Amended Statement of Beneficial Ownership (sc 13d/a)

February 14 2023 - 1:35PM

Edgar (US Regulatory)

CUSIP NO. 453415606

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 9)*

INDEPENDENCE

CONTRACT DRILLING, INC.

(Name of Issuer)

Common Stock, $0.01 par value per share

(Title of Class of Securities)

453415606

(CUSIP Number)

C. Alex Bahn

WilmerHale

1875

Pennsylvania Avenue, NW

Washington, DC 20006

202-663-6000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communication)

February 14, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note. Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 240.13d-7 for other parties to whom copies are to be sent.

CUSIP NO. 453415606

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

MSD Partners, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☐ (b) ☒ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) AF |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

2,960,406 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

2,960,406

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,960,406 (1) |

| 12 |

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 19.9%

(2) |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) PN |

| 1) |

(1)Includes (i) 1,701,000 shares of common stock beneficially owned, and (ii) 1,259,406 shares of common stock

underlying the Issuer’s Floating Rate Convertible Senior Secured PIK Toggle Notes due 2026 (the “Notes”), assuming application of a 19.9% Restricted Ownership Percentage (as defined in this Schedule 13D/A). The Notes are currently

convertible into shares of common stock at the option of the Reporting Persons at a conversion price of $4.51 per share. |

| (2) |

The percentage used herein and in the rest of this Schedule 13D is calculated based upon (i) 13,617,005 shares

of the Issuer’s common stock outstanding as of October 28, 2022, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on

November 1, 2022, and (ii) 1,259,406 shares of common stock issuable upon conversion of the Notes, which, due to the Restricted Ownership Percentage, is the maximum number of shares that could be received by the Reporting Persons upon

conversion of the Notes. |

CUSIP NO. 453415606

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

MSD Credit Opportunity Master Fund, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☐ (b) ☒ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) WC |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman

Islands |

|

|

|

|

|

|

|

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

1,628,523 (3) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,628,523

(3) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,628,523 (3) |

| 12 |

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 10.9%

(2) |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) PN |

| (3) |

Includes (1) 369,117 shares of common stock beneficially owned and (2) 1,259,406 shares of common stock

underlying the Notes assuming application of the 19.9% Restricted Ownership Percentage. |

CUSIP NO. 453415606

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

MSD PCOF Partners LXXIII, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☐ (b) ☒ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) WC |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

2,261,635 (4) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

2,261,635

(4) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,261,635 (4) |

| 12 |

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 15.2%

(2) |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) OO |

| (4) |

Includes (1) 1,002,229 shares of common stock beneficially owned and (2) 1,259,406 shares of common stock

underlying the Notes assuming application of the 19.9% Restricted Ownership Percentage. |

CUSIP NO. 453415606

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

MSD Private Credit Opportunity (NON-ECI) Fund, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☐ (b) ☒ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) WC |

| 5 |

|

CHECK IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

1,589,060 (5) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

1,589,060

(5) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,589,060 (5) |

| 12 |

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 10.7%

(2) |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) OO |

| 5 |

Includes (1) 329,654 shares of common stock beneficially owned and (2) 1,259,406 shares of common stock

underlying the Notes assuming application of the 19.9% Restricted Ownership Percentage. |

CUSIP NO. 453415606

Explanatory Note

This Amendment No. 9 (this “Amendment”) reflects changes to the information in the Schedule 13D relating to the common stock,

par value $0.01 per share (the “Shares”) of Independence Contract Drilling, Inc., a Delaware corporation (the Issuer”) filed October 3, 2018, as amended by Amendment No. 1 filed December 14, 2020, Amendment No. 2

filed January 4, 2021, Amendment No. 3 filed June 9, 2021, Amendment No. 4 filed July 6, 2021, Amendment No. 5 filed March 23, 2022, Amendment No. 6 filed April 7, 2022, Amendment No. 7 filed

December 22, 2022 and Amendment No. 8 filed December 22, 2022, by the Reporting Persons (as amended, the “Schedule 13D”).

Unless otherwise indicated, each capitalized term used but not defined in this Amendment shall have the meaning assigned to such term in the

Schedule 13D. With the exception of the changes indicated below, the Schedule 13D is unchanged.

| Item 5. |

Interest in Securities of the Issuer |

Items 5(a) and (b):

| (a) |

As of the date hereof, MSD Partners, L.P. beneficially owns, in aggregate, 2,960,406 Shares, representing 19.9%

of the Issuer’s outstanding Shares.6 |

| (b) |

Number of shares as to which such person has: |

| (i) |

Sole power to vote or direct the vote:

-0- |

| (ii) |

Shared power to vote or direct the vote: 2,960,406 |

| (iii) |

Sole power to dispose or direct the disposition: -0-

|

| (iv) |

Shared power to dispose or direct the disposition: 2,960,406 |

| B. |

MSD Credit Opportunity Master Fund, L.P. |

| (a) |

As of the date hereof, MSD Credit Opportunity Master Fund, L.P. beneficially owns, in aggregate, 1,628,523

Shares, representing 10.9% of the Issuer’s outstanding Shares.6 |

| (b) |

Number of shares as to which such person has: |

| (i) |

Sole power to vote or direct the vote:

-0- |

| (ii) |

Shared power to vote or direct the vote: 1,628,523 |

| (iii) |

Sole power to dispose or direct the disposition: -0-

|

| (iv) |

Shared power to dispose or direct the disposition: 1,628,523 |

| C. |

MSD PCOF Partners LXXIII, LLC |

| (a) |

As of the date hereof, MSD PCOF Partners LXXIII, LLC, beneficially owns, in aggregate, 2,261,635 Shares,

representing 15.2% of the Issuer’s outstanding Shares.6 |

| (b) |

Number of shares as to which such person has: |

| (i) |

Sole power to vote or direct the vote:

