over the long term, while ensuring independent oversight by the Board and the Lead Director. The Lead Director role is robust and ensures

effective independent oversight at all times. IBM’s strong, independent Board and commitment to good corporate governance adds further

support to the Board leadership structure.

Commitment to Pay for Performance: Vote FOR

Item of Business 3

Our compensation strategy, with significant pay at risk, supports the

drivers of IBM’s high value business model. Our senior executive pay is heavily weighted to IBM’s performance through the

annual and long-term incentive programs, with targets set at challenging levels consistent with IBM’s financial model as shared

with investors. In our discussions with investors representing more than 50% of the shares that voted on Say on Pay at the 2020 Annual

Meeting, investors reaffirmed their support for the Company’s compensation policies and programs, which focus on long-term financial

performance that drives stockholder value.

To reinforce the strategic shift in our business, we have made thoughtful

changes to our executive short- term and long-term compensation programs to ensure alignment with IBM’s growth strategy and investor

expectations for 2021 and beyond. We have redesigned the metrics to emphasize revenue and cash generation, aligning compensation with

IBM’s focus on delivering sustainable growth as a hybrid cloud and AI company. We have also added a diversity modifier to our Annual

Incentive Program to reaffirm management’s commitment to improving a diverse representation of our workforce.

You will also see in the Proxy Statement that in 2020 the Company made a one-time Retention Performance Share Unit (RPSU) award to a Red

Hat Executive as consideration for signing an IBM Non-Competition Agreement before undertaking a new role as IBM’s President. The

RPSU includes performance criteria that impact the amounts that will vest under this award. More importantly, like all of IBM’s

Non-Competition Agreements, the purpose of this Non-Competition Agreement is to promote IBM stockholder value by protecting IBM’s

intellectual property and other confidential information. The IBM Non-Competition Agreement signed covers the broader scope of IBM’s

business footprint and confidential information to which the former Red Hat Executive is now exposed as a member of IBM’s senior

leadership team.

For these reasons and those discussed in more detail in our proxy statement,

the Board believes that our compensation policies and practices are aligned with the interests of our stockholders and designed to reward

for performance.

We are proud of IBM’s latest achievements, including the evolution

of our ESG practices and disclosures. We hope to receive your support on all of the Board’s recommendations in IBM’s 2021

Proxy Statement.

Sincerely,

|

/s/Michael L. Eskew

|

|

/s/ Frederick H. Waddell

|

|

Michael L. Eskew

|

|

Frederick H. Waddell

|

|

IBM’s Lead Director

|

|

Chair of IBM’s Directors and Corporate

|

|

Chair of IBM’s Audit Committee

|

|

Governance Committee

|

|

|

|

|

|

|

|

|

|

/S/ Alex Gorsky

|

|

|

|

Alex Gorsky

|

|

|

|

Chair of IBM’s Executive Compensation

|

|

|

|

and Management Resources Committee

|

|

|

IBM Investor Update Spring 2021

Revenue Gross Profit Margin Net Income from Continuing Operations Cash from Operations 2 2020 Business Results $73.6B Grew Cloud revenues to over $25 billion with strong double - digit growth year over year Red Hat delivered strong double - digit revenue growth, normalized (non - GAAP) 48.3% Expanded gross margin 100 basis points, reflecting a continued shift to higher value businesses and improved services productivity $5.5B Reflects significant investment and a $2 billion pre - tax charge in 4Q for structural actions $18.2B Increased Cash from Ops over $3 billion, driven by strong cash management and actions taken to optimize our financing portfolio Generated free cash flow of about $11 billion Increased the dividend for the 25 th consecutive year, returning $5.8 billion to stockholders Strategy

Hybrid Cloud and AI Strategy 3 Hybrid Cloud Value AI Differentiation IBM Global Business Services System Integrator Partners Software and SaaS Partners Hybrid Cloud Platform Dev Sec Ops IBM’s Hybrid Cloud and AI Solutions SOFTWARE HYBRID CLOUD PLATFORM INFRASTRUCTURE Automation Language Trust 76% AI professionals cite trust as critically or very important to their business IBM Systems IBM Public Cloud Public Clouds AWS | Azure | Others Enterprise Infrastructure 2.5 X Hybrid cloud value vs. public only $1T Hybrid cloud market opportunity SERVICES IBM Software Cloud Paks Strategy

