Current Report Filing (8-k)

July 02 2020 - 5:38PM

Edgar (US Regulatory)

false000005114300000511432020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Zero300NotesDue2028Member2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Six22DebenturesDue2027Member2020-07-022020-07-020000051143us-gaap:CommonStockMemberibm:ChicagoStockExchangeIncMember2020-07-022020-07-020000051143ibm:Two625NotesDue2022Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:One750NotesDue2031Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:Zero650NotesDue2032Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Six50DebenturesDue2028Member2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:One250NotesDue2023Member2020-07-022020-07-020000051143us-gaap:CommonStockMemberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Seven125DebenturesDue2096Member2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Zero950NotesDue2025Member2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:One200NotesDue2040Member2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Two875NotesDue2025Member2020-07-022020-07-020000051143ibm:Zero875NotesDue2025Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:One875NotesDue2020Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:One125NotesDue2024Member2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Seven00DebenturesDue2045Member2020-07-022020-07-020000051143ibm:Zero500NotesDue2021Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:Zero375NotesDue2023Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:One500NotesDue2029Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:One750NotesDue2028Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:Zero300NotesDue2026Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:Seven00DebenturesDue2025Member2020-07-022020-07-020000051143ibm:Two750NotesDue2020Memberibm:NewYorkStockExchangeMember2020-07-022020-07-020000051143ibm:NewYorkStockExchangeMemberibm:One250NotesDue2027Member2020-07-022020-07-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: July 2, 2020

(Date of earliest event reported)

INTERNATIONAL BUSINESS MACHINES CORPORATION

(Exact name of registrant as specified in its charter)

914-499-1900

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On July 2, 2020, International Business Machines Corporation (“IBM”) and IBM Credit LLC (“IBM Credit,” together with IBM, the “Borrowers”) (i) entered into a new $2.5

billion 364-Day Credit Agreement (the “New 364-Day Credit Agreement”) with the several banks and other financial institutions from time to time parties thereto (the “364-Day Lenders”) and (ii) entered into the First Amendment (the “Three-Year

Amendment”) to the existing $2.5 billion Amended and Restated Three-Year Credit Agreement dated as of July 19, 2018 (the “Existing Three-Year Credit Agreement”), among the Borrowers, the several banks and other financial institutions from time to

time parties thereto (the “Three-Year Lenders”), JPMorgan Chase Bank, N.A., as Administrative Agent, BNP Paribas, Citibank N.A., Royal Bank of Canada and Mizuho Bank Ltd., as Syndication Agents, and the Documentation Agents named therein. Also, on

July 2, 2020, IBM entered into the First Amendment (the “Five-Year Amendment”) to the existing $10.25 billion Amended and Restated Five-Year Credit Agreement dated as of July 19, 2018 (the “Existing Five-Year Credit Agreement”), among IBM, each

Subsidiary Borrower (as defined therein), the several banks and other financial institutions from time to time parties thereto (the “Five-Year Lenders,” together with the Three-Year Lenders and the 364-Day Lenders, the “Lenders”), JPMorgan Chase

Bank, N.A., as Administrative Agent, BNP Paribas, Citibank N.A., Royal Bank of Canada and Mizuho Bank Ltd., as Syndication Agents, and the Documentation Agents named therein.

The New 364-Day Credit Agreement permits the Borrowers to borrow up to an aggregate of $2.5 billion on a revolving basis at any time during the term of

the New 364-Day Credit Agreement, subject to the terms therein. Neither Borrower is a guarantor or co-obligor of the other Borrower under the New 364-Day Credit Agreement. Funds borrowed may be used for the general corporate purposes of the

Borrowers. Interest rates on borrowings under the New 364-Day Credit Agreement will be based on prevailing market interest rates plus a margin, as further described therein. The New 364-Day Credit Agreement contains customary representations and

warranties, covenants, events of default and indemnification provisions. The foregoing description of the New 364-Day Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the New 364-Day

Credit Agreement, which is filed as Exhibit 10.1 to this report, and is incorporated by reference herein.

The Three-Year Amendment, among other things, modifies certain of the minimum interest rate spreads applicable to future borrowings and extends the maturity of the

Existing Three-Year Credit Agreement to July 20, 2023. The Five-Year Amendment, among other things, permits IBM to request, at any time during a specified period in the year ended December 31, 2021, an extension of the maturity of the Existing

Five-Year Credit Agreement (with a current maturity of July 20, 2024) by two years. The foregoing descriptions of the Three-Year Amendment and the Five-Year Amendment do not purport to be complete and are qualified in their entirety by reference to

the full text of the Three-Year Amendment and the Five-Year Amendment, which are filed as Exhibits 10.2 and 10.3 to this report, and are incorporated by reference herein.

In the ordinary course of their respective businesses, the Lenders and their affiliates have engaged, and may in the future engage, in commercial

banking, investment banking, financial advisory or other services with the Borrowers for which they have in the past and/or may in the future receive customary compensation and expense reimbursement.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, hereunto duly authorized.

|

Date: July 2, 2020

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Simon J. Beaumont

|

|

|

|

|

Simon J. Beaumont

|

|

|

|

|

Vice President and Treasurer

|

|

|

|

|

|

|

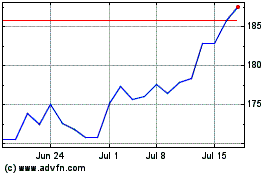

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024