-0- |

| (ii) |

Shared power to vote or direct the vote: 2,261,635 |

| (iii) |

Sole power to dispose or direct the disposition: -0-

|

CUSIP NO. 453415606

| (iv) |

Shared power to dispose or direct the disposition: 2,261,635 |

| D. |

MSD Private Credit Opportunity (NON-ECI) Fund, LLC

|

| (a) |

As of the date hereof, MSD Private Credit Opportunity (NON-ECI) Fund,

LLC beneficially owns, in aggregate, 1,589,060 Shares, representing 10.7% of the Issuer’s outstanding Shares.6 |

| (b) |

Number of shares as to which such person has: |

| (i) |

Sole power to vote or direct the vote:

-0- |

| (ii) |

Shared power to vote or direct the vote: 1,589,060 |

| (iii) |

Sole power to dispose or direct the disposition: -0-

|

| (iv) |

Shared power to dispose or direct the disposition: 1,589,060 |

| E. |

MSD Partners (GP), LLC |

| (a) |

As of the date hereof, MSD Partners (GP), LLC beneficially owns, in aggregate, 2,960,406 Shares, representing

19.9% of the Issuer’s outstanding Shares.6 |

| (b) |

Number of shares as to which such person has: |

| (i) |

Sole power to vote or direct the vote:

-0- |

| (ii) |

Shared power to vote or direct the vote: 2,960,406 |

| (iii) |

Sole power to dispose or direct the disposition: -0-

|

| (iv) |

Shared power to dispose or direct the disposition: 2,960,406 |

| (a) |

As of the date hereof, Gregg R. Lemkau beneficially owns, in aggregate, 2,960,406 Shares, representing 19.9% of

the Issuer’s outstanding Shares.6 |

| (b) |

Number of shares as to which such person has: |

| (i) |

Sole power to vote or direct the vote:

-0- |

| (ii) |

Shared power to vote or direct the vote: 2,960,406 |

| (iii) |

Sole power to dispose or direct the disposition: -0-

|

| (iv) |

Shared power to dispose or direct the disposition: 2,960,406 |

CUSIP NO. 453415606

| 6 |

Includes shares of the Issuer’s common stock underlying the Notes held by the Reporting Persons, as

specified on the cover pages of this Schedule 13D/A, after application of the Restricted Ownership Percentage. The percentage used herein and in the rest of this Schedule 13D is calculated based upon (i) 13,617,005 shares of the Issuer’s common

stock outstanding as of October 28, 2022, as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on November 1, 2022, and

(ii) 1,259,406 shares of common stock issuable upon conversion of the Notes, which, due to the Restricted Ownership Percentage, is the maximum number of shares that could be received by the Reporting Persons upon conversion of the Notes.

|

Item 5(d):

Not

Applicable.

Item 5(e):

Not Applicable.

CUSIP NO. 453415606

| Item 7 |

Material to be filed as Exhibits |

|

|

|

| Exhibit |

|

Description of Exhibit |

|

|

| 99.1 |

|

Joint Filing Agreement dated February 14, 2023 |

CUSIP NO. 453415606

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 14, 2023

|

|

|

| MSD Partners, L.P. |

|

|

| By: |

|

MSD Partners (GP), LLC |

| Its: |

|

General Partner |

|

|

| By: |

|

/s/ Robert K. Simonds |

| Name: |

|

Robert K. Simonds |

| Title: |

|

Authorized Signatory |

|

|

|

| MSD Credit Opportunity Master Fund, L.P. |

|

|

| By: |

|

MSD Partners, L.P. |

| Its: |

|

Investment Manager |

| By: |

|

MSD Partners (GP), LLC |

| Its: |

|

General Partner |

|

|

| By: |

|

/s/ Robert K. Simonds |

| Name: |

|

Robert K. Simonds |

| Title: |

|

Authorized Signatory |

|

|

|

| MSD PCOF Partners LXXIII, LLC |

|

|

| By: |

|

MSD Partners, L.P. |

| Its: |

|

Investment Manager |

| By: |

|

MSD Partners (GP), LLC |

| Its: |

|

General Partner |

|

|

| By: |

|

/s/ Robert K. Simonds |

| Name: |

|

Robert K. Simonds |

| Title: |

|

Authorized Signatory |

CUSIP NO. 453415606

|

|

|

| MSD Private Credit Opportunity (NON-ECI) Fund, LLC |

|

|

| By: |

|

MSD Partners, L.P. |

| Its: |

|

Investment Manager |

| By: |

|

MSD Partners (GP), LLC |

| Its: |

|

General Partner |

|

|

| By: |

|

/s/ Robert K. Simonds |

| Name: |

|

Robert K. Simonds |

| Title: |

|

Authorized Signatory |

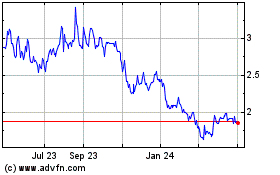

Independence Contract Dr... (NYSE:ICD)

Historical Stock Chart

From Mar 2024 to Apr 2024

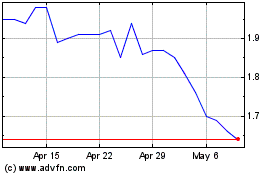

Independence Contract Dr... (NYSE:ICD)

Historical Stock Chart

From Apr 2023 to Apr 2024