Accelerating IBM's Performance Growth Mindset Separate NewCo Streamline Operations Technology Skills Ecosystem Sustainable revenue growth and free cash flow Key Initiatives Increased Investments Organic/Inorganic Accelerated Growth 4 Strategy

Establishing Two Market - Leading Companies with Focused Strategies IBM #1 Hybrid Cloud Platform and AI Company NewCo #1 Managed Infrastructure Services Company Technology & platform innovation Digital transformations Significant growth opportunities IT infrastructure modernization Service delivery excellence Operational efficiency and cash flow generation $59B Revenue* *TTM revenue through June 30, 2020, adjusted to reflect estimated historical sales between IBM and NewCo IBM and NewCo will have a strong strategic relationship For more information, visit our Investor Relations page $19B Revenue* 5 Strategy

6 Building the Right Board for IBM’s Next Chapter @ 2020 IBM Corporation Retired Chairman and CEO, The Vanguard Group President, Cornell University Retired Chairman, President & CEO, Anthem, Inc. Chairman, Emerson Electric Co. Retired Chairman and CEO, UPS Retired CEO, Royal Dutch Shell plc Retired Chairman and CEO, Northern Trust Corporation Retired Admiral, United States Navy Chairman and CEO, Johnson & Johnson CEO, AXA S.A. Lead Director Chairman and CEO, IBM Retired Chairman and CEO, Dow Chemical Industry Expertise: ANDREW LIVERIS WILLIAM MCNABB III MARTHA POLLACK JOSEPH SWEDISH PETER VOSER FREDERICK WADDELL MICHELLE HOWARD ALEX GORSKY DAVID FARR THOMAS BUBERL MICHAEL ESKEW ARVIND KRISHNA Healthcare: Energy: Government: Financial Services: Manufacturing: Information Technology: Transport & Logistics: Research & Development: Chemicals: Board & Governance

Optimal Mix of Skills and Experience for Board Public Company Board 9 Organizational Leadership and Management 12 Global Business Operations 10 Finance/Public Company CFO 6 Tech, Cybersecurity, or Digital 12 Government / Public Policy 12 Highly Qualified Director Nominees with Diverse Experiences Industry leaders with deep executive and oversight experience Global experience necessary to oversee a business of IBM’s scale, scope and complexity Critical skill given industry trends and transformation Emphasis on Diversity Key insight into IBM’s regulatory environment In the last 3 years: 2 women directors added 2 ethnically diverse directors added Balanced Mix of Tenures 7 Directors 4 Directors 3 Directors Average Tenure is 5.3 years 7 Directors: < 5 years 3 Directors: 5 - 10 years 2 directors: > 10 years 7 3 2 7 25% Diverse Board & Governance

Reinforcing IBM’s Pivot to Sustainable Growth IBM’s Compensation Practices have been revamped to ensure alignment with IBM’s growth strategy and investor expectations: 1. Accelerate our Hybrid Cloud and AI revenue growth strategy 2. Generate cash flow growth for increased investment and shareholder return 3. Advance our best - in - class culture of diversity and inclusion Compensation 40% 40% 50% 20% 50% + Diversity Modifier (New in 2021) Operating Cash Flow* Operating Net Income Revenue New Design Prior Design 70% 30% 30% 30% 40% Free Cash Flow Operating EPS Revenue Prior Design New Design AIP PSUs + Return on Invested Capital Modifier *Net Cash from Operating Activities, excluding Global Financing receivables

Compensation Aligns with High - Value Business Model Short Term (25%) Base Salary (8%) Annual Incentive (16%) Target: 200% of Base Salary Long Term (75%) Performance Share Units (49%) Restricted Stock Units (26%) 9 Compensation For 2020, at target, 65% of CEO pay was at risk and subject to attainment of rigorous performance goals 65% At - Risk CEO holding requirement is 10x base salary, aligning CEO compensation with stockholders’ interests Target (100 % ) 90 99 102 81 100 85 0 50 100 150 2015 2016 2017 2018 2019 2020 CEO ANNUAL INCENTIVE AWARD AS % OF TARGET* *2020 pertains to Mr. Krishna and prior years pertain to Mrs. Rometty . 32 67 99 90 71 0 50 100 150 2014-16 2015-17 2016-18 2017-19 2018-20 Target (100%) LONG TERM PERFORMANCE SHARE UNIT PAYOUTS AS % OF TARGET Payouts in both the annual and long term programs reflect rigorous performance goals

Responsibly Advocating Public Policy Protecting the Environment Responding to COVID - 19 Supporting the IBMer Operating with Trust and Transparency @ 2020 IBM Corporation Environmental and Social Responsibility Environment & Social IBM’s Proxy Statement sets forth our world - class governance practices and also includes a new section devoted to environmental and social responsibility, providing deep insight into how IBM is: 10

Protecting the Environment Net Zero greenhouse gas emissions by 2030 Reduce greenhouse gas emissions 65% by 2025 versus 2010 base year 75% renewable electricity by 2025; 90% by 2030 11 Environment & Social

IBM seeks to ensure IBMers from diverse backgrounds are engaged, feel supported to be their authentic selves, build skills, and achieve their greatest potential IBM’s Board of Directors recently adopted a policy committing IBM to publish annually a diversity and inclusion report; the first report will be published in the second quarter of 2021 We have committed to publish EEO - 1 data in 2022 after the completion of the Company’s spin - off of its managed infrastructure services business @ 2020 IBM Corporation IBM’s Commitment to Diversity & Inclusion Environment & Social

▪ IBM’s Lead Director role is robust and ensures effective independent oversight at all times ▪ The full Board reviews our leadership structure annually to ensure the allocation of responsibilities remains appropriate ▪ The Board’s flexibility to determine the appropriate Board leadership structure is essential ▪ Consistent, unified leadership to execute and oversee the Company’s strategy is essential to long - term success Voting Item 4: Stockholder Proposal on Independent Chair @ 2020 IBM Corporation The Board recommends a vote AGAINST this proposal because the Board’s flexibility to determine the appropriate leadership structure is essential and IBM has a robust Lead Director role ensuring effective independent oversight 13 Proposals

▪ Majority written consent would allow a bare majority of stockholders to act without a meeting , let alone notice to the other IBM stockholders ▪ This allows for meaningful discourse and deliberation to occur before important decisions are made affecting IBM ▪ This transparency and fairness for all stockholders would be negated with a majority written consent provision Voting Item 5: Stockholder Proposal on Written Consent @ 2020 IBM Corporation The Board recommends a vote AGAINST this proposal and believes that action by written consent without prior notice to all stockholders is not in the best interest of stockholders 14 Proposals

We Request Your Support at the 2021 Annual Meeting of Stockholders The Board asks that you vote: x FOR Election of all Twelve Director Nominees x FOR Ratification of PricewaterhouseCoopers LLP as IBM’s Independent Registered Public Accounting Firm x FOR Advisory Vote on Executive Compensation x FOR Stockholder Proposal on Diversity, Equity and Inclusion Report × AGAINST Stockholder Proposal on Right to Act by Written Consent × AGAINST Stockholder Proposal to Have an Independent Board Chair 15 Proposals

Forward - Looking Statements, Non - GAAP and Other Information @ 2020 IBM Corporation Certain comments made in this presentation may be characterized as forward looking under the Private Securities Litigation Reform Act of 1995. Forward - looking statements are based on the company’s current assumptions regarding future business and financial performance. Those statements by their nature address matters that are uncertain to different degrees. Those statements involve a number of factors that could cause actual results to differ materially. Additional information concerning these factors is contained in the Company’s filings with the SEC. Copies are available from the SEC, from the IBM website, or from IBM Investor Relations. Any forward - looking statement made during this presentation speaks only as of the date on which it is made. The company assumes no obligation to update or revise any forward - looking statements except as required by law; these charts and the associated remarks and comments are integrally related and are intended to be presented and understood together. In an effort to provide additional and useful information regarding the company’s financial results and other financial information, as determined by generally accepted accounting principles (GAAP), these materials contain certain non - GAAP financial measures on a continuing operations basis, specifically free cash flow. The rationale for management’s use of this non - GAAP information and its reconciliation to GAAP are included on pages 57 and 58, respectively, of the Company’s Annual Report which is Exhibit 13 to the Form 10 - K submitted with the SEC on February 23, 2021 . These materials also contain year - to - year change in revenue for Red Hat, normalized for historical comparability. The rationale for management’s use of this non - GAAP financial measure and its reconciliation to GAAP are respectively included as Exhibits 99.2 and 99.1 to the Company’s Form 8 - K submitted with the SEC on January 21, 2021. Note: ROIC equals net operating profits after tax (GAAP net income from continuing operations plus after - tax interest expense) divided by the sum of the average debt and average total stockholder’ equity. It is computed excluding current period U.S. Tax reform charges and goodwill associated with the Red Hat acquisition.

[E-MAIL]

Dear IBM Senior Leaders:

Re: Voting Your IBM Shares for the 2021 Annual Meeting

I hope you and your family are staying healthy and safe. With this

note, I am writing to remind you to make sure to vote all of your IBM shares for the 2021 Annual Meeting. By now you should have received

a copy of IBM’s 2021 Proxy Statement along with the proxy card or notice of Internet availability of proxy materials. If you hold

IBM shares in “street name” (i.e., through a bank or broker), you will have received a voter instruction form from your bank

or broker. We expect that many of you will receive multiple copies of the proxy materials, reflecting different ownership accounts you

may have. Please make sure to vote all of the proxy voting cards that you receive or follow the instructions on the notice of Internet

availability of proxy materials, if applicable.

As you know, IBM has taken substantial actions to focus on hybrid cloud

and AI and redefine itself to drive sustainable growth. In 2020, we announced the separation of our managed infrastructure services business,

closed seven strategic acquisitions and launched new industry clouds. We also generated more than $73 billion in revenue, growing Cloud

revenues to more than $25 billion with strong double-digit growth year to year. We also achieved strong cash generation with cash from

operating activities of $18.2 billion and free cash flow of about $11 billion. IBM returned $5.7 billion to you, our stockholders, while

increasing our dividend for the 25th consecutive year. As we rapidly expand our global ecosystem of partners and align

our go-to-market strategy to drive our hybrid cloud and AI strategy, we are confident that your Company will exit this challenging period

stronger.

As you see in the Proxy Statement, the Board recommends a vote:

|

|

·

|

FOR Item of Business 1: Election of our Directors

|

|

|

·

|

FOR Item of Business 2: Ratification of our Independent Accounting

Firm

|

|

|

·

|

FOR Item of Business 3: Say on Pay Proposal

|

|

|

·

|

AGAINST Item of Business 4: Stockholder Proposal to Have an Independent

Board Chairman

|

|

|

·

|

AGAINST Item of Business 5: Stockholder Proposal on the Right

to Act by Written Consent

|

|

|

·

|

FOR Item of Business 6: Stockholder Proposal Requesting the Company

to Publish Annually its Diversity, Equity and Inclusion Efforts

|

For the reasons explained in our Proxy Statement, we believe that such

votes are in the best interests of our Company and its stockholders. It is important that you show your support for IBM and vote your

shares.

|

|

·

|

If

you hold your shares in record name (i.e., directly through our transfer agent, Computershare)

and need assistance regarding your record accounts, please contact Bob Wilt at infoibm@us.ibm.com.

|

|

|

·

|

If you hold your shares in street name (e.g., Morgan Stanley, TD Ameritrade,

Charles Schwab, or another financial institution), IBM cannot access your account or provide you with a replacement voting instruction

form. In this case, you will need to contact your broker directly in order to obtain a replacement voting instruction form.

|

If you have already voted all of your shares, there is no need to contact

us and no further action is required on your part. In case you have not received or have misplaced your proxy voting card, IBM periodically

sends a follow-up mailing that includes a proxy voting card.

You may also find additional information at http://www.ibm.com/investor/proxyinformation.

If you do not receive a copy of the Proxy Statement or notice of Internet availability of proxy materials by Thursday, April 15, 2021,

please contact Bob Wilt at infoibm@us.ibm.com. Please do not hesitate to call me at 914-499-xxxx or email me at xxxxxx@us.ibm.com if

you have questions or comments.

Sincerely,

|

/s/ Frank Sedlarcik

|

|

|

|

|

|

Frank Sedlarcik

|

|

|

Vice President and Secretary

|

|

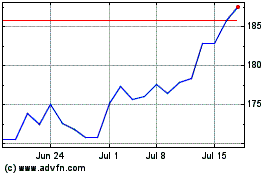

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024